Mint Blockchain, as a Layer 2 infrastructure focused on NFTs and RWAs, is driving industry development through efficient and low-cost solutions.

Written by: Deep Tide TechFlow

Introduction

The narrative in the crypto world is always dramatic—when the meme frenzy on Solana pauses, public data shows that funds are quietly returning to the ETH ecosystem.

But what else can be played with on Ethereum?

Of course, it cannot escape the two most crowded tracks: Layer 2 and NFTs. However, both seem to have fallen into the innovator's dilemma:

In the L2 battlefield, the performance arms race has reduced the TPS figures of ZK-Rollup and OP-Rollup to mere footnotes of "ineffective internal competition"; in the NFT field, the narrative of collecting PFP small images is gradually fading, with trading volume shrinking by more than 90% compared to the peak in 2021.

As the Ethereum ecosystem engages in repeated internal strife between "faster chains" and "more expensive JPGs," we observe that a project seems to be breaking this situation in the recent market.

Mint Blockchain, as the first NFT-specific L2 of the Optimism Superchain, does not engage in ineffective internal competition over TPS but chooses a more radical path: to make NFTs the "value routers" connecting the physical world and AI.

When AI begins to hold NFTs, what underlying protocols are needed for support? Besides trading small images, what use cases can unlock the non-financial attributes of NFTs?

These long-standing questions in the field are hidden in the white paper recently released by Mint Blockchain.

At the same time, Mint's official website has a series of marketing activities to build momentum for the $MINT token airdrop, and the white paper partially reveals the token's economics, which is also a part that most players are more concerned about.

Therefore, Deep Tide TechFlow seizes this opportunity to attempt an in-depth interpretation of Mint's white paper to answer the following questions:

Can this seemingly non-mainstream L2 really step out of the pure TPS worship and shift towards scenario-based service capabilities for NFTs?

Key Points

Project Positioning:

Mint Blockchain is an Ethereum-based L2 focused on supporting the entire lifecycle of NFTs, including creation, assetization, trading, cross-chain liquidity, and data analysis.

As a core member of the Optimism Superchain, Mint utilizes OP Stack technology to provide efficient, low-cost blockchain infrastructure, promoting the widespread application of NFTs in consumption, finance, social, and real-world asset (RWA) fields.

Value Points:

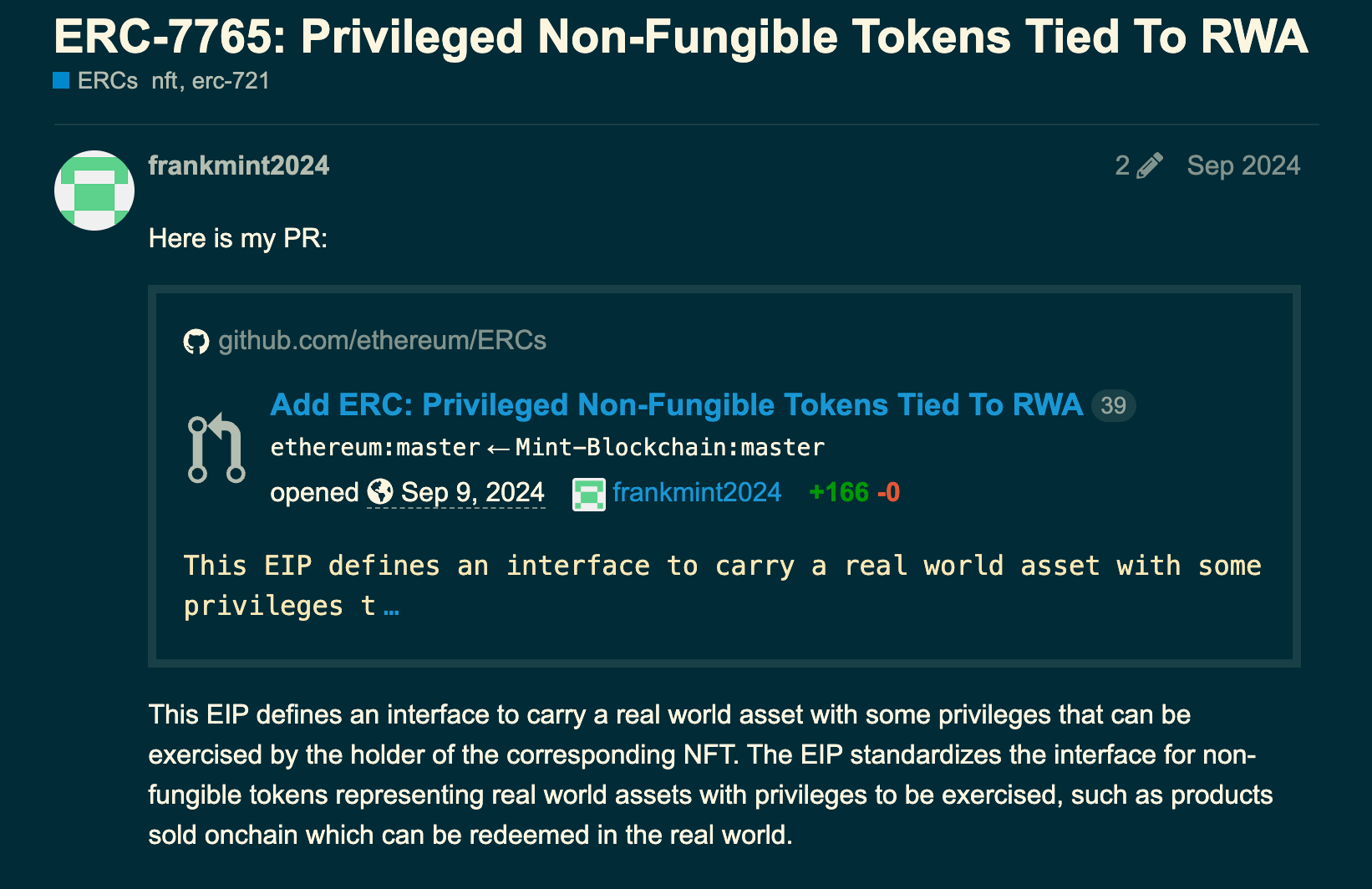

Innovative Protocol Standard: The ERC-7765 protocol achieves a seamless integration of NFTs and real-world assets for the first time, opening up a new track for RWA NFTs.

Cross-chain Liquidity Integration: Mint Liquid provides liquidity aggregation for multi-chain NFTs and tokens, building the world's largest NFT order routing network.

Multi-module Support: From Mint Studio's NFT creation tools to RareShop's RWA NFT marketplace, Mint offers full-stack NFT ecosystem support.

Efficient Economic Model: Through the $MINT Staking & Restaking mechanism, users can earn up to 15% annualized returns and share network income, enhancing capital efficiency.

Optimism Superchain Member: As an important part of the OP Superchain, Mint enjoys strong technical support and community resources.

Noteworthy Information:

$MINT Airdrop: In addition to participating in Mint Forest and Mint mainnet activities, MintID staking, etc., to receive $MINT airdrops, Mint has launched the NFT Legends Season event, allocating 1% of the total $MINT supply (10 million tokens) to NFT OG users, rewarding historical contributors.

Staking Rewards: $MINT holders can earn dual rewards through the Staking & Restaking mechanism, including 15% annualized returns and network income sharing.

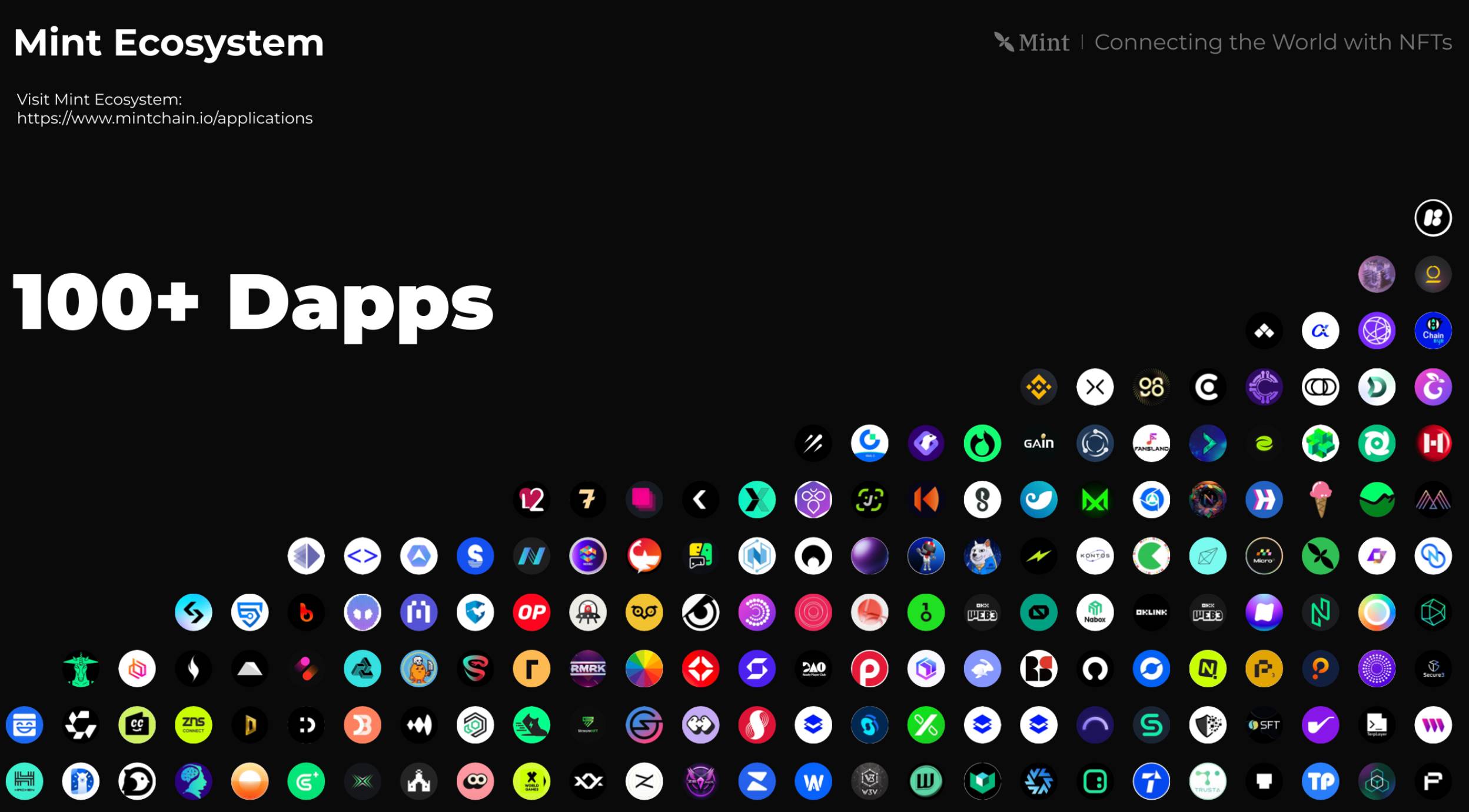

Early Ecosystem Dividends: As a rapidly growing Layer 2 network, Mint has attracted over 400,000 active users and 100 ecosystem applications, and joining the ecosystem provides an opportunity to enjoy early dividends.

RWA NFT Opportunities: RareShop offers innovative scenarios for the NFTization of real-world assets, allowing users to participate in the world's first RWA NFT marketplace through the Mint network.

Why does NFT need a dedicated Layer 2?

Today, when people talk about NFTs, they often only think of the frenzied scene of "trading small images" and the subsequent market crash.

As a result, discussing NFTs now may feel a bit out of place, but in reality, speculation does not mean the end of value.

Besides small images, NFTs can also be legitimately used for RWAs, becoming digital carriers of real assets; they can also be used for identity verification, copyright protection, game asset management, and other broader scenarios…

However, these potentials have yet to be fully explored, and one important reason may be that the current infrastructure does not provide dedicated support for NFTs.

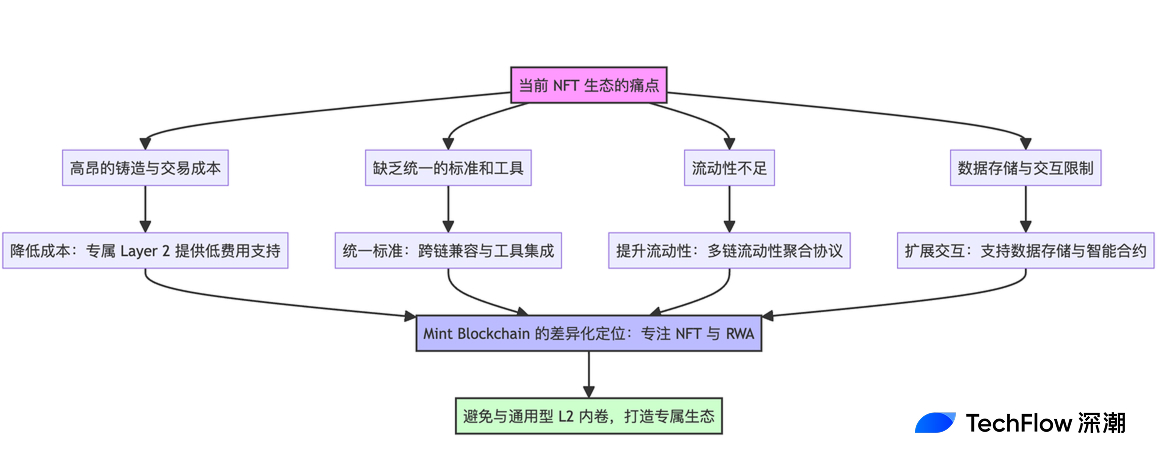

We have previously seen that NFTs face several issues:

High Minting and Trading Costs: The costs of minting and trading NFTs on the Ethereum mainnet remain high, especially for small creators and ordinary users, making it too costly to enter.

Lack of Unified Standards and Tools: The creation, management, and cross-chain circulation of NFTs remain complex, and developers and creators face compatibility issues across different chains.

Insufficient Liquidity: Although the NFT market continues to expand, its liquidity is far lower than that of the token market, making it difficult for many NFT assets to be traded quickly or realize value.

Data Storage and Interaction Limitations: The NFT ecosystem's demand for data storage and interaction is increasing, but existing infrastructure offers limited support in this area.

This creates a unique narrative direction and infrastructure gap for Mint Blockchain—to provide a dedicated Layer 2 solution for the NFT ecosystem.

Positioning is crucial, especially in the competitive L2 track.

From the positioning revealed in the white paper, Mint does not attempt to compete directly with general-purpose L2s but chooses to focus on the NFT and RWA fields, creating infrastructure tailored for these assets.

This differentiated positioning not only avoids the dilemma of ineffective performance competition but also provides NFT creators, developers, and users with new possibilities.

Mint Blockchain: L2 Infrastructure for the NFT World

The official information from the white paper indicates that Mint Blockchain is an Ethereum Layer 2 network jointly initiated by NFTScan Labs and the MintCore developer team, starting construction in October 2023, with the mainnet launched in May 2024, entering the ecological development phase.

In traditional Layer 2 networks, NFTs are often just "ancillary features" and do not receive dedicated technical support.

The goal of Mint Blockchain is to unleash the true potential of NFTs through specialized infrastructure, thus promoting their transformation from "speculative tools" to "value tools."

Furthermore, the technical architecture of Mint Blockchain is based on OP Stack, which naturally brings EVM compatibility; however, more functional points are specifically optimized for NFTs.

Focus on Full Lifecycle Support for NFTs and RWAs: From minting to trading, from liquidity management to cross-chain circulation, Mint Blockchain provides a complete set of optimized tools and modules specifically designed for the NFT ecosystem.

Optimized Storage and Data Layer: Special optimizations have been made for the storage, liquidity, and data management of NFTs. For example, it supports efficient batch minting and transfer operations for NFTs, addressing the low trading efficiency of NFTs in traditional blockchains.

Additionally, as mentioned at the beginning, NFTs can also be applied in the RWA field, serving as certificates for real assets. However, relying solely on one chain clearly cannot bring this idea to fruition. Mint Blockchain has also associated a unique ERC-7765 standard aimed at solving the technical challenges of integrating NFTs with real assets.

Through this standard, NFTs can be bound to real assets and carry specific rights that can be exercised. For example, an NFT ticket can be exchanged for entry to an offline event, and an NFT product can be mapped to actual logistics delivery.

Here, we do not intend to discuss more technical details; interested readers can refer to the original white paper or protocol documentation.

In addition to these technologies, Mint's white paper seems to reference the recent hot topic of AI Agents, suggesting the use of NFTs to link users and AI Agents, allowing every individual (including both humans and AI Agents) to freely own NFT assets.

We will elaborate on this section regarding AI in the next chapter.

Overall, Mint Blockchain is reshaping the use of L2 by focusing on the optimized design of NFTs and RWAs, combined with innovative technical architecture (such as OP Stack and the ERC-7765 standard) and intelligent tools (like AI Agents).

Exploring the Ecological Toolbox of Mint Blockchain from Creators to Users

The chain is established, but how should it be implemented in specific application scenarios?

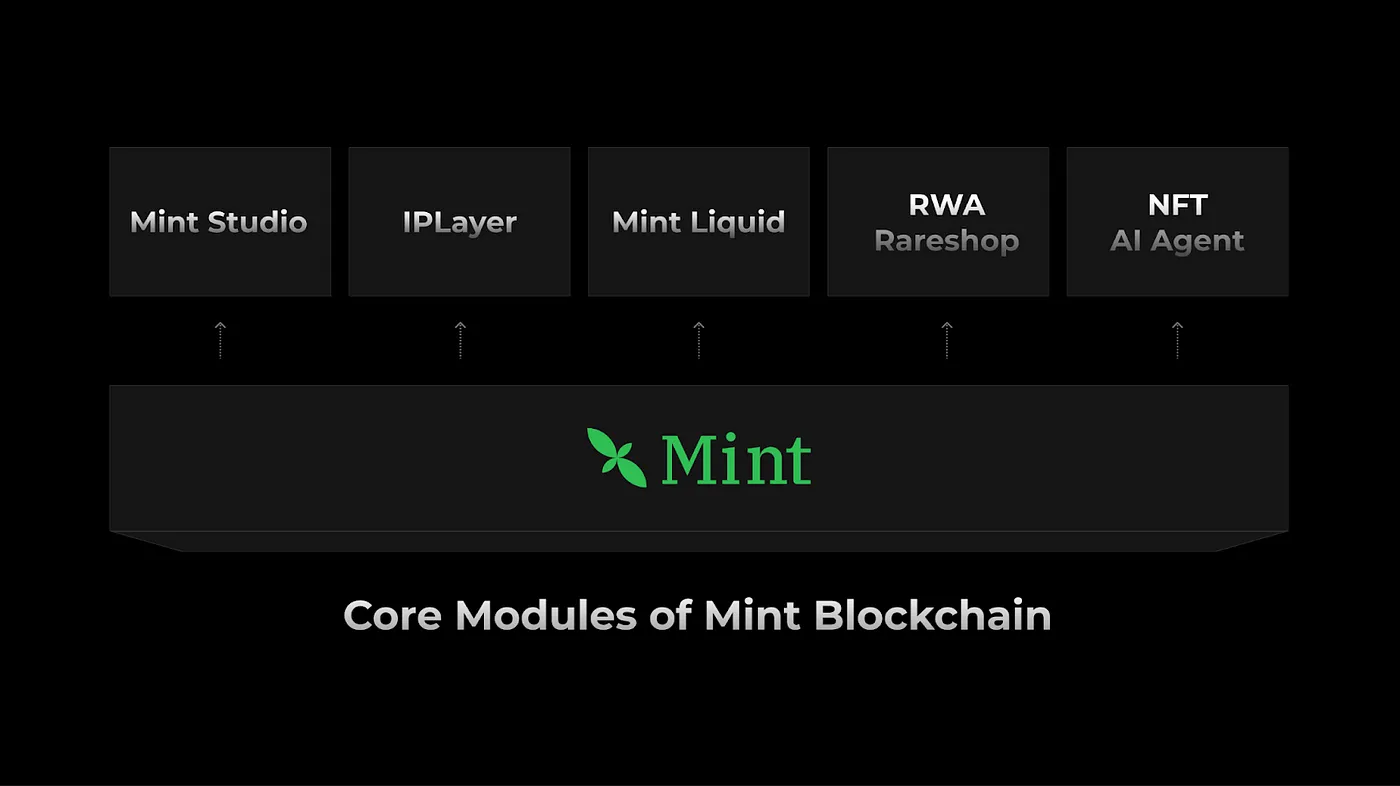

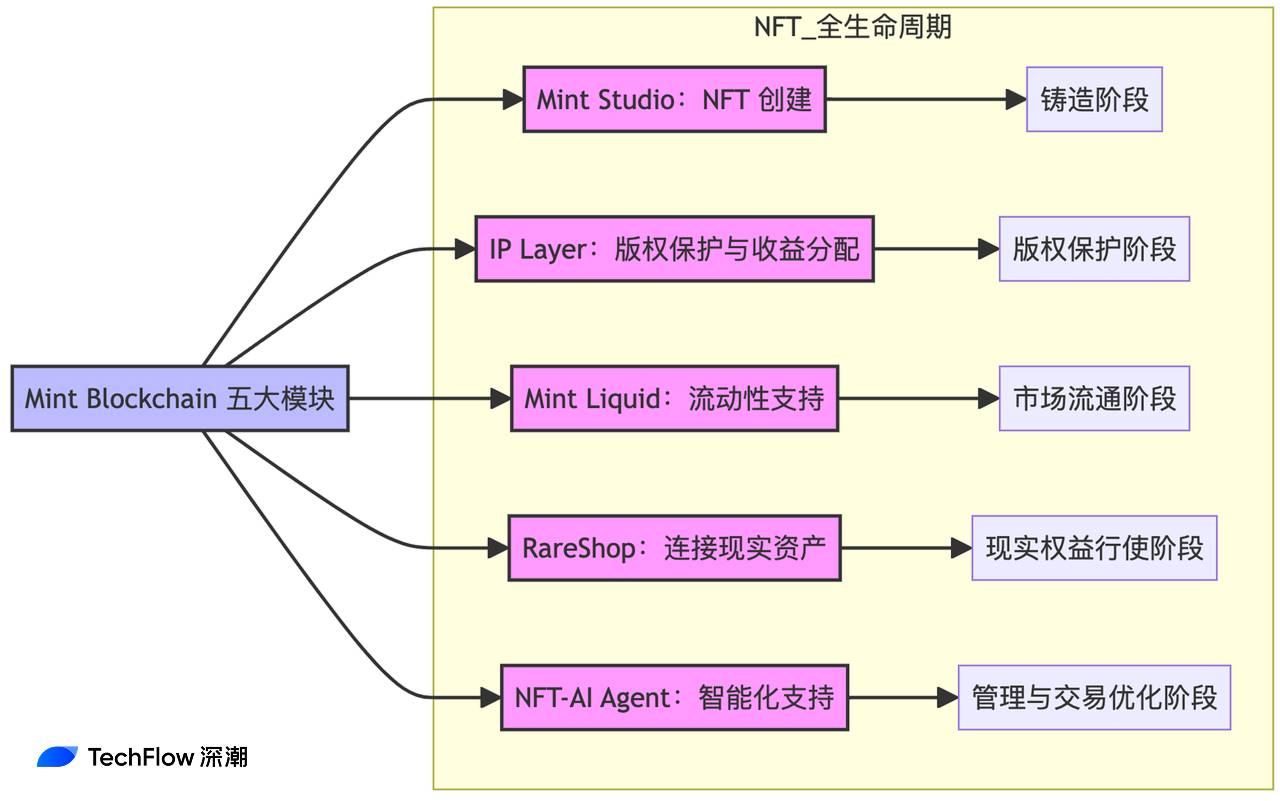

Beyond its L2, Mint Blockchain has designed five core modules to build a complete NFT infrastructure, covering everything from NFT minting to circulation and the exercise of real-world rights.

- #### Mint Studio: Cross-chain NFT Minting Tool for Creators

Mint Studio is one of the core tools provided by Mint Blockchain, designed specifically for NFT creators, supporting various forms of NFT creation (such as text, images, audio, and video).

One of the most significant benefits of this module is the broader cross-chain options it provides.

Creators can mint NFTs across multiple blockchain networks (such as Berachain, Base, Optimism, etc.) through Mint Studio, enabling cross-chain deployment of assets.

At the same time, this module also offers a user-friendly interface design, allowing creators without a technical background to easily complete NFT minting.

Overall, the goal of Mint Studio is to lower the barriers to NFT creation, providing creators with more creative freedom and technical support.

- #### IP Layer: NFT Intellectual Property Assetization and Pricing Platform

IP Layer is a module focused on NFT intellectual property management, helping creators convert their digital assets into legally effective intellectual property and achieve revenue distribution through smart contracts.

Creators can register the copyright of NFTs on-chain, ensuring the uniqueness and legality of their works. Through smart contracts, creators can automatically receive secondary sales revenue from NFTs, avoiding copyright disputes in traditional markets.

The core goal of this layer is to protect creators' rights while introducing more transparency and trust into the NFT market.

- #### Mint Liquid: Multi-chain Liquidity Aggregation Protocol

Mint Liquid is Mint Blockchain's liquidity solution, aimed at addressing the fragmentation of NFT market transactions and insufficient liquidity.

This module supports cross-chain trading of NFTs and tokens, allowing users to freely transfer assets between different networks; it also provides a more efficient trading experience, reducing transaction costs.

The goal of Mint Liquid is to provide an efficient circulation environment for NFTs and RWAs, enhancing market activity and trading efficiency.

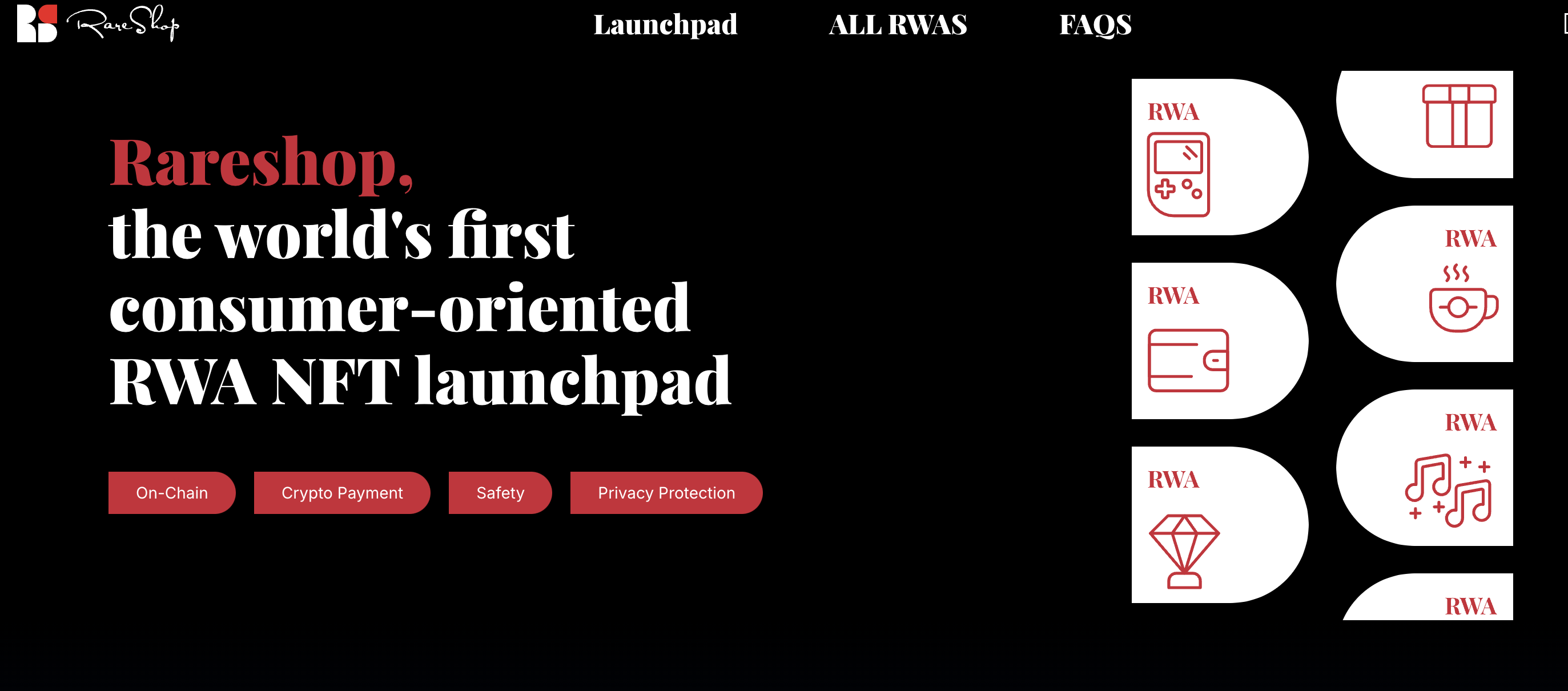

- #### RareShop: RWA NFT Marketplace for Consumers

RareShop is an NFT marketplace focused on real-world assets (RWAs), allowing users to purchase, trade, and exercise real-world rights through NFTs.

Users can obtain corresponding physical goods or services (such as limited edition products, offline event tickets, etc.) by purchasing NFTs.

At the same time, this marketplace supports various cryptocurrency payment methods, providing users with more payment options. From a privacy perspective, the marketplace also integrates technologies like zero-knowledge proofs to ensure that users' transaction privacy is not compromised.

- #### NFT-AI Agent: Intelligent Tool Integrating AI and NFT Data Analysis

In the current hot trend of AI Agents, Mint Blockchain also provides an intelligent tool module that utilizes AI technology to offer users comprehensive NFT data analysis and market insights.

For example, the AI Agent can analyze NFT market data in real-time, helping users grasp market trends; at the same time, by analyzing historical transaction data, the AI Agent provides pricing suggestions for NFTs.

Regarding creative autonomy, the AI Agent can also generate NFT creation suggestions based on user preferences or assist users in completing their creations.

The goal of this module is to reduce users' decision-making costs through intelligent tools and provide creators with more creative inspiration.

From the five modules listed by Mint, we can see that these modules, through high integration and correlation, effectively cover the entire lifecycle of NFTs:

Mint Studio is responsible for NFT creation;

IP Layer ensures copyright protection and revenue distribution for NFTs;

Mint Liquid provides liquidity support, promoting the market circulation of NFTs;

RareShop connects NFTs with real-world assets;

NFT-AI Agent offers intelligent support to users, optimizing NFT management and trading.

Overall, whether it is NFT minting, circulation, or the exercise of real-world rights, the five core modules of Mint Blockchain construct a complete NFT infrastructure to meet the aforementioned needs.

Current Ecological Progress

Since the mainnet launch in May last year, how has Mint been performing? Let's start with some fundamental data.

Active Wallet Addresses: Reached 590,000, with 276,000 active users.

Daily Average Transaction Volume: Exceeded 330,000 transactions, primarily focused on NFT and RWA (real asset) related transactions.

Number of Ecological Applications: Over 100 applications launched, including native applications like MintSwap Finance, Mint Forest, RareShop, etc.

- Global Community: Covers 12 languages, with over 300,000 community members.

Additionally, in the background, in May 2024, the project secured $5 million in seed round financing, with investors including Jsquare, BlockAI Ventures, SNZ, Mask Network, and others.

Notably, the project also received a strategic investment of $2 million from the Optimism Foundation in October last year, along with 1 million $OP governance voting rights, clearly indicating the support intentions of the OP ecosystem.

Through these milestone events, it is evident that Mint Blockchain has not only achieved breakthroughs in technology but has also further solidified its ecological position through financing and collaboration.

In the Roadmap document outside the white paper, we also found that this year the project will focus more on token economics and staking mechanisms.

The token TGE is believed to be a key focus for many players.

$MINT Economics and Airdrop Activities

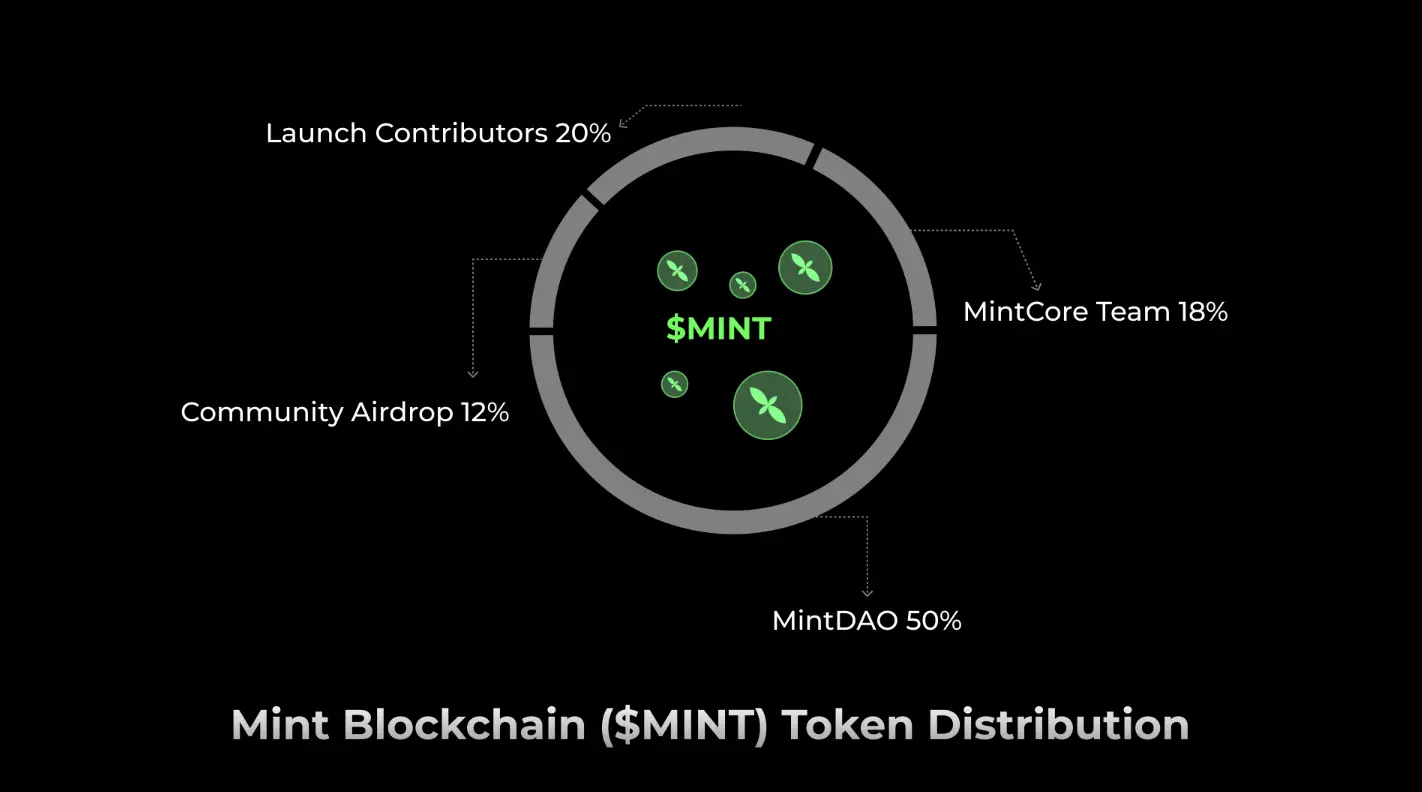

As the core value carrier of the ecosystem, the distribution design of $MINT aims to balance community incentives with long-term development needs. The white paper also mentions the specific distribution plan for $MINT:

Total Supply: 1 billion $MINT.

Distribution Ratio:

82% for Community Building:

MintDAO: 50%, used to support ecological incentives, staking rewards, infrastructure development, etc.

Early Contributors: 20%, rewarding early supporters and developers.

Community Airdrop: 12%, expanding the community size through activities and incentive mechanisms.

18% allocated to the MintCore team, for team development and long-term operations.

However, there are currently no further details regarding unlocking conditions, ratios, and timelines, so it may be necessary to pay attention to the project's social media for further updates.

In terms of the role of the token, $MINT plays several key roles in the ecosystem:

Governance Rights: $MINT holders can participate in network governance, including proposal voting and ecological decision-making.

Ecological Incentives: Used to reward developers, creators, and users, encouraging them to contribute to ecological development.

Network Transaction Asset: $MINT is the primary payment asset within the network, used for transaction fees, asset issuance, and other on-chain activities.

Asset Pricing: $MINT is used for pricing and trading assets such as RWAs, NFTs, and Tokens, becoming an important value unit within the ecosystem.

Staking and Re-staking: Through the staking and re-staking mechanism of $MINT, users can earn a share of network revenue and additional rewards.

Among these, the re-staking mechanism, which is directly related to revenue, deserves further discussion.

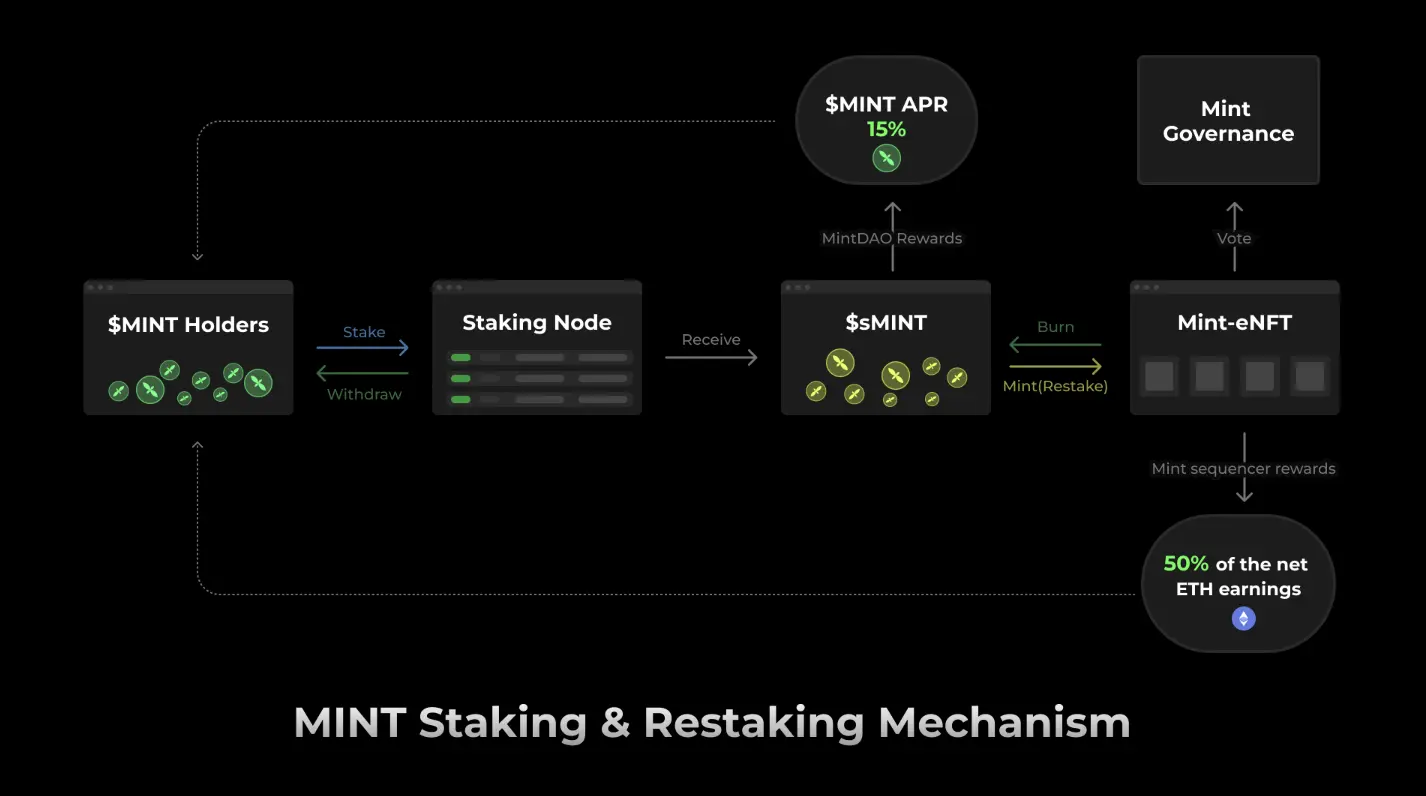

Staking Mechanism:

Users can stake $MINT, $ETH, or NFT assets through the MintPool protocol.

After staking, users need to choose a staking node (divided into super nodes and basic nodes):

Super Nodes: Operated by infrastructure providers and investment institutions within the ecosystem, requiring a large amount of $MINT to be staked.

Basic Nodes: Operated by the community and developers, with lower thresholds and greater openness.

Staking Rewards: Users earn an annual percentage rate (APR) of 15% through staking, funded by MintDAO.

Re-staking Mechanism:

After staking $MINT, users receive a staking certificate called sMINT (Staked MINT Tokens).

Users holding sMINT can convert it into BC721 Mint-eNFT (a strategic NFT based on Bonding Curve).

Users holding BC721 Mint-eNFT will receive 50% of the income from Mint Blockchain's sorters (after deducting DA and Superchain fees).

Through staking and re-staking, users can not only earn token rewards but also participate in network revenue sharing. This mechanism effectively enhances the capital efficiency of $MINT and provides users with long-term returns.

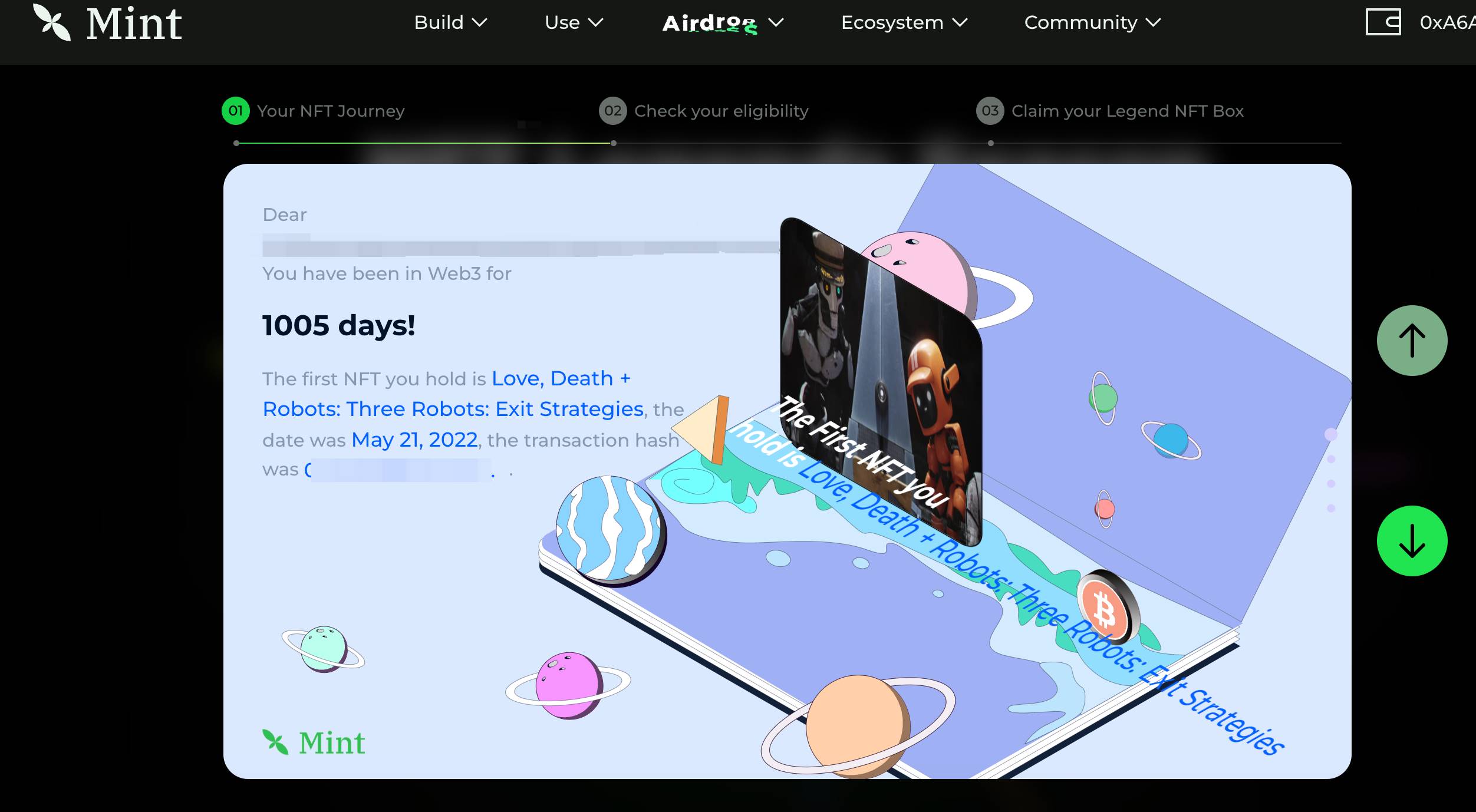

Airdrop Activity: NFT Legends Season

Regarding the highly anticipated airdrop activity, Mint Blockchain has launched NFT Legends Season to further incentivize community participation.

The total airdrop amount for the NFT Legends Season event is 1% of the total supply of $MINT (i.e., 10 million tokens), and the event runs from January 2, 2025, to February 15, 2025.

During this period, eligible users can claim an NFT Legend Box. These NFT Legend Boxes are the core of the event, with each box containing different levels of rewards, categorized into four tiers: A (normal rewards), S (high rewards), SS (rare rewards), and SSS (legendary rewards). Among these, the SSS tier rewards are the most anticipated part of the event, containing the highest number of $MINT tokens.

Participation Conditions:

OG NFT Holders: Users holding specific NFT collections (such as CryptoPunks, BoredApeYachtClub, etc.) can claim different quantities of NFT Legend Boxes.

Major NFT Marketplace Users: Users trading on markets like OpenSea and Blur can claim Boxes based on their trading volume.

NFTFi Platform Users: Users staking NFTs on platforms like Blur Lending and BendDAO are also eligible.

Users who have claimed the boxes can currently participate in unboxing, which will continue until February 28, thereby locking in this portion of the $MINT airdrop.

The Infinite Possibilities from NFTs to Real Assets

Overall, Mint Blockchain, as a Layer 2 infrastructure focused on NFTs and RWAs, is driving industry development through efficient and low-cost solutions.

With five core modules and technical support based on the Optimism Superchain, Mint not only addresses industry pain points such as NFT standardization and liquidity but also provides a solid foundation for the integration of NFTs and real assets.

Through innovative incentives like the $MINT airdrop activity (NFT Legends Season), Mint has successfully attracted participation from OG users and emerging players, further expanding the community size and ecological influence. In the future, Mint aims to become the largest NFT application network globally and, by supporting RWAs, break the boundaries between on-chain and off-chain assets, opening up new possibilities for the practical application of blockchain technology.

From the perspective of crypto players, Mint Blockchain offers excellent opportunities for users and developers to participate and innovate. Whether through early ecological dividends or airdrop activities, the broad scope of incentives is evident;

Moderate participation is a good choice when current market hotspots are lacking or secondary returns are hard to find.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。