Today's homework is still quite heavy. I really didn't expect Bitcoin's price to drop below $10,000 within 24 hours. The market sentiment is indeed very poor. Many friends are looking for reasons for the decline today. There seem to be many possibilities, but in reality, it is still investors' panic over Trump's tariffs, and behind the tariffs is the Federal Reserve's monetary policy.

So ultimately, it is liquidity that is influencing the market. In fact, the recent positive news has been quite good. The support from the U.S. for cryptocurrencies is evident. If this situation continues into 2024, it is likely that #Bitcoin will reach a new high without any issues. Unfortunately, in 2025, investors' sentiment is more focused on monetary policy, with expectations for interest rate cuts and liquidity far exceeding expectations for policy.

There has been a constant mention of a lack of breath, and what is lacking is this breath of liquidity. Today, many investors are criticizing Trump, believing that he is even worse than Biden. Although he claims to support cryptocurrencies and AI, in reality, both sectors have recently seen significant declines. His tariff policy, on one hand, increases the actual shopping pressure on the public, and on the other hand, erects a higher wall for interest rate cuts.

Of course, some friends hold opposing views. After all, from a long-term perspective, Trump's support for cryptocurrencies and AI may allow these two industries to go further and better. Although there may be some short-term setbacks, these are all considerations of "America First," especially with the increase in tariffs, which is actually aimed at reducing tariffs from other countries on the U.S. It can also increase fiscal revenue and alleviate the fiscal deficit, especially with Musk's DOGE department, which has already begun to engage with U.S. government agencies, possibly laying off more personnel to reduce fiscal pressure.

So no matter what, as investors, we can only passively endure. We either anticipate Trump's toughness in advance and exit early, or we endure through the difficult times. After all, from a long-term trend perspective, the U.S. is gradually shifting from monetary tightening to monetary easing. This is an undeniable fact, but this path may be particularly difficult in the next two years, especially in 2025. In fact, when it was first mentioned in 2024 that there might only be two interest rate cuts in 2025, it was already destined that the difficulty in 2025 would significantly increase.

Will things continue to worsen? I think it still depends on monetary policy. Everything currently is based on expectations of monetary policy. The core PCE data released on Friday is an example. Although it is inevitable that there will be no interest rate adjustments in March, investors still want to know whether the data that the Federal Reserve is most concerned about is rising or falling. I still feel that the Q1 inflation data is within expectations, but when the tariffs are fully reflected in the data in Q2, that will be more challenging.

My view on the market remains that it is "garbage time." The current situation is becoming more and more like 2023. In 2023, the market's ups and downs were largely dependent on the BTC spot ETF. A little bit of news would cause a rise, and after the news period, it would drop. 2024 is similar; at that time, the market sentiment was influenced by the elections.

By 2025, the sentiment will be influenced by strategic reserves. Many friends ask me if I still have confidence in Q1. My answer remains that compared to the upcoming days, Q1 still has expected value. Starting in Q2, it may become more difficult, especially for altcoins, which are only just beginning to face challenges.

Looking back at the #BTC data, panic is inevitable. The turnover throughout the day reached nearly 210,000 BTC, but the main body of panic still comes from short-term holders, especially those with costs above $95,000, who are showing signs of increased panic. In contrast, investors with costs below $95,000 are actively buying. Currently, there are no signs of panic among long-term investors.

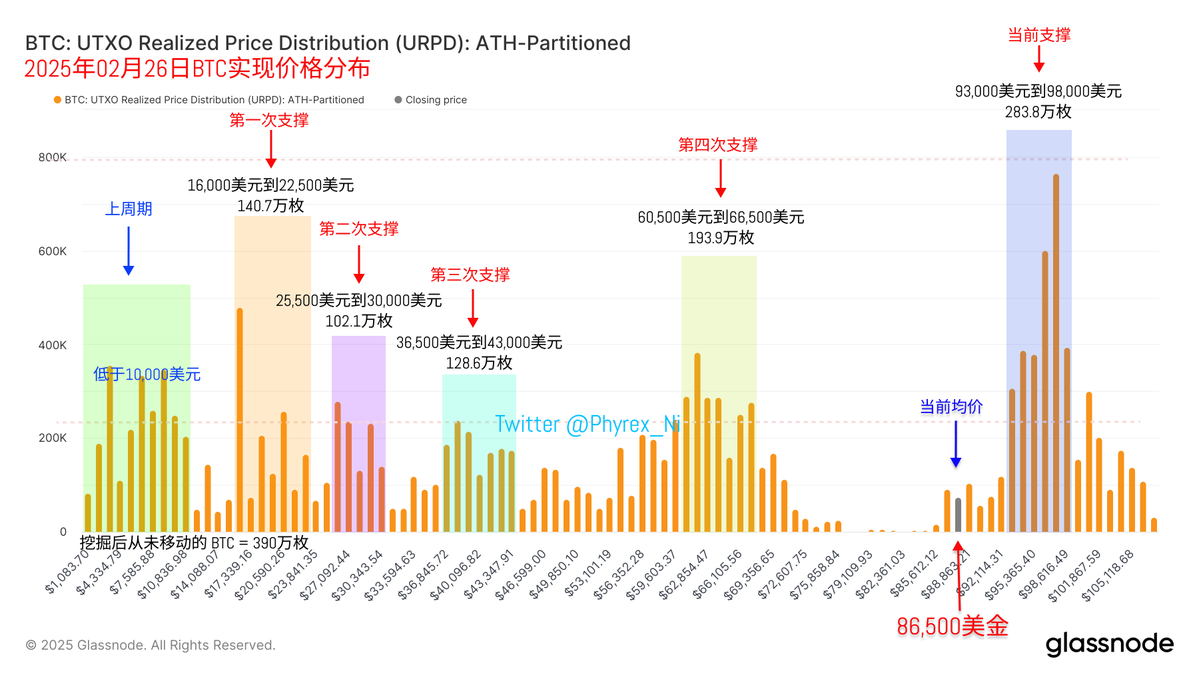

In terms of support, investors between $93,000 and $98,000 have not shown significant signs of large-scale selling. Although panic is increasing, more investors are not selling, especially those around $97,000, who have not shown significant reductions. In the last 24 hours, the reduction of BTC between $93,000 and $98,000 is only about 16,000, which is not particularly exaggerated.

Additionally, from the UPRD data, the gap between $77,000 and $84,000 has still not been filled. This gap is very similar to the downward gap in CME's BTC futures. Historically, UPRD has never had a situation where a gap was not filled. Of course, at least for now, I still do not believe that this gap will be filled in the short term. If it does get filled, it may only happen after Q2.

The data has been updated. Address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。