The rise of cryptocurrency is not just a technological wave, but a profound rebellion against the "legitimate violence" of monetary plunder.

Written by: Daii

This weekend, the North Korean hacker group—Lazarus Group—made headlines again. This time, they pulled off a major heist, stealing nearly $1.5 billion worth of Ethereum from the Bybit exchange. This is the largest theft in cryptocurrency history, significantly impacting the market, with ETH's price dropping from around 2850 and nearly falling below 2600.

The principle behind this North Korean hacker attack is not complicated; it still relies on social engineering to trick relevant personnel into executing malicious programs. At the end of last year, I provided a detailed analysis of this deception process in "Is a Cold Wallet Really Cold? How a Veteran Journalist Was Scammed Out of $400,000," which includes many tips for ordinary users to avoid scams. I recommend you take a look when you have time.

In fact, I think there is something even more worth your attention. That is Nigeria's claim against Binance for $81.5 billion, which includes $2 billion in taxes and $79.5 billion in compensation.

Because, theft by hackers is a crime, and there is nothing more to say; everyone should work together to catch the bad guys and minimize losses. However, the rights and wrongs of Nigeria's claim for $79.5 billion are not so clear-cut.

Have you noticed that both cases share a common point: the shadow of a nation looms behind them. Cryptocurrency is becoming a new battlefield for national competition, and the involvement of state power makes this process more complex and challenging.

So, what exactly did Binance do to warrant such a large compensation to Nigeria?

What Binance did was simply provide a P2P platform for the people of Nigeria to purchase cryptocurrency with fiat currency, allowing them to exchange Naira (NGN) for Bitcoin or stablecoins when their currency depreciated.

Of course, I don't have much goodwill towards Binance either. They have engaged in activities like pinning and targeted explosions.

The reason I am speaking up for Binance today is that one of the core values of centralized exchanges in blockchain is to provide a safe and convenient channel for converting fiat currency to cryptocurrency.

If Nigeria succeeds this time, many more rogue nations will follow suit. In the future, there may not even be any theft; it could turn into outright robbery. At that time, rogue nations secretly capturing executives of centralized exchanges across borders will become a business, and the entire blockchain ecosystem will suffer. This is not alarmism; it is a fact that has already occurred. All of this stems from the fact that, at present, the state is the only entity that can possess legitimate violence.

Now, let's first understand what exactly happened between Nigeria and Binance.

1. Did Binance Cause the Depreciation of the Naira?

On February 19, 2025, the Federal Inland Revenue Service (FIRS) of Nigeria filed a lawsuit against Binance, the world's largest cryptocurrency exchange, demanding $79.5 billion in economic compensation and $2 billion in taxes, claiming that Binance's "illegal operations" led to a 70% depreciation of the Naira and triggered severe inflation.

Nigeria's accusations seem "logically clear": the trading volume of Naira on the Binance platform is massive, with users exchanging their local currency for crypto dollars (like USDT) or Bitcoin through its P2P market, leading to a surge in foreign exchange demand and the collapse of the Naira's exchange rate. In 2023, Nigeria's central bank stated that $26 billion illegally flowed out through Binance, while the country's inflation rate soared to 33.88% in 2024.

But the truth behind the data is more complex.

Binance is indeed a "accomplice" in a technical sense: its platform provides the public with a convenient tool to bypass foreign exchange controls. In the context of Naira depreciation and dollar shortages, cryptocurrency has become a new "safe-haven asset"—previously, people relied on underground money changers to exchange for dollars, but now it can be done with just a mobile phone. In March 2024, Binance was forced to shut down Naira trading services, but by then, the Naira had already fallen to a historical low of 1605 NGN to 1 USD.

First, we should rule out that Binance is the "culprit" behind the Naira's plunge.

After Binance left, the exchange rate briefly rose to 1100 NGN to 1 USD in mid-April 2024 (see the above chart). However, you will notice that the exchange rate then fell back to near its historical low, currently around 1500 NGN to 1 USD.

So, without Binance, the Naira's exchange rate would still have plummeted this badly. As for the reasons, I will explain in detail later. But at least for now, it is clear that Binance is not the "real culprit."

So, who is behind this currency crisis?

2. Who is the Real Culprit of the Currency Crisis?

The real culprit is Nigeria itself, with three main issues:

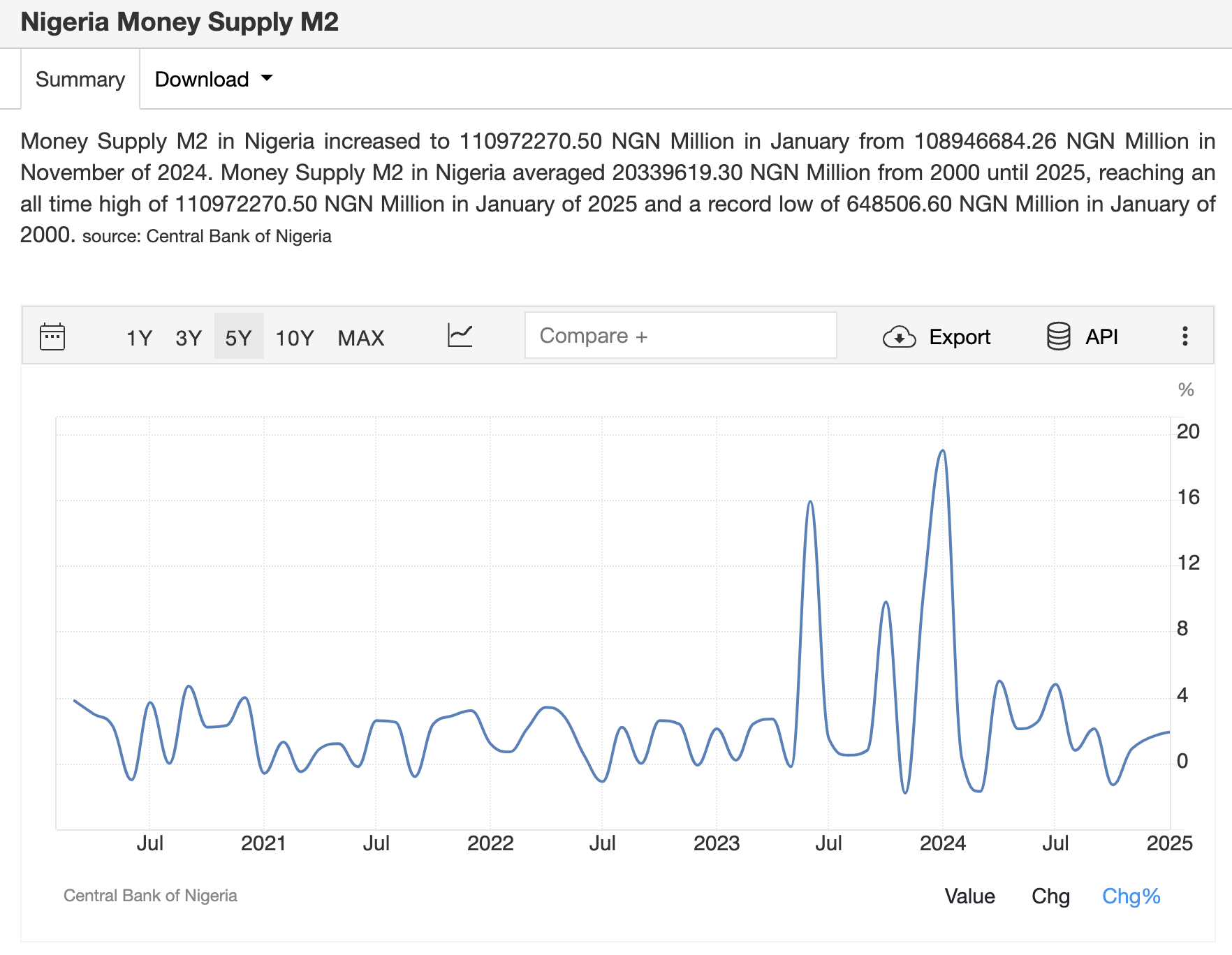

M2 money supply surge: Since 2019, Nigeria's M2 has grown by over 17%, far exceeding GDP growth, directly pushing up inflation.

Reliance on oil and foreign exchange shortages: 80% of the country's foreign exchange income relies on oil exports, but unstable production capacity has led to depleted dollar reserves and rising prices for imported food.

Policy mistakes: In 2023, President Tinubu relaxed foreign exchange controls in an attempt to attract foreign investment, which led to a free-fall decline in the Naira's exchange rate.

Please note: The depreciation of the Naira and inflation in Nigeria occurred simultaneously and mutually reinforced each other, creating a strong positive feedback loop.

What is positive feedback?

A simple example is when you point a microphone at a speaker and shout; you will then hear a screeching sound. This is the simplest form of positive feedback in reality.

Specifically, in Nigeria's case, the positive feedback process between currency depreciation and inflation is as follows.

As the Naira depreciates, the prices of imported goods soar, leading to a significant increase in domestic price levels, while high prices further exacerbate the cost of living for the public, thereby intensifying inflation.

To prevent the Naira they hold from depreciating, the public rushes to exchange their Naira for cryptocurrencies (Bitcoin or stablecoins) through P2P platforms like Binance, further driving down the value of the Naira.

According to data from Nigeria's National Bureau of Statistics, in 2023, the relationship between the Naira's depreciation and inflation was particularly close. For example, Nigeria's annual inflation rate reached 32.85% in 2023, while food prices rose by over 40%.

However, the good news is that since 2025, Nigeria's inflation rate has been declining from a peak of 34.8% to around 24% (see the above chart).

But you should know that a 24% inflation rate is still a relatively high level. If Nigeria cannot effectively resolve this issue, it may become another Venezuela.

By comparing Nigeria's economic plight with that of Venezuela, you will find many astonishing similarities.

Since 2010, Venezuela has experienced severe currency depreciation and hyperinflation, ultimately leading to the near-total loss of purchasing power of its currency, the Bolívar.

According to data from the International Monetary Fund (IMF), Venezuela's inflation rate in 2023 still exceeds 3000%. Soaring prices have plunged the public into poverty, and currency depreciation has forced many to exchange Bolívars for foreign currencies, especially dollars and Bitcoin. In fact, cryptocurrency has a very high circulation rate in Venezuela, becoming the only way for many to hedge against inflation risks. In 2023, Venezuela's cryptocurrency trading volume ranked among the top globally, especially on P2P trading platforms, where the public uses Bitcoin and stablecoins for daily transactions.

If Nigeria cannot effectively address its fundamental issues of currency depreciation and high inflation, like Venezuela, the Naira may also head down the path of "Bolívarization," becoming a currency with no real purchasing power, completely unable to support the daily lives of its people.

Ultimately, the people will choose to abandon their national currency, the Naira, and turn to cryptocurrency. However, in those days without cryptocurrency, do you know how the national currency acted with impunity?

3. How Does the State Plunder the People Through Currency?

In a word, backed by legitimate violence, they act recklessly.

On the Pacific island of Yap, primitive tribes used two-meter-diameter limestone discs as currency. These several-ton "stone money" do not need to be moved; ownership records are simply changed during transactions—this may be the earliest form of blockchain. When Spanish colonizers carved crosses on the stone money with explosives, they inadvertently illustrated the most ironic fable in the history of currency: the authority of money always comes from the backing of violence.

From the debt certificates recorded on clay tablets by the Sumerians to the bronze shell money of the Shang and Zhou dynasties, humanity has spent five thousand years transforming money from a measure of value into a tool of domination. After the collapse of the Bretton Woods system in 1971, the dollar was decoupled from gold, and the world officially entered the "fiat currency carnival era."

3.1 Inflation: The Wealth Transfer Technique of Boiling Frogs

The scene of housewives in the Weimar Republic pushing wheelbarrows full of cash to buy bread has evolved into a more covert form of plunder in modern society. According to IMF data, the global average inflation rate in 2023 is 6.9%, and behind this seemingly mild number is a continuous 51-year-long escape of purchasing power under the dollar system—$1 in January 1971 is equivalent to only 0.02 grams of gold today, a reduction of 98%.

- Inflation is essentially a phenomenon where the money supply exceeds the demand for economic growth, leading to a decline in the purchasing power of money. When the government or central bank overissues currency, the newly printed money does not increase the total wealth of society; it merely dilutes the value of the existing currency. The process of wealth transfer is covert and slow:

- Over-issuance of currency: The government or central bank increases the money supply through quantitative easing, monetization of fiscal deficits, and other means.

- Price increases: Excess money chases limited goods and services, leading to widespread price increases. Initially, price increases may start in certain areas and gradually spread to various sectors.

- Decline in purchasing power: As prices rise, the amount of goods and services that people can purchase with the money they hold decreases, leading to a decline in purchasing power. Fixed-income earners (such as retirees and low-income groups) are hit hardest, as their income growth often lags behind inflation.

- Wealth transfer: Inflation effectively transfers wealth from currency holders (especially savers) to debtors (such as governments and indebted enterprises) and those who receive the newly issued currency first. The government can use inflation to alleviate its debt burden, while those who can obtain new currency more quickly (for example, businesses and financial institutions closely related to the government) can take advantage of the initial period of inflation when prices have not fully risen to purchase assets or goods at lower prices, thus profiting.

3.2 Three Paths of Wealth Robbery

The state, as the designer and controller of the modern monetary system, acts like a skilled alchemist, capable of transforming seemingly intangible currency into tangible social wealth, while quietly completing the "plunder" of national wealth in the process. This plunder is not overt but is carried out in the name of "legitimacy," with sophisticated methods and far-reaching effects that deserve in-depth analysis. Next, we will focus on how the state quietly completes the "plunder" of people's wealth through three main monetary means.

1. Seigniorage: The Most Elegant Robbery

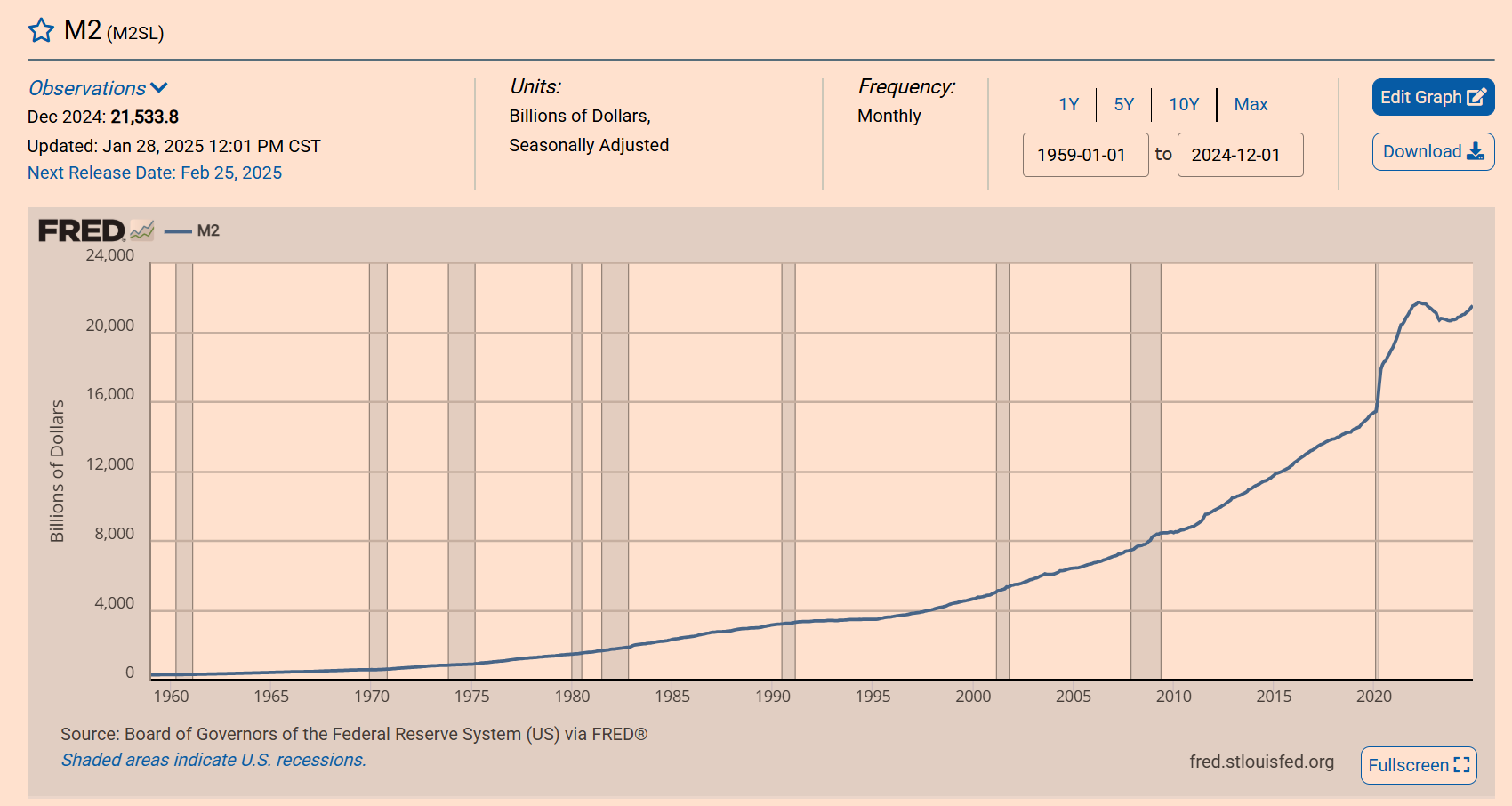

When the Federal Reserve creates $1 trillion out of thin air to purchase government bonds, it effectively imposes a hidden tax of 4.8% on global dollar holders (based on the 2024 U.S. M2 money supply of $20.8 trillion). When Sri Lanka's foreign exchange reserves were depleted in 2022, the government directly froze citizens' dollar accounts, and the forced exchange rate difference reached 40%—this is the most blatant form of monetary plunder.

Seigniorage originally referred to the revenue generated by the government from issuing currency. In the gold standard era, it referred to the difference between the face value of currency and the cost of minting it. In the modern fiat currency system, the concept of seigniorage has been expanded to refer to the government's actions of increasing the money supply through currency issuance, thereby diluting the value of existing currency and transferring social wealth. Its mechanism is similar to inflation but focuses more on the government's role as the currency issuer:

Government issues currency: The central bank acts as the agent of the government, issuing new currency. In the modern electronic currency system, issuing currency is more of an accounting operation rather than the actual printing of banknotes.

Purchasing assets or covering fiscal deficits: The government uses newly issued currency to purchase government bonds, foreign exchange, and other assets, or directly to cover fiscal deficits and stimulate the economy.

Inflation effect: The increase in the money supply ultimately reduces the purchasing power of existing currency through inflation.

Wealth transfer: The essence of seigniorage remains wealth transfer, moving wealth from all currency holders to the government. The government gains income through currency issuance, while the purchasing power of the public's money is diluted. Compared to traditional taxation, seigniorage is more covert and less noticeable, hence it is also referred to as "the most elegant robbery."

2. Capital Controls: The Cage Drawn by the Golden Rod

From the end of 2023 to the beginning of 2024, the Argentine government tightened capital controls further in response to the ongoing economic crisis and hyperinflation. Individuals were strictly limited to purchasing $200 per month through official channels. The harsh regulatory policies directly led to rampant black markets, with the black market exchange rate for the "blue dollar" (dólar blue) soaring, at one point exceeding the official rate by over 100% at the end of 2023. This "golden rod" of capital controls ultimately trapped not only capital but also the economic freedom of the people.

Capital controls refer to government measures that restrict the cross-border flow of funds, commonly including restrictions on foreign exchange transactions, limits on capital outflows, and forced currency exchanges. While capital controls may be viewed by the government as necessary measures to stabilize the economy and prevent capital flight during specific periods, they often distort the market and result in wealth transfer in the long run:

Artificially creating exchange rate differences: Capital controls artificially sever the official exchange rate from the market rate, leading to a situation where the official rate is suppressed while the black market rate reflects the true supply and demand relationship. This exchange rate difference is the core mechanism of wealth transfer.

Forced or de facto forced currency exchange: The government may compel exporting companies to sell their foreign exchange earnings to the central bank at the official rate or use other means to indirectly enforce currency exchange. Due to the undervaluation of the official rate, the actual income of exporting companies shrinks, transferring wealth to the government.

Rent-seeking space and corruption: Capital controls create significant rent-seeking opportunities. Individuals and companies that can obtain foreign exchange at the official rate or can circumvent capital controls to transfer funds abroad often reap substantial benefits. This rent-seeking behavior can easily breed corruption, leading to the concentration of social wealth in the hands of a privileged few.

Shrinking wealth for the public: For ordinary citizens, capital controls limit their freedom to hold foreign currency and invest overseas. In the context of currency depreciation, their savings face the risk of shrinking. At the same time, due to high black market rates, if citizens need to purchase foreign exchange (for example, for studying abroad, traveling, or buying imported goods), they must pay a higher cost, resulting in a form of wealth plunder.

3. Debt Monetization: The Contract of Selling Off Future Generations

Japan's national debt has reached 217.4% of GDP, equivalent to each newborn being burdened with $73,000 in debt. The U.S. government pays $2.38 billion in interest on national debt every day, and these figures will ultimately be passed on to taxpayers through inflation. As cryptocurrency begins to consume the pool of buyers for government bonds, the proportion of U.S. debt held overseas dropped to a historic low of 30% in 2023.

Debt monetization refers to the government's direct or indirect conversion of a portion of national debt into currency, usually achieved through the central bank purchasing government bonds. In extreme cases, the government may directly instruct the central bank to print money to buy government bonds to cover fiscal deficits. While debt monetization may alleviate the government's fiscal pressure in the short term, it poses serious risks in the long run:

Expansion of government fiscal deficits: Debt monetization can lead to fiscal dependency, with the government overly relying on printing money to cover deficits rather than adopting responsible fiscal policies to control spending and increase revenue.

Erosion of central bank independence: Direct government intervention in currency issuance undermines the independence of the central bank, turning it into the government's "money printer," unable to effectively control inflation.

Risk of hyperinflation: Long-term, large-scale debt monetization inevitably leads to uncontrolled money supply, triggering hyperinflation. Historically, countries like the Weimar Republic and Zimbabwe have experienced hyperinflation due to excessive debt monetization, resulting in the collapse of their monetary systems and chaos in social and economic order.

Wealth plunder: Hyperinflation is the most brutal form of plunder of social wealth. All savings and asset values denominated in local currency will significantly shrink, leading to a redistribution of social wealth, alleviating the government's debt burden while causing massive losses to the wealth of the public. Debt monetization effectively shifts current fiscal risks onto future society, using future inflation to pay for today's debt.

From the "elegance" of seigniorage to the "cage" of capital controls, and then to the "contract of selling off" through debt monetization, the state's methods of plundering the wealth of the people are indeed "varied and hard to guard against." These "legitimate" plunders often disguise themselves as measures to maintain economic stability, respond to crises, and stimulate growth, while in reality, they quietly transfer social wealth and erode the economic freedom of the public.

3.3 The Cost of Wealth Robbery

The state's plunder of people's wealth through monetary means has impacts that extend beyond the economic realm, permeating social, political, and cultural dimensions, resulting in profound and negative effects:

Social Level:

Widening wealth gap: Monetary plunder often makes the rich richer and the poor poorer, exacerbating social inequality. The privileged class and vested interest groups are more likely to profit from monetary plunder, while ordinary citizens, especially vulnerable groups, become the primary victims.

Intensified social injustice: Covert forms of monetary plunder, such as inflation, are often difficult to detect, but the wealth transfer they cause is real, which can exacerbate feelings of social unfairness and lead to social conflicts and tensions.

Erosion of social trust: When the public realizes that the government is plundering wealth through monetary means, trust in the government, central bank, and the entire socio-economic system may waver or even completely collapse, leading to a decline in social cohesion.

Political Level:

Decline in government credibility: Regardless of how "legitimate" monetary plunder may seem, it is essentially an infringement on the wealth of the public. Long-term reliance on such means will inevitably lead to a decline in credibility and questions about the legitimacy of governance.

Authoritarian tendencies: To maintain control and cover up the truth of monetary plunder, the government may strengthen information control, suppress dissent, and even move towards authoritarianism.

Risk of political turmoil: Long-term economic hardship and social injustice may ultimately trigger political turmoil and social change. Historically, hyperinflation has often been a significant catalyst for social unrest and regime change.

Cultural Level:

Distorted values: When society widely recognizes that honest labor cannot lead to wealth, while speculation and dependence on power can yield profits, societal values become distorted, and the traditional virtue of hard work leading to prosperity is continuously eroded.

Prevalence of cynicism: Faced with the unstoppable monetary plunder, the public may develop feelings of powerlessness and despair, turning to cynicism and becoming indifferent to social and political issues, even mocking all that is noble and idealistic.

Crisis of national identity: Long-term economic difficulties and social injustice may lead to a decline in national identity, the disintegration of national cohesion, and even trigger social division and national disintegration.

It is evident that in the process of plundering the wealth of the people through monetary means, there exists a sharp contradiction between the state's monetary sovereignty and the people's property rights. At this point, the state's violence comes into play.

4. State Violence Endorsing Monetary Plunder

"When the guns fire, gold is worth a lot."

The essence of state violence is to maintain order and serve as the ultimate arbiter of wealth. When the state's "legitimate" plunder through currency faces challenges, state violence often steps forward without hesitation to safeguard monetary plunder.

The Nigerian government has done just that.

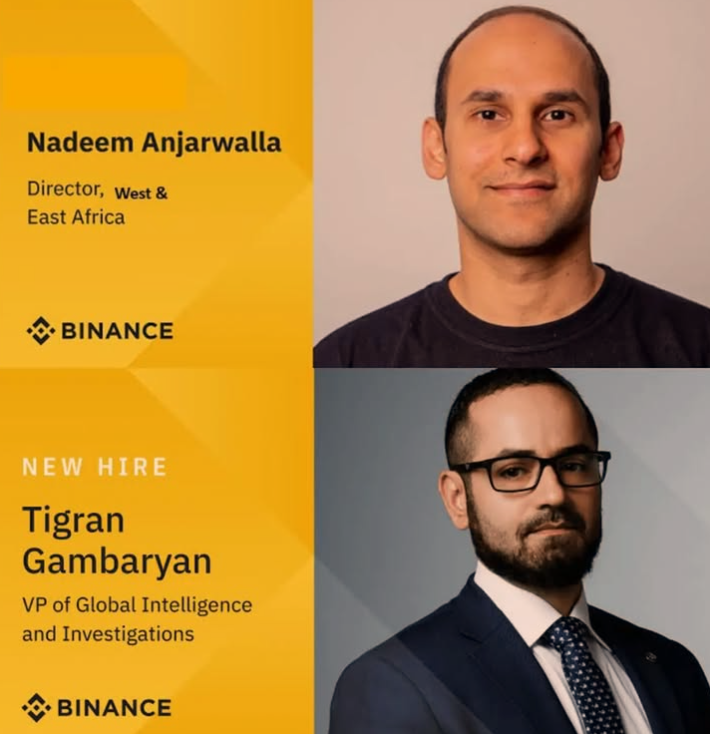

Previously, two Binance executives—American citizen Tigran Gambaryan and British citizen Nadeem Anjarwalla—were invited by the Nigerian government to negotiate issues related to cryptocurrency trading. However, what awaited them was not a negotiation table but a carefully woven trap by Nigeria. The government detained the two executives for a long time on charges of "illegal operations" and "causing the depreciation of the Naira."

While Nadeem Anjarwalla managed to escape, Tigran Gambaryan was held by Nigerian authorities for nearly seven months, during which he contracted malaria, and the prison's medical conditions were virtually non-existent, putting his life and health in jeopardy. Ultimately, the U.S. government had to intervene, applying significant diplomatic pressure to force Nigeria to release him.

The machinery of state violence endorsing monetary plunder is not unique to Nigeria; it is a universal phenomenon throughout the history of currency. To maintain the dominance of the fiat currency system and safeguard the state's monopoly over currency, governments around the world have not hesitated to employ the machinery of state violence.

Historically, there is the "nationalization" of gold in the United States.

In 1933, in response to the Great Depression and the crisis of the gold standard, President Roosevelt signed Executive Order 6102, compelling American citizens to surrender their gold holdings to the government at a very low price under the threat of "treason." Those who refused faced severe penalties and hefty fines. Through this, the U.S. government "legally" confiscated the gold wealth of the public, clearing the way for the government to overissue currency and implement Keynesian policies. Roosevelt's administration utilized the machinery of state violence to enforce monetary policy, laying the foundation for the future dominance of the dollar.

Recently, Venezuela's "Bolívar push."

Venezuela has long been trapped in hyperinflation, with its currency, the Bolívar, nearly collapsing. In the face of the public's spontaneous use of foreign currencies like the dollar for self-preservation—a trend known as "dollarization"—the Venezuelan government not only failed to reflect on its monetary policy mistakes but instead intensified its use of state violence to enforce "Bolívar sovereignty," suppressing the circulation of foreign currencies.

The Venezuelan government deployed the military and police to crack down on "illegal foreign exchange trading" nationwide, arresting individuals and merchants exchanging dollars on the streets and confiscating "illegally" held dollars. Furthermore, the government forced businesses and merchants to accept Bolívar payments, refusing to accept dollars and other foreign currencies, imposing heavy fines on those who did not comply, and even revoking business licenses. The Venezuelan government used state violence not to rebuild a healthy monetary system but to maintain its control over the already discredited Bolívar, continuing to plunder the wealth of its citizens through hyperinflation and forced currency exchanges.

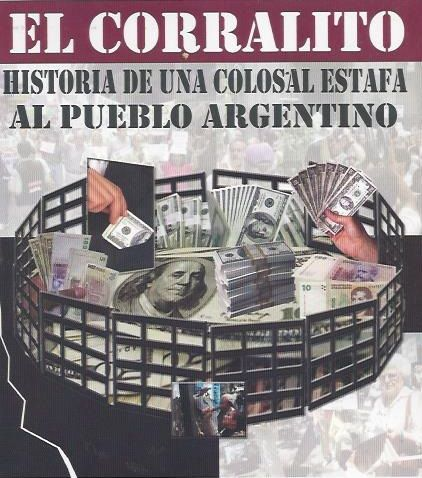

Even bloodier was Argentina's "Corralito."

In 2001, Argentina experienced a severe financial crisis. To prevent bank runs and capital flight, the government implemented the "Corralito" policy, forcibly freezing bank accounts and restricting citizens' withdrawals. This policy directly deprived the public of their savings freedom, locking their wealth "legally" in banks, allowing the government to exploit it at will.

The "Corralito" policy sparked outrage in Argentine society. Angry citizens took to the streets, banging pots and pans, demanding the government lift the "Corralito" and return their deposits.

However, the Argentine government not only refused to respond to the public's demands but also deployed police and security forces to violently suppress the protests. In December 2001, Argentina declared a state of emergency, leading to violent clashes between military police and protesters, resulting in dozens of deaths and hundreds of injuries.

Clearly, each instance of state violence serves as a reminder of an undeniable fact: the property rights of the people are vulnerable in the face of state monetary sovereignty.

However, the story does not end here. Beneath the iron curtain of state violence endorsing monetary plunder, a ray of hope is penetrating the darkness: the rise of cryptocurrency.

5. Cryptocurrency: The Era of Regaining Control Over Wealth

The rise of cryptocurrency is like a "Sword of Damocles" hanging over the heads of government monetary powers, threatening those who arbitrarily manipulate fiat currencies. It is not merely a payment tool but a profound challenge to the global monetary system, providing people worldwide with an unprecedented weapon to regain control over their wealth and freedom.

You may ask, can mere digital currency really contend with the immense power of government?

The answer is affirmative—cryptocurrency can not only resist centralized financial systems but is inherently designed to become a key tool against state violence.

5.1 The Power of Decentralization: Restructuring Wealth Control

The birth of Bitcoin profoundly questioned the global financial order.

In 2008, amid the global financial crisis, Satoshi Nakamoto created Bitcoin. This new form of currency no longer relies on central banks or any government institutions for issuance and regulation; its supply is fixed, transaction records are immutable, and all transactions are verified and confirmed by decentralized nodes worldwide.

The decentralized nature of Bitcoin makes it a powerful weapon against government monetary violence. Especially in countries where corruption, excessive money printing, or financial oppression have severely plundered the wealth of the people, cryptocurrency provides a safe haven. For example, in 2018, after the Argentine government implemented cash control policies, citizens turned to Bitcoin and other cryptocurrencies to bypass government monetary interventions. According to Blockchain.com, Bitcoin trading volume in Argentina surged over 200% during the cash control period.

This decentralized attribute also makes cryptocurrency an effective hedge against global inflation risks. In March 2020, global central banks implemented massive monetary easing due to the pandemic, leading to the depreciation of fiat currencies. Meanwhile, Bitcoin's returns skyrocketed; data shows that since the outbreak of the pandemic, Bitcoin's total return rate has approached 400%, while gold only reached 30%, and the stock market experienced significant volatility, failing to preserve value effectively. Cryptocurrency has become the preferred choice for many asset holders seeking to preserve value.

5.2 Transparency and Immutability: The Defense Against Wealth Plunder

In addition to decentralization, the transparency and immutability of blockchain make cryptocurrency another powerful tool against financial violence. Every transaction recorded on the blockchain is permanently unchangeable, meaning that all flows of funds will be subject to public scrutiny, eliminating the opportunity for the state to conduct invisible plunder through manipulation of monetary policy.

For instance, Venezuela's hyperinflation and the devaluation of the Bolívar have led many citizens to choose the dollar as an alternative. However, the government has taken coercive measures, forcing merchants and citizens to use only Bolívar and severely cracking down on dollar transactions. Yet, these measures have not stopped an increasing number of citizens from turning to cryptocurrency, especially during economic hardships. Statistics show that Bitcoin trading volume in Venezuela surged over 100% in 2018, while the monopoly and corruption of the traditional financial system remain unresolved. Through cryptocurrency, Venezuelans successfully bypassed the government's control over traditional currency.

Cryptocurrency provides a reliable financial freedom channel, allowing Venezuelans to protect their wealth and allocate assets across borders without state intervention, offering them a way to escape the domestic currency crisis.

5.3 Data and Facts: The Global Momentum of Cryptocurrency's Rise

Since the birth of Bitcoin, the market size of cryptocurrency has shown exponential growth. According to CoinGecko, the global cryptocurrency market value has risen from less than $100 billion in 2017 to $3.29 trillion today, an increase of over 30 times. This growth is not only driven by speculative investors but, more importantly, by the increasing trust of the public in cryptocurrency amid global economic crises, fiat currency depreciation, and financial oppression.

Particularly in countries that have experienced monetary violence, such as Argentina, Venezuela, and Turkey, the market demand for cryptocurrency has surged. In 2018, the significant increase in Bitcoin trading volume in Venezuela indicated a loss of trust in fiat currency, leading citizens to turn to cryptocurrency as a means of wealth preservation. Similarly, during the depreciation of the Turkish lira in 2020, Bitcoin became a safe-haven asset, with trading volume rising sharply.

These data strongly indicate that cryptocurrency is becoming a new choice for global wealth management, especially in the face of state violence and currency depreciation pressures.

5.4 The Future of Cryptocurrency: A New Dawn for the Global Financial System

Cryptocurrency is not just a tool against violent monetary policies; it is also a carrier of a new wealth management philosophy. In a decentralized, transparent, and immutable system, individuals can fully control their wealth without worrying about government infringement and plunder. As more citizens in various countries become aware of this, the application scenarios for cryptocurrency will become increasingly widespread, making it an important component of the future global financial system.

The irony of history is that when governments alienate the power of currency issuance into a tool of exploitation, the people will ultimately use technology to rebuild the original intent of currency—not as a tool of power but as a measure of value. In this emerging era, wealth is no longer a subordinate of the state machinery but a private property of every individual.

A global financial revolution has quietly begun, driven by cryptocurrency. Those state violence machines that once recklessly plundered wealth are now facing an undeniable opponent—decentralized cryptocurrency. Bitcoin provides them with an effective means to maintain wealth value and conduct cross-border transactions against the backdrop of government-imposed exchange rate declines. If you are a beginner looking to protect your wealth through Bitcoin, here are two beginner-friendly tutorials: one on how to buy Bitcoin and another on how to send Bitcoin to a cold wallet, which should be sufficient for you.

Summary: Cryptocurrency is a Challenge and Transformation Against State Monetary Violence

The rise of cryptocurrency is not only a technological innovation but also a profound reflection and challenge to the traditional financial violence system. It empowers individuals to regain control over their wealth and provides new mechanisms and pathways for wealth transfer on a global scale. As Satoshi Nakamoto said, "We no longer need to trust central banks; we can trust algorithms."

Not all crows are black. One country has recognized the dangers of the abuse of monetary sovereignty and has actively embraced Bitcoin.

6. El Salvador's Active Embrace of Bitcoin

El Salvador's active embrace of Bitcoin is not only to address currency depreciation and inflation but also to establish a brand-new financial system, freeing itself from the constraints of traditional monetary policies.

On September 7, 2021, El Salvador became the first country in the world to legalize Bitcoin. The government announced that Bitcoin would be recognized as legal tender alongside the U.S. dollar, a decision that sparked widespread attention and controversy in the global financial community.

El Salvador's President Nayib Bukele believes that the traditional monetary system can no longer meet the needs of the country's economic development, especially for the impoverished population without bank accounts. Bitcoin offers a new form of financial freedom. Through Bitcoin, Salvadorans can bypass high banking fees and directly participate in the global financial system.

According to data from the El Salvador government, by 2023, over 2 million citizens in El Salvador were using Bitcoin wallets (Chivo wallets), accounting for about 30% of the total population. Additionally, stores and businesses in El Salvador have begun accepting Bitcoin as a payment method, benefiting the tourism industry by attracting numerous Bitcoin enthusiasts and investors to visit, spend, and invest. El Salvador also plans to raise funds for national infrastructure development through the issuance of Bitcoin bonds (Volcano Bonds), part of which will be invested in Bitcoin mining to further promote economic growth.

Although this reform has brought short-term market volatility and some degree of international criticism, El Salvador's Bitcoin experiment has become an important testing ground for the development of blockchain and cryptocurrency globally. In many developing countries, the demand for Bitcoin as an alternative currency is increasing, and El Salvador has undoubtedly become a pioneer of this trend.

However, El Salvador's Bitcoin experiment is not without challenges. Due to the high volatility of Bitcoin prices, the government must manage market risks. For example, the sharp decline in Bitcoin prices at the end of 2021 led to significant losses in El Salvador's Bitcoin reserves.

In February 2025, the El Salvador Congress passed a new policy that removed the mandatory requirement for merchants to accept Bitcoin payments, and taxes were limited to payments in U.S. dollars. However, El Salvador did not abandon Bitcoin's status as legal tender but adjusted related policies to alleviate external pressure.

Interestingly, in such a crypto-friendly country, the demand for cryptocurrency is not very strong. A survey showed that only 7.5% of respondents indicated they used cryptocurrency for transactions, while 92% had never used it. Nevertheless, El Salvador still plans to build new capital markets around Bitcoin and prepare to launch more regulatory support policies.

Clearly, El Salvador is an outlier, a country that actively relinquishes monetary sovereignty to embrace Bitcoin. However, whether this top-down reform will ultimately succeed remains uncertain. Nonetheless, the government's decision to return the right to choose which currency to use back to the people is a significant advancement.

So, why aren't more countries following suit? For example, in Nigeria, why has the issue of currency depreciation not been resolved even after driving Binance away?

7. Binance Left, Why Does the Exchange Rate Continue to Fall?

The reason is simple: although Binance is the largest exchange, it is not the only one.

For many Nigerians, Binance is just a bridge to the world of cryptocurrency, and there are many other bridges to cross. As long as there is demand for cryptocurrency, any bridge can be taken.

And indeed, after Binance left Nigeria, the Naira's exchange rate briefly rebounded to 1100 NGN to 1 USD in April 2024, but soon fell back to the historical low of 1500 NGN.

Currently, there are 217 exchanges similar to Binance around the world. Many of these platforms also offer P2P trading, helping people bypass foreign exchange controls to convert Naira into USD stablecoins or Bitcoin. The existence of these exchanges not only quickly filled the gap left by Binance's departure from Nigeria but also formed a vast global cryptocurrency circulation network.

With the rapid development of the global cryptocurrency ecosystem, competition among major exchanges has become increasingly fierce. The differences between platforms mainly lie in user experience and transaction fees, but for people urgently needing to avoid currency depreciation, the substitutability of platforms is almost unquestionable.

Binance has undoubtedly become the scapegoat for Nigeria's currency crisis. Killing the scapegoat does not solve Nigeria's problems, which remain unresolved and will not be resolved. As for how to address the issue of currency depreciation, that is the responsibility of the Nigerian government, not something for outsiders to worry about.

What we need to be concerned about is how to remain vigilant against state violence becoming an accomplice in the decentralized financial revolution initiated by Bitcoin.

Conclusion

In the shadow of state violence, monetary sovereignty has been a tool for governments to exploit at will, a legal facade for wealth plunder. The game between Nigeria and Binance is merely the tip of the iceberg in this power struggle.

As the foundations of the traditional financial order begin to loosen, the rise of cryptocurrency is not just a technological wave but a profound rebellion against "legitimate violence" in monetary plunder. It heralds the arrival of a new era: the wave of digitization is deconstructing the old order, the definition of wealth will be rewritten, and individuals will reclaim economic sovereignty within a decentralized network.

In the future, the boundaries between the state and individuals will be redrawn, and cryptocurrency may become a key force in reshaping these boundaries, ultimately pointing towards a more balanced and vibrant new landscape for the global economy.

However, before this new landscape is realized, we must remain highly vigilant, examining the power logic behind each technological advancement, so that we can find our true "freedom channel" amidst the complex economic and political storms.

Because, throughout history, currency has never been merely a tool for exchange; it has always been a symbol of power.

With the rise of blockchain, the function of currency as a measure of value is being rediscovered. Perhaps this is also the beginning of our redefinition of "wealth" and "freedom."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。