Will a trading platform without LP and insider trading become the Super hero of memes?

Written by: Ashley

The market has long suffered from insider traders. This is likely a sentiment echoed by every degen who has been harvested by presidential coins and wife coins. After barely surviving the retail traps and rug pulls, a waterfall washout sends market sentiment into a FUD frenzy again.

At this moment, "No LP, no insider trading." "We will save the bear market!" — a project named Super.exchange has made a super hero-like declaration to rescue the market, striking at the pain points and quickly gaining attention in the community. What magic does this new asset issuance platform in the Solana ecosystem possess?

Upgraded Pump.fun

Why do meme insider trading incidents frequently occur, sniper attacks continue, and pool withdrawals are common? According to Super.exchange, a significant part of the problem lies in the fact that "Bonding Curves have been broken" — this is one of the core reasons why tokens cannot achieve price discovery, leading to wild fluctuations.

To address early control issues, Super.exchange has upgraded the traditional bonding curve to an Infinite Bonding Curve, also known as Super Curve, which allows for a more gradual price increase. The principle of Super Curve is not complex; it can be viewed as a Bonding Curve composed of seven different curves. These seven curves function like the gears of a manual transmission car; to accelerate, the car must shift gears. Similarly, to "accelerate" the price of a token, its underlying liquidity must also "shift gears." The seven "gears" of the Super Curve promote rapid and sustained price growth while maintaining market depth stability.

So what does Super Curve solve? Traditional bonding curves experience slow early growth, allowing certain buyers to accumulate a large proportion of the token supply. Later, due to rapid curve growth, liquidity gaps can occur, making continued trading difficult without market maker support. However, with Super Curve, all price ranges have permanently locked liquidity, avoiding rug risks and ensuring sustainable price growth.

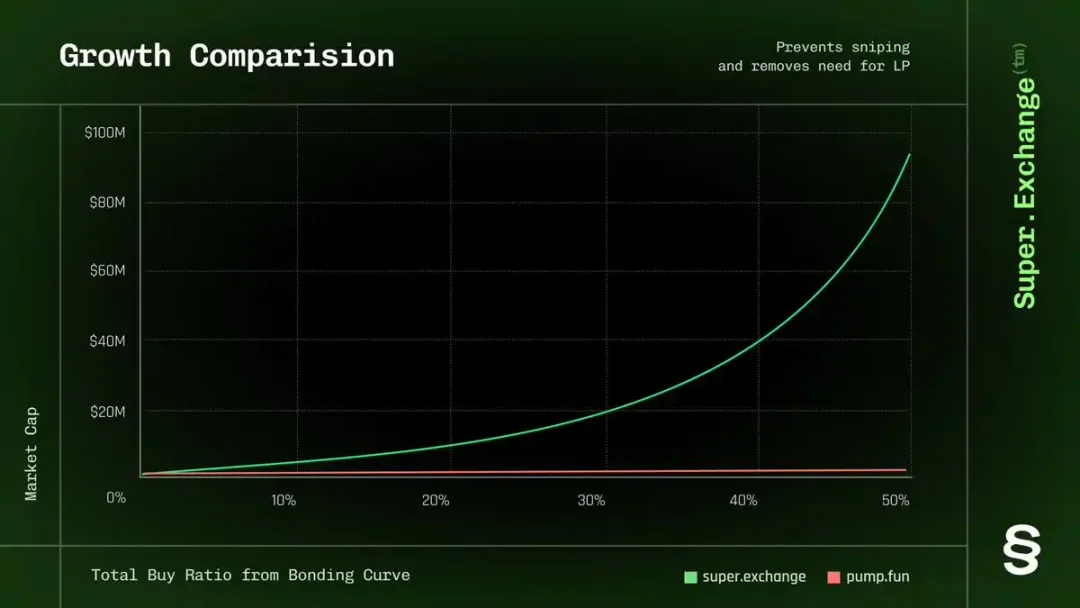

Comparison of token growth using Super Curve versus traditional Bonding Curve, image from @_superexchange official account

To be more specific, controlling 80% of the token supply through traditional Bonding Curve on Pump.fun requires less than $20,000, with the price only increasing 15 times. But on Super, to buy 80% of the tokens, the price would rise 40,269 times. This makes it difficult to accumulate a large amount of tokens at a low price in the early stages.

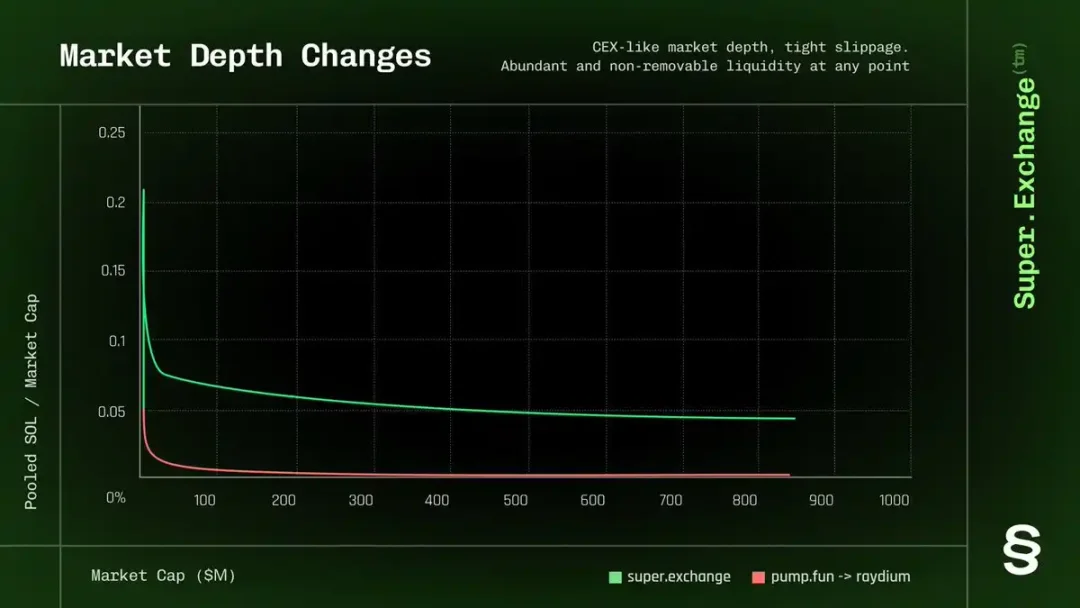

Market depth characteristics of Super Curve versus traditional models, image from @_superexchange official account

On Pump.fun, as the market cap increases, the depth of the pool rapidly declines. Super.exchange has created a safe and growth-oriented trading environment by eliminating reliance on liquidity providers, preventing pool withdrawals, and ensuring sustainable liquidity.

Not only is there innovation in Super Curve, but Super.exchange has also keenly addressed another pain point that troubles everyone from small players to big players during meme rushes — the uniqueness of tickers.

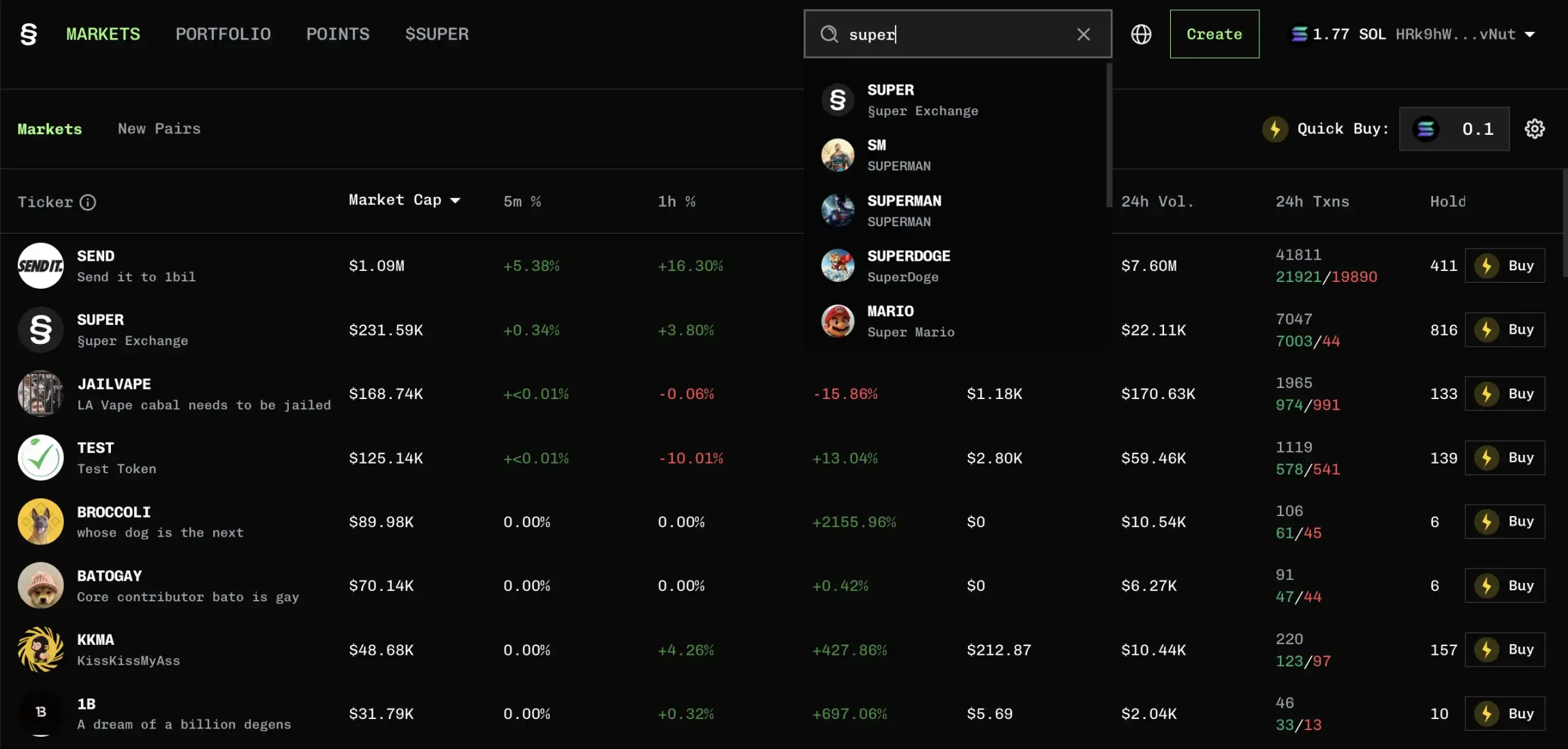

Do you remember the Broccoli War on the BNB Chain half a month ago? A large number of homogeneous tokens were issued simultaneously, flooding the new coin board with the same images and names, leading to intense PVP. But trying to search for $SUPER on Super.exchange yields refreshing results. No more need to check each one for authenticity; each ticker is a unique identifier for the token, all in uppercase letters, thus ending the case of case sensitivity.

Finally, Super.exchange has created its own platform token, $SUPER. $SUPER is 100% owned by the community, featuring a deflationary mechanism and a transparent buyback and burn policy. A total supply of 1 billion $SUPER was fairly launched, with no reservations, no front-running, and no VC allocations. Of this, 50% of platform fee revenue is used to buy back $SUPER and burn it, executed by smart contracts every five minutes, with the entire process transparently recorded on-chain. Moreover, as the platform develops, the scale of buybacks will expand, driving long-term price growth and building a community growth flywheel.

How to Use Super.exchange

How to get started with Super.exchange? After users enter the homepage and link their wallets, they can mainly interact with the following three functions.

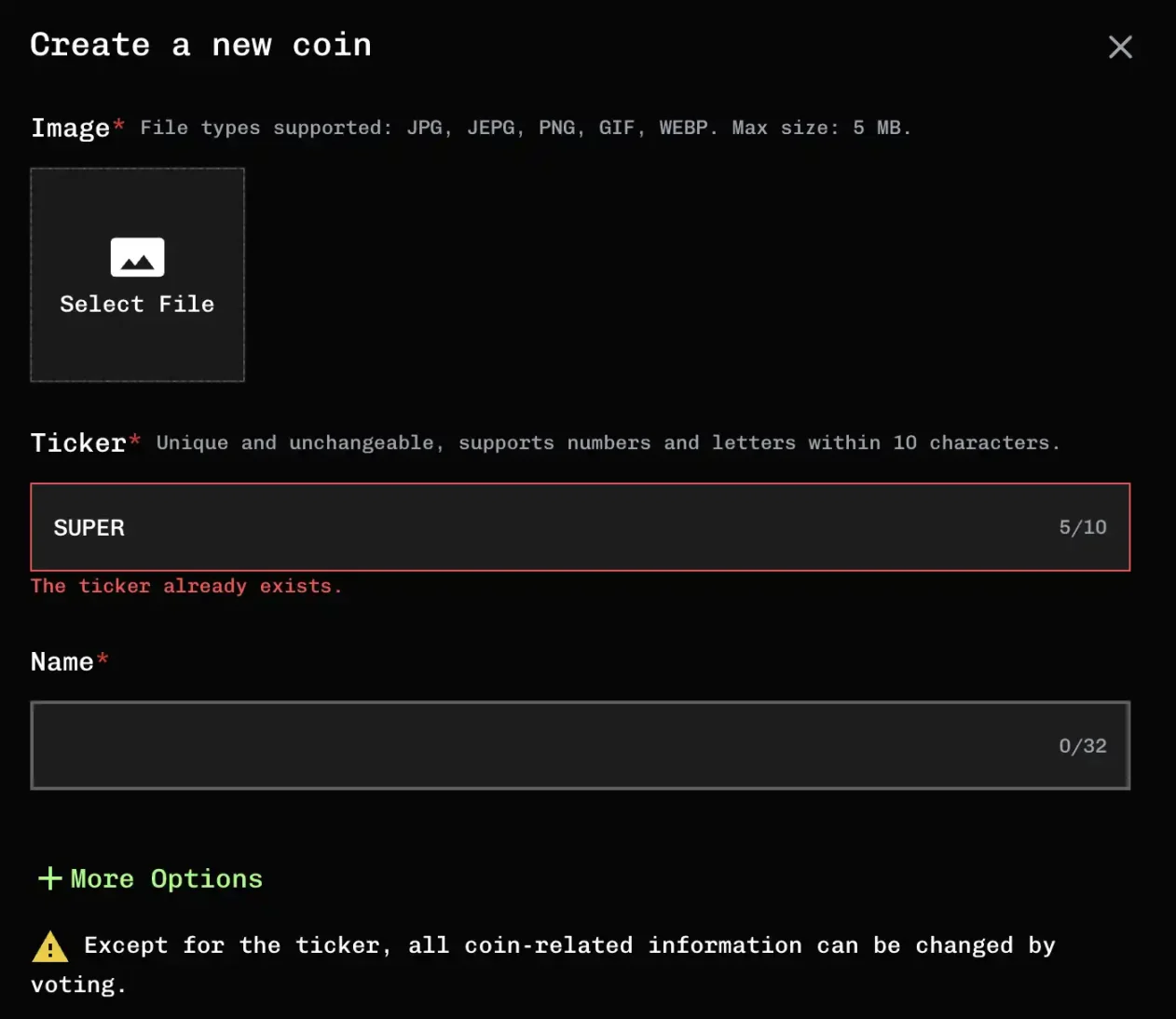

How to Issue Tokens

In the upper right corner of the homepage, there is a "create" option. After clicking it, users can input the token's avatar, ticker, and name to complete the creation. If the chosen ticker is already taken, a token with the same name cannot be issued, supporting a combination of numbers and letters within 10 characters. Other options can be modified after community voting, except for the ticker, which cannot be changed once created. Based on practical results, issuing a token requires about a 2.5% fee, slightly higher than Pump.fun.

How to Buy Tokens

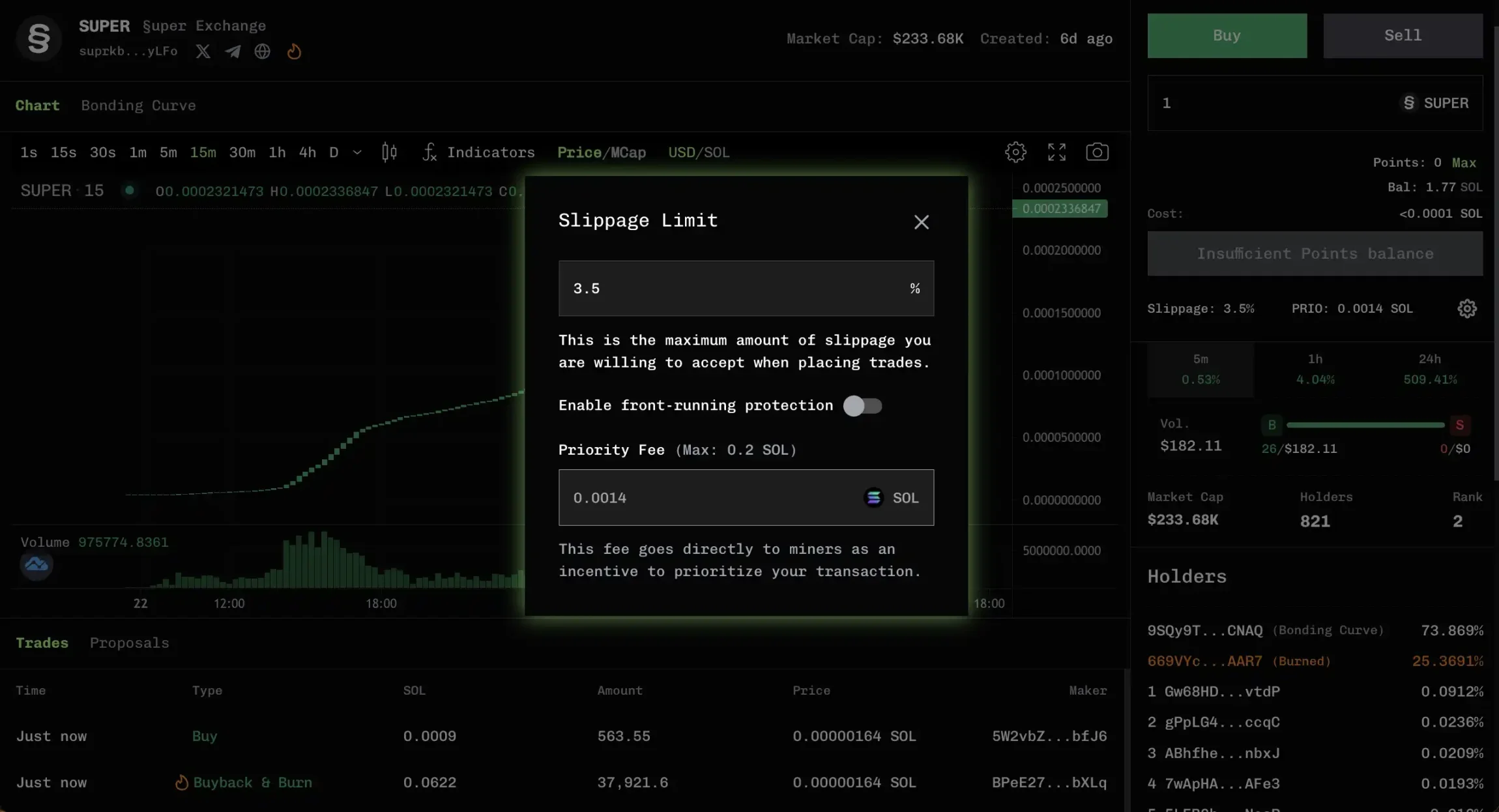

Super.exchange also distinguishes between internal and external markets. By clicking "MARKETS" on the homepage, users can see the token board, where "Markets" represents the external market; "New Pairs" corresponds to the internal market. The market cap of each token is calculated using the Super Curve. By clicking on the token avatar, users can enter the purchase page and set the amount and slippage themselves. After purchasing, assets can be viewed in the "PORTFOLIO."

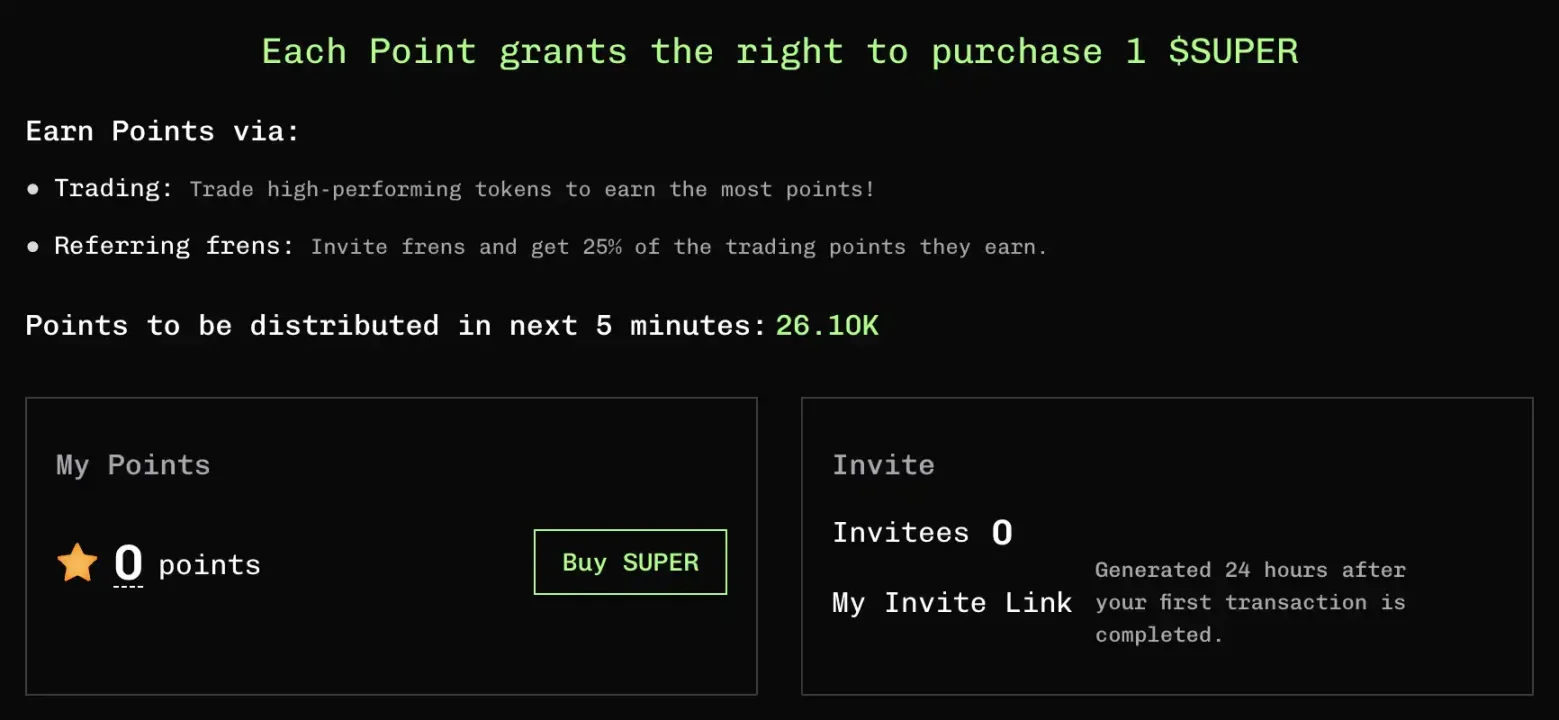

How to Obtain $SUPER

Currently, the official website only provides two ways to obtain $SUPER: trading and referrals. The higher the trading performance of a token, the more points earned; inviting friends allows users to earn 25% of their trading points. 1 point = the right to purchase 1 $SUPER, meaning only active traders on the platform have the right to buy $SUPER, benefiting early users who genuinely use the platform for trading, rather than allowing whales to lock millions in liquidity in new DeFi protocols.

Will it be the Super hero of memes?

It seems that Super.exchange has indeed addressed some of the pain points currently plaguing the meme market: insider trading by manipulators, low-price accumulation, difficulty in distinguishing tickers, and rug pulls after price surges. These issues have filled the market with uncertainty and a crisis of trust after memes have completely devolved into a casino. In this regard, Super.exchange, through its unique design and mechanisms, appears to provide a solution to these chaotic phenomena, at least on the surface, making the trading environment seem more transparent and fair.

However, if we look back at the entire meme super cycle, its rise is more of a community-driven cultural phenomenon, rather than something that can be fully encompassed by technology or token issuance mechanisms. Although Super.exchange has optimized the trading mechanism, it is hard to deny that a significant part of the appeal of memes comes from the custom lottery stations and the myth of wealth creation by hundreds or thousands of times that Pump.fun offers.

Current improvements may curb some speculative behavior, but they do not answer the following questions: How can a strong and lasting community consensus be quickly formed without the short-term stimulus of price surges? If the lottery odds of memes are no longer enticing, will it still attract so many people to sit idly and bring new liquidity? Especially in the current bear market, will memes be treated as oversupply and cleared by the market, or will they continue to transcend cycles with their emotional and ideological value? This may be the true key to the future development of memes.

As for Super.exchange, can it filter out truly consensus-driven and valuable memes through a more reasonable price discovery mechanism after the market has been riddled with wounds? Under the dual drive of innovative mechanisms and community flywheel effects, can it become the Super hero that saves memes? Perhaps only time will tell.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。