Author: Azum, Odaily Planet Daily

The mainstream DEX protocol on Solana, Raydium (RAY), plummeted today. The direct trigger seems to be that pump.fun is testing its own AMM liquidity pool. The market speculates that this move may lead to the future pump.fun tokens not being added to Raydium after breaking out of the "internal market," but instead being directly siphoned off within the pump.fun protocol, resulting in a decrease in Raydium's trading volume and a corresponding reduction in income and buyback levels.

The logic behind RAY's decline (readers familiar with the relevant logic can skip this)

A brief overview of the relationship between Raydium and pump.fun.

As the most mainstream meme token launchpad platform on Solana, the token issuance of pump.fun goes through two stages: "internal market" and "external market." After the token is issued, it will first enter the "internal market" trading phase, which relies on the pump.fun protocol's own Bonding Curve for matching. Once the trading volume reaches $69,000, it will enter the "external market" trading phase, at which point liquidity will migrate to Raydium, where a pool will be created on this DEX and trading will continue.

Next, let's look at Raydium and RAY.

Raydium currently charges a 0.25% fee on each transaction, of which 0.22% is distributed to Raydium's liquidity providers (LPs), and 0.03% is used for RAY buybacks and ecosystem support. In short, Raydium's trading volume will indirectly affect RAY's price through fee income.

So the current situation is that if pump.fun builds its own AMM, future liquidity will no longer migrate to Raydium, thereby reducing the latter's trading volume and fees, which in turn affects RAY's value performance.

How much does Raydium rely on pump.fun?

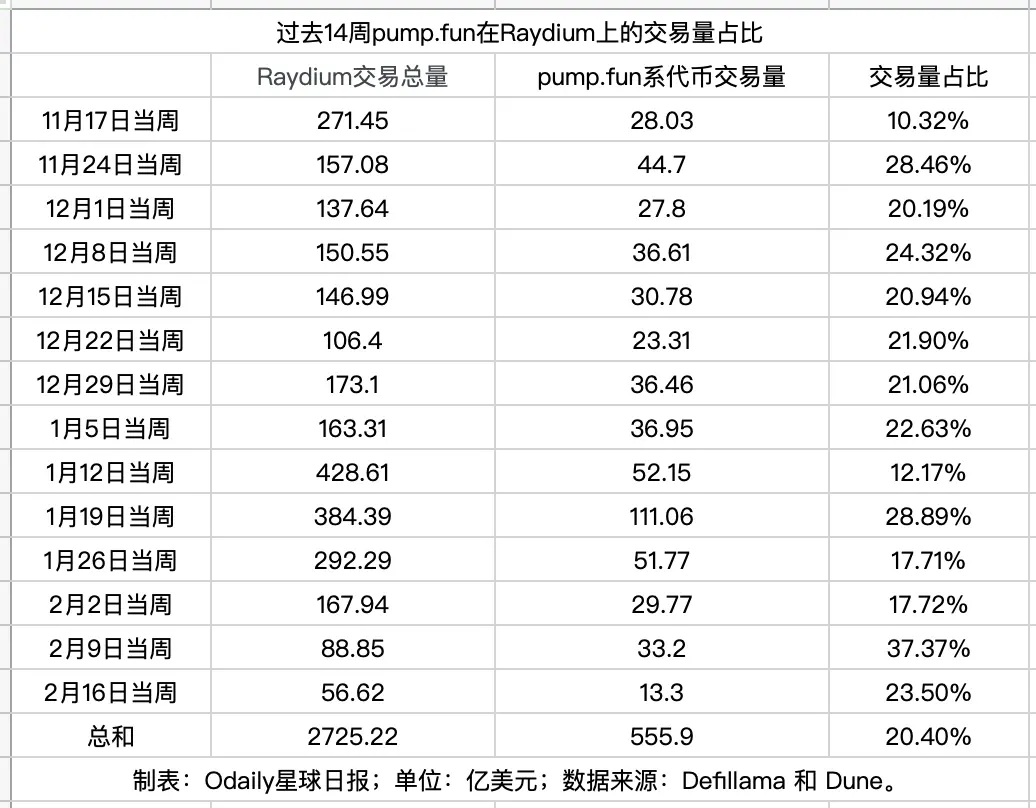

In the above section, there have been many analyses in the market today, but it seems that no one has carefully sorted out how much Raydium relies on pump.fun in terms of trading volume. To this end, we queried some data sources on Defillama and Dune, and the conclusion is shown in the figure below.

From the figure above, it can be seen that over the past 14 weeks, the trading volume of pump.fun tokens on Raydium has accounted for about 20%. This means that if pump.fun really siphons off Raydium through its own AMM in the future (not considering the autonomous liquidity migration activities due to uncertain platform fee differences), Raydium is expected to see a trading volume reduction of about 20%.

Is it oversold?

Returning to the market, OKX shows that RAY dropped to a low of $2.82 today, corresponding to a decline of over 30% (data was pulled too late, and it indeed appears to have been oversold at that time). The current price has gradually recovered to $3.15, corresponding to a decline of 25.43%.

Considering that SOL itself also experienced a 5.8% decline, RAY's current decline is basically within a reasonable range, indicating that the market has already priced in pump.fun's siphoning behavior.

Finally, let's conclude with the words of Fluid COO DMH:

The sharp drop in RAY once again proves to us that "distribution >>> tech." There are countless examples in the traditional world (Microsoft) and the crypto field (Metamask) that show if you have a large enough user base, your product becomes less important.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。