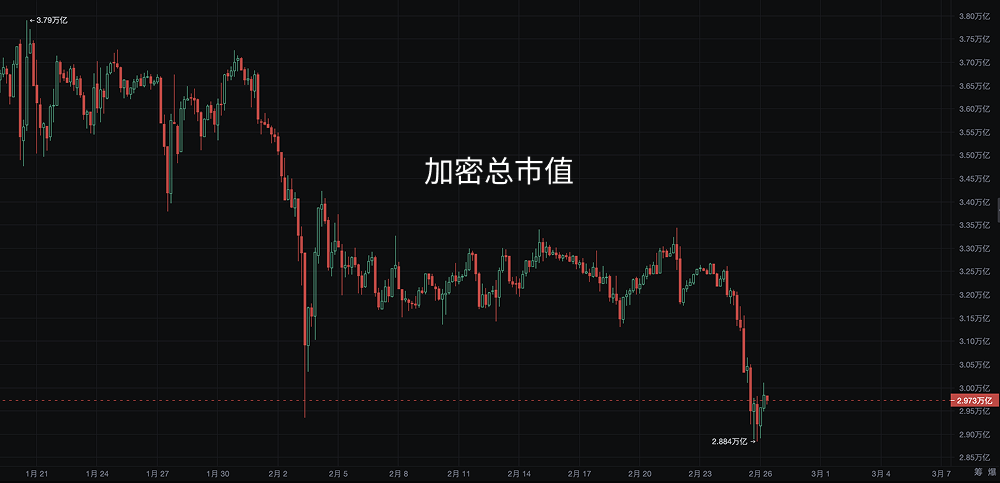

February 26, 2025 — In the past 24 hours, global financial markets have experienced severe turbulence, with the cryptocurrency market's total market capitalization plummeting to a three-year low of $2.86 trillion, a drop of about 8%, approaching levels seen in November 2021. Bitcoin's price fell sharply by 8% to $86,700, the lowest since last November; Ethereum, XRP, and Solana saw declines ranging from 8% to 10%. This round of sell-off was triggered by multiple factors, including U.S. President Donald Trump's announcement of "continuing tariffs on imports from Canada and Mexico next week," a $1.5 billion attack on Bybit exchange by the North Korean hacker group Lazarus, and the collapse of the meme coin craze, leading to extreme panic in market sentiment.

Market Dynamics: Bitcoin's Dominance Rises, Small and Mid-Cap Assets Under Pressure

AiCoin data shows that Bitcoin's market dominance surged from 41% in November 2021 to 61%, while Ethereum's market share shrank from 20% to 10%. CoinGecko further pointed out that the share of "other" assets outside the top nine cryptocurrencies dropped from 25% to 9%, reflecting a stagnation in the growth of small and mid-cap assets over the past three years. Jeffrey Kendrick, head of global digital asset research at Standard Chartered Bank, noted: "While Bitcoin has performed relatively robustly in the digital asset space, the sell-off triggered by the Solana ecosystem's meme coins and overall risk-averse sentiment has dragged it into the mire."

One of the triggers for the sell-off was last Friday's hack of Bybit, which resulted in the theft of over $1.5 billion in ETH and related tokens, marking the largest loss in the history of centralized exchanges. Previously, the LIBRA meme coin promoted by Argentine President Javier Milei saw its valuation plummet 95% from $4.5 billion, compounded by revelations of Melania and Milei using meme coins for money laundering, effectively ending the meme coin craze. Bitwise Chief Investment Officer Matt Hogan commented on X: "The meme coin boom is dead; it may not be today, but it will be completely gone within six months."

Macroeconomic Pressures and Liquidation Wave

Trump's tariff statements have exacerbated global trade tensions, with U.S. stocks plummeting and Nasdaq futures falling over 4% since February 18, further heightening market risk aversion. Bitcoin futures exchanges saw a liquidation amount of $227 million on Monday, the third-highest level since last September. The U.S. spot Bitcoin ETF recorded a net outflow of $516 million on Monday, followed by another 6% drop on Tuesday. The GMCI 30 index, representing the top 30 cryptocurrencies, fell 6% within 24 hours, with a cumulative decline of 26% over the past month.

Binance CEO Richard Teng stated on X: "History shows that the crypto market reacts to macroeconomic changes similarly to traditional assets, but its resilience should not be overlooked. This is a tactical retreat, not a structural collapse." He pointed out that price volatility obscures the stability of the industry's core drivers.

Expert Opinions: Cautious in the Short Term, Optimistic in the Long Term

Analysts have differing views on future trends, but long-term bullish sentiment prevails:

Arthur Hayes (Co-founder of BitMEX): Predicts Bitcoin could drop to $70,000;

Chris Burniske (Partner at Placeholder): Insists this is a bull market correction, with a bright long-term outlook;

Zhao Wei from OKX Research Institute: States the decline is driven by trade tensions, U.S. stock volatility, leveraged liquidations, and security incidents, with the future depending on incremental funds and technological innovation;

Matrixport: Warns that technical breakdowns indicate short-term risks, but a rebound may occur in the second half of the year;

Raoul Pal (CEO of Real Vision): Advises patience, stating that the market structure resembles 2017, and after a correction, new highs will be reached;

Ansem (Trader): Emphasizes that $96,500 is a key support level, and a U.S. stock market crash could initiate a downward trend;

CoinDesk's Omkar Godbole: Attributes the situation to expectations of interest rate hikes by the Bank of Japan and declines in Nasdaq futures.

Regulatory Silver Lining and Future Outlook

Despite the market downturn, there are signs of warmth in the U.S. regulatory environment. The U.S. Securities and Exchange Commission recently concluded investigations into Uniswap Labs, Coinbase, and Robinhood, clearing some obstacles for industry development. Teng stated: "Crypto has matured into a global financial asset class, and its ability to rebound from macro-driven declines has been proven. The current pullback is an opportunity for experienced investors to position themselves for the next round of increases."

Hogan pointed out that institutional adoption of Bitcoin, the revival of stablecoins, and DeFi will fill the void left by the retreat of meme coins, but short-term exhaustion of energy will still weigh on the market. Experts generally agree that whether Bitcoin can hold key support and attract incremental funds will determine its ability to regain upward momentum amid global uncertainty.

Disclaimer: The above content does not constitute investment advice.

AiCoin official website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。