Who is shorting ETH?

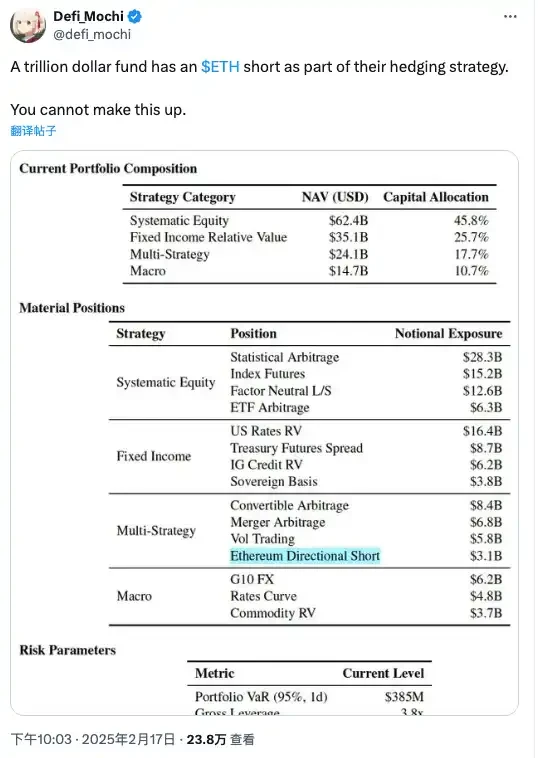

Recently, a mysterious institution's asset allocation sheet has surfaced, notably marking a "3.1 billion dollars in Ethereum short assets" in its "multi-strategy" portfolio.

So the question arises: who exactly is the holder of this 3.1 billion dollars in Ethereum short assets?

Rhythm BlockBeats has explored various sources of this asset allocation sheet and speculated on two of the most likely candidates:

First is Bridgewater Associates. Some other sources' leaked data aligns with this asset allocation sheet, and Bridgewater's CEO Ray Dalio has expressed interest in cryptocurrencies, being a BTC maximalist, which somewhat aligns with the logic of shorting ETH.

The other candidate that has been discussed the most is Citadel Securities, which we will focus on today.

One "big player" has fallen, and another "big player" has arrived

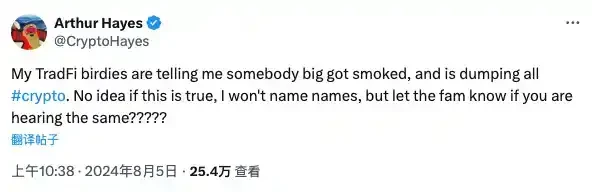

If you remember the Black Monday in August 2024, triggered by Japan's interest rate hike, it caused a massive crash.

Japan's first interest rate hike since ending its negative interest rate policy led to a surge in the yen against the dollar, reversing arbitrage trades and triggering large-scale liquidations. The global financial market collapsed instantly, with the Japanese stock market plummeting by 9%, and the Nikkei index triggering circuit breakers twice, marking the largest single-day drop in eight years. The stock markets in South Korea and Taiwan were also not spared, and the cryptocurrency market suffered a heavy blow, with Bitcoin briefly falling below 50,000 dollars, while Ethereum plummeted by more than 25%, erasing all gains for the year.

However, attributing the collapse of cryptocurrencies solely to the impact of the Japanese economy is clearly not convincing for everyone, until some veteran players revealed the inside story.

As an early crypto king who appeared before SBF, BitMEX co-founder Arthur Hayes posted on social media that he learned through traditional financial channels that a "big player" was liquidating crypto assets.

Although he did not specify names, the community's indications have become quite clear, pointing to Jump Trading and its cryptocurrency division, Jump Crypto. Since June of last year, the U.S. Commodity Futures Trading Commission (CFTC) has begun investigating Jump Crypto. In addition to facing regulatory pressure, Jump Crypto has also been embroiled in several controversial incidents. First, the collapse of FTX caused significant losses for Jump Crypto. Additionally, Jump has drawn regulatory attention for its involvement in the TerraUSD stablecoin collapse.

As the CFTC investigation deepened, Jump Crypto's young CEO Kanav Kariya announced his departure, and the official Twitter account related to Jump also stopped updating, seemingly signaling Jump's gradual exit from the crypto industry.

However, while one "big player" has fallen, another "big player" has taken the stage.

Yesterday, Citadel Securities announced plans to enter the cryptocurrency market-making field. It seems like a market relay race among traditional financial giants, with Jump Crypto exiting and Citadel Securities, also from a traditional financial background, choosing to take over the baton in the crypto market.

Jump and Citadel, as representatives of traditional financial giants, share similar backgrounds and strategies. Both companies started as market makers, with Jump establishing a foothold in financial markets through high-frequency trading, while Citadel became one of the largest market makers globally through hedge funds and high-frequency quantitative analysis. When Jump entered the crypto market, it brought a strong technical team, hardware, and financial support, and Citadel possesses these advantages as well.

The Myth of Citadel, Wall Street's Largest Market Maker

Citadel Securities is one of the largest market makers on the NYSE. Its daily trading volume accounts for nearly 35% of U.S. stock trading volume, equivalent to the daily transaction volume of the Shanghai and Shenzhen stock exchanges, with annual revenue around 7 billion dollars. Related reading: "Earning over 100 million a day, why is Citadel Securities so good at attracting capital?"

Beyond its market-making business, Citadel's main business is hedge funds, managing 65 billion dollars in assets. It is a tech-driven hedge fund that analyzes the market through a wealth of information and various mathematical models while focusing on fundamental investment value, reportedly investing billions of dollars annually in models and hardware.

According to data from LCH Investments, in 2022, the top 20 hedge fund companies generated a total of 22.4 billion dollars in profits (after fees), with Citadel ranking first with a profit of 16 billion dollars in 2022, setting a new record for annual returns among hedge funds. The latest data shows that Citadel still ranks first in net returns and valuations among all global hedge funds since its inception, with Bridgewater Associates in fourth place.

Data source: LCH Investments

Citadel founder Ken Griffin has a net worth of 45.9 billion dollars, ranking 22nd on the Forbes 400 list of billionaires and 31st globally. He even boldly stated, "We do indeed produce money."

Interestingly, the CEO of Citadel Securities has a name similar to that of the richest person in the crypto space, Zhao Peng.

Compared to Ken Griffin's background, Zhao Peng's resume resonates with every Asian: he entered a gifted program at age 10, was admitted to Peking University's mathematics department at 14, and then pursued a Ph.D. at the University of California, Berkeley.

In 2006, Zhao Peng joined Citadel, quickly rising to prominence due to his exceptional mathematical talent. By 2017, he had become CEO, becoming one of Ken Griffin's most trusted individuals.

During Zhao Peng's four years as CEO, he quintupled Citadel Securities' net trading revenue, a growth rate that is almost unimaginable. Under his leadership, Citadel Securities not only strengthened its advantageous position in the market but also achieved unprecedented levels of profitability.

Zhao Peng's name has become synonymous with the elite among international students from over a decade ago. Related reading: "Citadel Securities CEO Zhao Peng: The pinnacle of Chinese Americans on Wall Street, living a charmed life since age 10"

According to recollections from international students at the time, in an old Sichuan restaurant in Chinatown, students would chat excitedly about Zhao Peng while enjoying spicy hot pot: "On the Chicago landmark Lakeshore, he bought two luxury apartments facing Lake Michigan and connected them, worth over ten million dollars." They all hoped to become the next Zhao Peng.

Citadel's "Secret Passage" with Sequoia and Paradigm

Citadel officially entered the crypto space much later than its competitors, as Jane Street and Jump Trading began establishing digital asset businesses in 2017 and 2021, respectively. It seems that due to regulatory issues, Citadel's connections with the crypto market have been "under the radar."

In 2021, a highly publicized event occurred in the crypto space. A Sotheby's auction featured a 1787 version of the U.S. Constitution. At that time, 1,700 crypto players formed a decentralized organization called ConstitutionDAO, crowdfunding a total of 43 million dollars through social media to bid on the Constitution, which led to the creation of the PEOPLE token.

Unfortunately, they were unable to successfully purchase the Constitution, and the highest bidder turned out to be Citadel's founder Ken Griffin.

In 2022, this billionaire accepted the first external investment for Citadel Securities, completing a 1.15 billion dollar financing at a valuation of 22 billion dollars, led by familiar faces in the crypto industry, Sequoia Capital and Paradigm.

Sequoia Capital partner Lin Junrui will join the board of Citadel Securities, and Paradigm co-founder Matt Huang stated that he will work with Citadel Securities to expand its technology and expertise into more markets and asset classes, including crypto assets. Nevertheless, at that time, Griffin claimed to the media that Citadel Securities had not yet ventured into cryptocurrency trading to avoid regulatory issues.

However, such a response clearly did not cover up the traces of Citadel's quiet layout. It was from that year that Citadel officially began to test the waters in the crypto industry, establishing a dedicated crypto business department.

First, they appointed Jamil Nazarali, the global business development head of Citadel Securities, as the CEO of Citadel's crypto business, collaborating with another top market maker, Virtu Financial, and financial giants Charles Schwab and Fidelity to start digital asset trading and brokerage services.

Then, in June 2023, they officially launched their jointly developed cryptocurrency trading platform, EDX Markets, with Jamil Nazarali as CEO. The trading platform focuses on "non-custodial" and "no retail," with trading targets limited to Bitcoin, Ethereum, Litecoin, and Bitcoin Cash.

In addition to Jamil Nazarali, Citadel has also nurtured many elites closely related to the crypto space. For example, Brett Harrison, the former president of FTX US, who left due to management issues and conflicts with SBF, previously served as the head of technology at Citadel Securities, bringing significant technological innovations to the company.

However, Griffin himself has always had a contradictory attitude towards cryptocurrencies. Initially, he publicly stated that he was cautious about cryptocurrencies, believing they had no real value. Yet in a recent interview, he admitted that he regretted not investing in Bitcoin earlier, stating that if he had seen clearer value, he might have bought these assets long ago.

The reason for Citadel Securities' entry into the crypto field is not as complicated as we might think; politically "standing on the right side" has further deepened his connection with the crypto world. After Trump was elected president, especially with his support for the crypto industry, many traditional financial giants, including Griffin, began to see the enormous potential of crypto. Like most whales in the crypto industry, Griffin firmly supported the Republican Party during the 2024 election. In the recently concluded election cycle, he was one of the top five donors to the Republican Party, second only to Elon Musk.

Citadel's Shorting: From Stock Market to Crypto Market

Returning to the topic we discussed at the beginning of the article, why is the institution holding "3.1 billion dollars in Ethereum short assets" suspected to be from Citadel?

In addition to its recent activities in the crypto industry, Citadel's name is often closely associated with "shorting." There are numerous rumors in the market about their shorting activities.

As early as during the stock market crash in 2015, there were rumors that foreign short-selling forces were one of the culprits behind the sharp decline in A-shares. At that time, the China Securities Regulatory Commission investigated many accounts and suspended a batch of trading accounts suspected of affecting stock prices or other investors' investment decisions.

Among them was an inconspicuous company: Sidu (Shanghai) Trading Co., Ltd. This Sidu company was shown in the national enterprise credit information public system as a wholly foreign-owned enterprise, with Citadel as the shareholder. After a lengthy five-year investigation and negotiation, Sidu ultimately agreed to pay 100 million dollars to reach a settlement with Chinese regulators. At that time, a well-known overseas financial blog, Zerohedge, revealed that Citadel was closely linked to the Federal Reserve and often held secret meetings, effectively serving as a tool for the Fed to control market stability. They used high-frequency trading and other means to drive up the U.S. stock market.

Looking at 2021, when Robinhood banned retail trading during the GameStop (GME) crash, Citadel's name again appeared at the center of many accusations. Retail investors believed that Citadel manipulated the showdown between retail and institutional investors through its financial support of Robinhood. Although Ken Griffin denied these allegations during the hearings, the close ties between his company and Robinhood kept these accusations alive.

It is important to note that Citadel Securities is not just any market maker. Its relationship with Robinhood appears to be that of a client and supplier, but behind the scenes, Citadel provided a significant amount of order flow to Robinhood. All of this was laid bare during the GameStop incident. Since Citadel paid Robinhood tens of millions of dollars to execute these trades, it naturally became the "puppet master" in the eyes of retail investors.

In fact, Citadel's shorting operations over the years have already made it an "invisible manipulator" in the market.

Even in 2023, Terraform even accused Citadel of possibly participating in shorting UST, ultimately leading to UST's de-pegging in May 2022, demanding that Citadel Securities provide some key trading data. Even though Citadel firmly denied any direct connection to the UST collapse.

"No wonder the price movements of GME are so close to ETH," pointed out a community member, indicating that Citadel Securities plays an important role in this, such as using the same strategies and methods for market making. Indeed, since July 2024, the price movements of ETH have closely mirrored those of GME.

Above: ETH price movement; Below: GME price movement

It is no wonder that Citadel Securities has recently been suspected of being one of the institutions shorting ETH.

That said, as a top hedge fund, the possibility of holding a large amount of ETH spot while simultaneously shorting ETH for risk hedging is also plausible. From this perspective, perhaps this is a good thing; after all, the spot they hold is the main position, and shorting is merely a supplementary strategy aimed at ensuring the stable appreciation of assets.

This also indirectly supports the widely circulated rumor of a "big shift in ETH ownership," as Wall Street giants are gradually building positions to become new crypto players. The competition and game among crypto market makers continue.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。