The cryptocurrency market is in a state of turmoil.

Written by: Pzai, Foresight News

On February 25, the cryptocurrency Fear and Greed Index dropped to 25, marking a new low since September 2024, as the market shifted from a neutral state to one of extreme fear. Amidst Trump's aggressive tariff policies and the shaky political fundamentals in Europe, U.S. stocks closed lower on Monday, with the S&P 500 index down 0.49% and the Nasdaq down 1.2%.

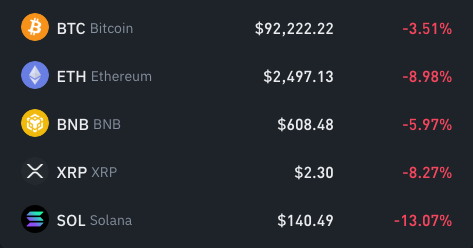

A number of tokens have also severely impacted market expectations with a "high dive" approach. Bitcoin briefly dipped to around $90,000, while SOL fell to the $140 mark in just one day.

From the perspective of related U.S. stocks in the crypto space, MSTR was affected by Bitcoin price fluctuations, dropping to around $282, returning to mid-November 2024 levels, while Coinbase fell to $230, hitting a new low since November 2024. What exactly is happening in today's crypto market? This article will analyze the situation from both market sentiment and on-chain conditions.

Market Analysis

On February 24, Bitfinex reported that due to the continued stagnation of market momentum, Bitcoin had maintained a range of fluctuations between $91,000 and $102,000 over the past week. On February 21, following news of significant sell-offs due to S&P 500 options expiration, volatility surged, leading to a 4.7% drop in Bitcoin on that day.

Additionally, recent geopolitical factors have raised red flags for market expectations, such as Trump's statement at a press conference regarding punitive tariffs on Canada and Mexico, which will "proceed on time and as planned."

Recent hacking incidents have also created some selling expectations in the market, with ByBit's $1.5 billion ETH assets being stolen, which significantly impacted Ethereum's asset price, causing it to fall below the $2,500 mark.

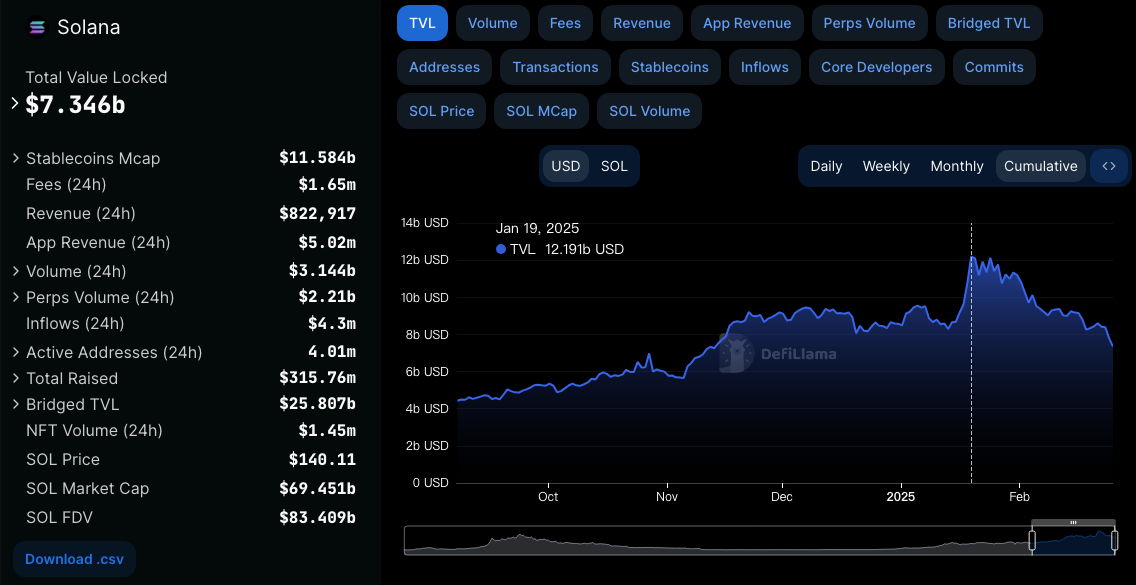

In terms of mainstream assets, under the pressure of MEME retreat and large unlock sell-offs, SOL saw a decline of 13.07%. According to DeFillama data, Solana's TVL has continuously decreased from a peak of $12.19 billion on January 19 to $7.346 billion, a drop of nearly 40%.

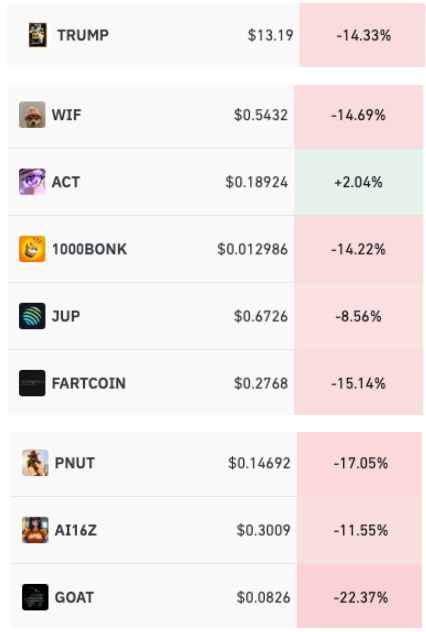

Overall, as liquidity from MEME is withdrawn, Solana's ecosystem tokens have also experienced declines, with an average drop of over 10%. Recently, whether it’s Argentina's President Milei's LIBRA coin or Kanye West's token controversy, the impact on market confidence has been significant, leading to a shift in focus back to other projects. Nic Puckrin, founder of The Coin Bureau, stated that people in the current crypto market have begun to grow weary of Meme coins, with new meme coins being launched almost daily, and some celebrities participating in hype and sell-offs. Current investor sentiment may be as low as it was during the FTX collapse, if not lower.

Sentiment Spread

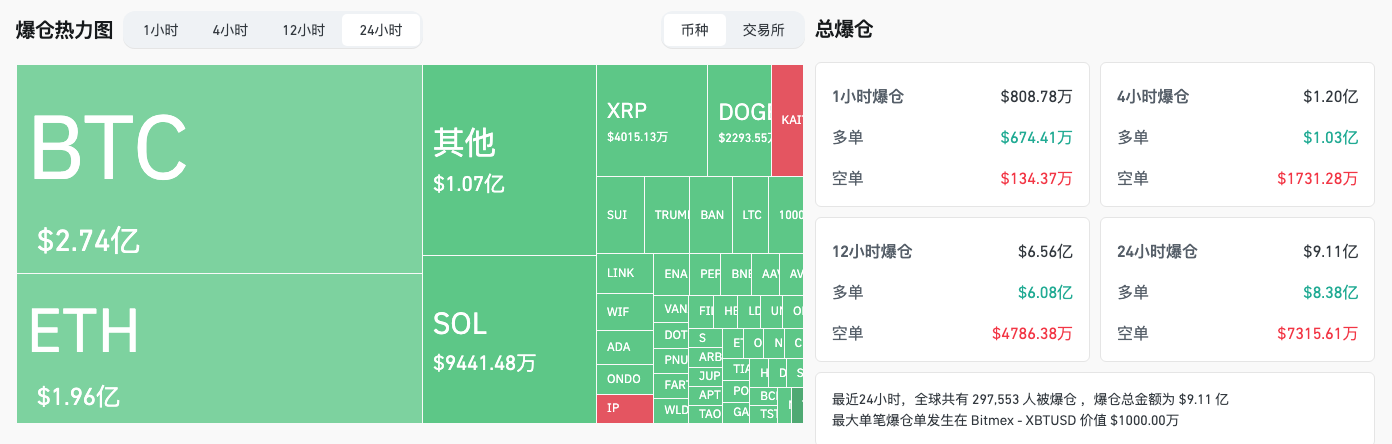

Arthur Hayes, co-founder of BitMEX, analyzed from the ETF perspective, stating that many IBIT holders are earning returns above short-term U.S. Treasury yields by going long on ETFs and shorting CME futures. If the BTC price drops and the basis narrows, these funds will sell IBIT and cover CME futures. He also expressed a bearish outlook, predicting a drop to 70,000 USDT. Jeff Dorman, Chief Investment Officer of digital asset management firm Arca, stated, "The weakness in the cryptocurrency market is largely due to low market sentiment, losses from the failed issuance of various Meme coins, and a lack of funding to support new tokens." According to Coinglass data, the impact of this market situation has led to liquidations reaching $911 million within 24 hours, a new high in nearly three weeks.

However, behind the panic, many companies continue to accumulate. On February 24, Strategy (formerly Microstrategy) increased its holdings by 20,356 Bitcoins at an average price of $97,514, bringing its total holdings to 499,096 BTC. Metaplanet also announced on February 25 that it had purchased another 135 BTC at an average purchase price of $95,826, with a total purchase value of approximately $12.936 million. Overall, these companies still maintain sufficient confidence in Bitcoin's status as a mainstream crypto asset.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。