After nearly 90 days of turbulent consolidation, Bitcoin has once again fallen below the $91,000 mark, causing market sentiment to tighten sharply. The Fear and Greed Index has dropped to its lowest level since mid-September last year, shifting to extreme fear.

AiCoin (aicoin.com) data shows that in the past 24 hours, BTC has dropped over 5.4%, hitting a low of $90,912; ETH plummeted by 10%, falling below the $2,500 mark; and the total market capitalization of the entire cryptocurrency market has evaporated by 8.36%, shrinking to $3.032 trillion. Statistics indicate that this crash triggered over $500 million in liquidations, with long positions accounting for the majority of the losses, and the largest single long position liquidation amount reaching $10 million.

Hacker Storm: Bybit and Infini Suffer Huge Theft

Amidst the market turmoil, two major hacking incidents have once again drawn industry attention. On February 22, the cryptocurrency exchange Bybit was hacked, with hackers gaining control of its Ethereum cold wallet and stealing up to $1.46 billion in ETH. Although Bybit emphasized that other wallets remain secure and withdrawal operations are unaffected, such a large-scale theft has still raised market vigilance.

Two days later, prepaid card issuer Infini was also attacked by hackers, losing nearly $50 million. Infini claims to have obtained the attacker's IP and device information and threatened to take legal action while offering a 20% ransom to facilitate the return of funds. This kind of "hacker negotiation" approach has become increasingly common in recent years' security incidents in the cryptocurrency industry.

Global Regulatory Storm: OKX, Binance, and Coinbase Face Setbacks

Regulatory crackdowns have also had a significant impact on the industry. Recently, several leading exchanges have found themselves in trouble due to compliance issues.

First, OKX, whose operator Aux Cayes FinTech Co. Ltd was accused by the U.S. Department of Justice of operating an unlicensed remittance business in violation of anti-money laundering regulations. Ultimately, OKX agreed to pay over $500 million in fines to settle and acknowledged previous compliance gaps. Although OKX emphasized that the affected users only represent a small portion of its total user base, this incident undoubtedly impacted its brand image.

Meanwhile, Binance faced a massive lawsuit in Nigeria. The Nigerian government accused Binance of causing the depreciation of the country's fiat currency and demanded $81.5 billion in compensation. More dramatically, two Binance executives were briefly detained and faced charges of tax fraud and money laundering. Although the related lawsuit has been withdrawn, the operational environment for Binance in the country remains fraught with uncertainty.

Additionally, U.S. cryptocurrency exchange Coinbase has also been sued, accused of misleading investors, failing to adequately disclose bankruptcy risks, and violating securities laws. Furthermore, the company is actively lobbying the U.S. Congress, hoping for the CFTC (Commodity Futures Trading Commission) to take over the regulation of the spot cryptocurrency market to weaken the SEC's power.

Policy Uncertainty: Bitcoin Reserve Bill Rejected, Russia-Ukraine Conflict Escalates

In addition to market and regulatory uncertainties, the global political and economic situation has also had a significant impact on the cryptocurrency market. Recently, South Dakota in the U.S. vetoed a bill that would allow the state treasury to hold Bitcoin as a reserve asset, reflecting a cautious attitude towards cryptocurrencies within the mainstream financial system.

At the same time, the Russia-Ukraine situation has escalated again, leading to increased risk aversion in global markets. Reports indicate that Russian air defense forces destroyed 22 Ukrainian drones at night, while Ukraine is seeking support through economic agreements. The changing attitudes of countries like the U.S., France, and Russia in the conflict may influence global capital flows in the future.

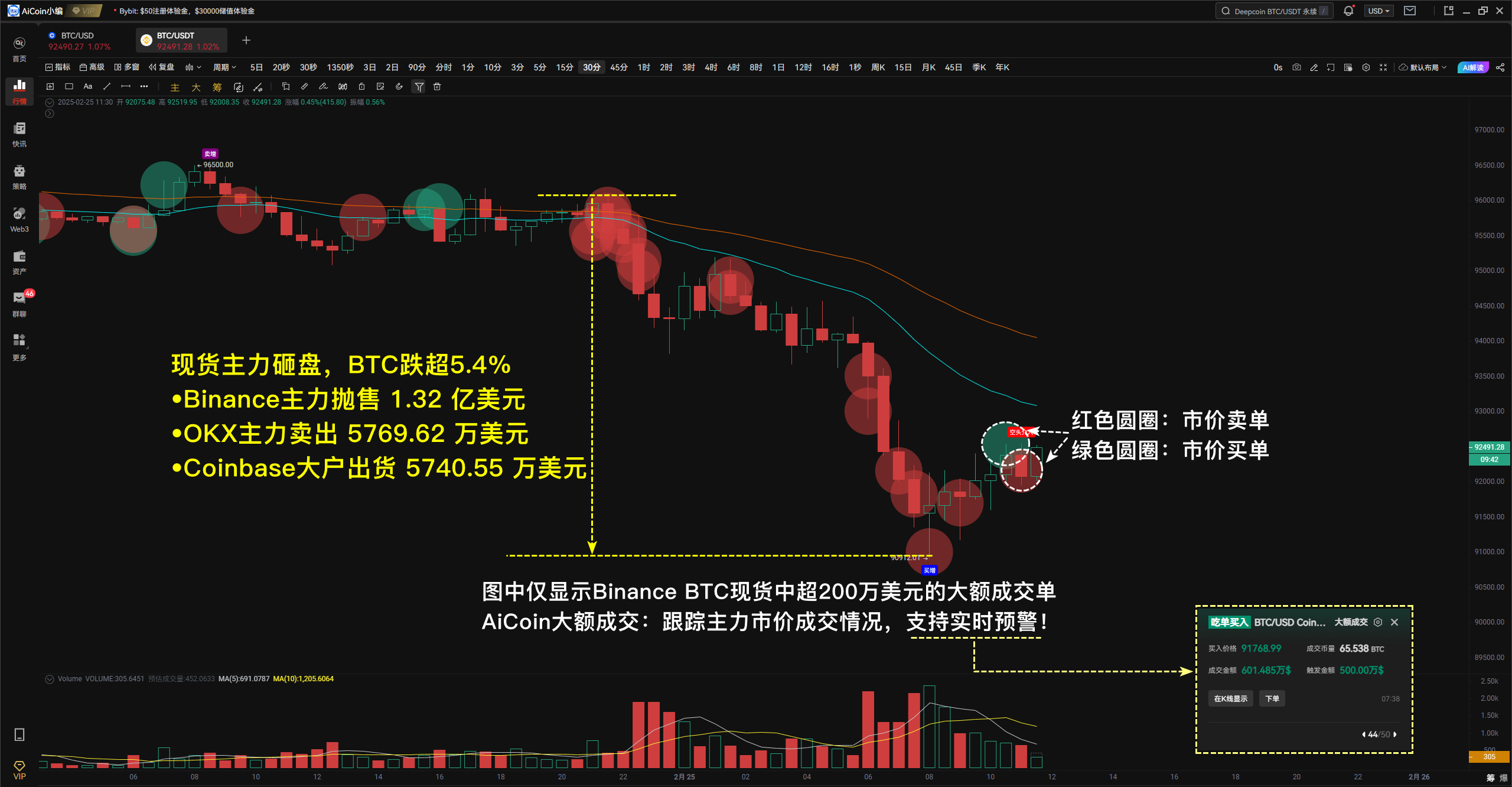

Hidden Hand: Major Players Dump Over $240 Million

According to AiCoin tracking, large-scale selling by major players is one of the main reasons for this significant BTC pullback. After 21:30 last night, large sell orders appeared on Binance, OKX, and Coinbase:

- Binance major sell-off of $132 million, average price $93,270.82

- OKX large holder sold $57.696 million, average price $93,232

- Coinbase major sell-off of $57.405 million, average price $92,900.23

Large Transactions: Real-time tracking of major market price situations, identifying major buying or selling behaviors, get it immediately: https://www.aicoin.com/vip

Moreover, the outflow of institutional funds is also exacerbating the market's pessimistic sentiment. Bitcoin spot ETF funds have seen a net outflow for five consecutive trading days, with an average daily outflow amount reaching $182 million. Coupled with rising inflation expectations in the U.S., market risk aversion has intensified, further dampening investors' interest in risk assets.

Trader Perspectives: Bears Dominate, Market May Continue to Test Bottoms

The market turbulence has also drawn the attention of several industry professionals. Bitfinex analysts pointed out that this wave of decline is not only due to the weakness of the cryptocurrency market itself but is also closely related to the global macroeconomic situation. Traditional markets are also under pressure, with the S&P 500 index down 2.3% over five days and the Nasdaq index down 4%. The correlation between Bitcoin and traditional markets is increasing, and the uncertainty in global financial markets is becoming a key factor hindering the cryptocurrency market from breaking the deadlock.

Arthur Hayes, co-founder of BitMEX, believes that many Bitcoin spot ETF holders are hedge funds that typically employ an arbitrage strategy of "going long on ETFs and shorting CME futures." As Bitcoin prices fall and the basis narrows, these funds may sell ETFs and cover shorts, further exacerbating downward pressure on the market. Hayes even predicts that Bitcoin could drop to $70,000.

On the other hand, trader Nebraskan Gooner stated that the weakness of altcoins usually signals further declines for Bitcoin. He believes that if BTC loses the support level of $95,500, the likelihood of falling below $90,000 will significantly increase.

However, not all analysts hold a pessimistic view. Bitcoin researcher Axel Adler Jr. believes that despite increased market volatility, long-term investors remain steadfast and have not engaged in panic selling. Additionally, the small buying behavior of institutional investors on Binance indicates that some funds are still looking to buy on dips.

Latest Dynamics Analysis: BTC Under Short-term Pressure, Risk of Correction Increases

After a turbulent morning, BTC saw some buying from major funds on Coinbase, with a market price purchase of $32.315 million, indicating a certain willingness to buy on dips. However, major funds on Binance continue to sell, with a cumulative sell-off of $64.5745 million since 08:00, and the overall market remains in a state of net fund outflow, limiting short-term rebound momentum and maintaining the risk of correction.

From a technical perspective, BTC is currently constrained by the EMA24 moving average, showing a typical "bearish engulfing" pattern within a 45-minute cycle, accompanied by increased trading volume, indicating that bears are in control. Meanwhile, the KDJ indicator has formed a death cross, and the MACD fast and slow lines are below the zero axis, reflecting weak market momentum and a lack of sustained support for bulls. In the short term, BTC faces further correction pressure, with a key support level to watch at $90,000. If this level is lost, the next critical support will be in the $88,000 range, and if that position cannot stabilize, it may further test the deep support in the $85,500 to $86,000 range.

The editor reminds: The current market is still in a high volatility state, and it is necessary to closely monitor fund flows and the performance of key technical levels; bottom fishing should be approached with caution.

The above content is for sharing only and for reference, not constituting any investment advice. If you have any questions, feel free to join the 【PRO CLUB】 group to discuss with the editor~

Please recognize AiCoin's only official website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。