Author: YBB Capital Researcher Ac-Core

I. How to Solve the Fragmentation Problem of Ethereum

Image source: @ethereumfndn

With the rise of different L2s and various DeFi projects, the liquidity fragmentation problem of Ethereum has gradually emerged, mainly manifested in the difficulty of unifying asset liquidity within the ecosystem, which has been fragmented into multiple small pieces by L1 and various L2s. Different L2s compete for TVL, leading to assets and transactions being dispersed across multiple decentralized platforms and protocols, but these platforms lack effective connections and interoperability. The liquidity on each chain can only operate within its own independent "small circle," exacerbating the overall fragmentation cost problem of Ethereum.

In 2024 alone, over 100 new Ethereum chains are expected to go live, akin to entering a mall where we see a dazzling array of products but need to settle using different currencies from various countries. On February 20 of this year, the Ethereum Foundation seemingly announced the opening of the Open Intents Framework, akin to "Qin Shi Huang unifying weights and measures," allowing Ethereum to have a seamless trading experience like a "single chain," and within just a few days, it garnered support from over 50 protocols.

According to the content explanation from openintents.xyz, the Open Intents Framework consists of three core components (see extended link 1):

Open-source Solver: The framework provides an open-source solver written in TypeScript that can monitor on-chain events and process intents. Unlike solvers that rely on specific infrastructure, it shares a reference solver with protocol independence, supporting functions such as indexing, transaction submission, and rebalancing, allowing developers to customize and adjust according to their needs;

Composable Smart Contracts: The framework offers a series of pre-built smart contracts based on the ERC-7683 standard, which defines the logic for interpreting, executing, and settling intents. It natively supports limit order trading and Hyperlane ISM settlement;

UI Templates: The framework also provides a pre-built, customizable user interface template designed to make intent products more accessible to end users.

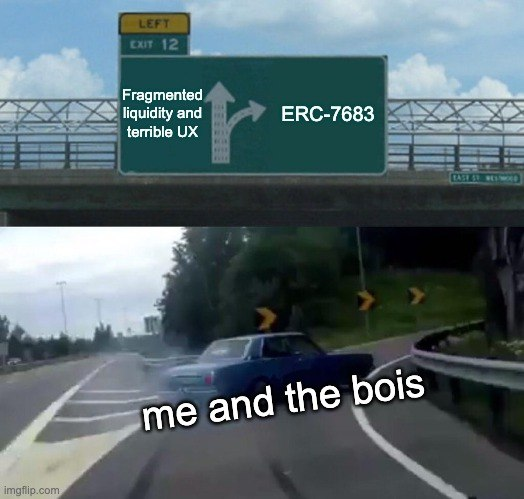

II. The Core ERC-7683 of the Open Intents Framework

Image source: @KanishkKhurana_

ERC-7683 is a universal standard for cross-chain intents on Ethereum, led by Across (@AcrossProtocol) and Uniswap Labs (@Uniswap), aiming to standardize cross-chain intents. It is designed to provide a unified, standardized framework for expressing and executing cross-chain operations, particularly between multiple L2 solutions and sidechains.

Core Content and Components of ERC-7683:

CrossChainOrder Structure: Defines the format of cross-chain orders, ensuring consistency between different blockchains and platforms. It standardizes the composition of cross-chain transactions, enabling interoperability between operations on different chains;

ISettlementContract Interface: Standardizes the handling of the settlement process. ERC-7683 defines how to handle transaction settlements across different chains through this interface, allowing cross-chain transactions to be flexibly executed across different platforms, supporting customized transaction processes;

Fulfil: ERC-7683 introduces the "Fulfil" mechanism, allowing participants to compete to complete cross-chain intents within a shared network. Participants can lower costs and improve efficiency by providing services (e.g., executing orders) within these networks, enabling cross-chain transactions to be completed more efficiently and optimizing the user experience;

Fill Deadline: This is a Uni X timestamp that marks the expiration time of the cross-chain intent. If the intent is not completed within the specified time, it will become invalid, thus avoiding prolonged waiting for ineffective transactions;

Order Data Type: Uses EIP-712 type hashes to specify the structure and format of intent data. Through this type hash, developers and platforms can clarify how data is formatted for transmission and interpretation across different chains;

Order Data: Order data contains the core parameters of cross-chain transactions (such as tokens, amounts, chains, recipients), which define the expected outcomes of cross-chain transactions. It ensures that transaction participants can accurately understand and execute cross-chain operations.

One of the greatest advantages of ERC-7683 is its ability to achieve seamless cross-chain interactions. By standardizing the expression of cross-chain intents, users can perform operations across different blockchains, such as token swaps or NFT transfers, without complex setups. This simplifies the standardized framework of operational processes, significantly lowering the technical barriers for cross-chain operations, allowing users to conduct cross-chain transactions more conveniently.

Additionally, ERC-7683 enhances governance capabilities. It simplifies governance processes between different blockchains, particularly for decentralized autonomous organizations (DAOs), making it easier to manage proposals and decisions across multiple chains. The uniformity of ERC-7683 makes cross-chain governance for DAOs more efficient across multiple platforms, enhancing governance flexibility and transparency.

III. Where is the Endpoint of Intent and DeFAI "Abstraction"?

Image source: Self-made

Whether it is Intent or DeFAI, they are essentially derivatives of the financial attributes of DeFi, but the two real issues that DeFi needs to solve are scalability and liquidity. Intent seems to have more practical significance in aggregating liquidity through UNI and ERC-7683, while DeFAI, leveraging the wave of AI narratives and the automated AI trading already realized by Hey Anon (@HeyAnonai), becomes more interesting. The respective solutions of Intent and DeFAI mainly focus on enhancing the user experience of DeFi, optimizing trade execution, and improving the stability and security of protocols, but they differ in approach:

The core goal of Intent is to simplify the user interaction process through an "intent-driven trading" mechanism. Users can set their trading intents and strategies, and the system will automatically execute them without manual intervention at every step. This not only enhances the usability of DeFi but also optimizes strategy execution and improves trading efficiency. Additionally, Intent may address liquidity bottlenecks in DeFi through cross-chain technology. By enhancing cross-chain liquidity, Intent helps break down barriers between different chains, optimizing liquidity pools, thereby improving the market depth and trading efficiency of decentralized exchanges.

DeFAI, as an AI-based decentralized finance protocol, focuses on addressing compliance and risk control issues in DeFi. DeFAI utilizes AI technology to analyze and predict market trends, helping protocols identify potential risks, thereby reducing operational risks while ensuring protocol stability. AI can process vast amounts of market data, providing users with more accurate decision support, optimizing market operations and risk management.

To solve the problem of liquidity fragmentation, we move from account abstraction, chain abstraction to intents and DeFAI. Ultimately, abstraction is endless, and the demands of technology and the market are driving the emergence of more layers of abstraction. We need abstraction, but it should be moderate. The issue of liquidity fragmentation itself resembles an "ecosystem integration problem," which relies not only on increasing layers of abstraction but more on how to optimize existing protocols.

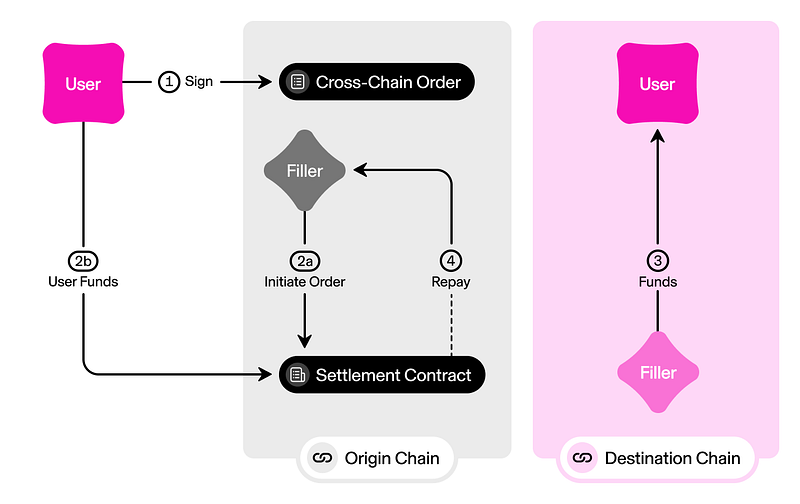

IV. Why Only Uniswap Can Truly Drive the Development of ERC-7683

Image source: @Uniswap

Although "intent" is a grand narrative concept, in my personal view, the core support for ERC-7683 can only be driven by Uniswap. The reason is that both Intent and DeFAI fundamentally aim to better serve DeFi, and the key elements for maintaining the healthy development of DeFi are market liquidity, which relies on two conditions: "efficient liquidity supply" and "deeply integrated liquidity."

1. Liquidity Advantages of Uniswap V4

The introduction of Uniswap V4 makes liquidity pool management more flexible and efficient, especially for providing concentrated liquidity across different price ranges. This mechanism optimizes capital efficiency, making cross-chain transactions smoother. In version V3, each new pool required a separate smart contract deployment, leading to high gas fees. V4 replaces this with a single PoolManager contract, reducing the deployment cost of all mining pools by 99% and lowering exchange costs. Additionally, Hooks allow for the development of customized AMM pools, enabling the ERC-7683 protocol to adjust according to different market demands, better matching different trading pairs and asset liquidity.

2. The Potential of Uniswap X

Uni X is expected to further enhance cross-chain interoperability. It may introduce new cross-chain bridging mechanisms or deeply integrate with ERC-7683, providing more efficient cross-chain asset exchange channels. If Uni X can offer cross-chain liquidity solutions, it will become an important platform for executing cross-chain intents with ERC-7683. Therefore, ERC-7683 can achieve seamless cross-chain transactions on a larger scale by leveraging Uni X's liquidity pools and technical optimizations.

3. Dependency on the Implementation of Cross-Chain Protocols

Due to ERC-7683's reliance on standardized cross-chain transaction structures and settlement mechanisms, and given Uniswap's significant position in decentralized exchanges, the protocol is likely to depend on the liquidity pools, automated market making, and cross-chain trading capabilities provided by Uniswap. Especially with the support of Uniswap X and Unichain, Uniswap can not only support the efficient execution of ERC-7683 but, more critically, ensure the stability and security of its cross-chain and multi-asset trading.

V. What is the Practical Significance of Intent?

When we set aside the abstract definition of "intent," it can be understood as a clear trading goal or driving force. The concept of intent can be traced back to the article "Intent-Based Architectures and Their Risks" published by Paradigm on June 1, 2023, which explains the interpretation of the intent concept. However, it has remained in the conceptual stage, and the issues regarding fragmented liquidity and the solving paths of solvers have not been resolved. Nevertheless, the launch of ERC-7683 seems to offer a promising solution to the fragmented liquidity dilemma.

The ultimate goal is to inject new vitality into Uniswap, hoping that Uniswap will trigger a new wave of DeFi enthusiasm. Therefore, intent and ERC-7683 are not merely about continuing L2 expansion but achieving more efficient trading through Uniswap, creating richer functionalities and stronger cross-chain interoperability, and even introducing new incentive mechanisms or trading models to attract more users and liquidity.

If Uniswap V4 or Uniswap X introduces some new smart contract logic or trading models at the protocol level, through ERC-7683, Uniswap can further enhance cross-chain liquidity, reduce trading costs, and increase more trading pairs and liquidity pools based on the existing AMM model. This will transform Uniswap from merely being a liquidity-dispersed AMM, and these improvements will also become an important part of "intent."

Extended link:

(1) https://www.openintents.xyz/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。