Survive, survive, keep surviving.

Author: Loopify

Compiled by: Deep Tide TechFlow

I am not the first person to propose this view, nor am I someone who waits until things settle down to express an opinion, as that would only be seen as "Monday morning quarterbacking." But I still want to make a bold judgment: I believe the craze for Memecoins has come to an end.

This round of Memecoin mania has essentially reached its conclusion. Existing coins may have a chance to return to their historical highs, but it is unlikely that new coins will reach a market cap of billions of dollars and sustain it. For mid to low market cap coins, the probability of recovery is almost 0.1%.

You can mark the key moments that led to the impending collapse of the Meme market from the chart: $TRUMP was the first coin to trigger the shift, followed by $MELANIA, and then a series of other rug pulls, with the final straw that broke the market being $LIBRA.

The emergence of large-scale scams and exits is inevitable, just as platforms like pump.fun will always appear in some form.

Market volatility has been excessive, swinging from extreme rises (PvE memecoin climbing to billions in market cap) to extreme scams (national-level gang rug operations). Most people either made money or suffered losses during this process.

No True Holders

Regarding the trenches of Solana, one very important point is: it is entirely driven by market momentum. The vast majority of people buying these tokens are simply looking to make money, as the "narrative" appeal in traditional crypto projects has disappeared. This also means that the price of these coins drops faster than others.

Albert Murad Einstein promotes Memecoins

The Memecoin craze has been touted as the purest form of trading because it has no restrictions. This is also a key reason why they can run so wildly. However, this "purity" also brings significant downsides.

Once the excitement of making money fades, holders will quickly exit, and this same group will completely abandon the market. This is different from other cryptocurrencies, where holders usually still have faith in the project itself, as these projects at least have some real value backing them, while Memecoins rely entirely on market sentiment, with almost no substance.

This point somewhat applies to NFTs, but NFTs still differ from Memecoins. Memecoins have completely abandoned the concept of "utility," with only a few breaking through the attention barrier and being regarded by the market as "classic" or "timeless," such as $PEPE.

This round of the Memecoin craze has also spawned some relatively new phenomena, such as copy trading. In the past, people would always track wallet behavior on-chain, but this time the influx of coins reached unprecedented levels. The user experience (UX) of trading on Solana and improvements in liquidity have also made this phenomenon more popular.

However, some people have already made hundreds of thousands of dollars through this model. They profit by attracting followers (this is not referring to any specific person, but rather a common phenomenon—those who become famous for "making a lot of money" in public wallets often attract a large number of followers, and some even deliberately exploit this).

DEXs have long had copy trading features, but in the past, you couldn't buy a coin with a market cap (MCAP) of only $10,000 for 5 SOL and sell it for 10 SOL just 15 seconds later.

This phenomenon has led more people to follow so-called KOLs into the "furnace" (i.e., losses), but unlike before, this time there has been almost no widespread criticism on social media, as these traders did not explicitly promote or advertise certain tokens.

Comparison with NFTs

Do you remember the glory of NFTs? I make this comparison because it was a hot topic in the last cycle, just as ICOs were the trend in 2017.

Almost everyone has heard of NFTs. This trend was not only widely spread on the internet but also attracted countless A-list celebrities to launch their own projects (although most of these projects ended in scams). The trading volume of the NFT market reached hundreds of billions of dollars, with the floor prices of several series even reaching six figures.

In that wave, OpenSea became the biggest winner, with transaction fees exceeding $1 billion—by contrast, pumpfun's total trading volume was only about $500 million.

However, there is a significant difference between this memecoin craze and NFTs: many protocols have benefited massively from this one.

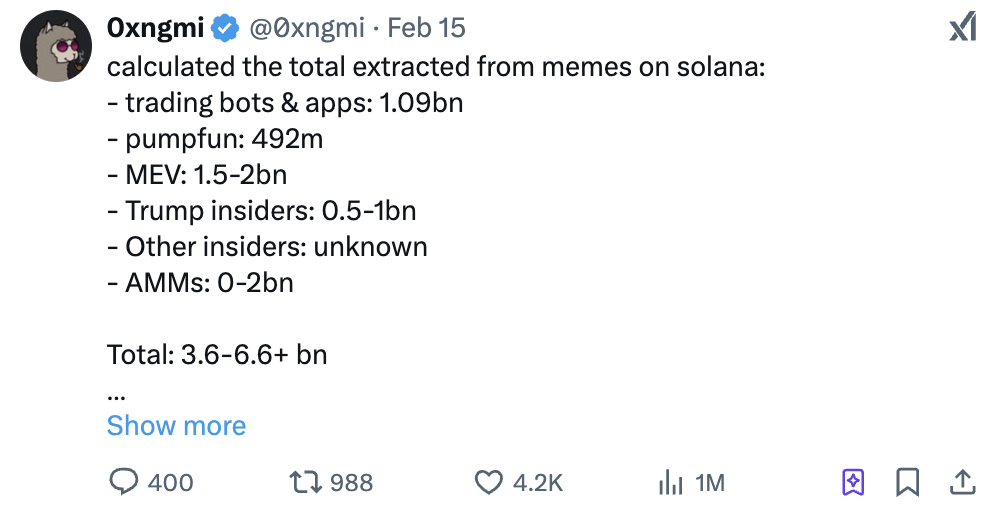

@0xngmi: The total "extraction" earnings from the memecoin craze on Solana are as follows:

Trading bots and applications: $1.09 billion

pumpfun: $492 million

Maximum extractable value (MEV): $1.5 billion to $2 billion

Trump insiders: $500 million to $1 billion

Other insiders: unknown

Automated market makers (AMMs): $0 to $2 billion

Total: $3.6 billion to $6.6 billion or more

Even at the lowest estimate, about $4 billion was "extracted" in this round of the craze, which is certainly not a small amount. (After all, one of the most powerful people in the world launched a coin that reached a market cap of $70 billion in just two days, which is no longer considered "early.")

In contrast, I roughly estimate that if we include market trading, royalties, and minting revenue, the total scale of NFTs is slightly below this figure.

This indicates that the memecoin craze has surpassed the trends of the previous cycle, and the characteristic of strong liquidity has made market adjustments faster.

Many members of the Solana community are sensitive to the term "extraction" (hence I specifically added quotes) and compare it to traditional business models. But I believe this comparison is inappropriate.

In traditional business, for example, if I buy a game, I gain entertainment value from it, while the company earns revenue; this is a positive-sum game.

You could say that many behaviors in the cryptocurrency market are zero-sum games, but many projects are intended to provide some actual value.

However, pumpfun is a negative-sum game, operating through a value extraction mechanism, similar to a casino, whose main function is to create tokens with no actual value, and the core use of these tokens is merely to speculate or gamble for more returns (of course, this does not include projects that are not specifically targeting Memecoins, like Jup or Phantom, although these projects benefit the most from Memecoins).

What Happens Next?

No one really knows when this cycle will end, and this will determine the market direction in the short term.

Every cycle brings a new hot topic, but it could also be an evolved version of the previous trend or a revival (or complete death), as people are always looking for the next opportunity to increase by 100 times.

Returning to my earlier point, I believe the likelihood of a Memecoin resurgence is lower than other trends because there are no true holders or believers.

Basically, the largest coins will survive, while the others will die off. If the market returns, the performance of new coins is likely to surpass everything currently existing.

You need to be prepared for this situation: survive, survive, keep surviving.

If you exit the market before the next trend arrives or lack capital, you will find it difficult to adapt. And in such a market, adaptability is crucial. Everyone can make money in a bull market, but making money in a bear market is the real skill, and then adapting to the next bull market is another skill altogether. (Each cycle requires a different mindset.)

Finally, I recommend an article that delves into why "getting rich" is only half the process, while the other half is "keeping wealth." The article also provides some actionable advice:

*Note: If you think an asset has already dropped 90%, so this advice is useless, remember, it could drop another 90%.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。