Author: Frank, PANews

Recently, the Solana governance forum initiated a proposal named SIMD-0228, which aims to reduce the annual issuance of SOL by 80% through dynamic adjustments to the inflation rate, directing funds from staking to DeFi. However, this seemingly "smart issuance" blueprint has sparked intense debate in the community regarding the "inflation spiral" and the game of interests—when the staking rate falls below a critical point, higher inflation may backfire on market confidence. Moreover, the income structure of validators and the distribution of benefits among ecological participants have become the hidden explosives in this token economic experiment.

New Proposal May Reduce Inflation by 80%, Cutting 22 Million SOL Issuance This Year

Solana's token issuance mechanism has always followed a fixed schedule, where the inflation rate decreases from 8% at a rate of 15% per year until it reaches a target of 1.5%. The current inflation rate is 4.694%. Under this inflation rate mechanism, the number of tokens issued this year is approximately 27.93 million, with a staking rate of about 64%.

In contrast, Ethereum's inflation rate is currently around 0%, with a staking rate of about 30%. The inflation model of SOL tokens is evidently less favorable for token value preservation, and the excessively high inflation rate has led many tokens to choose staking to obtain higher yields. This is detrimental to the development of the DeFi ecosystem.

The proposal suggests that MEV income has become the main source of income for validators in the Solana network, and reducing staking yields will not have a significant impact on earnings. "In simple terms, it is 'stupid issuance.' Given Solana's thriving economic activity, developing a monetary policy for the network to achieve 'smart issuance' makes sense."

In the proposal, a threshold is set, initially assumed to be 50%, meaning that when the staking rate exceeds 50%, the inflation rate will decrease, reducing staking rewards for the network. When the staking rate falls below 50%, the inflation rate will increase, expanding rewards to incentivize more funds to stake.

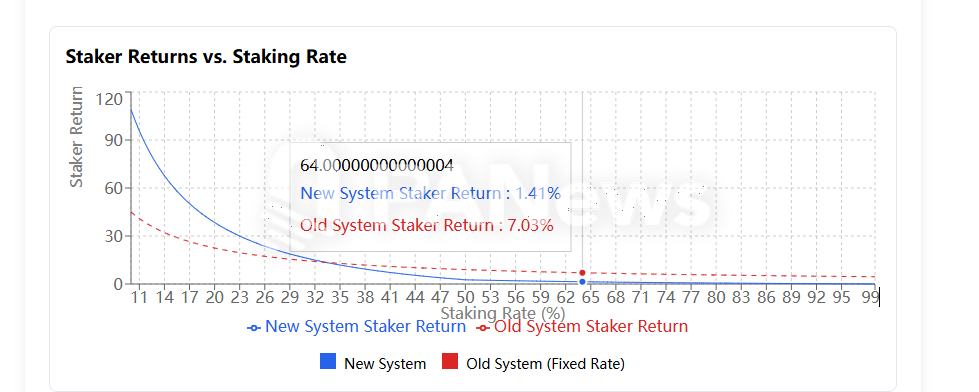

Subsequently, forum users questioned the lack of rigorous calculations behind the 50% threshold, arguing that the setting was too hasty. The proposer then provided a new algorithm curve, designating a staking rate of 33% as a boundary. When the staking rate exceeds 33%, the annual inflation rate will be lower than the current inflation rate.

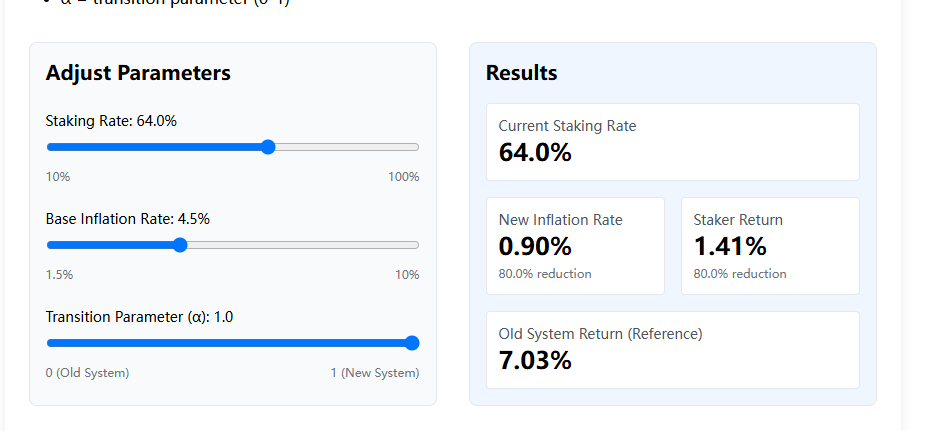

According to PANews calculations, taking the current staking rate of 64% as an example, the annualized inflation rate will drop from 4.694% to 0.939%, a reduction of about 80%.

If the proposal is ultimately approved, under the current staking rate, the annual issuance of SOL will decrease from 27.93 million to 5.59 million.

Modified Staking Rate and Inflation Rate in the Proposal

However, this assertion in the proposal seems to lack consensus in the forum, with many comments suggesting that if the plan is approved, reality may not unfold as ideally envisioned. For instance, when the staking rate declines, the rise in inflation may further lower market expectations for the token, potentially leading to further sell-offs of unstaked tokens, creating greater uncertainty.

After calculations, PANews found that when the staking rate is only 25%, it would generate an inflation of 44.13 million tokens, which is significantly higher than the current inflation rate.

If it truly falls into this inflation vortex, the result may be counterproductive. As the proposal states, the current source of income for validators is MEV income. This phenomenon is primarily due to the active trading on the Solana network, where many MEME players demand transaction speed and protection against sandwich attacks, resulting in a high proportion of MEV income. If the overall trading volume of the network declines in the future, the proportion of MEV income may struggle to maintain its status as the main source of income for validators. At that time, if combined with the dual blows of inflation and price decline, it may further dampen staking enthusiasm, leading to a reverse spiral of rising inflation and declining staking.

Validator Giants Remain Silent, Behind the Scenes of Interest Games Among Large Holders

This proposal was initiated by Vishal Kankani, an investor at Multicoin Capital, which is an early investor in Solana and led a $20 million Series A funding round in 2019. They hold a large amount of SOL tokens, having opted for SOL tokens instead of equity in early investments. From this background, it can be seen that Vishal Kankani represents the interests of large SOL holders, who are more sensitive to the impact of inflation on token market prices.

Interestingly, as of February 26, major validators in the Solana network, such as Helius, Binance Staking, and Galaxy, have not expressed any stance on this proposal. The founder of Helius frequently speaks about the development of the Solana ecosystem but only shared a related post regarding this proposal, commenting that selling SOL tokens now is foolish.

In fact, if this proposal is approved, it may not be good news for validators like Helius, which return 100% of MEV income to stakers. Currently, due to not generating income through MEV, Helius may rely more on the staking rewards themselves.

Overall, this proposal represents the interests of large SOL holders, who prefer to reduce inflation to achieve value stability. Additionally, from an ecological perspective, the current staking yield on the Solana network is about 7.03%. Under the new plan, the yield at the same staking rate will drop to 1.41%, a decrease of nearly 80%. This is not favorable for large validator nodes hoping to obtain risk-free returns through staking.

Of course, the proposal argues that the decline in staking yields will stimulate these validators to invest more tokens into the DeFi ecosystem, further enhancing the prosperity of Solana's DeFi ecosystem.

This token economic reform in Solana is essentially a power rebalancing among large holders, validators, and ecosystem builders. If the proposal passes, the 7.03% staking yield may plummet to 1.41%, forcing validators to shift from relying on inflation rewards to focusing on MEV and transaction fees—this is both an opportunity and a gamble.

If DeFi can absorb billions of dollars in idle liquidity, Solana may witness explosive innovations akin to Uniswap and Aave; however, if the market sells off due to declining yields, the issuance of 44.13 million tokens at a 25% staking rate may drag the network into a "inflation-sell pressure-more inflation" death spiral.

Currently, the silence of leading validators like Helius suggests a subtle tension in the interest chain—when the business model of returning 100% of MEV encounters a halving of basic income, the narrative of "decentralization" in the ecosystem may face a reality check. Meanwhile, the position of Multicoin Capital as an early whale reveals the deeper logic of this game: in the eyes of institutional investors, the value storage attribute of SOL has taken precedence over network security needs. In the coming months, as the vote on March 7 approaches, Solana's fate will no longer be dictated by code dictatorship but will depend on whether the community can find that precarious balance between idealism and capital rationality.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。