Author: Nancy, PANews

On February 24, after the time tokenization platform Time.fun officially launched on Solana, the Solana official team quickly provided strong support, with even Solana co-founder Toly mentioning it in a tweet, giving the market ample exposure. This move is not only a strong response to the liquidity drain caused by Pump.fun but also another exploration of growth after the Solana ecosystem was severely impacted by the chaos of celebrity token issuance.

Pump.fun Intends to "Flip the Table," Crisis in the Solana Ecosystem Intensifies

After experiencing scandals involving celebrity tokens like Libra, liquidity on Solana was rapidly withdrawn, and market sentiment remained low. As the traffic engine of the Solana ecosystem in this cycle and an on-chain "printing machine," the protocol is currently struggling to sustain liquidity. Multiple factors, including self-built AMM, rumors of token issuance, ongoing token sell-offs, and uncertainties surrounding regulatory lawsuits, have also caused dissatisfaction from the Solana official team.

In January of this year, Pump.fun's business, despite ongoing growth, unfortunately faced a lawsuit. According to a Bloomberg Law report at the time, Pump.fun was facing a class-action lawsuit, accused of violating U.S. securities laws by marketing and issuing unregistered and highly volatile meme tokens, exposing investors to significant financial risks, and collecting nearly $500 million in fees from it. The lawsuit was filed in the U.S. District Court for the Southern District of New York, with the plaintiffs describing it as a "new evolution of a Ponzi scheme and pump and dump." Shortly after, two U.S. law firms, Burwick Law and Wolf Popper, also sued Pump.fun, demanding the platform remove tokens using their IP, pointing out that these tokens used intellectual property (including their logo and name) without permission.

Worse still, as MEME "cooled off," Pump.fun, as the primary target of this wave of impact, saw both its graduation rate and trading volume plummet, further affecting the overall activity of the Solana ecosystem.

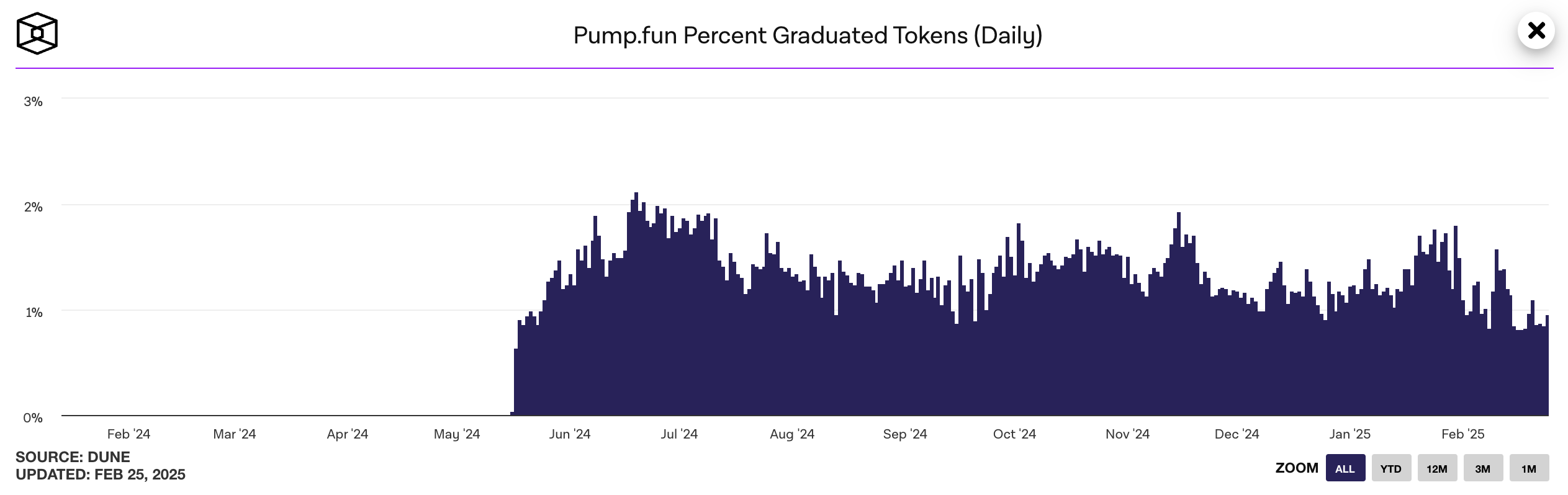

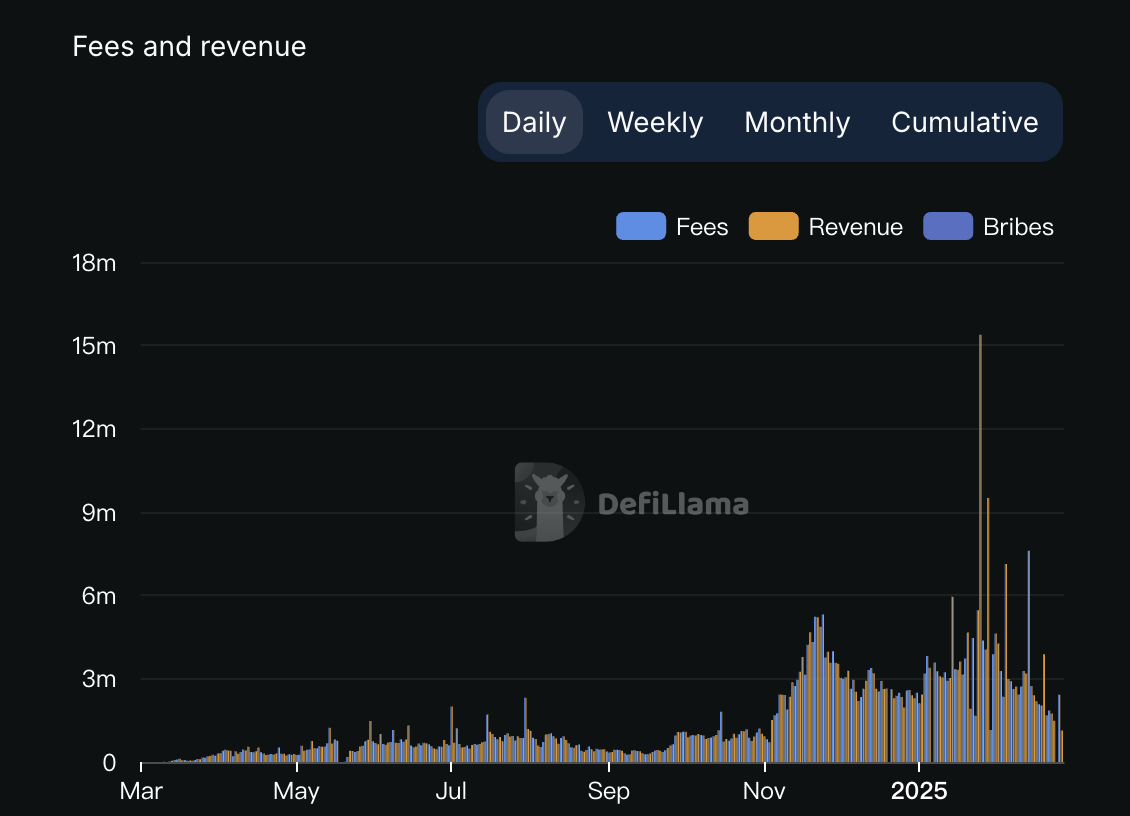

Data from The Block shows that as of February 24, the graduation rate of Pump.fun tokens transferred to Raydium was only 0.96%, down 54.7% from the historical peak of 2.12%. Meanwhile, Pump.fun's on-chain trading also significantly cooled, with the average daily trading volume dropping from a peak of $3.13 billion in January to $190 million as of February 24, a staggering decline of 93.9%. In terms of protocol fee revenue, DefiLlama data shows that as of February 25, Pump.fun's protocol fee revenue was $2.45 million, nearly 84.1% less than the historical peak of $15.38 million on January 25.

The significant decline in business forced Pump.fun to explore more products. However, some of these initiatives undoubtedly dealt a heavy blow to Solana, which has yet to recover. Earlier this month, crypto KOL Hebi (@hebi555) disclosed on X that Pump.fun plans to adopt a Dutch auction model for public offerings on multiple CEXs (centralized exchanges). Although Pump.fun co-founder Alon denied this rumor and stated that the news about potential tokens was untrue, this response was questioned by many industry insiders. For instance, Wu said Blockchain publicly pointed out that Alon was lying, and several listed companies on CEX confirmed Pump.fun's token issuance plan, stating they could publicly disclose relevant preparatory documents once permission was obtained. If Pump.fun ultimately issues tokens, it will undoubtedly have a huge impact on the Solana market, especially given the already tight liquidity, which will likely lead to even greater capital withdrawal.

Moreover, Pump.fun has earned considerable income through trading fees, even ranking among the top 10 global gambling companies in 2024 with an annual revenue of $1 billion. According to Onchain Lens monitoring, Pump.fun has accumulated approximately 2.99 million SOL, with a current market value of about $431 million, and its ongoing cash-out behavior has also put significant selling pressure on the SOL token.

What is even more concerning is that Pump.fun recently intends to "flip the table." On February 24, market rumors suggested that Pump.fun is internally testing a self-developed AMM (automated market maker) liquidity pool, with the community speculating that it may launch its own Swap platform to replace third-party supplier Raydium, in order to extract more trading fees. This move is widely regarded by the community as overly greedy. If this news is true, it would undoubtedly deal a heavy blow to DEXs on Solana, as Raydium and Jupiter have carried a significant amount of liquidity from Pump.fun, and these DEXs are also the liquidity hub of the Solana ecosystem. To make matters worse, platforms like Raydium and Jupiter have recently also been implicated in the Libra insider token issuance scandal.

Following this news, CoinGecko data shows that since the announcement of Pump.fun's AMM, the price of Raydium's token RAY has plummeted by 40.9%, although the overall market decline has also had some impact.

In response to the possibility that Pump.fun might completely abandon Raydium, Raydium core contributor InfraRAY stated that this is a "strategic misjudgment" and questioned whether Pump.fun could replicate existing success. He also pointed out that if Pump.fun shifts to a new AMM, it may face multiple risks, including insufficient infrastructure, low demand for token migration, and inadequate trading volume in the initial launch phase. It is worth noting that the Solana Foundation invested in Raydium and Jupiter in October 2020 and March 2021, respectively, and Pump.fun's "going solo" move undoubtedly touches the interests of the Solana Foundation, creating greater uncertainty for the Solana ecosystem.

"Those bastards who disrupt the market to maximize their profits can reap what they sow. But those companies that create quality products, charge transparent fees, and compete for users are great. Their revenue should motivate you to compete and capture their market share," Toly's latest tweet has also been interpreted by the community as a criticism of Pump.fun.

Backed by MEME Core, Time.fun Receives Strong Support from Solana Officials

As one of the important drivers for Solana's turnaround, MEME has become a new product that Solana officials have started to support openly after the betrayal by Pump.fun.

As a product also originating from AllianceDAO, Time.fun is a time tokenization platform similar to the previously popular Friend.tech, allowing creators to tokenize time and sell it as tradable tokens. Initially, the product was based on the Base network but announced its migration to Solana in November 2024. At that time, Time.fun co-founder 0xKawz stated, "Over the past year, Solana has achieved significant advantages in many aspects. In contrast, the Ethereum ecosystem feels exhausted, often overly focused on technology and appearing arrogant. The atmosphere in Ethereum is like a group of aloof philosophers. If Ethereum does not address its cultural issues, as more developers like Time.fun choose to migrate, Solana will gradually dominate."

On February 24 of this year, after officially migrating to the Solana network, Time.fun publicly promoted a MEME token called "Toly's minutes" on X. This tweet also received a reply from Toly himself, who stated that time is fun, and business communication is his favorite crypto application case. This statement once propelled the market value of the token Toly to soar. Subsequently, Toly released more than ten tweets about Time.fun, showing clear support. In addition to Toly, Solana co-founder Raj Gokal and Helius CEO Mert Mumtaz also participated in promoting Time.fun.

For Solana, Time.fun and Pump.fun have similar gameplay, both possessing a MEME core, and support for this product may continue this trend. At the same time, Time.fun adopts a celebrity token issuance model with a verification mechanism, which to some extent reduces the common RUG risks seen in previous celebrity MEME token chaos.

According to The Block, Time.fun founder Kawz stated that in the future, they will consider issuing the platform's own token. If other platforms are built on the basis of tokenizing time, then a platform-based token can connect them all together. However, Kawz also admitted that it is still too early to discuss the Time.fun token, as the platform must first find product-market fit, and the key goal of the platform is to make tokenized time composable for use in other platforms built on Time.fun. He pointed out that Time.fun's true long-term goal is to create a new asset class that allows people to own others' time, trade it, and use it for various products and services.

Ecosystem Faces Decline, but Several Key Indicators Remain Strong

Recently, the Solana ecosystem has faced numerous challenges, with constant market FUD.

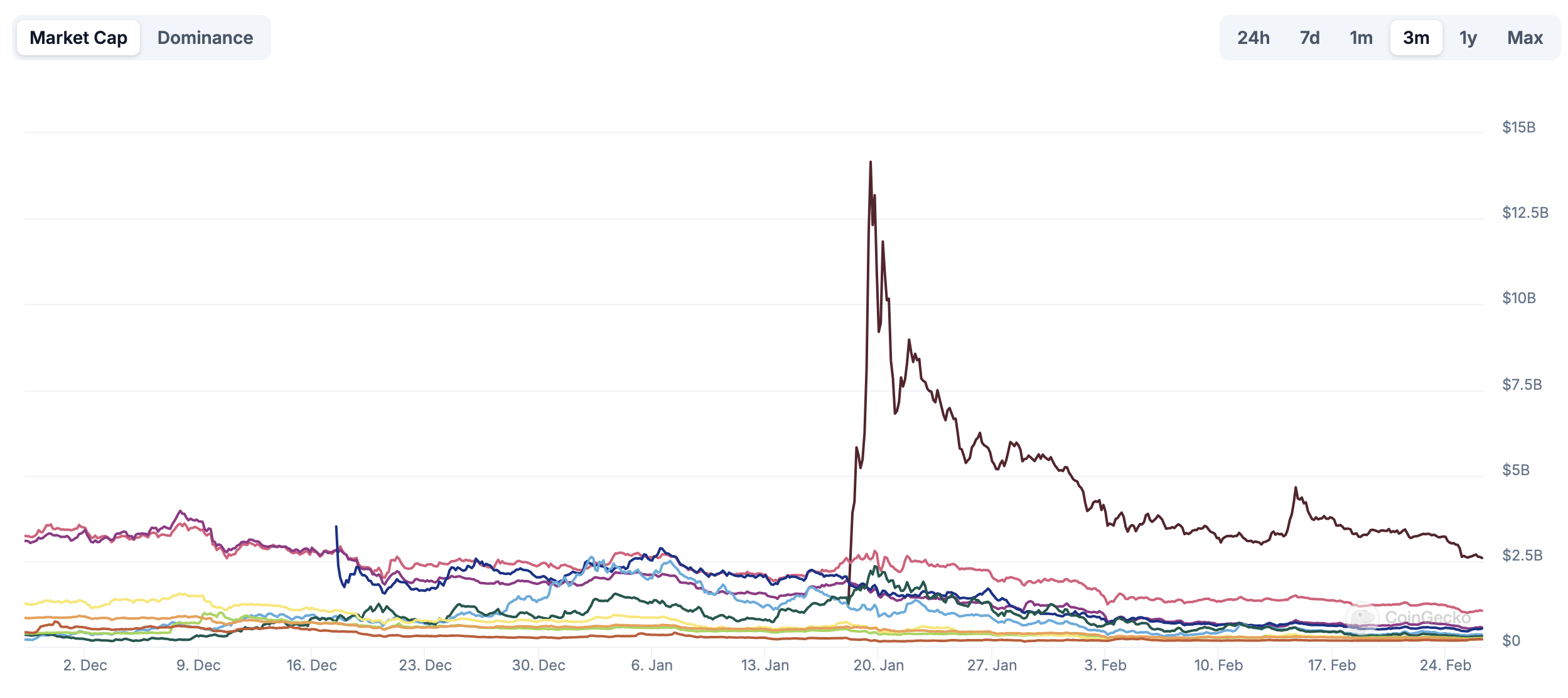

On one hand, the market value of MEME on Solana has halved after cooling down. CoinGecko data shows that as of February 26, the market value of MEME on Solana was $8.64 billion, down from nearly $15 billion at its peak in January.

At the same time, the massive SOL unlock is bringing liquidity pressure. A total of 11.2 million SOL will be unlocked for circulation on March 1, marking the largest token unlock in history (valued at $2 billion). According to crypto analyst Artchick.eth, over the next three months, more than 15 million SOL (approximately $2.5 billion) will enter circulation, most of which were purchased by institutions such as Galaxy Digital, Pantera Capital, and Figure through FTX auctions at $64 per SOL, with several VCs still holding substantial profits. Trader RunnerXBT pointed out that Galaxy Digital, Pantera, and Figure hold unrealized profits of $3 billion, $1 billion, and $150 million in SOL, respectively. The market speculates that these institutions may sell their holdings, and the recent endorsement of the MEME coin LIBRA scam by Argentine President Milei has intensified market panic.

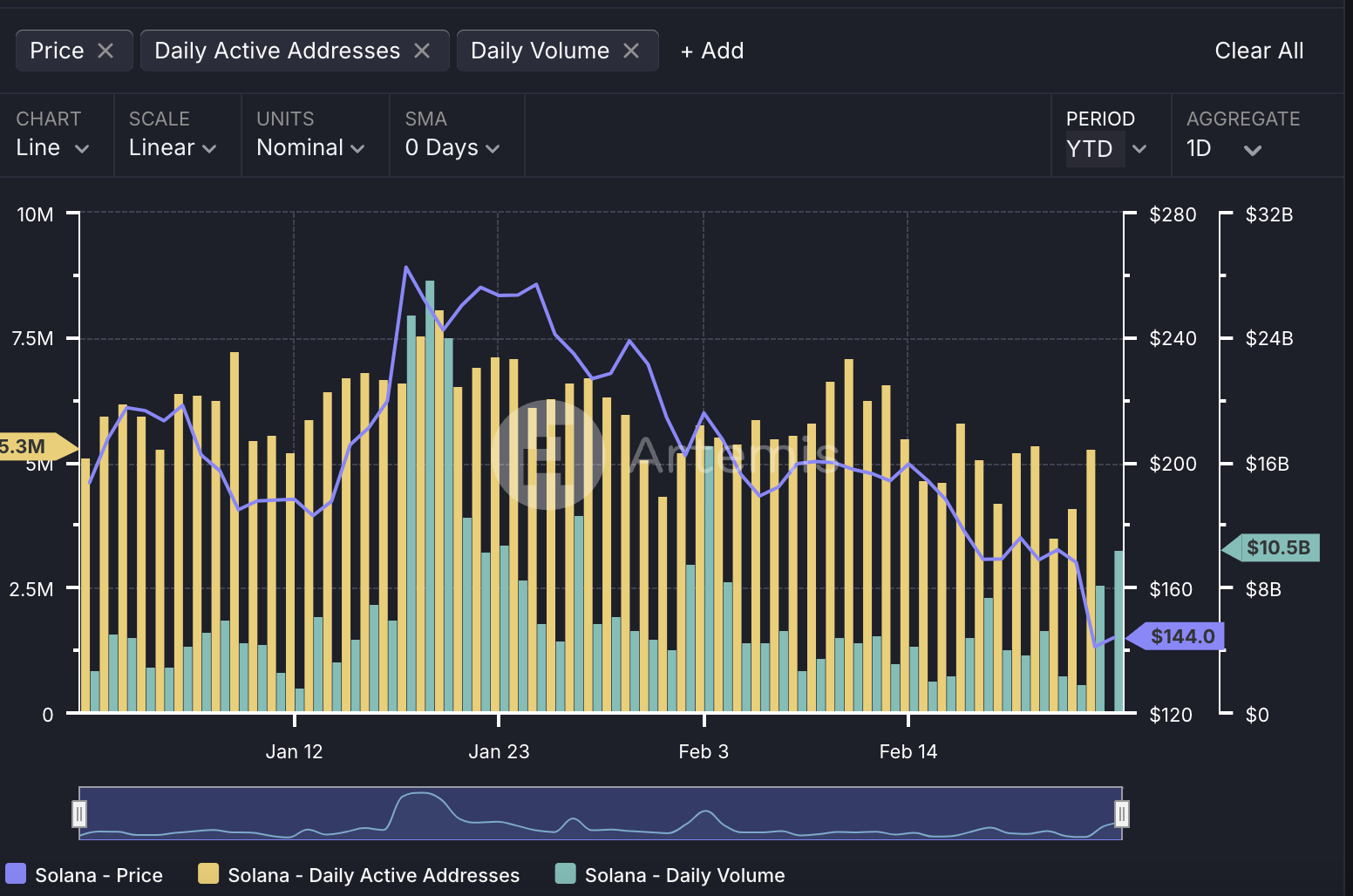

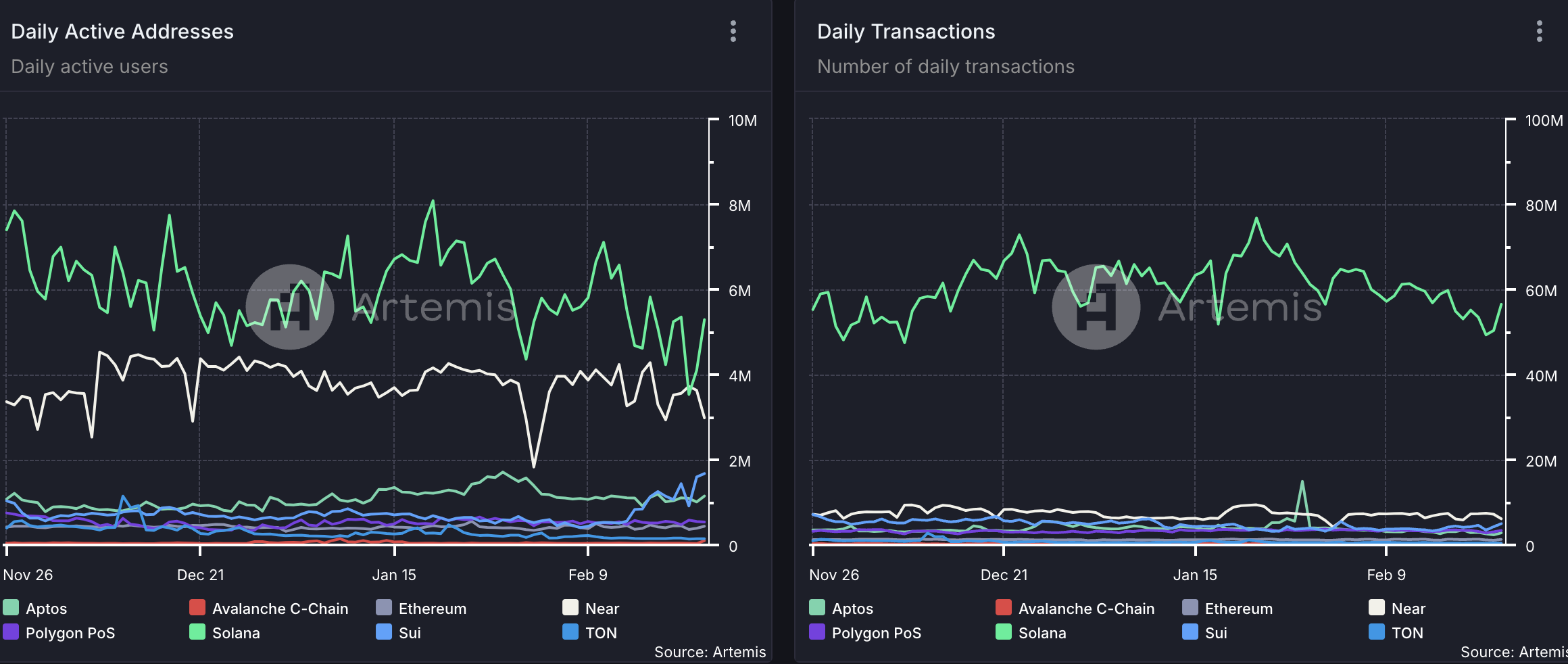

Data also clearly reflects the pressure facing the Solana ecosystem. Artemis data shows that as of February 24, the number of daily active addresses on Solana was 5.3 million, a decrease of over 34.5% from this year's peak; daily trading volume has also significantly dropped from this year's high of $27.7 billion, down 62.1%, currently remaining at $10.5 billion. Among these, the decline in DEX trading volume is particularly notable; although it still ranks second among all chains, it has decreased by 89.9% compared to the peak in January. Additionally, the price of the SOL token has fallen by 46.2% from this year's peak of $262.6.

These data reflect a significant decline in the activity and market enthusiasm of the Solana ecosystem. However, Solana still performs outstandingly in many key indicators. Artemis data shows that as of February 24, in terms of daily active addresses, Solana ranks first with 5.3 million, surpassing Ethereum, NEAR, SUI, and Aptos. In terms of transaction volume, Solana's daily transaction count is a staggering 56.5 million, while other chains only have millions or even fewer. In terms of TVL, Solana's TVL reaches $7.3 billion, second only to Ethereum, surpassing Sui, Avalanche, and Aptos.

Additionally, Solana has several potential positives, such as expectations for SOL spot ETF applications and the opening of the Solana inflation model modification proposal SIMD-0228, which may inject more confidence and liquidity into Solana.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。