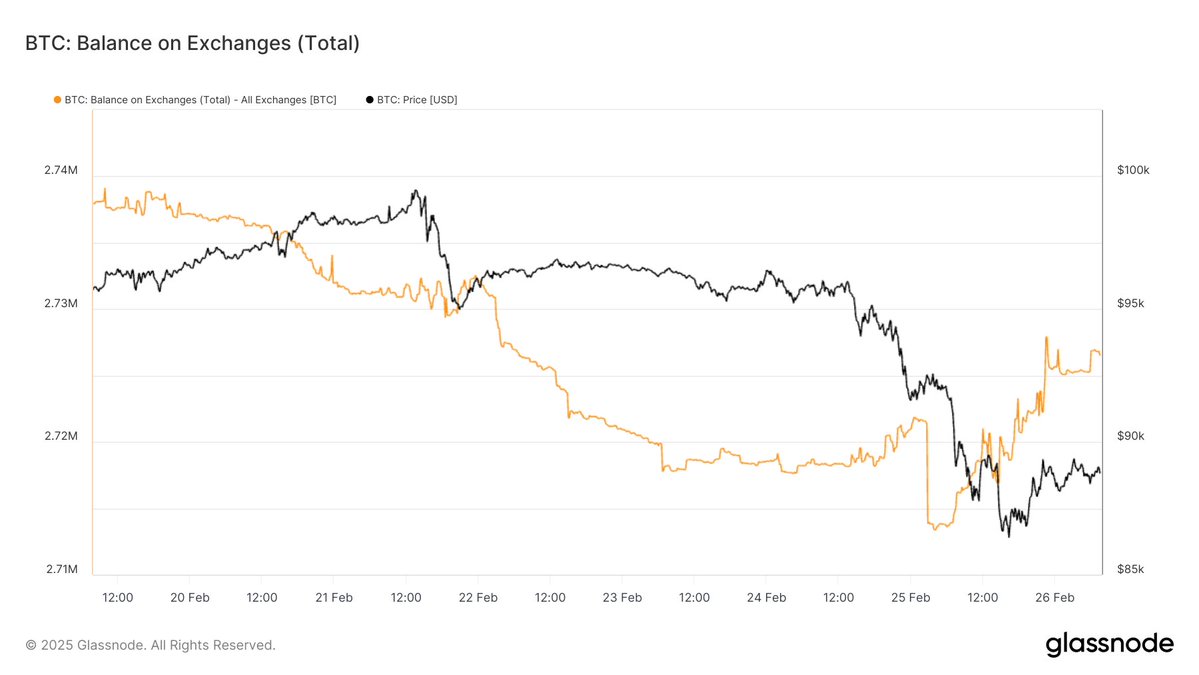

Recently, the data seems a bit simplistic, but I still believe that at this stage, it is either liquidity or investor sentiment, and ultimately, investor sentiment is more important. The chart shows the #Bitcoin supply across all exchanges, and it is clear that as the price rebounds, the BTC supply on exchanges has started to increase, currently by about 10,000 coins, indicating that the panic sentiment has not completely ended.

Some investors still choose to prepare to exit during the rebound, primarily among Asian partners. We still need to observe the sentiment of American investors tonight. From the current trend, U.S. stock pre-market futures have started to rise, which corresponds to yesterday's reaction that may have been somewhat excessive.

In fact, there are currently no confirmed negative factors, and of course, there are no positive factors either. So essentially, it is still a tug-of-war between information and sentiment, with the implementation of tariffs expected in April.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。