Interview: Mensh, ChainCatcher

Guest: Armani Ferrante, Backpack CEO

Armani gives off a very friendly vibe. On the way to the interview location, he politely engages in brief conversations with everyone who greets him warmly. However, he quickly becomes pensive or replies to messages, leaving no moment of idle time.

The hotel where the Backpack team is staying is in the same complex as the Consensus venue, and it is clear that the room rates are quite high. Armani explains that this is his way of reducing commuting time. In Japan, his residence is also very close to the office, and on days without social obligations, he is a workaholic who travels between just two points.

During our conversation, perhaps due to his meticulous nature as an engineer, he takes a moment to reflect before defining and breaking down each question before answering. Where he does not provide specific evidence, he adds, "You can verify it yourself."

Armani was once an engineer at Apple. In 2017, he was introduced to Ethereum and became fascinated by the concept of a "world computer." He almost immediately resigned from his job at Apple and has since devoted himself to the development of blockchain technology.

Backpack Wallet was established in April 2022, and after the collapse of FTX later that year, the company lost 88% of its treasury funds. However, in the midst of the crisis, Armani saw an opportunity for a compliant exchange. Backpack Exchange was founded in March 2023.

In April 2023, Backpack launched the first xNFT series on Solana, Mad Lads, which was a huge success, with total trading volume briefly ranking first across the network, even surpassing established Ethereum blue-chip NFTs like BAYC. During the bear market, Backpack had to rely on the $1.4 million raised from Mad Lads NFT sales to maintain operations.

In February 2024, Backpack completed a $17 million financing round led by Placeholder, with participation from Wintermute, Robot Ventures, Selini Capital, Amber Group, and others.

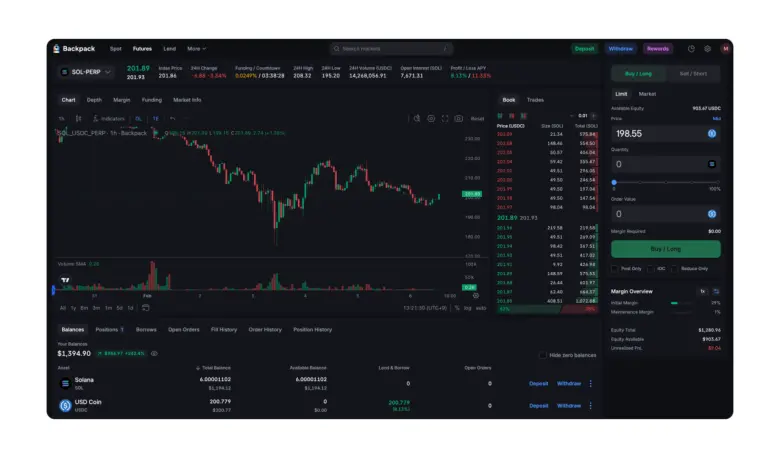

Currently, Backpack has 57 spot trading pairs, 15 perpetual contracts, and 5 collateral lending liquidity pools. According to Coinmarketcap data, Backpack's total asset amount is $34.12 million, with approximately 54% in USDC and 26.22% in SOL. As of the time of publication, the trading volume is $6,194,018.

Also, influenced by the warning from FTX, Backpack places great importance on compliance in various regions and actively seeks licenses. In October 2023, Backpack obtained a Virtual Asset Service Provider (VASP) license issued by the Dubai Virtual Assets Regulatory Authority (VARA). On December 10, 2024, Backpack was officially registered as a Class II member of the Japan Virtual Currency and Crypto Assets Exchange Association (JVCEA). On January 7 of this year, Backpack acquired the European branch of FTX, FTX EU, for $32.7 million. FTX EU previously held a MiFID II license issued by the Cyprus Securities and Exchange Commission (CySEC). Armani stated that the company plans to become the only regulated perpetual contract provider in Europe and has submitted a MiCA notification, expecting to launch in the first quarter of 2025.

In this interview, we talked with Armani about how Backpack, as a young exchange, positions itself in the market, future product plans, and his personal entrepreneurial life.

From Apple Engineer to Founding an Exchange: A Bumpy Journey of Faith

ChainCatcher: You were an engineer at Apple; why did you decide to enter the crypto world?

Armani: After graduating from university and working at a big company, like any ordinary engineer, you are just a cog in this huge machine. In 2017, as Bitcoin and Ethereum prices kept rising, that moment was truly magical. I remember very clearly sitting in a café on Market Street in San Francisco, reading the Ethereum white paper on my laptop, feeling that this was the coolest thing ever. I was completely captivated; I didn’t know what to do, how to make money, or for whom to work, but I knew I wanted to be part of it. So, I quit my job at Apple. Even though I didn’t know what I was doing, I decided to give it a try because everything at that time motivated me.

ChainCatcher: Can you share the entrepreneurial journey from xNFT to Mad Labs and then to Backpack Wallet?

Armani: I entered Solana in September 2020, when there was almost no ecosystem. I joined this ecosystem and did a lot of things, including DeFi-related work, early wallet infrastructure, developer tools, and so on. These efforts later became very successful, and the network began to grow rapidly in its early stages. It was because of the network's growth that I decided to start my own venture. Solana made me feel for the first time that the infrastructure issues were basically resolved, so I began to think about what problems to solve next to drive the network and industry forward. At that time, I believed many people understood the importance of mobile and recognized that building mobile applications in the crypto space was very challenging due to the near-monopoly of the iOS and Android app stores. So, my team and I thought about how to build a decentralized app store. This is the origin of xNFT; we wanted to tokenize applications like image tokenization, creating a new distribution channel to establish decentralized applications. That was the initial concept, although we did make some changes later.

ChainCatcher: Why did you choose NFTs as your starting point?

Armani: NFTs are actually a universal form representing some kind of collectible. We usually associate them with things like 10K avatars, funny JPEGs, or CryptoPunks, but they are actually a universal way to own anything. At the same time, those NFT series, especially the 10K style avatar series, created fantastic communities, with examples like CryptoPunks being very successful. These communities garnered widespread attention in the industry and became one of the most exciting social events in the crypto space. Therefore, this also paved the way for the story of Mad Labs.

We ultimately decided to build our own NFT series for two main reasons: first, if we are going to build our own NFT platform and NFT protocol, then we should create our own NFT series and become our own users. Secondly, at that time, the community's enthusiasm was very strong, which felt very exciting.

The Beginning of Backpack: Regional Compliance Opportunities

ChainCatcher: You mentioned that when FTX collapsed, you saw a gap in the exchange market. What is this gap?

Armani: As the industry matures, especially when the situation regarding rules and regulations becomes clearer, exchanges should not be classified simply as decentralized or centralized. A more appropriate classification is: one category consists of systems that have censorship resistance, which are widely distributed globally and do not have specific regional application rules. For example, the internet is one such example, including decentralized exchanges like Uniswap. The other category consists of compliant entities that are centralized and can enforce rules and tools in any region where they serve users.

As the industry matures, people are forced to fall into one of these two categories. But the challenge is that many people are very good at products; they can build great exchanges but are not skilled at constructing all the operational infrastructure needed to build a compliant financial institution. Meanwhile, there are also some people who are very good at compliance and operations, possibly coming from a traditional finance background, but they are not very good at building products and do not understand the characteristics of the crypto industry. You will see many people struggling in these two categories, and the real big opportunity is to take the middle path, building a financial institution that is very well adapted to this industry, capable of building things on-chain, having a wallet, and solving the bridging issues between the traditional financial system and the crypto world.

You can see this happening in many places, like a week or two ago in Japan, where many unregulated exchange apps were kicked out of the app market because they did not comply with Japanese rules. In Europe, all the largest derivatives exchanges have also been forced to exit because they did not comply with European rules. For example, five derivatives exchanges, including OKX derivatives, currently have almost no exchanges offering derivatives in Europe because no one is compliant. So, the opportunity lies here—becoming a compliant and trustworthy participant, solving the challenges between traditional finance and the crypto world, and bringing all the value of traditional finance into the blockchain.

ChainCatcher: What products is Backpack currently focusing on to connect traditional finance with the crypto industry?

Armani: There are many different levels of products. You can't just say, "I want to build a competitor to Robinhood or Uniswap" right away. We have two parts, two businesses. One is the wallet, and the other is the exchange.

In terms of the exchange, the primary goal is to establish liquidity. Because as a product, the most important thing is liquidity. So, the first product we are focusing on now is to build a very attractive trading product. About two and a half weeks ago, we launched our public beta, testing a new product, which we call "Yield Futures" or "Yield Professional Futures," which is different from regular perpetual futures. In our futures product, users can earn yield on their collateral. We have a native cross-chain currency market where you can lend your assets and use those borrowed assets for trading. In the past two and a half weeks, we achieved over $2.4 billion in trading volume just during the testing phase. So, we plan to officially launch in early March, at which point we will exit the public beta and be fully open, ready for global users. This is the first product we are building, providing a very attractive trading experience, including spot, margin, lending, and perpetual futures where users can earn interest. We have invested a lot of effort into building a truly excellent and differentiated product that solves problems that decentralized exchanges cannot address. This is our first step.

The second part is the wallet. You can think of Backpack Wallet as a self-custody key management system. We currently support chains like Solana, Ethereum, Base, Eclipse, Arbitrum, Optimism, Polygon, and we hope to support every chain, similar to wallets like MetaMask. However, there is indeed a very important issue that needs to be addressed in the wallet space. If you open Solflare (a wallet for Solana) today, they will tell you a shocking statistic: every year, $2.4 billion in funds are lost because people lose access to their crypto wallets, at least that was the case last year. Although I forgot the exact statistic, this is a huge failure for the entire industry. This number even exceeds the losses of all centralized exchanges combined each year.

Self-custody is a solution. If we don't have self-custody, then you can question many of the things we are doing. This is also another important part of our product, focusing on how to solve these self-custody issues so that I can confidently tell my parents or relatives and friends that you can use cryptocurrency without risk. You don't have to worry about self-custody, you don't have to worry about losing keys, and you don't have to worry about how to use passwords. This is one of the most important problems that need to be solved today. So this is where we start.

ChainCatcher: Platforms like Pump.fun and Moonshot are very popular, and GMGN is well-liked by everyone. How do you view the current competitive trend between centralized exchanges (CEX) and decentralized exchanges (DEX)?

Armani: The very important point I mentioned earlier applies here as well: **this is not a competition between decentralized exchanges and centralized exchanges, but rather a competition between *censorship resistance* and compliance.** Depending on which path you choose, you will get very different products and characteristics.

One lesson we learned during this cycle is that **there is nothing that decentralized exchanges are better at than *issuing* long-tail assets.** Pump.fun may seem absurd, but it is precisely an example that cannot be built in the same way on centralized exchanges. And this is where decentralized exchanges truly excel over centralized exchanges. As for other aspects of the product, margin trading, futures, spot margin, stocks, U.S. Treasury bonds, and fiat on-ramps are the strengths of centralized exchanges. There are subtle reasons behind each aspect; after all, it all comes down to compliance and direct connections with banks. If you want on-ramps, only regulated exchanges can do it best. So, this is the advantage of centralized exchanges, and they will continue to play a role in deeply regulated products. For example, the U.S. stock market is perhaps the best example, and this is where the appeal of centralized exchanges lies. But look at examples like Robinhood; if they were to tokenize stocks, they would have the ability to do it better than anyone else. This is the advantage of centralized exchanges.

When it comes to margin trading, it is not just about custody. When you engage in margin trading, you do not have the concept of self-custody. Whether it is futures or spot margin trading, or options, you do not own your assets. The system owns your assets, and the clearinghouse owns your assets. So it all comes down to the rules of the system, especially risk management. Therefore, when it comes to margin trading, the boundaries are very blurred. There are indeed pros and cons to examples of margin trading. For instance, if you have decentralized risk management and transparent risk management, projects like Aave do very well. But if you are talking about high leverage and highly volatile assets, that is usually a domain for a select few, which is the limitation of decentralization. This issue is almost irrelevant in both CEX and DEX. The question is, who is making these decisions? Who is funding the brand? Who is doing the risk modeling? That is the very important question.

ChainCatcher: What is the biggest challenge you face when building on-chain systems and self-custody wallets?

Armani: These two worlds will continue to merge. So we are very intentionally combining centralized exchanges and decentralized exchanges in one application. If you have an exchange, you can build the best wallet; if you have a wallet, you can build the best exchange. There are many synergies between the two.

For a simple example, you can completely solve the asset recovery problem. Do you remember the shocking statistic I mentioned earlier—money lost due to self-custody every year? If you apply modern technology, such as account abstraction, you might solve all the user experience issues currently present in self-custody. Therefore, I believe these two will continue to merge. I think the key is to leverage each other's strengths; they are not a zero-sum game.

Focus and Dedication: A Workaholic on a Two-Point Line

ChainCatcher: How do you allocate your time? What does a typical day look like for you?

Armani: My time is mainly spent on two major categories, and there might be a third. One is recruitment and company building, the other is product—you must have a great product and innovate in this area, and I proudly say we have achieved that. The third category is coordinating between compliance, product, and engineering so that we can truly solve all problems and build a market with high trust and integrity. So far, we have basically climbed these "mountains."

The next "mountain" we need to climb is how to push to market. Now everything boils down to liquidity. No matter how great your product is, no matter how many healthy regions you can serve, if there is no deep liquidity, then everything is meaningless. So this is the next "mountain" we need to climb.

So far, we have done very well, both in terms of product and in building a great spot and derivatives product, and even in compliance. One of our biggest advantages is our market trust. We can confidently say that we will be one of the most regulated exchanges in the market, and you can go to all major institutions, and they can trust what they are trading. This is why the U.S. capital markets are so special; they are the deepest, most liquid, and most regulated capital markets in the world, with trillions of dollars traded here because people trust it. Everyone knows it is real, not fake, and not manipulated. Bringing this maturity into the cryptocurrency market is also the "mountain" we need to climb next, and it will be our focus in the coming months.

ChainCatcher: I heard you are very busy, even going a whole week without time to shower, is that true?

Armani: Unfortunately, yes.

ChainCatcher: As a CEO of an exchange, do you think it is better to be an excellent trader or to be less familiar with trading?

Armani: You must understand your users. If you do not understand your users, you cannot build a great product. Your job is to build products that solve user problems. If you are not a user from the start, then you better become one. Not just as a trader. When you talk about futures, you are talking about traders; when you talk about mass market consumer finance, about an "all-in-one" application that covers all funds, you will talk about different market segments. Whether you are using on-chain applications, DeFi, wallets, DApps, etc., you need to know your user needs.

ChainCatcher: Do you trade yourself?

Armani: Yes and no. I do trade, but I view investing as a Buffett-like approach, holding your punch card, with 20 investment opportunities, punching a hole each time you invest. You only have 20 chances, and then you buy these assets and never sell them; that is your investment strategy for life. This is my approach to investing. I think everyone has different methods, but this is not financial advice. But this is how I view the market.

Advantages and Strategy: Tackling the Toughest Challenges First

ChainCatcher: What is Backpack's competitive advantage compared to other exchanges?

Armani: The opportunity we see is that very few exchanges can truly penetrate and bring cryptocurrency into the mainstream mass consumer finance market. The reason is that only a handful of exchanges are doing the hard work of integrating it into the social framework. This comes down to compliance. Going back to our previous discussion, look at some of the largest markets in the world, see who can operate in these markets and who cannot. And there is a huge gap and opportunity here to ultimately bring these products to these regions, which are the largest markets in the world.

This is also why we chose to take this difficult path. Although we could have built and launched the exchange a year ago, we did not. We took the time to solve problems and obtained licenses globally to build. Our company has only 16 engineers on one product, and everything is done by these 16 engineers, but we have about 90 people in total, with the rest being compliance, legal, operations, and customer support staff, and not just one language, but all languages, meeting the requirements to build a trusted financial market where you can have the deepest liquidity because you have market integrity and regulatory oversight, allowing all participants, traditional regulatory market players, to enter the crypto market. This is the huge opportunity. What we need to do is build this correctly, help the industry mature, and bring the value that exists in traditional markets into the crypto market so that cryptocurrency is no longer some unregulated fringe thing but is integrated into the social framework. This is a huge opportunity that few people see.

ChainCatcher: Why is Backpack headquartered in Japan?

Armani: Japan is one of the largest markets in the world and also one of the most difficult markets to enter because it has very strict compliance requirements. You cannot just serve Japanese users; many companies have tried, but those companies have recently been kicked out of the app store. Therefore, we believe we have the capability and technology to solve these problems and do the right thing in a way that very few crypto-native exchanges can do. Japan is also a very livable place.

ChainCatcher: But it seems that the Japanese are not very enthusiastic about trading; the Japanese market may be more conservative.

Armani: Every place in the world has a different culture, but I think many people overlook that Japan was once a focal point for cryptocurrency. For example, Binance originally started in Tokyo. Due to many hacking incidents at exchanges, regulations became very strict, forcing many people to exit. But now, Japan is filled with radical policies, attitudes, and spirit regarding cryptocurrency, which is very exciting. Recently, we saw that Japan's cryptocurrency tax rate will drop from 55% to 20% or 25%. This is a huge change that will bring a lot of capital inflow into Japan's crypto market. So, I believe the tide is changing in Japan, and the future opportunities are here.

ChainCatcher: Do you have any upgrade data you would like to share with us? For example, trading volume, user numbers, or financial data.

Armani: When we started the exchange, we did 60 billion in trading volume. We call it pre-season because the exchange was not fully built at that time; we only offered spot trading for Solana, Bitcoin, and Ethereum. At that time, especially in the Chinese-speaking market, everyone was excited to see a new exchange after the FTX incident. Since then, we have done a lot of work and are finally ready to start from several major markets and connect to the global largest capital market liquidity. The real opportunity is that cryptocurrency is a globally internet-native capital market, not just in China, but also in Japan, the U.S., Europe, and Africa, everywhere. That is the essence of cryptocurrency; it is borderless.

March is when we truly begin. Now we have a complete beta testing program, we have launched the new yield futures product, the margin system is also online, and all compliance infrastructure is in place. In the past two and a half weeks, just in the beta testing phase, we have completed about $2.4 billion in trading volume, and with the trading season approaching, we expect activity to grow significantly.

ChainCatcher: What is the decision-making process for Backpack to list meme coins?

Armani: There are several questions to ask myself. The most fundamental question is: Do users want this? Users are never wrong. So there are many key performance indicators (KPIs) to refer to, but from a qualitative perspective, is there really a demand from users?

Next, there is a more important question, which is the integrity of the market. This question is much more difficult to solve: Is this market safe? Is it not only exciting but also decentralized enough that it won't become a market manipulated by insiders? I think this is a huge criticism that meme coins currently face.

This is true on centralized exchanges and also on decentralized exchanges. So this is one of the most important things. Will this market become an information-asymmetric market where some parties can harm others? One huge benefit of centralized exchanges is that we act as a filter, which can be both good and bad. I think many people are dissatisfied with centralized exchanges right now because they feel there is a lot of value extraction happening, whether everyone is fighting for the next listing opportunity, wanting to go live on the first day and list as quickly as possible, without really knowing or caring what the project is about; they only see their competitors doing the same thing. So they also want to go live as soon as possible. Typically, market charts look like this: they go up first and then down. This is a very fair criticism and also a point we want to rebut.

Everyone is caught in this prisoner's dilemma, looking at their competitors and asking themselves, will they list? If they do, do I have the option not to list? I take pride in our judgment to always do the right thing, but these are also the thoughts that every exchange is grappling with. This is the dilemma behind it.

ChainCatcher: Last year, Backpack just completed its Series A funding. What was the funding from the last round mainly used for?

Armani: The last round of funding was mainly used to build the team, hire personnel, and ensure that we could obtain the necessary licenses globally and ultimately enter the market. This includes engineers, compliance personnel, customer support, operations, legal, etc. Building an exchange is a massive undertaking, unlike traditional tech companies, which only need to hire a bunch of very smart engineers and product people to get started. Our team members have very diverse skill backgrounds from different countries; we are an international team.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。