After the news of Trump's adjustment of tariffs on Europe to 25%, the US stock market also experienced a comprehensive pullback. Previously, the Nasdaq had risen over 1%, but it is now down 0.15%. The S&P had risen over 0.5%, but it is now down 0.23%.

The main reason affecting market sentiment right now is the tariffs. It's difficult for me to simply evaluate tariffs as either positive or negative, but from the current market direction, the increase in tariffs will inevitably raise the prices of imports for both sides, thereby increasing prices, and an increase in prices means rising inflation.

Rising inflation indicates that the Federal Reserve will pay more attention to monetary policy, which likely means a reduction in the number of interest rate cuts expected in 2025. This is very unfavorable for the market, not just for cryptocurrencies, but also for US stocks. Although the tariffs will officially take effect on April 2, investors have already begun to anticipate the potential impacts of the tariff increases.

It can be said that the declines over the past two days are almost entirely due to the tariff issue. However, tariffs can help the US address some fiscal deficits, bring manufacturing back to the US, and even force some countries to lower their tariffs on the US. In the long term, this may not be a bad thing.

But in the short term, many may not survive, and how many investors can consider the long term, especially in the cryptocurrency industry, particularly those holding a large number of altcoins? The decline of #Bitcoin will likely drag altcoins down as well. I've heard many times that altcoins don't follow BTC down anymore, but these are usually very short-lived. If you extend the time frame a bit, altcoins will inevitably drop harder than BTC.

I really don't want to believe that a tariff issue has pulled the entire risk market into a bear market. It's hard to say whether Trump is a hero or a butcher for cryptocurrencies. The current market has completely turned into an expectation of Trump, which is quite troublesome. I even don't know how much it will drop.

Looking back at the BTC data, there's not much good to say. With Trump's increase of tariffs on Europe to 25%, the risk market has entered a new round of panic, and it's hard to say what situation this panic will bring the market to. Market sentiment is already very poor, though it hasn't reached a state of despair. On Friday, we can see if the core PCE data can pull sentiment back a bit. If the core PCE data is too bad, then it will be even worse.

It's a pity that when I saw Trump raise the tariffs on Europe to 25%, I should have started shorting. Unfortunately, I was too busy writing at that time. However, I do feel that the current market panic is intensifying, and I wouldn't rule out what might happen in the Asian time zone tomorrow. But fortunately, my long position at $41,000 should be able to earn some funding rates.

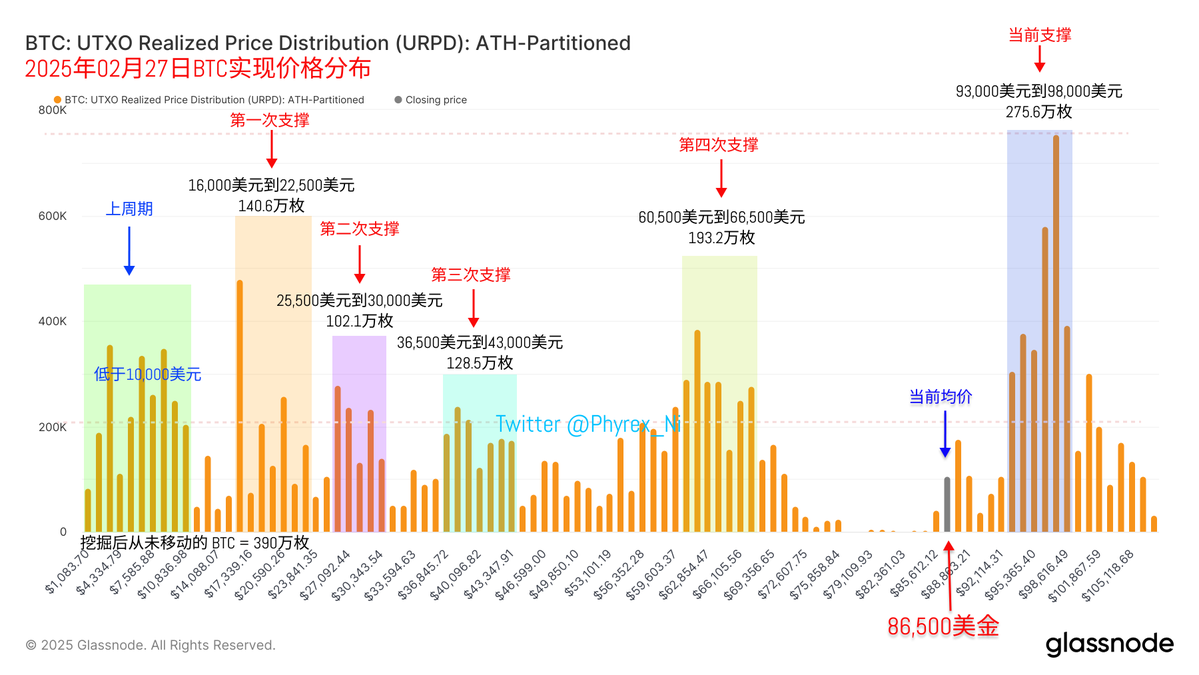

From the support data, although market sentiment is very poor, the support between $93,000 and $98,000 has not been broken. I don't want to argue about this again; we argued a lot when it was at $65,000. At least for now, the support at this position is quite solid, and there are currently no significant signs of investors leaving this position.

Data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。