When data ownership returns to individuals, privacy protection and value flow can be achieved simultaneously. The trillion-dollar data economy, monopolized by Web2 giants, may face a silent yet thorough reconstruction.

Written by: Luke, Mars Finance

As the entire cryptocurrency market is mired in difficulties, a unique current flows against the tide—while the total market capitalization of cryptocurrencies falls below $3 trillion, the VANA token surges with an astonishing 54% increase in a single day, becoming the brightest star in the bear market. This inevitably raises the question: what disruptive secrets lie within this obscure project?

Disruptor in the Data Monopoly Dilemma

Over the past two decades, internet giants have quietly transformed the data of billions of users into fuel worth trillions by using free services as bait. From Google's targeted advertising to Reddit selling user content to AI companies, platforms enjoy the data dividends while the true producers—users—have become "unpaid miners" of the digital economy. With the explosion of AI technology, high-quality data has become the key to victory, but the contradictions are increasingly sharp: on one hand, personal data value is systematically stripped away; on the other hand, AI developers struggle with a lack of compliant data sources.

This is the era in which VANA was born. This Web3 project, listed on the "AI Must-Watch List" by a16z partners, aims to reconstruct the underlying logic of the data economy using blockchain. Its core proposition directly addresses the issue: allowing everyone to truly own, govern, and monetize their data assets. This "pulling the rug out" from traditional data monopolies may be the root of the capital frenzy—top institutions, from Coinbase Ventures to Paradigm and Polychain, have injected over $25 million in funding, and even Binance founder CZ has joined as an advisor.

On February 24, 2025, TheBlock reported that YZi Labs (formerly Binance Labs) has invested in the crypto AI startup Vana, with Binance founder CZ joining as an advisor, though the specific investment amount has not been disclosed. This investment marks YZi Labs' first focus on the AI field since its rebranding. Previously, YZi Labs' investments in the Web3 space covered several crypto AI projects, such as Sahara AI and MyShell. A spokesperson stated that YZi Labs will continue to explore innovative opportunities at the intersection of various fields, including artificial intelligence and biotechnology.

It is worth mentioning that Vana's early financing has also attracted attention. On September 18, 2024, Vana secured $5 million in strategic financing through Coinbase Ventures, while in December 2022, it received a total of $18 million in investments from top institutions such as Paradigm and Polychain. The influx of these funds has undoubtedly accelerated the rapid growth of the Vana network and laid a more solid foundation for its development.

Through these initiatives, Vana is gradually promoting the construction of a decentralized data market, challenging traditional monopoly models, and providing users with a new platform to control and monetize their data.

Technical Architecture: Balancing Privacy and Value

VANA's disruptive nature lies in its innovative solution to the "impossible triangle" of the data economy: ensuring privacy, enabling value flow, and meeting the high-quality data needs for AI training. Through an EVM-compatible AI public chain, VANA has built a decentralized governance data market with encrypted rights confirmation. Users can encrypt and store social media records, health data, and even genetic information in the "Data Liquidity Pool" (DLP), negotiate commercial use through the DataDAO community, and earn rewards based on their contributions.

Two key technological breakthroughs are hidden here:

- Trustworthy Data Verification Network Satya: Based on Trusted Execution Environment (TEE) and zero-knowledge proofs, it achieves dual guarantees of data quality verification and privacy protection.

- Tokenized Data Assets: Transforming unstructured data into tradable DLP tokens, pioneering the introduction of the "data derivatives" concept in the DeFi market.

This design allows VANA to hit multiple explosive points simultaneously: for users, it is the first time they can participate in data governance and earn rewards by staking $VANA (current APY up to 273%); for developers, a channel for compliant access to sensitive data such as finance and health is opened; and investors see a new blue ocean for tokenizing trillion-dollar data assets—just as Pendle redefined yield-bearing assets, VANA is transforming "data oil" into programmable financial targets.

Economic Model

VANA's economic model promotes decentralized data trading through carefully designed token distribution and multi-layered incentive mechanisms, ensuring that all participants can benefit from the network's growth, ultimately achieving a self-sustaining and self-reinforcing ecosystem.

1. Token Distribution

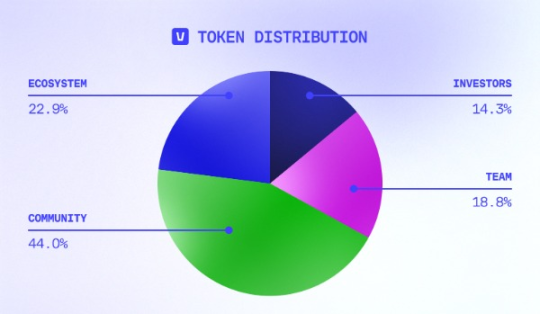

The total supply of VANA tokens is 120 million, with 66.9% allocated to the community to incentivize data contributors and users to participate in data governance. This distribution method will help ensure that community participants can grow in sync with the VANA network over the long term.

The specific distribution is as follows:

- Community (44%): This portion of tokens will be used to reward data contributors, incentivize early users and developers, and support ongoing community participation through airdrops and other means. These tokens have a lock-up period of 0 months and will be fully unlocked within 36 months.

- Ecosystem (22.9%): This portion of tokens will be used to ensure the sustainability of the VANA protocol, including providing grants to DataDAO, supporting newly created DataDAO tokens, network partnerships, and incentivizing block rewards. The lock-up period for ecosystem tokens is 0 months, with full unlocking to be completed in 48 months.

- Investors (14.2%): Tokens received by investors will be used to reward early supporters. This portion has a lock-up period of 12 months, a release period of 36 months, and will be fully unlocked in 48 months.

- Core Contributors (18.8%): These tokens will be allocated to the VANA team to reward their hard work in the early stages of the project. Core contributors' tokens will have a lock-up period of 12 months, a release period of 48 months, and will be fully unlocked within 60 months.

2. Token Uses and Functions

The $VANA token serves multiple key functions within the VANA network, including network security, transaction fees, data governance, and incentive mechanisms.

- Network Security: As the native token of the VANA network, $VANA is used for staking to ensure network security. Validators in the network stake $VANA to guarantee the stability of the blockchain and the reliable verification of transactions. In the early stages of the network, all Layer 1 validators' rewards will be transferred to a public funding pool to support the entire ecosystem.

- Transaction Fees: $VANA is the payment medium for all transactions on the network, including data operations, smart contract executions, and interactions with DataDAO. Users need to pay a certain amount of $VANA as transaction fees when contributing or accessing data.

- DataDAO Staking: Users can participate in governance in DataDAOs by staking $VANA and receive rewards for supporting DataDAOs that increase data capital. Staked $VANA will also affect the top 16 DataDAOs, which will be able to provide rewards to participants and community members, promoting data quality improvement.

- Default Data Access Currency: Datasets managed by DataDAO can be accessed using $VANA. While $VANA is the default payment token, users can also exchange it with other tokens to meet the needs of buyers and sellers.

- Governance Function: Holders of $VANA can participate in the decentralized governance of the VANA network, using a voting mechanism to decide on important proposals for the network. This provides community members with decision-making power and ensures decentralized management.

3. Token Economics and Distribution Phases

VANA's token economic model is divided into four phases to ensure stable growth and long-term sustainability of the network.

Phase 1: Establishing Data Liquidity (0-6 months)

In this phase, VANA focuses on attracting data contributors and promoting the early development of DataDAO. The token issuance in this phase is primarily used to incentivize DataDAO creators and early data contributors, quickly attracting users through rewards and ensuring the initial growth of the ecosystem.

Phase 2: Accelerating AI Innovation and Application (6-12 months)

As the network expands, VANA will encourage the creation of AI agents and promote the formation of co-owned AI models. At this point, the network will begin to support token issuance through fee income and reward users who contribute high-value data and developers who create innovative AI applications.

Phase 3: Decentralization and Governance (12-18 months)

In this phase, VANA will gradually transition to a community governance model and increase user rewards. Token issuance will gradually decrease, relying more on transaction fees to support reward distribution. The community will begin to have more control, helping to manage the reward structure and token distribution.

Phase 4: Network Expansion (18-24 months)

As the VANA network further develops, token issuance will fully transition to a demand-driven reward mechanism, ensuring the long-term stability of the network. In this phase, integration across DLPs (Data Liquidity Pools) will become a focus, promoting more cross-chain cooperation and ecosystem integration.

Total Token Supply and Unlocking Mechanism

The total supply of VANA tokens is strictly controlled to ensure that no excessive tokens flood the market in the short term. Token releases are gradually carried out in four phases, considering long-term sustainability. The token release schedule for each participant is precisely set to ensure their long-term participation and support in the protocol.

Through these designs, the VANA economic model not only effectively mobilizes all participants in the network but also provides strong support for data democratization, AI innovation, and decentralized governance. The multiple uses and reward mechanisms of the $VANA token provide balanced incentives for users, developers, data contributors, validators, and investors, driving the VANA network towards a healthier and more sustainable ecosystem.

Ecological Flywheel: From DataDAO to AI Democratization

If the technical architecture is the skeleton, then ecological construction is the flesh and blood. VANA's ambition lies in building a self-reinforcing data economy flywheel:

- Underlying Protocol: Transforming the data procurement costs of AI companies into token deflationary momentum through a destruction mechanism.

- Middle Layer: 12 active DataDAOs have covered diverse scenarios such as Twitter data, genetic maps, and transaction records.

- Application Layer: Incubating innovative projects like vChars AI (Telegram data transformation into virtual personas) and MindDAO (mental health data alliance).

This ecological explosiveness is evidenced in the token economy: behind a circulating market cap of only $500 million lies a high incentive design where 44% of tokens are allocated to the community, along with a long-term commitment of gradual unlocking of investor tokens over three years. Even more noteworthy is its "data Launchpool" model—just as dFusion AI airdrops 1:1 to $VANA stakers, the rise of each new DataDAO could trigger a value spillover effect.

The Paradigm Collision of Web3 and AI

While the industry is still debating the intersection of AI and blockchain, VANA has already demonstrated true integrated value. In the equation AI = data + computing power + models, it precisely positions itself in the most core yet most decentralized data track. Unlike traditional platforms' "predatory mining" of data, VANA deeply binds the interests of data contributors, validators, and users through its token economy. This attempt at "data democratization" mirrors Bitcoin's challenge to traditional finance.

Interestingly, its explosive timing coincides with the dawn of the AI Agent revolution. As models like GPT-5 approach data bottlenecks, compliant, diverse, and high-quality datasets will become the key to victory. The distributed data network built by VANA may very well be the key to unlocking the next generation of AI application scenarios—while tech giants are mired in privacy compliance, VANA's DataDAOs have gathered financial behavior data that Reddit cannot reach and health records that Twitter struggles to obtain. The value release of these "data gold mines" has only just begun.

In this crypto winter, VANA's counter-trend surge is by no means coincidental. It reveals a deeper trend: as data ownership returns to individuals, and as privacy protection and value flow can be achieved simultaneously, the trillion-dollar data economy monopolized by Web2 giants may face a silent yet thorough reconstruction. The whistle of this transformation may have quietly sounded the moment $VANA broke through $9.7.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。