Author: Alea Research

Compiled by: Tim, PANews

In yesterday's report, we explored several structural changes that have occurred in the cryptocurrency market over the past few months. As of now, before the U.S. market opens, the total market capitalization in the crypto space has dropped nearly 9%, with Bitcoin falling over 7% in the past 24 hours. Although Bitcoin rebounded to the $89,000 mark after hitting a new low above $87,000, the current trend shows signs of fatigue.

In today's report, we will once again examine market trends, attempting to clarify the causes behind the current downward trend in cryptocurrencies and assess the necessary conditions for the market to regain bullish sentiment.

Current Macro and Crypto Environment

Over the past year, the overall trend of the crypto market has shown a high correlation with Bitcoin. Starting in the second quarter of 2024, Bitcoin and altcoins entered a sideways consolidation period lasting about six months. With the upcoming U.S. elections in November acting as a catalyst, the entire crypto market saw a nearly universal rise. However, this pattern has recently taken a sharp turn, evidenced by the rapid divergence in the trends of Bitcoin and altcoins.

This sell-off does not have a clear trigger pointing to the cryptocurrency sector. We have discussed in detail the collapse of the Libra token and the recent attack on Bybit in our member communications and emails. The chain reaction triggered by the Libra token has severely impacted the Solana ecosystem, with the SOL token plummeting nearly 45% in the past month. The Bybit incident is now largely under control, with the exchange claiming to have raised enough ETH to cover a funding gap of about $1.4 billion.

Yesterday, there was even positive news: Citadel Securities announced it would increase its presence in the crypto space, which may be related to the increasingly clear regulatory environment.

Previously, Robinhood disclosed that one-third of its fourth-quarter revenue came from crypto services and plans to continue increasing its investment in this area, but the market reacted lukewarmly to such positive news from traditional financial institutions entering the space.

Citadel Securities announced it will strengthen its market-making efforts in the cryptocurrency sector.

The current market may be more focused on news from the U.S. government, holding a cautious attitude towards any policy developments that do not reach the "Strategic Bitcoin Reserve" (SBR) level, even viewing them as a selling opportunity when "good news is fully priced in." This tendency can be seen in the market's reactions to statements and executive orders regarding cryptocurrencies from figures such as President Trump, crypto and AI affairs director David Sacks, and Senator Cynthia Lummis.

Current market volatility may largely be related to Trump's policies and the unexpected reactions they provoke. From certain perspectives, the former president has shown a polarized approach to fulfilling campaign promises: some policies concerning core market concerns have seen insufficient follow-through, while others have advanced beyond expectations, exacerbating market uncertainty.

1. Tariff Policy

Since taking office, Trump has repeatedly announced tariffs on Canada and Mexico, only to later delay their implementation; he then introduced new metal tariffs affecting both countries; and recently claimed he would ultimately impose comprehensive tariffs on them. This flip-flopping not only increases market uncertainty but may also lead to a "boy who cried wolf" credibility crisis regarding policy.

2. Immigration Policy

The Trump administration has deported fewer illegal immigrants than previous administrations. This may be a positive signal for the market, as large-scale rapid deportations could lead to market disruptions in labor-intensive sectors such as agriculture, housing construction, and services.

3. Foreign Policy

The Trump administration has shown a tendency to distance itself from Europe, negotiating directly with Russia while bypassing countries like Ukraine. While this may not necessarily trigger a significant negative market reaction, it has indeed caught some observers off guard.

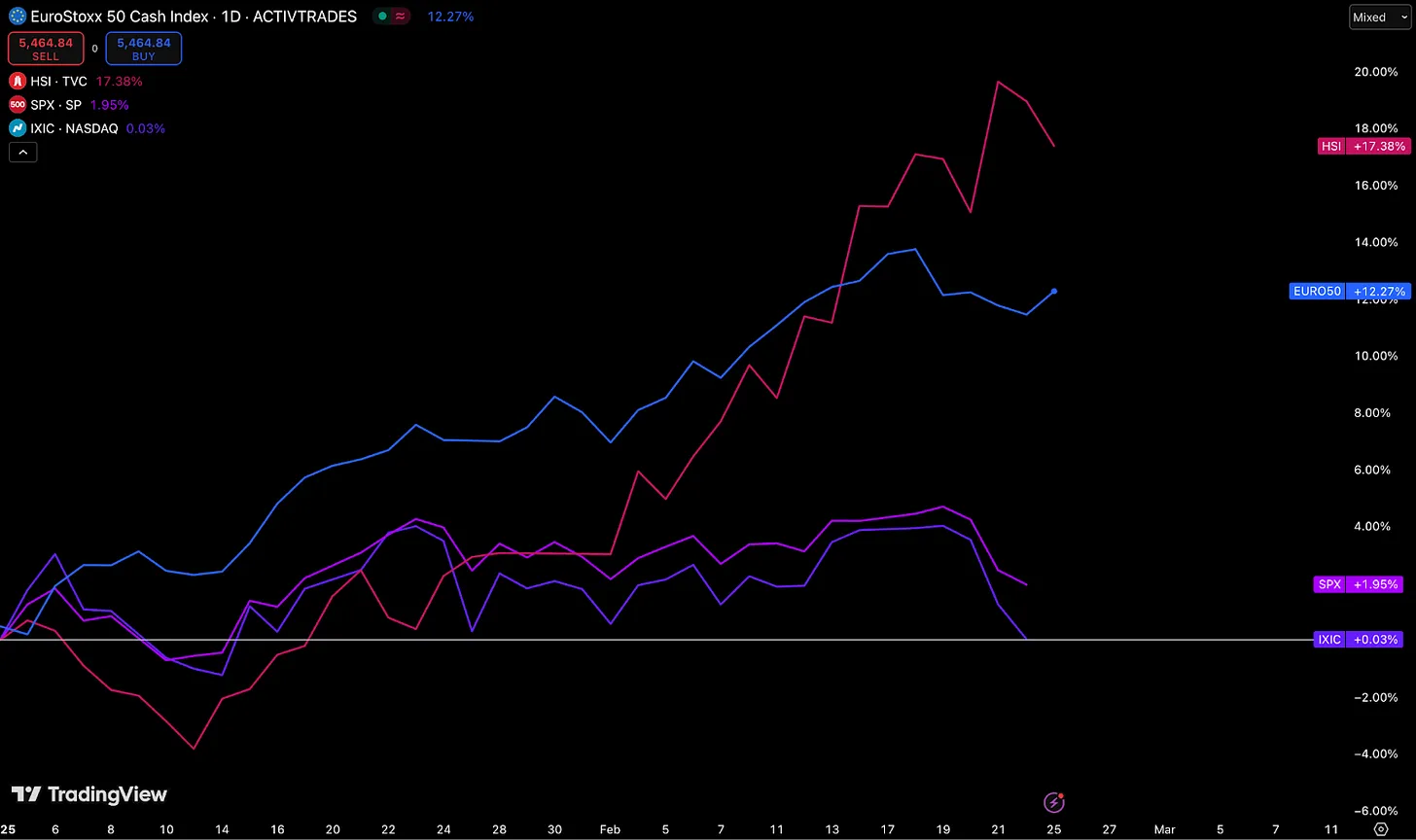

The market has always disliked uncertainty, and the Trump administration's first month in office fully demonstrated its ability to create uncertainty. Since the beginning of the year, U.S. stocks have underperformed European stocks and Chinese concept stocks, with the Nasdaq index nearly falling into negative territory. This may reasonably explain why cryptocurrencies performed poorly in the first quarter: despite Michael Saylor's "strategic accumulation" providing liquidity support and ETF inflows keeping Bitcoin at relatively high levels, the overall performance of the crypto market still lagged significantly.

Target Shift, Heavy Debt Light Stocks?

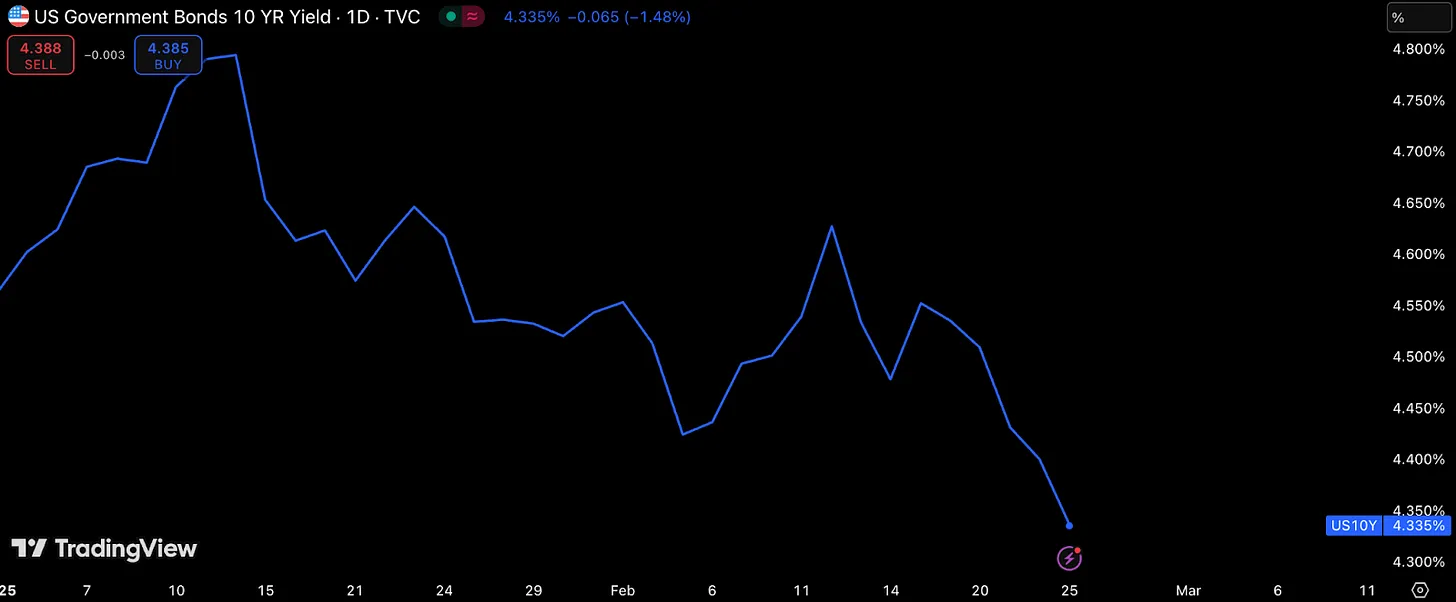

The poor performance of both cryptocurrencies and U.S. stocks may be closely related to the Trump administration's shift in policy focus towards lowering bond yields rather than boosting the stock market (not to mention Bitcoin prices, which the White House rarely pays attention to). If lowering bond market yields is seen as a measure of policy success, then the current situation may be more optimistic than it appears when judged solely by stock market performance.

Since Trump took office, the yield on the U.S. 10-year Treasury bond has significantly declined. This indicator can serve as an alternative benchmark for assessing the long-term resilience of the U.S. economy: lower interest rates help reduce the cost of capital for homebuyers and large corporations.

In the current macro landscape, the U.S. government needs to seek a balance between short-term interests and long-term goals, as stock market euphoria may not align with the success criteria set by the Trump team. Over time, the market may gradually adapt to the unconventional operations of this administration. On the positive side, if regulatory barriers can be substantially removed (as hinted by DOGE), it could unleash more economic vitality. However, in the short to medium term, large-scale layoffs and budget cuts by the federal government may have a contractionary effect on the economy and siphon off some funds that could have been injected into the market.

Related Links:

Current Crypto Market Structure Newsletter

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。