The self-developed inference large model has been long awaited but has not yet been released.

Author: Ma Shuye, Letter List

Image source: Generated by Wujie AI

Binding DeepSeek, Tencent's Yuanbao, which has emerged later, is putting greater pressure on ByteDance.

Ten days after integrating DeepSeek, starting from February 22, Tencent's AI application "Tencent Yuanbao" surpassed ByteDance's AI application Doubao, jumping to the second place in the free app download rankings in the Apple App Store in China, and has maintained this position ever since.

Caption: Tencent Yuanbao's download volume surpasses ByteDance's Doubao

Image source: Screenshot from Letter List

"Since the beginning of the year, I've heard that product managers in Tencent's C-end business are all transitioning to AI product managers, but I didn't expect Tencent to act so quickly," said Chen Ming (pseudonym), an employee from a large model business group at ByteDance, to Letter List (ID: wujicaijing). After returning from the holiday, while the team was working overtime to develop the inference large model, no one expected Tencent, which has always been laid-back, to take such drastic action this time.

However, compared to the huge discussions triggered by DeepSeek R1 within ByteDance, Tencent's T1 inference large model seems to be "not impressive enough." In casual conversations in the break room, Tencent's presence was not frequently mentioned; they firmly believe that, "If a domestic inference large model emerges that catches up to or even surpasses DeepSeek R1, it will definitely be ByteDance."

And ByteDance's goal is to "surpass."

Relevant sources revealed to Letter List that ByteDance's self-developed inference large model is expected to be launched by the end of March. Meanwhile, Doubao, which has already drained traffic from Douyin last year, has decided to pause its advertising on platforms like Bilibili.

In response, Letter List sought confirmation from ByteDance, which did not confirm the specific release time for the self-developed inference large model but pointed out that Doubao has not drained traffic from Douyin.

On the other hand, Tencent's entire suite of applications is gradually integrating DeepSeek. The usually restrained WeChat has frequently promoted Tencent Yuanbao. Ads for Yuanbao have appeared in WeChat Moments, Bilibili's splash page, and even on the main page of Tencent Meeting.

"The best DeepSeek experience under Tencent is in Tencent Yuanbao," has now become the new slogan for Tencent's large model C-end business. According to DataEye data, before February 15, the amount of advertising materials for Doubao and Kimi exceeded that of Tencent Yuanbao by 2-3 times. Subsequently, from February 18 to 23, Yuanbao's advertising material volume increased by 345.1% compared to the previous period. Tencent has taken over from ByteDance and is racing towards becoming the next tech giant to spend heavily on advertising.

ByteDance is also being pushed into a corner by Tencent, which is rapidly embracing DeepSeek. Before DeepSeek's explosive rise, Doubao was undoubtedly the star product in the C-end application space over the past year, but now, the emerging Yuanbao is stealing some of Doubao's former glory.

If previously being surpassed by DeepSeek could be seen as an unexpected event for ByteDance, now that Tencent has once again surpassed Doubao by leveraging DeepSeek, the narrative of competition in large models has officially escalated to a contest of applications between tech giants. Since the mobile internet era, Tencent and ByteDance, both of which have gained prominence through their products, have repeatedly clashed at the application level.

It is easy to imagine that the news of Tencent Yuanbao surpassing Doubao will continue to amplify the shock and impact within ByteDance.

The rise of DeepSeek has awakened Zhang Yiming and ByteDance from the victorious dream of Doubao over the past year. Now, with Liang Wenfeng's support, Ma Huateng has completely cornered Zhang Yiming, and ByteDance may have reached a point where it must take action.

1

In the face of Tencent Yuanbao's attack, the most direct and effective counterattack for ByteDance is to quickly launch a new self-developed inference large model.

"Tencent Yuanbao iterated five versions in a week, moving from a laid-back approach to a rapid pace. Tencent is not only aiming to capture the traffic overflow from WeChat AI search but is also betting that ByteDance won't be able to produce a new inference large model in a short time." A leading algorithm engineer from an internet company told Letter List that Tencent has undoubtedly targeted the gap before ByteDance's self-developed inference large model is launched. At this time, pouring money into promoting Yuanbao and aggressively pushing its own T1 inference large model is all about timing.

From the results, Tencent's timing strategy has achieved some effect.

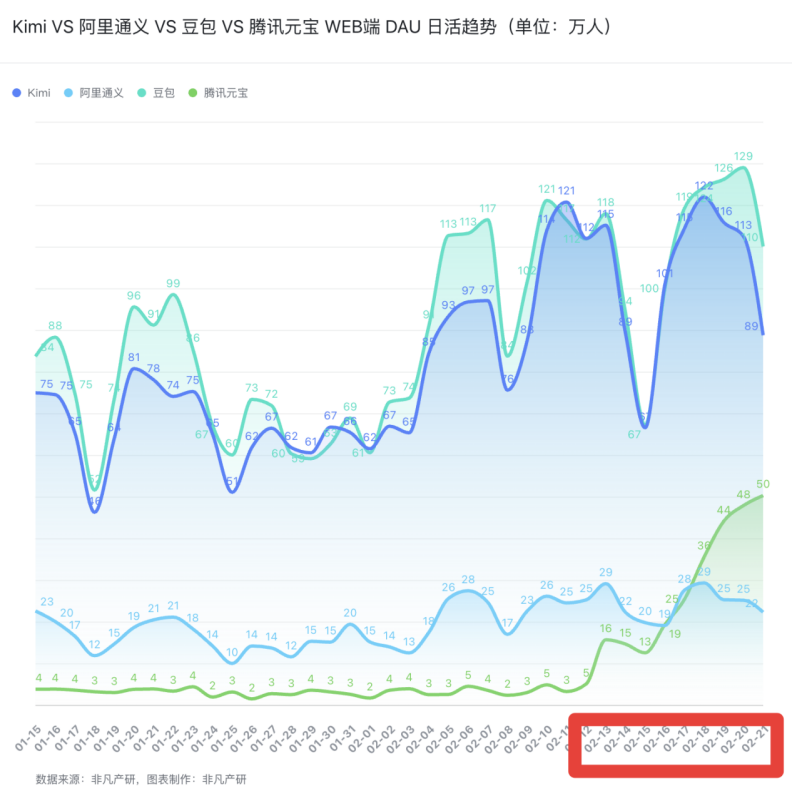

According to data from Feifan Research, from the announcement of integrating DeepSeek on February 13 to February 21, the daily active users on the web for Tencent Yuanbao continued to rise, reaching 500,000 on February 21. In less than ten days, the daily active users of Tencent Yuanbao reached nearly half of ByteDance's Doubao's average daily active users. It successfully surpassed Doubao in the Apple free app download rankings, rising to second place.

Caption: Doubao VS Tencent Yuanbao web daily active user trend

Image source: Feifan Research

With Tencent's T1 inference large model already in the internal testing phase, and Tencent Yuanbao quickly attracting traffic through its integration with DeepSeek, Baidu has also announced that it will launch a new large model in the next 4-5 months, while Alibaba has officially announced that it will invest over 380 billion yuan in the next three years to achieve its AGI dream.

The tech giants have initiated a new arms race, and now only ByteDance has not announced any new plans.

"Since returning to work after the Spring Festival, we have been working overtime to develop the self-developed inference large model." Chen Ming stated that the ByteDance office building located in Beijing's Dazhongsi, which houses the Douyin business team and the Volcano Engine business team, is still brightly lit even after 10 PM on weekends.

As for the appearance of ByteDance's self-developed inference large model, one clear requirement given internally is to align with or even surpass DeepSeek R1.

Recently, the Doubao large model team at ByteDance has also taken timely action.

According to reports, the core department Seed, which focuses on cutting-edge research within ByteDance, is rapidly adjusting its positioning and has just brought in the talented Wu Yonghui, who participated in the development of Gemini at Google. Wu Yonghui will become the new technical head of Seed, while the former head Zhu Wenjia will oversee the application side. In addition to adjusting business divisions, ByteDance has also proposed a new sparse model architecture called UltraMem.

According to public data, the latest architecture proposed by the Doubao team improves inference speed by 2-6 times compared to the MoE architecture, and inference costs can be reduced by up to 83%. Faster and cheaper, ByteDance seems to be targeting DeepSeek's comfort zone.

However, although launching a new self-developed inference large model as quickly as possible, like Musk, is ByteDance's best response strategy, besides relying on technological innovation for traffic, ByteDance has another path to catch up with Yuanbao, which is to continue spending heavily on advertising.

Previously, Doubao relied on exclusive advertising on Douyin and has been in the market for nearly half a year. ByteDance successfully made Doubao a leading domestic AI app with 70 million monthly active users through cost-agnostic investments.

However, whether such high-intensity advertising can be sustained until 2025 is undoubtedly questionable.

After all, while advertising yields quick results, it also burns money. According to AppGrowing data, in the second half of last year, Kimi, which had the most extravagant advertising, spent over 500 million yuan in total, with over 200 million yuan spent in October alone. Doubao was the closest competitor, spending over 400 million yuan during the same period. Even for a financially robust company like ByteDance, it faces the dilemma of hitting a growth bottleneck and increasingly expensive advertising.

Reports indicate that the advertising expert "The Dark Side of the Moon" has recently decided to significantly cut Kimi's product advertising budget. Whether to continue spending recklessly on advertising or to adjust the advertising policy is a new dilemma that ByteDance must confront.

2

Compared to Tencent's glory after being empowered by DeepSeek, ByteDance's past achievements have now transformed into shackles tied to the integration of DeepSeek—the more ByteDance valued Doubao before, the more difficult it is to integrate DeepSeek now.

As Tencent's entire suite of applications gradually integrates DeepSeek, ByteDance seems to prefer embracing DeepSeek in its B-end businesses.

Recently, ByteDance's Volcano Engine announced a major giveaway of R1 API, encouraging users to invite more friends to register and offering vouchers worth up to 145 yuan, which can be used to offset 36.25 million tokens for the DeepSeek R1 model API.

However, despite ByteDance's willingness to spend money on attracting new users in the B-end, there has been no news of its flagship C-end products, whether Douyin or Doubao, integrating DeepSeek.

Unlike Tencent, which has previously been quite laid-back in AI large model development and has never promoted a C-end app in its own WeChat traffic pool, ByteDance's all-in approach to AI is quite aggressive; in other words, ByteDance's burden is too heavy.

Previously, in order to seize the initiative in the large model race, ByteDance was both poaching talent and heavily promoting Doubao.

Take Wu Yonghui, who has recently been reported to join ByteDance's core AI department Seed, as an example. Although the details of the poaching deal have not been disclosed, given his position, "the annual salary is definitely over ten million, with a significant portion likely in stock." said Xing Ze, founder of the headhunting company Jiaming.

At the same time, to support Doubao, ByteDance has almost turned Douyin into an exclusive traffic source for Doubao.

On March 18 last year, Douyin's giant advertising announced restrictions on AIGC software advertising, stating that from April 2 to the end of the year, no non-ByteDance products could use Douyin and Toutiao's vast traffic pool. Since August last year, although Doubao's advertising scale is smaller than that of Kimi, Zhipu, and Xingye, it has quickly become a leading application with nearly 600 million average monthly downloads and 70 million monthly active users.

In the e-commerce sector, Douyin can still earn money while serving its own interests, but to allow Doubao to catch up, ByteDance has become the first platform to restrict advertising for other similar products.

With such a large investment, it has become increasingly difficult for ByteDance, this giant, to turn around.

As both tech giants, Baidu, which also insists on self-development and rarely invests in other large model companies, has begun to integrate DeepSeek into its C-end main applications. ByteDance's insistence on not integrating DeepSeek is now facing growing scrutiny from the outside world, while more pressure is also mounting on ByteDance and Zhang Yiming.

3

However, it is important to note that this AGI battle is far from over; a temporary lead does not determine the outcome, and both Tencent and ByteDance have their own opportunities and challenges.

Although Tencent has shown a momentum to catch up in the competition for C-end users by binding DeepSeek, it is worth noting that ByteDance still holds a certain leading advantage in the layout of multimodal technology.

As Tencent's first AI product to integrate the DeepSeek R1 model, Yuanbao offers features including AI search, intelligent document processing, AI music recommendations, AI map navigation, and intelligent assistant functions.

However, compared to this, ByteDance has been deeply engaged in the field of text-to-video for a year, not only launching Jimeng AI to compete with Kuaishou's Keling but also recently introducing VideoWorld (an open-source video large model), which can perform tasks without relying on any reinforcement learning search or reward function mechanisms, achieving a professional 5-dan level in 9x9 Go.

Moreover, ByteDance has already established a strong presence in the B-end market with Jianying, giving it a time advantage over the later entrants like DeepSeek and Tencent.

At the same time, according to a Bloomberg report on February 21, considering the potential of Doubao, SoftBank Group's Vision Fund has raised ByteDance's valuation to over $400 billion by December 2024. The valuation has increased from $300 billion last year to $400 billion this year. Despite facing challenges from newcomers like DeepSeek, the external outlook on ByteDance's profit potential in the AI era remains optimistic.

For DeepSeek, maintaining a leading level of technology requires continuous iteration, and the difficulty of research and development will undoubtedly grow exponentially. Whether future new models can continue to provide stunning experiences like R1 is still full of uncertainties.

For Tencent, which is already laying out multimodal large models, in order to truly retain the traffic overflow from DeepSeek, it also needs to accelerate its own research and development progress to catch up with ByteDance and match DeepSeek in model performance.

The war around the cognitive revolution in AI has yet to see a definitive winner, but it is destined to redefine the next decade for tech giants. For the 800 million daily active users of Douyin, what they are about to witness may be the most intense paradigm shift in history.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。