01 Market Review

1.1 Cryptocurrency Market Fundamentals

Since the first half of 2024, the cryptocurrency market has experienced significant growth, with its total market capitalization soaring from $2.31 trillion to $3.33 trillion, an increase of 44.2%. This growth has been supported by several key milestones, including the approval of spot Bitcoin ETFs in the first half of 2024, and Donald Trump's overwhelming victory in the second half of the year—his regulatory-friendly atmosphere and crypto-friendly policies have injected optimism into the industry. Bitcoin's dominance has also risen, increasing from 53.4% to 56.8%, primarily due to the doubling of assets under management in Bitcoin ETFs, reflecting heightened interest from institutional investors.

Despite the launch of Ethereum ETFs in the second half of 2024, their performance has been relatively lackluster, with a clear preference among institutional investors for Bitcoin, as evidenced by the continuously declining ETH/BTC ratio.

Solana has also performed well, with its SOL price rising by 29.3% since the first half of 2024. In addition to the price increase, Solana's ecosystem saw a net inflow of $2 billion in 2024.

In 2024, the market share of DeFi further expanded, with the total value locked (TVL) growing more than double since the beginning of the year. Thanks to deeper liquidity and the established brand effects of decentralized exchanges (DEXs) on platforms like Solana and Base, the trading volume ratio of DEX/CEX increased from 9.37% at the beginning of the year to 11.05% by year-end, with overall trading volume significantly increasing, reaching an annualized trading volume of $2.67 trillion. A more streamlined listing process has also encouraged more projects to adopt DEX-centric strategies, supporting a more diverse trading of long-tail assets. Notably, Solana and Base saw their DeFi TVL market shares more than double in 2024, reaching 7.17% and 3%, respectively.

As a "killer application" in the crypto space, the adoption of stablecoins has also significantly increased, with their market capitalization growing by 26.8% to a historic high of over $205 billion, further propelled by new entrants like Ethena offering competitive yields. Looking ahead, the potential approval of ETFs for other institutionally preferred assets like XRP and SOL is expected to bring positive catalysts to the market.

1.2 Macroeconomic Environment and Politics

Politics

The political landscape in the United States has changed, with Trump defeating Harris in the November 2024 election and the Republican Party winning a majority in both houses. This Trump administration will have greater authority and executive power. Trump's America First and isolationist policies may bring significant uncertainty to the international situation, prompting other countries to follow suit and begin trade protectionism and economic regionalization. Trump's campaign was very friendly towards the cryptocurrency market, claiming he would allow self-custody wallets, vigorously develop dollar stablecoins, select crypto-friendly economic officials, and consider designating BTC as a reserve asset for the U.S. Treasury. However, whether he can truly promote the development of the crypto market will depend on his actual policies after taking office.

Europe is primarily affected by the Russia-Ukraine war, which seems to have entered a stalemate, potentially prolonging the conflict and leading to rising energy prices in Europe. The war has also prompted European countries to increase military spending. In terms of political party dynamics, right-wing parties have gained significant influence; in the Netherlands, the far-right Freedom Party has become the largest party in the lower house; in Germany, the Alternative for Germany party ranked second in the European Parliament elections, surpassing the ruling Social Democratic Party. Additionally, right-wing parties in Italy, Finland, the Czech Republic, and Slovakia have played important roles in their governments. Influenced by the U.S., limiting illegal immigration and economic isolation have also become major issues for European countries. Europe's policies towards the crypto market are more in a following state, with the implementation of the Markets in Crypto-Assets (MiCA) regulation at the end of 2024 clarifying the regulatory framework for stablecoins and cryptocurrency entities, while European countries maintain strict scrutiny over crypto tax regulations.

Geopolitics in Other Regions

The Middle East remains embroiled in conflict, with Hamas launching large-scale terrorist attacks against Israel last year. In the following year, Israel has conducted operations in Gaza and eliminated several senior Hamas leaders, bringing the situation to a close. Meanwhile, Iran and Lebanon have also had friction with Israel, leading to armed conflicts, and the Syrian civil war has resulted in the downfall of the Assad regime. In South America, Argentina's Milei has implemented extensive reforms, eliminating numerous government departments and dollarizing the currency, achieving some success in reducing Argentina's overall inflation rate. Many countries and regions in South America are also advocates of Bitcoin, with Argentina, Brazil, and El Salvador advancing legislation to allow crypto to be legally regulated and circulated in their countries.

Economy

In 2024, global GDP is expected to grow by 2.6%, with an inflation rate of 2.5%. The world has emerged from the recession caused by COVID-19 and has returned to growth levels seen before the outbreak. After two years of continuous interest rate hikes, the U.S. has finally managed to partially control inflation, with the Federal Reserve starting to cut rates by 25 basis points in three consecutive meetings beginning in September 2024. Currently, inflation seems to be under control, and the economy is moving towards a stable landing. The Eurozone has been more affected by geopolitical conflicts, leading to soaring energy prices, and the European Central Bank has been forced to raise rates in response to the Fed's high rates, resulting in sluggish economic growth. China and emerging market countries continue to maintain high growth rates but face significant challenges. China is experiencing deflation due to weak domestic consumption and export resistance, facing high unemployment rates and difficulties for businesses, along with a real estate bubble burst that poses risks of significant debt and bad loans. Emerging market countries are also affected by the Fed's interest rate hikes, leading to severe depreciation of some local currencies.

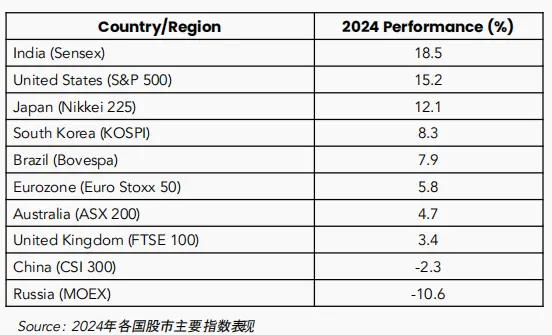

Looking at the development of the U.S. economy in 2024, it remains in a leading position globally. The three major U.S. indices have all seen significant increases, with the tech-heavy Nasdaq rising over 28%, and the S&P 500 also increasing by 15.2%. Throughout the year, the U.S. has been largely engaged in a long-term battle against inflation, and despite extremely tight funding conditions, tech companies have still demonstrated remarkable growth potential. AI tech companies, represented by Nvidia, have performed exceptionally well this year, and the development of AI has met investors' expectations, with AI large models like ChatGPT disrupting various fields such as professions, education, and artistic creation, exponentially increasing productivity. With the continuous improvement of computing power, AI is expected to expand its practical applications in more fields. Another standout performance on the list is the Nikkei index, as the yen maintains a 0% interest rate during the global interest rate hike cycle, attracting international investors to engage in carry trades in the Japanese stock market, which has driven up Japanese stocks and led to yen depreciation. The pursuit of capital and the export trade advantages brought by yen depreciation have enhanced the profitability of Japanese companies, allowing the Japanese stock market to finally reach new highs after more than 30 years of bubble collapse.

02 Bitcoin

Product and Protocol Design

In the second half of 2024, there have been some important software upgrades on Bitcoin, such as the introduction of flexible transaction forwarding strategies in Bitcoin Core 28.0 and BOLT12 for the Lightning Network. These client upgrades may impact various application scenarios. For example, Bitcoin Core's implementation of V3 transactions now supports zero-fee transaction forwarding, which may influence the development of MEV-related business models adopted by mining pools.

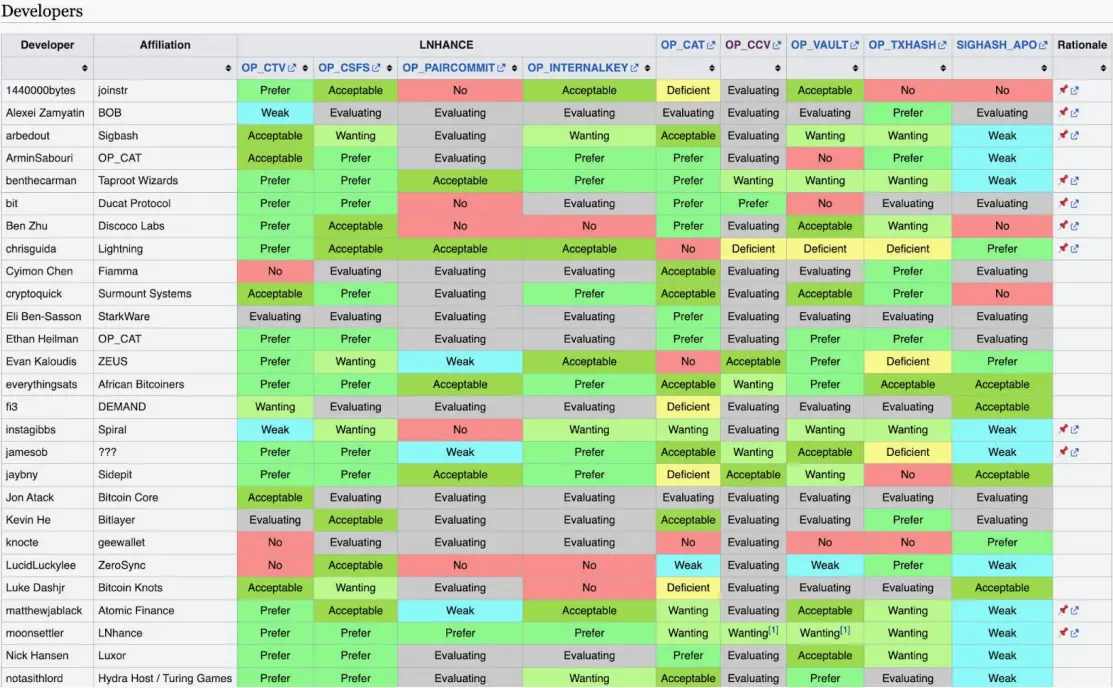

Discussions regarding the design of the Bitcoin protocol layer are ongoing, primarily focusing on soft fork proposals. There are significant disagreements among many developers, as seen in the OPNEXT summit held at the end of 2024 and subsequent discussions. Currently, these discussions can be roughly divided into several camps: one group aims to achieve restrictive clauses or other more flexible functions by adding new opcodes, such as OPCTV and OP_CAT; another group is LNHANCE, which introduces a complete set of tools to improve the Lightning Network; and some developers are pushing for what is called the "Great Script Restoration" movement.

In these discussions, no consensus has been reached. Some discussions focus on whether certain upgrades are overly specialized and lack diversity (such as OPCTV), while others concern whether some proposals are too flexible (such as OPCAT), which could lead to unintended uses like recursive restrictions, thereby introducing unforeseen risks at the protocol level. Additionally, some developers advocate for a consensus cleanup before pursuing functional upgrades.

Discussions about these proposals mainly take place in mailing lists. There is also a feedback form in the community to collect opinions from developers of various backgrounds. Furthermore, several studies have analyzed transactions related to soft fork proposals that are currently active on signet.

(Source link: https://en.bitcoin.it/wiki/Covenants_support)

However, it is foreseeable that many intense discussions and controversies will arise during the activation process of future soft forks, similar to the previous Taproot soft fork upgrade. By 2025, we hope to see some form of consensus and development.

Another previously discussed implementation plan—the implementation of BitVM—is still progressing steadily. Similar to previous reports, the current focus remains on the design and implementation of cross-chain bridges. Recently, some test versions of BitVM-based cross-chain bridges have begun to operate, such as BitLayer.

Layer 2 - Lightning Network

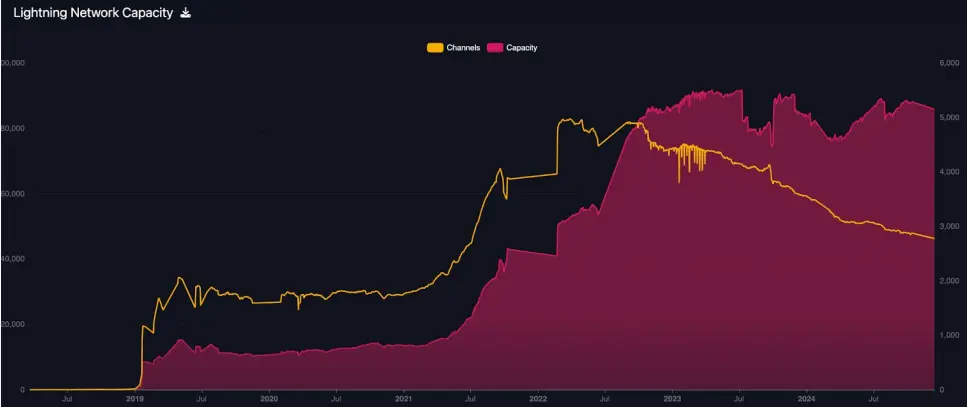

The number of publicly accessible Lightning Network channels has not changed significantly, remaining at around 5,000 BTC. The number of nodes has remained stable, but the number of channels has continued to decrease. This may indicate that the liquidity of the Lightning Network is gradually concentrating in the hands of a few large node service providers, or that some early channels have been closed due to security patch updates. However, the protocol and application ecosystem of the Lightning Network continue to evolve. For example, BOLT12 (offer) has been adopted by many clients, supporting static payment methods to enhance user experience.

In addition, some Layer 1 networks (such as Nervos CK B, etc.) are actively developing Layer 2 solutions that comply with BOLT specifications to achieve compatibility and interoperability with the Lightning Network. The main focus in this area remains on assessing the feasibility of business models. Since token issuance is generally not used as a fundraising method or integrated into business operations, investment and financing decisions must pay more attention to performance indicators of projects, such as user numbers and asset scale.

As the payment sector gains increasing attention, the Lightning Network's ability to support payment services makes it a promising solution for widespread adoption. Service-oriented projects, especially those utilizing the Lightning Network as a settlement layer for cross-border transactions, may receive more attention. Projects providing the Lightning Network as a settlement layer for cross-border, peer-to-peer (P2P), and business-to-business (B2B) transactions (such as Breez Technology, etc.) are expected to gain more attention and development momentum. The future development in this area depends on issuing stablecoins on the Lightning Network, with possible implementations including RG B and Taproot Assets mentioned below.

Layer 2 - Side Chains

The performance of Layer 2 side chains has been mixed. Some projects have seen a decline since their peak, while others continue to grow. As shown in the chart below, the TVL of various Layer 2 projects exhibits a clear alternating trend.

Source: DeFi Llama

The challenges faced by Bitcoin Layer 2 (L2) and BTCFi are multifaceted, with one key issue being the reliance on unsustainable TVL surges and airdrop incentives. Although attempts have been made to use points to incentivize TVL, the key factor remains building a robust ecosystem to ensure lasting liquidity. The main driver for Bitcoin deposits in L2 solutions is the opportunity to obtain low-risk returns priced in Bitcoin. However, in terms of portfolio composition, BTCFi can achieve better liquidity abstraction and protocol layer stacking by leveraging existing infrastructure. If Bitcoin L2 can focus on building an ecosystem around enhancing the utility of BTCFi rather than simply replicating EVM chains, there is still significant room for growth.

In summary, the key to the success of Bitcoin L2 lies in: 1) ensuring asset security (whether through third-party custody or self-custody); and 2) pursuing a vertical integration strategy (which will better serve BTCFi).

On-Chain Assets

Assets on the Bitcoin chain can generally be divided into two main categories: meta-protocols and CSV (Client-Side Validation). However, overall, these assets have not shown significant appreciation in value alongside the rise in Bitcoin prices and exhibit low activity. Altcoins on the Bitcoin chain have generally not outperformed other altcoins.

BRC20, Runes

BRC20, Runes, and other meta-protocol assets have recently underperformed. Their market capitalization and growth are far behind many popular meme assets this year, confirming that such assets have a short lifecycle and cyclical characteristics in the absence of strong utility. These easily replaceable tokens are now being supplanted by newer meme and AI agent narratives.

RGB

As one of the earliest CSV protocols, RGB is still being promoted. Some technical implementations are already capable of supporting integration with the Lightning Network. The narrative around RGB largely revolves around the issuance of Tether stablecoins, but specific implementation plans remain unclear. In terms of further programmability, AluVM's support for more flexible development possibilities may take some time. Therefore, overall, the performance of RGB-type protocols and assets remains to be observed.

Taproot Assets

Taproot Assets, launched by the Lightning Network development team Lightning Labs, enable the minting of stablecoins at lower fees and facilitate instant settlements on Bitcoin. Tether has also announced plans to issue stablecoins based on Taproot Assets.

In the on-chain asset space, due to the current insufficient experience and liquidity support of Bitcoin chain DEXs to meet the demand for better-performing tokens, CEXs remain important for such assets. At the same time, the inherent support of CEX exchanges for technologies like hot and cold wallets may pose certain challenges for the integration of some new asset types.

BTCFi

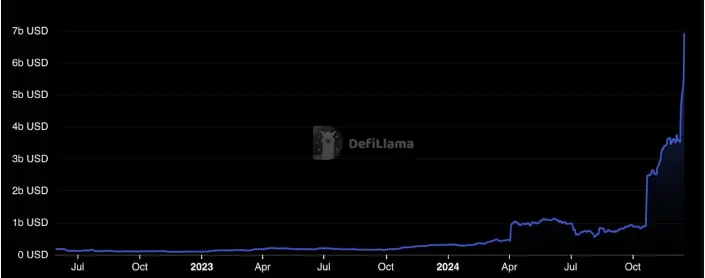

BTCFi can provide Bitcoin holders with additional returns priced in Bitcoin, and with the continuous improvement of infrastructure, the total value locked is expected to grow.

Source: DeFi Llama

Additionally, as mentioned in the L2 section above, the types of returns pursued by BTC assets have shifted from L2 to staking, liquid staking, and liquid re-staking, which can compound multiple returns and drive the growth of various BTCFi projects.

Among them, Babylon, as the cornerstone of this return pathway, has attracted a significant amount of Bitcoin-priced TVL after several phases of controlled testing, highlighting the community's urgent need to enhance BTC utility by leveraging Bitcoin's decentralized and proven security. As a gateway into the BTCFi ecosystem, Babylon enables Bitcoin holders to participate directly. Furthermore, various LST projects have emerged to unlock liquidity and promote DeFi activities. The designs of these LST projects generally draw on mature DeFi design concepts, incorporating methods like veModel and Pendle into the protocols; at the same time, they have unified the abstraction of rewards extracted from the liquidity layer and various partners. Over the past six months, the composability of these protocols has matured further. However, recent controversies surrounding Solv, as well as questions about how BTCFi TVL is calculated and how promised returns are fulfilled, cast a shadow over the start of BTCFi in 2025.

An important focus this year is finding ways to enable staked assets to be utilized and circulated efficiently rather than remaining idle. Projects like Yala, along with other lending and stablecoin initiatives, are leveraging the native infrastructure of the Bitcoin blockchain. With market support for a bullish outlook on BTCFi, these projects are expected to see significant growth and development opportunities. However, on the other hand, the rising capital costs during the bull market also pose considerable challenges for the listing strategies of projects. Protocols that can flexibly mobilize Bitcoin liquidity and support a richer variety of asset classes will have a better chance of success.

03 Ethereum

Despite the launch of ETH ETFs in the U.S. on July 23, 2024, their performance has not replicated the success of Bitcoin ETF pioneers, nor has it positively catalyzed the underperforming Ethereum price, with its ETH/BTC ratio dropping from 0.054 in January to 0.037 in December, highlighting institutional investors' interest in Bitcoin far exceeding that in Ethereum. Additionally, since the Dencun upgrade, gas fees on Layer 2 have significantly decreased compared to Ethereum, leading to more funds flowing into Layer 2 projects like Base, which recorded approximately $3.2 billion in net inflows in 2024, while Ethereum saw a net outflow of nearly $8 billion.

However, under a crypto-friendly Trump administration in 2025, Ethereum ETFs are expected to perform best in December, setting a record of approximately $2 billion in net inflows. Meanwhile, EVM remains the most dominant and active virtual machine in the ecosystem, prompting many developers to continue building EVM-compatible networks and applications, such as MegaETH and Monad, which are among the most anticipated launches in 2025. Given the simplicity of Solidity, its battle-tested security, and Ethereum's vast ecosystem, we believe Ethereum and its EVM ecosystem will continue to maintain dominance in 2025, although competitive alternatives may gradually erode its market share.

3.1 L2s

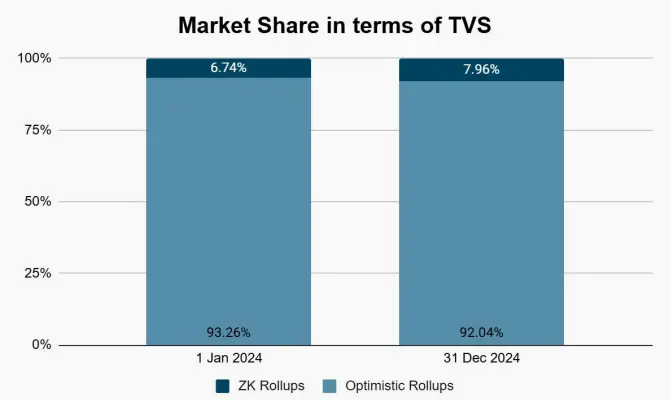

Since the introduction of blob data storage in the Dencun upgrade, the transaction fees for rollups have decreased by over 90%, enabling leading Layer 2s like Base, OPMainnet, and Arbitrum to achieve net inflows of $3.5 billion, $2.1 billion, and $1.7 billion, respectively. Consequently, the usage of rollups in 2024 has significantly increased: the daily transaction count for Layer 2 grew from 5.18 million to 16.86 million, an increase of over 325%, and the number of daily active addresses rose from 989,000 to 2.18 million. These mainstream rollups are filled with optimism, highlighting users' preferences for low costs and high efficiency, whereas zk rollups, despite having lower fraud risks, have relatively higher fees.

Source: L2 Beat, HashKey Capital

Base's significant influx of funds can be attributed to several factors, including a smooth consumer experience, a strategic partnership with Coinbase, and the launch of popular consumer applications such as Farcaster and Virtuals Protocol, which have attracted a large number of users to Base. The daily active user count has surged from 68,324 to 1.6 million. In 2024, DeFi activity on Base saw a significant increase, with its stablecoin market growing from $178 million to $3.6 billion, and daily decentralized exchange (DEX) trading volume skyrocketing from $21.6 million to $1.7 billion. Additionally, Base announced a significant partnership with Stripe. Under this partnership, Stripe will add support for USDC on Base in its crypto payment products and include USDC in its fiat-to-crypto channels, while Coinbase Wallet will also integrate Stripe's token listing feature, allowing users to seamlessly purchase cryptocurrencies with credit cards. Looking ahead, we believe the success of consumer applications on Base will attract more consumer-centric innovations, and developers will leverage the strategic partnership between Base and Coinbase to further expand the market.

Currently, Arbitrum, the largest rollup in terms of TVL, is also one of the main beneficiaries of L2 migration. The launch of Arbitrum Stylus allows developers to easily write smart contracts using various developer-friendly languages (such as Rust, C, C++), opening the door for over 10 million developers worldwide. Upgrades like ArbOS 32 and Nitro v3.2.0 further enhance network security, effectively preventing potential denial-of-service attacks. The protocol's future development roadmap includes measures such as multi-client support, adaptive pricing, chain clustering, and sequencer decentralization, which will promote a higher degree of synergy between Arbitrum's rollup chains and create cumulative value for the Arbitrum community.

In the second half of 2024, OP Superchain continues to gain momentum, with new chains like Unichain, Ink, and Soneium joining the ecosystem. By the end of the year, the total number of chains based on OP-Stack reached 56, accounting for 43% of all L2/3 chains, while Superchain's trading volume accounted for over 56% of all L2 trading volume. The number of active developers on OP Stack chains also surged from fewer than 900 to 3,446, reinforcing the positive network effects created by OP Superchain. However, most of the activity is still dominated by Base, which has firmly established itself as a top Superchain member. New entrants like UniSwap's Unichain, Kraken's Ink, and Sony's Soneium can also leverage their respective network effects and are expected to carve out a share from Base. Overall, we believe the competition between OP Stack, Arbitrum Orbit, and zkSync's Hyperchain will intensify in 2025, each vying for a virtuous cycle of network effects with unique and competitive value propositions.

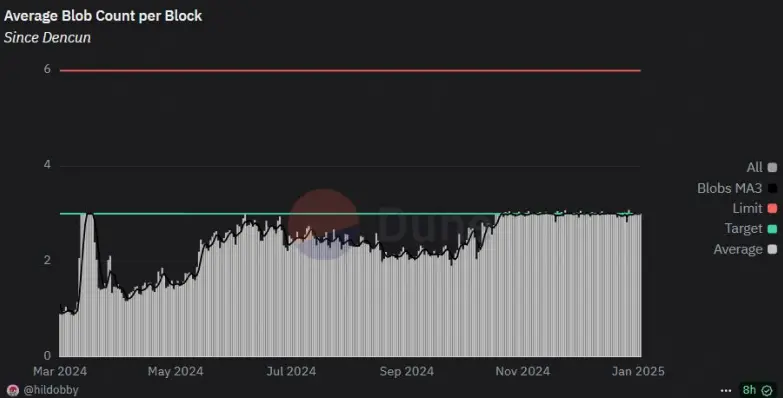

Although the Dencun upgrade has benefited many L2 networks, with blob capacity approaching target utilization since November, this upgrade has also sparked discussions about whether it constitutes an erosion of Ethereum itself. With the Pectra upgrade expected to launch in the second quarter of 2025, aiming to increase the target/max blob capacity from 3-6 to 6-9, we anticipate that L2 networks with unique positioning and value propositions will further consolidate and enhance user stickiness, becoming significant competitors to alt-L1 networks.

Source: Dune analytics (@hildobby)

3.2 Liquid Staking

In 2024, the overall amount of staked Ethereum showed an upward trend, reaching a peak of 34.5 million ETH as of November 10, 2024; meanwhile, yields have been on a downward trajectory, dropping to 3% by the end of the year, highlighting the inverse relationship between reward rates and staked Ethereum.

This phenomenon has prompted users to seek alternative yields through liquidity provision or lending activities in the form of liquid re-staking tokens. As a result, re-staking protocols (such as Eigenlayer) have attracted significant TVL, although their growth momentum weakened in the second half of 2024, with TVL declining from 5.11 million ETH to 4.44 million ETH by year-end. We believe this is primarily due to delays in the rollout of the slashing mechanism, which is expected to be enabled in the first quarter of 2025.

In the second half of 2024, Karak, as a re-staking platform, performed modestly, while Symbiotic's total locked value (TVL) saw substantial growth, skyrocketing from $307 million to $2.12 billion, an increase of over 5 times. This growth underscores the appeal and competitiveness of Symbiotic's flexible re-staking mechanism, attracting a broader and more diverse group of stakers.

As the importance of re-staking as a key economic and infrastructure pillar solidifies, future catalysts will depend on the successful rollout of the slashing mechanism and the flexibility offered to AVS, stakers, and node operators, which can achieve an optimal balance between economic security and the yields provided.

3.3 Ethereum's Future Roadmap and EIP Proposals

2025 is set to be one of the most significant years in Ethereum's development history, as it plans a major upgrade—Pectra. This upgrade is expected to be completed in the first quarter of 2025, but it has not been without its challenges, as clients and researchers have engaged in intense debates over multiple EIP proposals. The implementation of these EIPs is highly complex, posing challenges to the original timeline. However, after several rounds of discussions, the EIP versions to be included in Pectra have been finalized. If executed smoothly, the Pectra upgrade is expected to be completed as planned. Here are several key EIP proposals that will have a profound impact on Ethereum's adoption and scalability:

Key EIP Proposals

EIP-7691: Expand Blob Target Capacity, Reduce L2 Fees This upgrade plans to increase the target number of blobs per Ethereum block from 3 to 6, further reducing L2 transaction fees. Since November 2024, blob fees have approached the target upper limit, and as demand exceeds the target blob capacity, fees may increase exponentially. Therefore, this upgrade will help control L2 costs, making it more competitive against Alt-L1 in 2025.

EIP-7702: Implement Smart Contract Functionality for EOA Accounts This proposal replaces the earlier EIP-3074 and aims to introduce smart contract functionality for EOA (Externally Owned Accounts). Due to the need for applications and protocols to adapt to ERC-4337, its adoption has been slow. EIP-7702 will significantly enhance user experience by natively integrating account abstraction into the underlying network. We are excited about its potential to bring better wallet UX and enhanced security mechanisms to prevent users from inadvertently signing fraudulent transactions.

EIP-7251: Optimize Validator Management, Reduce Network Load This proposal aims to alleviate network load by increasing the maximum Ethereum staking limit for validators from 32 ETH to 2048 ETH, thereby reducing the number of active validators. This will lower the pressure on Ethereum's consensus layer and improve network efficiency.

Looking ahead, Ethereum's core research team has restructured its long-term development roadmap, aiming for a major upgrade in 2029 that will introduce core technologies such as zero-knowledge proofs (zk proofs) and post-quantum cryptography to fundamentally transform Ethereum's consensus layer.

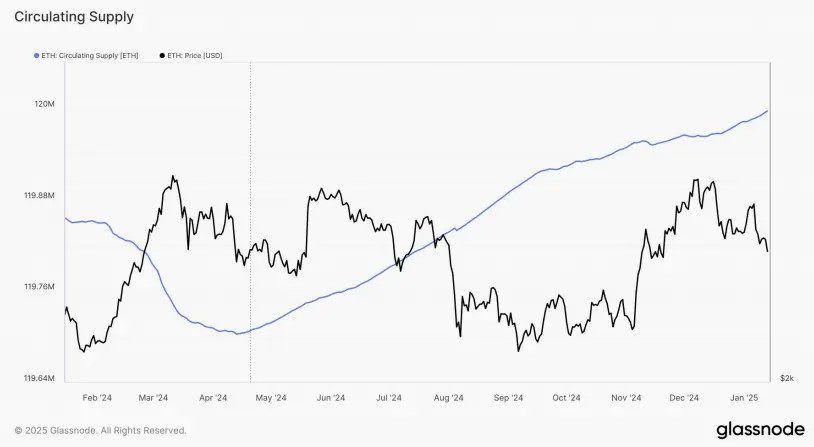

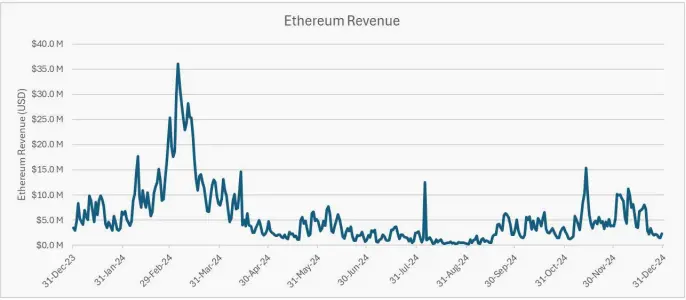

Currently, due to the continuous decline in L1 transaction fees, Ethereum has been in a state of net inflation for most of 2024. Therefore, Ethereum will need to adjust the issuance curve of staking rewards in the future while attracting high-throughput applications to run on its platform, creating greater value for holders.

Source: Glassnode

Source: Artemis.xyz

3.4 Other Infrastructure

Sequencers

As most Ethereum L2s rely on a single sequencer for operation, this centralization risk has raised concerns about censorship resistance and network resilience. The concept of decentralized shared sequencing aims to enhance network resilience during high-traffic periods and redistribute value capture through a decentralized network of sequencing node operators. The importance of this concept has been further highlighted by the increasing challenges of liquidity fragmentation and interoperability, especially in rollup ecosystems that operate independent sequencers.

In 2024, Metis became the first Ethereum rollup to achieve sequencer decentralization. Currently, major players in the decentralized sequencing space include Astria, Espresso, and Rome Protocol. As the adoption of decentralized sequencing rises, we expect significant growth in this area in 2025, with rollup projects like Arbitrum, Optimism, and Linea announcing plans to decentralize their sequencers. Other innovative sequencing designs are also being explored, such as the Solana shared sequencer proposed by Rome Protocol, which leverages Solana's localized fee market and high-performance network and may gain greater attention.

The future success of decentralized sequencing will depend on the Rollup ecosystem's demand for decentralization, including: censorship resistance, value redistribution, and enhanced network activity, while achieving a balance in areas such as transaction latency and economic incentive alignment to effectively manage a distributed sequencer network.

Data Availability and Modular Blockchains

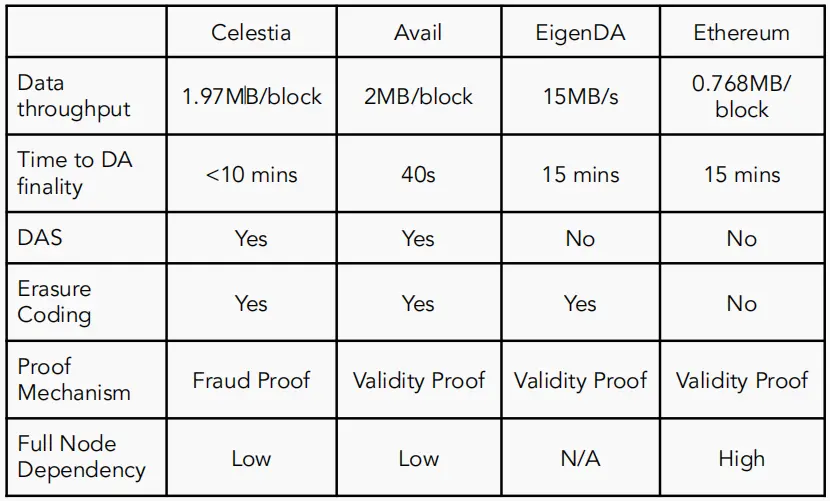

The data availability track is still dominated by Ethereum Blobs, Celestia, Avail, and EigenDA. As RaaS (Rollup-as-a-Service) makes Rollup deployment more seamless, the demand for data availability solutions continues to grow. Currently, 23 Rollups have adopted Celestia, with Eclipse being its largest client, consuming the largest amount of data availability blobs. At the same time, EigenDA is also deeply integrated with leading RaaS providers in the Alt Layer and Rollup stack architecture. EigenDA currently has a throughput of 15MB/s, aiming to reach 1GB/s in the future, but is still limited by the trust assumptions of its Data Availability Committee (DAC).

Currently, Ethereum's DA costs are high and its throughput is slow, providing an opportunity for data availability solutions to capture the market by increasing data throughput and reducing costs. In the long term, Ethereum's vision is to provide low-cost data availability solutions starting with the Pectra upgrade and ultimately implementing Peer DAs. Therefore, aligning Rollup-focused data availability solutions with the Ethereum ecosystem will be a favorable strategy.

Source: HashKey Capital

Intent and Chain Abstraction

Chain abstraction remains an important narrative in the Web3 space, especially as ecosystems evolve from monolithic, isolated networks to modular network architectures, with each layer of the tech stack optimized for performance. However, as this innovation continues to develop, the issue of cross-chain liquidity fragmentation has resurfaced. To address this challenge, the ChainAbstraction Coalition was established last year, comprising over 60 blockchains, including Arbitrum, Berachain, Linea, and BNB.

Other major players such as Particle Network and Xion have also launched Universal Accounts and Meta Accounts, respectively, promoting the adoption of chain abstraction solutions. Particle Network's Universal X (a trading platform based on Universal Accounts) has already integrated with 12 EVM networks and Solana. Xion's Meta account user base has also surpassed 4 million, demonstrating the demand and importance of chain abstraction.

In the second quarter of 2024, one of the most significant advancements in cross-chain interoperability was the introduction of the ERC-7683 proposal. ERC-7683 aims to address the urgent interoperability challenges faced by blockchain networks by building a universal filler network to support a shared liquidity layer. The introduction of this standard is expected to become an important milestone for cross-chain interoperability. We believe ERC-7683 may be favored by more protocols seeking to enhance user experience and gain broader adoption on their platforms.

AI Agents and Intent-Driven DeFi Trading

In August 2024, Circle Research published a study exploring the feasibility of executing intent-based transactions using large language models (LLMs) (such as OpenAI GPT-3.5 Turbo). As the reasoning capabilities of large language models continue to improve, combined with the maturation of AI agent technology, this field is rapidly innovating, bringing new breakthroughs to the DeFi trading experience. In the future, innovations in this direction will expand the boundaries of AI agent-based DeFi trading, significantly enhancing user experience. A noteworthy case is the AI agent Griffain, which can automatically execute trades based on users' natural language requests, further lowering the operational threshold for users and improving the usability of cross-chain DeFi.

04 Solana

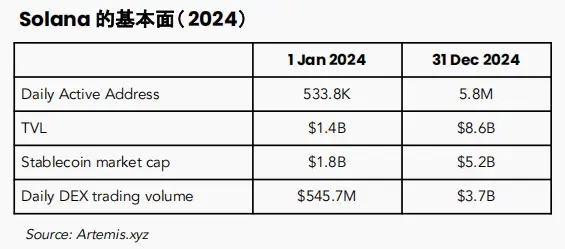

In 2024, Solana performed exceptionally well, with a price increase of about 75%, primarily due to its enhanced competitiveness against Ethereum, with its SOL/ETH ratio rising from 0.04 to 0.06, making it one of the best-performing blue chips. Leveraging its unique SVM architecture—supporting localized fee markets and parallel transaction processing—Solana offers lower fees and higher throughput. As a result, many high-performance decentralized applications have chosen to build on this network, and the influx of innovative applications has greatly improved Solana's fundamentals. Developments in DeFi in 2024 include the launch of cbBTC on Solana, incentive activities for PYUSD, and Solana's liquidity re-staking model boosting platform liquidity. As a leading indicator of network adoption, the market capitalization of stablecoins grew more than threefold in 2024, reaching $5.1 billion. In addition to its growing popularity among retail users, Solana also achieved significant growth in developer adoption. According to the latest report from Electric Capital, Solana attracted more new developers in 2024 than any other blockchain, surpassing Ethereum for the first time. Institutional adoption of Solana has also become increasingly evident, with partnerships with Shopify and Visa further strengthening the network's growth.

Clearly, Solana has demonstrated lasting competitiveness across multiple domains, including DeFi, NFTs, DePIN, payments, consumer-facing applications, and many others, attracting numerous significant projects and partners. In 2024, the focus of the Solana ecosystem was primarily on DePIN, meme, and PayFi:

DePIN

In early 2023, the leading DePIN project Helium officially migrated to Solana, leveraging Solana's low fees and high TPS to drive the connection and management of communication devices, becoming one of the largest IoT wireless networks globally, while also leaving a strong user community in the Solana ecosystem. The HNT token's FDV reached as high as $2.2 billion, completing the Solana DePIN template. Subsequently, another major DePIN project, RenderNetwork, also migrated to the Solana network, similarly leveraging Solana's platform advantages to provide decentralized computing and rendering services, with its token FDV exceeding $8 billion at one point, and network revenue tripling in 2024. Additionally, with the continuous development of artificial intelligence, the capabilities of various multimodal large language models are becoming increasingly evident. This growth, along with the increasing number of applications based on these large language models, in turn drives greater demand for computing resources such as GPUs. As one of the most influential computing power projects in 2024, the native token $IO of ionet has been highly anticipated since its primary market financing and mining incentive program launched. After going live, its fully diluted valuation (FDV) exceeded $4.8 billion. Based on this strong user and community foundation, a large number of well-regarded DePIN projects emerged in the Solana ecosystem in 2024, such as Hivemapper, Cudis, Grass, and XNET. In addition to the platform's performance advantages, the enthusiasm gathered by these DePIN projects is also a significant reason why Solana has become the preferred platform for DePIN project teams.

Meme

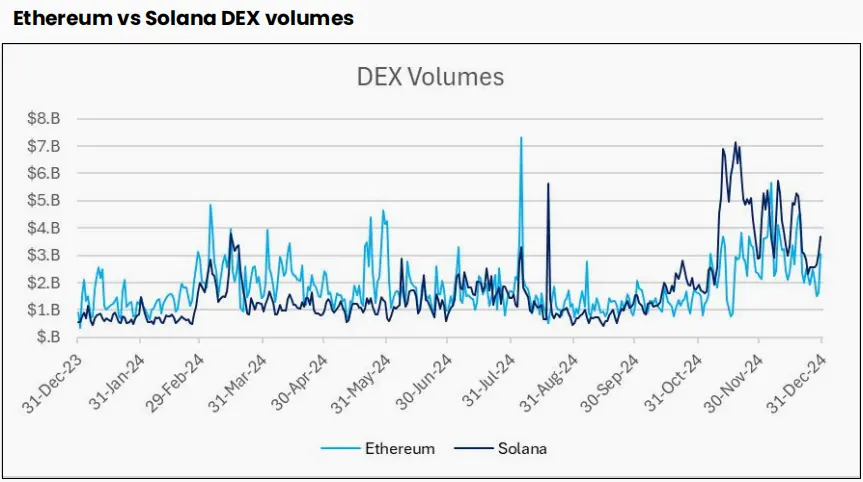

2024 is regarded as the year of Memecoins, where the status of Memecoins can even be compared to that of DeFi in the previous cycle, closely integrating new cultural and social forms with crypto, while also bringing a large number of users into the crypto industry. Due to the low entry barrier and frequent trading characteristics of Memecoins, they require a platform like Solana that offers high TPS, low transaction fees, and stable costs to provide the most user-friendly trading environment. At the same time, it also needs an active community to quickly gain community attention, all of which are advantages that Solana possesses. Notably, Pump.fun, as a launch platform for memecoins, has achieved great success, with various memecoins (such as PNUT, FARTCOIN, MOODENG, and GOAT) contributing significant trading volume on Solana. Since the fourth quarter of 2024, Solana's trading volume has largely surpassed that of Ethereum. The weekly DEX trading volume on Solana/Ethereum increased from 48.85% to 137.47%.

On the other hand, data analysis platforms are also crucial for early detection of meme investment opportunities. In addition to general platforms like Dexscreener and Dextool, GMGN.ai, which launched during the meme craze, provides more direct functionalities, such as Pump.fun line chart services, address tracking, and SmartMoney/KOL wallet tracking, better catering to the needs of meme coin investors. At the same time, a large number of TG bots have emerged, providing users with timely trading alerts through on-chain or community sentiment analysis, such as Solana Early Birds and Pump Alert.

Solana's Memecoins have repeatedly demonstrated the vibrancy of the Solana ecosystem, while also validating the existence of Memecoins as not just air, but as a culture and value system, serving as a community force with liquidity far stronger than NFTs.

PayFi

PayFi is a new concept proposed by Lily Liu, the chair of the Solana Foundation, aimed at building a brand new financial market centered around the time value of money. It integrates the efficient programmability of crypto payments, low friction and composability of DeFi behaviors, and other unique advantages of Web3, hoping to bring more traditional assets into Web3 and establish a new financial market that makes global financial payment activities more convenient and cost-effective.

One significant difference or advantage of the Solana ecosystem compared to others is that it has many out-of-the-box infrastructures, such as Solana Pay. The goal of Solana Pay is not just to "pay with cryptocurrency," but to usher in a new era of payments and commerce. Solana enables users to pay merchants with almost instant confirmation, with the lowest and most predictable fees. Solana Pay can be used as an integrated plugin option in Shopify-supported stores. Additionally, Solana has partnered with VISA to open up offline payment channels.

Looking Ahead

Although Firedancer has not yet been activated, its future activation and application will further enhance the network's performance and security, allowing it to capture more market share from Ethereum. The Solana plugin was released in early 2024, providing higher granularity, greater flexibility, and stronger programmability in token issuance. We believe this will drive more institutions to adopt on-chain solutions while maintaining enterprise-level security. The potential approval of Solana ETFs, the growth of the stablecoin market, institutional adoption, and the increasing DeFi activity will all serve as positive catalysts for the Solana ecosystem.

Source: Artemis.xyz

In the coming year, we will continue to focus on the following areas:

Solana itself: Solana has two potential positives in 2025: the possible launch of Sol ETFs and the rollout of the Firedancer client. These two points will be long-term positives for Solana. Of course, in the short term, there will also be a massive unlocking of Sol in the secondary market. Timing investments in the Sol token could be considered.

Solana SVM and Layer 2: Solana's current TPS may not be sufficient to support the future prosperity of the ecosystem. In addition to the Firedancer upgrade of the mainnet, SVM is also an opportunity. Of course, Solana's Layer 2 not only addresses network scalability issues but can also serve as a bridge for the Solana ecosystem, settling applications from other ecosystems on the Solana mainnet, bringing more transaction volume and ecosystem activity to Solana.

Applications

- Community-driven applications: Solana's community is undoubtedly one of the most active in the crypto industry. If Ethereum is driven by a technical community that easily produces new infrastructure innovations, then Solana is driven by a user community that easily attracts phenomenal applications. Even applications like Memecoins, which have no practical use, have gathered countless user attention, and this attention is the most valuable resource for developing applications.

- Out-of-the-box applications: Solana is clearly striving to break out in various fields. In terms of infrastructure, it has solved payment and deposit/withdrawal issues and launched the Solana phone as a carrier for applications and PayFi; on the user side, it has already made an impact in the traditional world through Memecoins and DePIN; in terms of business, it has numerous traditional partners like VISA and Shopify. If any ecosystem in the crypto industry can break out the fastest, it must be Solana. The mass adoption pursued by the crypto industry will also occur first in the Solana ecosystem.

05 Alt-L1s

Alt-L1s continued to gain strong attention in 2024, providing investors with experiences different from Ethereum and competing in various aspects, such as more active ecosystems, lower latency, higher throughput, and lower transaction fees. Here are some important and emerging Alt-L1s to watch in 2025.

5.1 Berachain

Unlike traditional PoS networks, Berachain introduces a brand new consensus mechanism. Through its unique Proof of Liquidity (PoL) mechanism, Berachain rewards liquidity providers with governance tokens, ensuring incentive alignment among validators, dApps, and users while maintaining decentralization. Berachain's BeaconKit modular consensus client is also EVM-compatible, allowing it to connect to the vast Ethereum ecosystem while offering competitive features such as Single Slot Finality and Optimistic Payload Building. Before its launch on February 6, 2025, Berachain had already gained significant attention, with its TVL (Total Value Locked) exceeding $1.5 billion, primarily from pre-funded vaults of its multiple partners. After launch, supported by its large and enthusiastic community, Berachain has risen to become the eighth-largest network by TVL, surpassing Sui and Avalanche. The future success of the network will depend on how it meets demand through innovative incentive mechanisms and applications.

5.2 TON

One of the most notable narratives in 2024 is TON, especially in Q2 and Q3. With over 900 million monthly active users (MAU) on Telegram, TON attracted significant attention in 2024. Among them, the highly popular game Catizen reached 4.7 million monthly active users, making it one of the hottest Telegram mini-games of 2024. Most blockchain networks face cold start issues and incentive mechanism challenges, while TON benefits from deep integration with Telegram, giving it a natural competitive advantage that allows a large user base to seamlessly engage in on-chain interactions through TON wallets (like UXUY), TON trading bots, and Telegram mini-games. This advantage is validated by the data:

TON's daily active users (DAU) grew from 27,725 in 2024 to 293,539.

TON's DeFi TVL has increased more than tenfold since the beginning of 2024, from $13.51 million to $261.7 million.

However, since Q4, as market attention began to shift to other hotspots, the TON ecosystem and performance fell short of expectations, and its underlying architecture made it difficult for leading DeFi protocols to migrate, resulting in a decline in TVL by the end of the year. In 2025, TON's growth will depend on establishing closer partnerships with Telegram and exploring innovative channels beyond simple click-to-earn models to attract new users and activate its ecosystem.

5.3 Kaia

Kaia is a new blockchain platform formed by the merger of Klaytn and Finschia, officially launching its mainnet on August 29, 2024. As a fully EVM-compatible platform, Kaia seamlessly integrates with LINE and KakaoTalk—two of the world's largest messaging applications, with a combined user base of over 250 million.

Kaia has addressed the common cold start issues faced by Web3 projects, but providing a good user experience is also crucial. To simplify user onboarding, Kaia offers a series of optimizations:

Support for Account Abstraction

Gas Fee Delegation

Keyless MPC Wallets to reduce technical complexity for retail users

Since its autonomous mainnet launch, Kaia's total value locked (TVL) has grown from $37 million to $60 million, indicating that user participation and adoption on the network are rising. Although Kaia has gained a significant advantage through its integration with LINE and KakaoTalk, its success will still depend on how effectively applications can acquire and retain users. To promote ecosystem prosperity across various fields of Web3, Kaia has launched the Kaia Wave program in collaboration with LINE NEXT, a $10 million incentive program that includes NEXT WEB SDK access, integration with LINE NEXT's DappPortal, marketing resources, funding support, and more.

Despite having a good user base, the difference between Kaia and TON is that Kaia's user group is primarily concentrated in Japan, Taiwan, and Thailand; their go-to-market (GTM) and ecosystem support strategies are also different. Therefore, at the current stage of the Kaia ecosystem, more investigation into the project's data and quality is needed before investment. As Kaia launches its first batch of 32 Web3 services under the Kaia Wave program and expands its mini dApp ecosystem, we remain optimistic about Kaia's future development.

5.4 Move

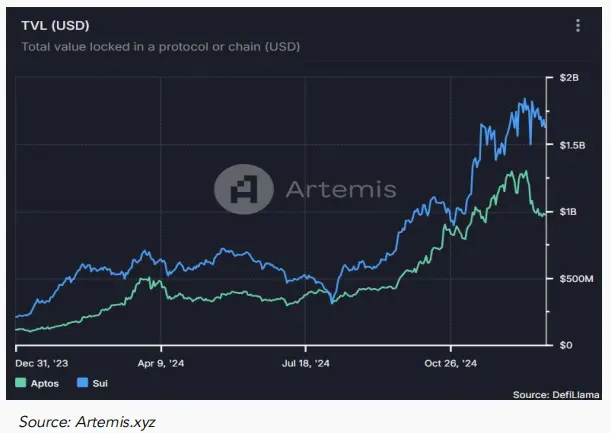

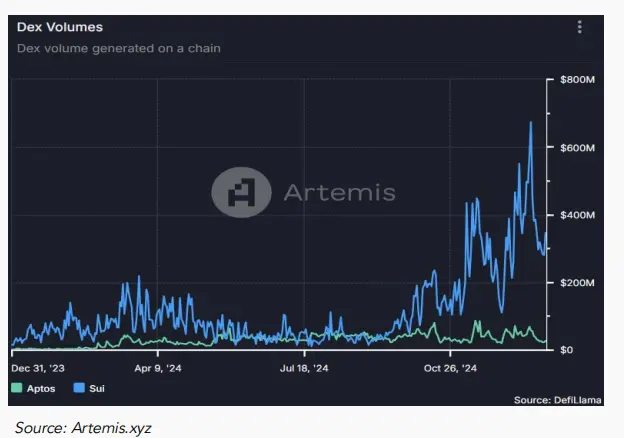

The Move ecosystem gained broader adoption in 2024, with the number of monthly active developers using the Move language increasing from 1,014 to over 1,500 by the end of 2024. Move is an open-source programming language based on Rust, developed by Facebook (Diem team), known for its security, scalability, and ease of use. Within the Move ecosystem, two blockchains dominate market recognition: Sui and Aptos. Both are positioned as high-performance L1s; however, in 2024, Sui significantly outperformed Aptos across several key metrics, including FDV (Fully Diluted Valuation), TVL (Total Value Locked), net capital inflow, and DEX trading volume.

Sui recorded a net inflow of $1.2 billion in 2024, with its native token price soaring nearly 500%. The market capitalization of stablecoins on Sui saw significant growth in 2024, increasing from less than $10 million to $370.77 million, primarily due to Sui's support for native USDC, FDUSD, and USDY. Since the launch of native USDC on Sui, its TVL has grown by over 70%, reaching $1.6 billion by the end of 2024. As the stablecoin market expands, DEX trading volume has also surged. Cetus DEX was listed on Binance in November, driving a substantial increase in its trading volume. Other DeFi protocols, such as Navi, Bluefin, and Haedal, also benefited from this trend, with both TVL and trading volume on the rise. The Sui ecosystem continues to focus on crypto-native applications. Looking ahead, we believe that as DeFi activity increases, institutional adoption of asset tokenization grows, and consumer applications rise, Sui will continue to attract capital.

Aptos also achieved significant growth in 2024. The TVL of Aptos grew from $117.81 million to $975.52 million, an increase of over 8 times. Meanwhile, the market capitalization of stablecoins on Aptos also grew more than 12 times in 2024, rising from $49.27 million to $633.22 million. The daily active user count on Aptos has increased from 88,000 to 1,100,000. However, Aptos is more focused on institutional directions such as RWA tokenization, stablecoins, and BTCFi. For example, leading asset management firms like BlackRock and Franklin Templeton have deployed their tokenized funds on Aptos. Whether the Aptos ecosystem will change after team adjustments remains to be seen in 2025.

Move ment is another network worth paying attention to besides Sui and Aptos. In the fourth quarter of 2024, Move ment announced the launch of its mainnet Beta version of the Ethereum scaling solution M2, based on the Move language. M2 combines the advantages of Move VM while allowing applications to leverage Ethereum's security and deep liquidity.

The Move ment Network also provides a modular toolkit that supports the deployment of Move-Rollups, allowing developers to freely choose: data availability solutions, cross-chain atomic settlement using M1 shared sequencer, and fast finality settlement (FFS).

In the current narrative where modular architecture is becoming a mainstream trend, whether M2 and Move-Rollups can compete with existing Rollups due to their unique architecture will be a focal point in 2025.

5.5 MegaETH

MegaETH is an EVM-compatible blockchain with a transaction throughput of up to 100,000 TPS, strong computational power, and millisecond block times, enabling developers to build low-latency, high-computation applications. Despite the emergence of numerous new chains in the blockchain industry, existing blockchains still face significant limitations in transaction throughput and computational capacity. MegaETH addresses these challenges by introducing node specialization, separating the roles of sequencer, prover, full node, and replica node to optimize overall performance. This innovative architecture allows each node type to match specialized hardware requirements, enhancing execution efficiency while maintaining decentralization. MegaETH also focuses on real-time transaction processing and state synchronization, which are crucial for high-frequency, low-latency applications. Discussions about MegaETH are lively, detailing its innovative real-time blockchain technology, which is expected to enhance Ethereum's scalability and attract high-performance applications. It will be interesting to see how MegaETH competes with rivals like Monad and Solana in attracting high-performance applications after its launch.

5.6 Monad

Monad is an L1 blockchain that achieves optimistic parallel transaction execution across multiple EVM instances while maintaining compatibility with Ethereum bytecode. The core of this technological breakthrough is its custom consensus mechanism—Monad BFT. Monad BFT differs from HotStuff BFT, focusing on reducing latency to enhance transaction confirmation speed. Additionally, Monad integrates Monad DB, its proprietary database that natively implements Patricia tree structure, optimizing data storage at both disk and memory levels to reduce computational bottlenecks. Monad also supports asynchronous I/O, allowing the CPU to process current transactions while concurrently executing other transactions, significantly increasing throughput. This architecture enables Monad to achieve a maximum of 10,000 transactions per second, providing a 1-second block time and 1-second finality. Given the strong support from the foundation through various hackathon activities, it is worth observing Monad's development. The Monad Foundation continues to play an active role in ecosystem development, organizing 65 builder events globally in 2024 and accelerating 46 early projects through Mach and Jumpstart. We remain optimistic about Monad's launch and the future growth of its ecosystem.

5.7 Competitive Landscape

It is clear that the narrative in 2024 is no longer limited to the competition between Ethereum and Solana. An increasing number of alternative L1 projects are emerging, and we believe they are poised to gain a larger market share in 2025.

06 Other Tracks

6.1 Meme

In 2024, the Meme track became the best-performing area in crypto, with an overall increase of 218%, further highlighting the role of Memes as a barometer of attention economy and culture-driven economy. Among them, Ethereum, Base, and Solana are the three most active public chains in the Meme ecosystem. The launch of Pump.fun became a milestone in the crypto industry, as its standardized token issuance framework completely abstracted the technical complexity of creating and issuing Memecoins, greatly unleashing retail demand and significantly increasing trading volume of Memecoins on Solana. In addition to Pump.fun, the prosperity of Memes in the Solana ecosystem also benefited from the ecological support of the Solana Foundation. Meanwhile, Memes on Ethereum, such as Pepe and SHIB, still have highly engaged communities, while Memes in the Base ecosystem tend to lean towards AI themes, as evidenced by the success of Virtuals Protocol. Similar to Pump.fun, Virtuals Protocol provides retail users with the ability to seamlessly create and issue AI agents, further expanding the Meme narrative.

Driven by the Memecoin craze, new tools are continuously emerging to help retail users seize market opportunities more efficiently. For example, Kaito, as an AI-driven analytics platform, provides users with deeper market insights. Photon and GMGN.AI focus on efficient sniping and trading, leveraging the high volatility of the Memecoin market.

Although most Memecoins fail and have short lifespans, the Meme track has become an important part of the industry and is expected to continue to grow. In the future, Solana and Base will maintain their leading positions in this field due to their already established Meme communities.

6.2 AI

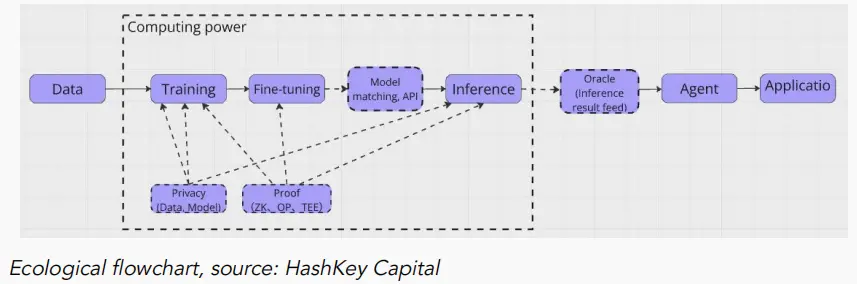

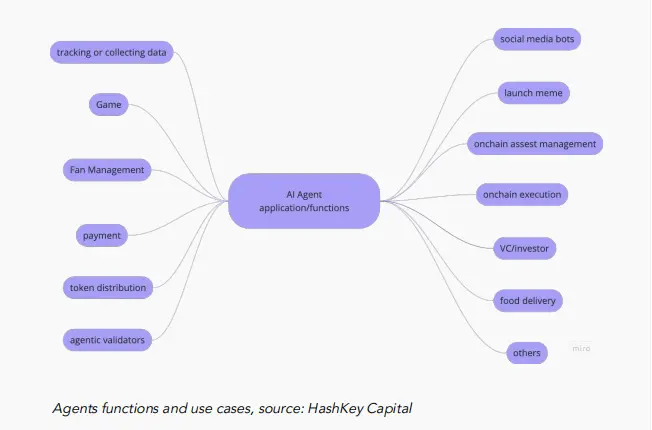

In 2024, the AI field was one of the hottest areas. From infrastructure at the beginning of the year to the explosive growth of agents in the second half, the development of AI in crypto encompasses both upstream and downstream industries. As shown in the figure below, Agents + applications, being closer to the end users, align with the fast development pace of crypto industry developers, while the upstream of AI poses challenges in terms of cost and development cycles for crypto teams, leading to a significant explosion of Agents in the second half of the year.

The explosion of Agents in the second half of the year was catalyzed by the successful transformation of Virtuals Protocol in the latter half of 2024, which launched several quite successful Agents such as AI XBT. This marked the first time that agents were positioned as an asset rather than merely a tool. With the growing interest and speculation surrounding trading AI agents, Virtuals Protocol firmly established itself as a leader in this field. Currently, the functional categories of Agents cover over a dozen types, with social media bots, on-chain execution, and VC agents being particularly popular in the crypto market. We expect the ecosystem of Agents to remain diverse.

However, these agents with different functions and application scenarios have not yet truly matured, with most still in the narrative stage. Nevertheless, the development framework for agents has maintained its popularity for over two months, indicating that this enthusiasm is not limited to speculative trading. Among them, Eli z aOS is the most developed framework, serving as the core framework for ai16 z. Other development frameworks differ in programming languages; for example, the RIG framework launched by @arcdotfun is a Rust-based system, while ZerePY is an open-source Python framework based on Zerebro. There are also frameworks focused on coordinating resource API interface calls, such as FXN.

Due to the prevalence of Meme culture, the combination of AI tokens (including AI Agents) with Memes has also become a major hotspot in the community. Although the valuations of these Memes mostly range from $1M to $5M, with significant price volatility risks, there are increasingly specialized narrative hotspots emerging from these Memes, such as virtual towns, anti-learning, jailbreaking, and multi-agents.

The significant paradigm shift brought about by AI leads us to believe that this technology can be applied across multiple fields, including Crypto. Therefore, we will continue to focus on deployable Agents and the collaborative work between Agents, such as multi-agents frameworks, tools, and economies.

6.3 RWA

Since the beginning of the year, the value of the RWA market has grown by 63%, rising from $8.36 billion to $13.67 billion, with most tokenized assets primarily distributed across two major asset classes: private credit and U.S. Treasury bonds. By the end of the year, there were over 66,931 asset holders and more than 115 asset issuers, including notable institutional issuers such as Franklin Templeton and BlackRock.

Several key events this year have helped shape the narrative around RWA, including announcements from BNB, Tether, Hedera, and Visa regarding the launch of tokenization services. This year also witnessed the establishment of the Tokenized Asset Coalition, an industry organization aimed at bringing the next trillion-dollar assets on-chain.

We seem to be at a turning point for RWA tokenization, with this new momentum attributed to the continuous maturation of tokenization technology, clearer regulations, and an increasing awareness of the efficiency gains from utilizing blockchain technology. In addition to private blockchains used by institutions, public blockchains are also becoming an increasingly popular choice. Among them, Ethereum remains the dominant public blockchain favored by asset issuers due to its battle-tested security and mature ecosystem. Other popular RWA blockchains include Plume Network, Stellar, Polygon, Solana, and Avalanche.

Private Credit

In the Web3 RWA (real-world assets) space, private credit has seen significant growth, with its total value locked (TVL) increasing by nearly 50% since the beginning of the year, surpassing $16 billion. Major protocols in this space include Huma Finance, Maple, Centrifuge, and Goldfinch. Maple Finance has issued loans exceeding $5 billion, while Centrifuge and Goldfinch have issued loans of over $560 million and $168 million, respectively. Huma Finance, as a facilitator of cross-border payment financing, has facilitated over $1.4 billion in transactions in its first year of operation. Although these figures are just the tip of the iceberg compared to the traditional private credit market, they highlight the demand for such platforms. However, the growth in demand for private credit does not mean that the sector is free from default risks, which is familiar to participants in decentralized private credit protocols. Therefore, prudent underwriting and collateral management, executed transparently, will help enhance confidence in this sector. Finally, a keen understanding of regional laws and the implementation of KYC/AML and identity solutions through privacy-preserving soul-bound tokens or zkTLS may also be key to driving the next phase of growth in this industry.

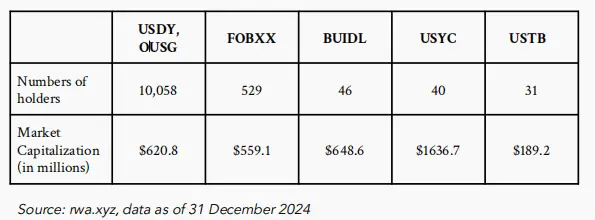

U.S. Treasury Bonds

Overall, since the beginning of the year, the TVL in this sub-sector has rapidly grown from $769 million to $3.96 billion by December 31, 2024. In March of this year, the world's largest asset management company, BlackRock, launched a tokenized fund called BUIDL, which is backed by cash, Treasury bills, and repurchase agreements among other money market securities. By 2024, its assets under management (AUM) had exceeded $648 million. Perhaps the most well-known decentralized RWA protocol, Ondo, currently has accumulated over $620 million in AUM across two products: USDY (a yield-bearing stablecoin backed by U.S. Treasury bonds with an annual yield of 4.65%) and OUSG (backed by short-term U.S. Treasury bonds, with an annual yield of 4.6%, supporting 24/7 minting and redemption, and available only to institutional investors). Due to strong demand for tokenized U.S. Treasury bonds, Ondo's TVL has grown by over 200% since the beginning of the year, leading the market in the number of token holders. Factors contributing to this growth include the increasing demand for yield-bearing stablecoins, the partnership between PayPal and Ondo (allowing users to seamlessly exchange between PYUSD and OUSG), lower entry barriers for retail investors, and the multi-chain strategy adopted by the protocol (broadly integrating its products across different ecosystems). Currently, competition in the tokenized Treasury bond space is exceptionally fierce, with major players completely waiving subscription fees, redemption fees, and performance fees. Coupled with their strong reputations and network effects, this makes it difficult for smaller players to enter and gain a foothold.

Stablecoins

Stablecoins became one of the most important use cases in 2024, providing an entry point for on-chain adoption. As of December 31, 2024, the total market supply of stablecoins has grown by 56% since the beginning of the year, reaching $203.73 billion, setting a new historical high. The trading volume of stablecoins has also significantly encroached on the share of traditional payment networks. Over the past 12 months, the adjusted trading volume of stablecoins exceeded $5.5 trillion, a 50% increase compared to 2023, while Visa's trading volume in 2024 was $15.7 trillion, a 7% year-on-year increase. By December 2024, the average number of monthly active stablecoin addresses had increased by nearly 50% year-on-year, reaching 37.83 million.

This clearly highlights the importance of stablecoins as a mainstream payment method in our daily lives. Due to the significantly lower transaction fees of stablecoins compared to traditional payment networks, they are highly economically viable for many businesses. Looking ahead, we expect more small and medium-sized enterprises, as well as large corporations, to adopt stablecoins to enhance operational efficiency. Currently, most stablecoins are still primarily dollar-based, but we also anticipate seeing more stablecoins pegged to other currencies, such as EURC.

Another area of demand growth in 2024 is RWA-backed and yield-bearing stablecoins. Ethena is a stablecoin that generates yield through staking and delta-neutral strategies, and it has seen strong demand since its public launch in February 2024. By the end of 2024, the TVL of USDe rapidly surpassed $5.8 billion, overtaking DAI to become the third-largest stablecoin. Additionally, another RWA-backed stablecoin, USDY, launched by Ondo, grew from $15.64 million to over $400 million by the end of the year, reflecting the market's demand for truly sustainable yields. As the adoption of stablecoins in mainstream payment sectors continues to rise, regulators are also working to oversee the development of stablecoins through legislative frameworks. Regulatory-compliant stablecoins are expected to gain more market attention in the future.

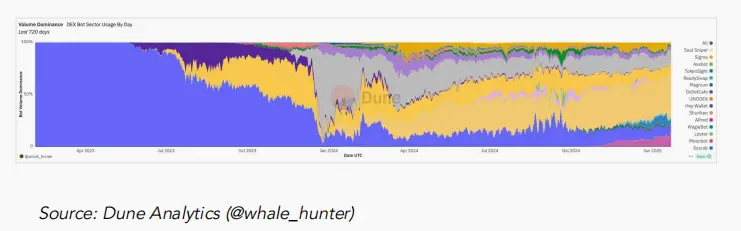

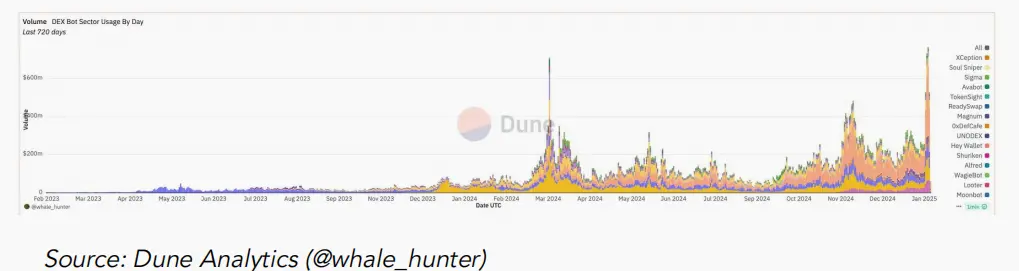

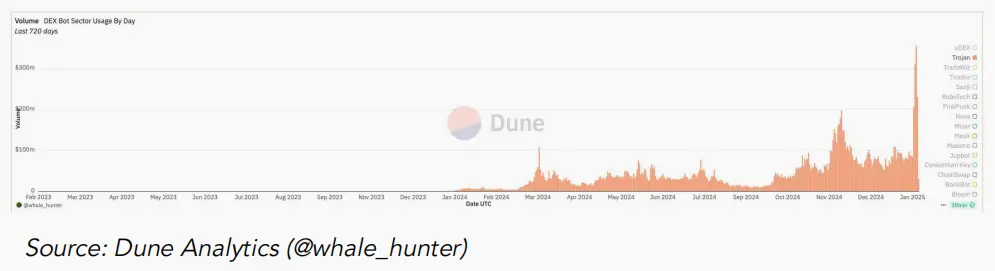

6.4 Trading Bots

A dashboard on Dune displays relevant statistics for trading bots. As shown in the figure below, before January 2024, Mastro (shown in light blue) held the largest market share. Banana Gun (shown in dark yellow) and Uni bot (shown in purple) entered the market in mid-2023, each capturing 20% of the market trading volume. As we entered 2024, competition in the trading bots market began to intensify. Bonk bot (shown in gray) emerged strongly, with its market trading volume reaching 80% at one point, but this only lasted for two months, after which it, along with Mastro, maintained around 15-20%. Another standout in 2024 was the Trojan trading bot (shown in light yellow), which maintained a stable trading volume of around 30-40% since April 2024, gradually becoming the largest trading bot. Additionally, Bloom (shown in purple) emerged at the end of 2024, steadily increasing its market share, which is worth noting.

However, the dashboard does not display data related to GMGN.AI. Combining the statistical results from the two images below, GMGN.AI's trading volume was about half that of Trojan before 2025, but after entering 2025, its trading volume caught up to two-thirds of Trojan's.

6.5 DeSci

DeSci, which stands for Decentralized Science, is a relatively emerging field aimed at leveraging blockchain technology to address the challenges currently faced by the scientific community. These challenges include opaque review processes, insufficient funding and interest in underexplored areas, and ensuring fair participation opportunities and compensation for contributors. Currently, there are nearly 100 DeSci projects distributed across biotechnology, space, humanities, and other academic fields, although biotechnology dominates the DeSci space and has gained more attention following Binance Labs' recent investment in Bio Protocol. However, as mentioned in our previous articles, DeSci still faces numerous challenges, such as insufficient funding compared to traditional scientific funding, potential legal risks, and the mismatched incentives often associated with launching speculative tokens.

6.6 DePIN

As of December 31, 2024, the total market capitalization of DePIN reached $50 billion, up from $18.1 billion at the beginning of the year, an increase of over 176%. By December 31, the number of projects had grown to over 295. This year, AI has dominated the industry narrative, with some of the largest DePIN projects positioned at the intersection of AI and DePIN. While Ethereum and Solana dominate the DePIN ecosystem in terms of market capitalization, blockchains focused on DePIN, such as Peaq and IoTeX, are also gaining increasing attention, with 46 and over 50 projects built on them, respectively. The topic of DePIN is widely discussed and can generally be divided into two main categories: those that are more "physically" intensive, typically requiring hardware and capital infrastructure investment (e.g., energy networks), and those that are less "physically" dependent, such as storage and computing. However, a common characteristic of DePIN is the need to utilize token incentives to overcome cold start issues and establish viable business models. Looking ahead, certain sub-sectors within DePIN are worth continued attention in 2025.

Energy Networks

Decentralized energy networks utilize blockchain technology to build renewable energy-driven power grids, improving energy efficiency and addressing infrastructure challenges such as transmission losses and system aging. This approach is driven by trends such as electrification and carbon neutrality goals, deploying distributed energy resources (DER) through token incentives, and modernizing the grid via virtual power plants (VPP) and demand response providers (DRP). Although global annual investment in solar energy has exceeded $500 billion, achieving net-zero emissions by 2050 will require $21 trillion in grid modernization investments. Current challenges include reliance on weather-dependent renewable energy, grid instability caused by bidirectional energy flow, regulatory support, and public awareness of virtual power plants. Early projects like Project Zero and PluralEnergy showcase the opportunities in this field, but unlocking its full potential will require significant innovation, education, and regulatory support.

Wireless Networks

Decentralized wireless networks (DeWi) address long-standing issues of accessibility and network congestion faced by traditional operators by enabling individuals to become internet service providers, offering affordable and widespread network services. Unlike traditional telecom operators, DeWi networks can thrive in areas where environmental, political, or economic factors are unfavorable for traditional operations.

Helium is a representative project in the DeWi space, with a year-to-date increase of 21.5% and a fully diluted valuation (FDV) of $1.85 billion. Although its scale is still far smaller than that of traditional telecom, it demonstrates potential. By the end of the year, Helium Mobile had over 124,000 mobile users and formed commercial partnerships with several major mobile operators to launch operator traffic offloading projects. The global 5G market presents significant investment opportunities, with the number of 5G subscriptions expected to grow from 2.17 billion in 2023 to 5.56 billion by 2030. Emerging economies such as Latin America and the Middle East and North Africa (MENA) are expected to achieve exponential growth, with adoption rates projected to increase tenfold, indicating considerable market expansion and value creation potential.

Geospatial Networks

This field consists of geospatial positioning, imaging, and mapping networks. Decentralized positioning service providers incentivize communities to provide location information through tokens, extracting valuable insights for various stakeholders. Projects in this field typically deploy physical sensors in locations such as vehicles and properties to gather relevant data, offering valuable services that include map data, weather data, and high-precision real-time data. A noteworthy project in the geospatial positioning sub-sector is Geodnet. This project aims to improve positioning accuracy by building a global navigation satellite system network and utilizing real-time kinematic (RTK) positioning technology to address the inaccuracies of GPS technology. This not only helps meet the demand for precise positioning in industries such as agriculture and construction but also provides higher returns for businesses transitioning to more economical solutions. By the end of 2024, Geodnet had recruited over 10,000 satellite miners, opening revenue opportunities for its RTK positioning service, which has now generated over $2 million in annual recurring revenue (ARR).

In the mapping field, the traditional mapping industry is a multi-billion dollar sector, with Google Maps alone generating over $11 billion in revenue in 2023. However, traditional mapping is often costly, inefficient, and sometimes inaccurate. As a decentralized alternative, Hivemapper aims to address these challenges by outsourcing mapping work to a global network of 156,000 contributors, who have helped map over 10 million miles in just over two years.

The key to success in this field lies in establishing a globally distributed network of devices that can achieve sufficient scale in both data quantity and quality to enter a revenue-generating phase (excluding node sales revenue for a more accurate measure of actual demand for such services).

By focusing on areas that are overlooked and lack high-quality positioning data, while employing optimal mechanisms and distribution strategies, projects can quickly activate serviceable markets and meet scaling demands. One of the main risks faced in this field is the scalability challenge posed by complex device setup processes.

Computing Networks

The rapid development of artificial intelligence (AI) has significantly increased the demand for computing power, putting pressure on the supply of high-performance infrastructure (such as GPUs and advanced data centers). Decentralized computing networks provide economically viable solutions to small and medium-sized enterprises and AI researchers blocked by traditional suppliers by leveraging idle computing resources tracked by blockchain. Representative projects in this field include Aethir, Akash Network, Hyperbolic, Compute Labs, and Render. As one of the largest decentralized computing service providers, Aethir has built a decentralized network containing over 360,000 GPUs and generated over $80 million in annual recurring revenue. For long-term success, projects need to address challenges such as task verification, privacy issues, and latency caused by consumer devices, and also establish solid partnerships with traditional Web2 businesses.

6.7 Gaming

In 2024, the gaming industry demonstrated significant resilience and growth, with the number of daily active wallets exceeding 7.6 million by the end of the year, more than five times that of 2023. Key games driving mainstream user engagement include LOL, World of Dypians, Treasure Ship Game, Pixudi, and Age of Dino, all of which have daily active wallets (UAW) exceeding 250,000. Gaming platforms like Forge have played a crucial role as Web3 game distribution channels, currently boasting over 1 million users and partnerships with over 65 games.

From the perspective of daily active wallets, the major gaming chains include opBNB, Ronin, Xterio, Skale, TON, and XAI. Ronin's influence in the gaming community continues to grow, with peak daily active users reaching 2.27 million, more than ten times that of 2023. Throughout 2024, Ronin Forge plans to onboard seven games, with a total of 17 new games launched on the network. Ronin games like PixelsHeroes have also ranked first in both the Google Play Store and Apple App Store, highlighting the increasing popularity of Web3 gaming. Challenges remain, as financing in the industry is still difficult, with blockchain game investments declining by 38% year-on-year, marking the worst year since 2020. Nevertheless, the gaming industry remains resilient, demonstrating characteristics that are not entirely correlated with the overall market environment. Looking ahead, we are optimistic about games that have diverse distribution channels and offer unique gameplay, capable of matching or surpassing Web2 gaming experiences, leading the next phase of growth in the gaming industry.

REFERENCES

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。