On February 25, 2025, the cryptocurrency market recently experienced a rare shock, falling below $90,000. Since February 21, the total market capitalization has shrunk by over $32.5 billion, with $10 billion evaporating in just one hour this afternoon at 5 PM. This sell-off was not accompanied by significant headline news, raising concerns within the industry about a liquidity crisis and potential trend reversal. Experts analyze that the current market turmoil may stem from a combination of technical weakness, event shocks, and a global decline in risk appetite.

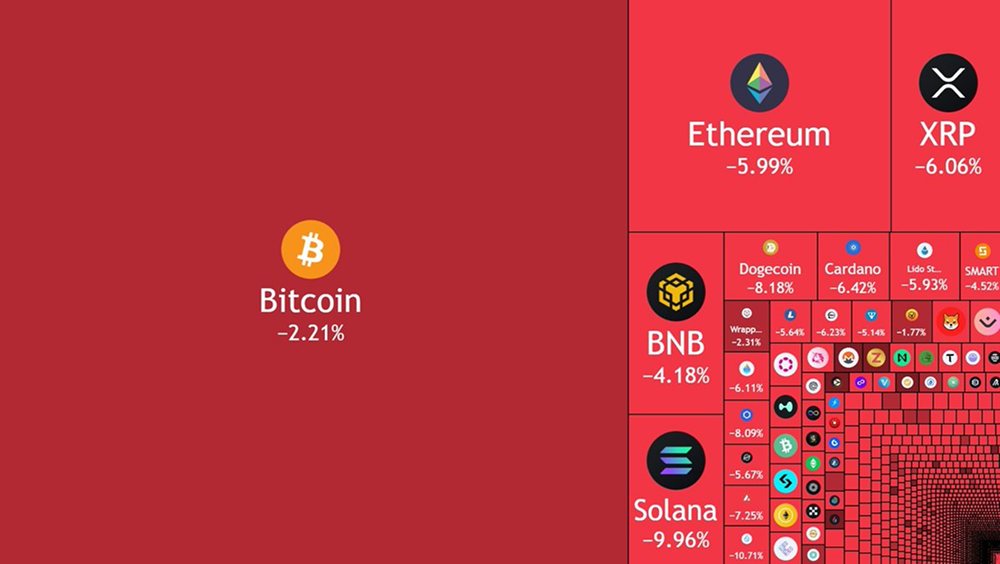

Sell-off Spreads: From Solana to Bitcoin

According to financial analysis firm "The Kobeissi Letter," this round of decline began with Solana, which dropped 22% since last Friday. As the meme coin craze faded, Solana was the first to falter, subsequently affecting the broader market. The decline of the S&P 500 index last Friday further dragged down Bitcoin, causing it to fall below the critical support level of $98,000, accelerating the sell-off across the network. In the past 24 hours, approximately $150 billion in funds were liquidated, with cryptocurrency assets generally suffering significant losses, and even the meme coin market was not spared.

Event Shocks and Eroding Confidence

Recent events have intensified market unease. On February 21, the Bybit exchange suffered the largest hacking attack in history, with losses exceeding twice that of the $611 million stolen from PolyNetwork in June 2021, termed by Arkham Intelligence as "the largest heist in financial history," severely undermining investor confidence. On the same day, asset management giant Citadel Securities (managing $65 billion) announced plans to provide liquidity for Bitcoin and cryptocurrencies, but the market interpreted this as a "sell the news" signal, failing to boost the market. The continued weakness of Ethereum further exacerbated the downward pressure. Meanwhile, Sam Bankman-Fried's high-profile return to the X platform added uncertainty to the market.

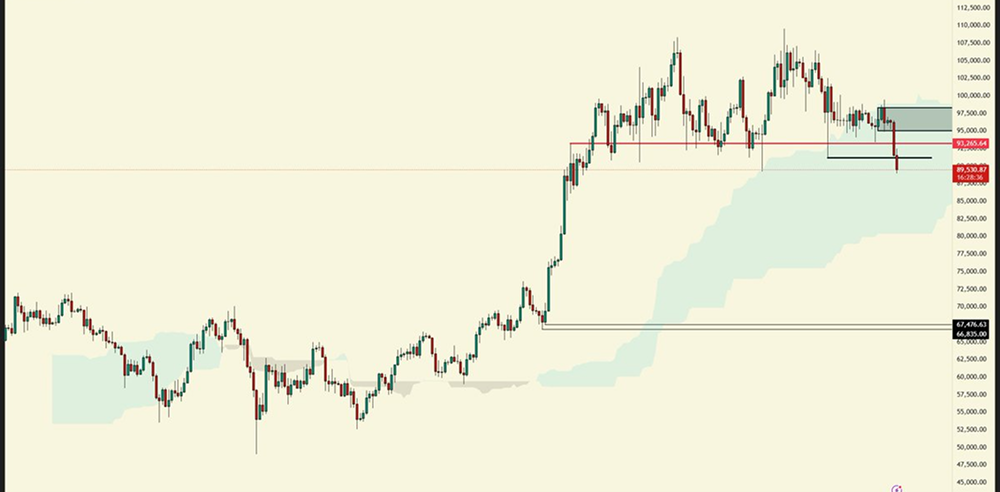

Dual Challenges of Technical and Macro Factors

From a technical perspective, Bitcoin's trajectory is concerning. Renowned crypto analyst Ansem pointed out that the current price has entered an acceptance phase following a "capitulation decline," with the high time frame trading range being breached. He views $96,500 as a watershed for the bearish trend; if this level cannot be reclaimed, the downside risk will significantly increase. Ansem also emphasized that this cycle has not yet shown a clear high time frame bear market breakout, and the current situation is merely a brief deviation from the lower boundary of the range, requiring further observation of the trend. He further warned that cryptocurrencies may be prematurely reflecting global risk-off sentiment; if stock indices break down in the coming weeks, this decline may not be a brief adjustment within an upward trend but rather the beginning of a longer downward cycle.

Liquidity Bottlenecks and Future Outlook

"The Kobeissi Letter" analyzes that the crypto market is highly dependent on liquidity, and the record risk appetite from 2024 to early 2025 is rapidly dissipating, leading to blocked capital flows. Although Bitcoin has historically experienced 10% pullbacks, technical adjustments are normal, this decline, compounded by stock market volatility, hacking incidents, and institutional dynamics, is far more complex than before. Ansem's judgment echoes this: if a downward trend in global stock markets is established, the crypto market may face systemic risks rather than just single asset volatility.

Industry insiders believe that this decline is not driven by a single factor but is the result of multiple pressures intertwining. In the coming weeks, the performance of global stock markets and the restoration of confidence in the crypto market will become key variables. The Kobeissi Letter stated that it will continue to track the developments and provide real-time analysis.

Disclaimer: The above content does not constitute investment advice.

AiCoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。