This article will introduce some risk-adjusted yield opportunities worth paying attention to.

Author: Charlie

Translation: Deep Tide TechFlow

In the current market environment, earning yields through stablecoins is one of the effective ways to tackle challenges and achieve growth. This article will introduce some risk-adjusted yield opportunities worth noting (in no particular order).

HLP (Hyperliquidity Provider)

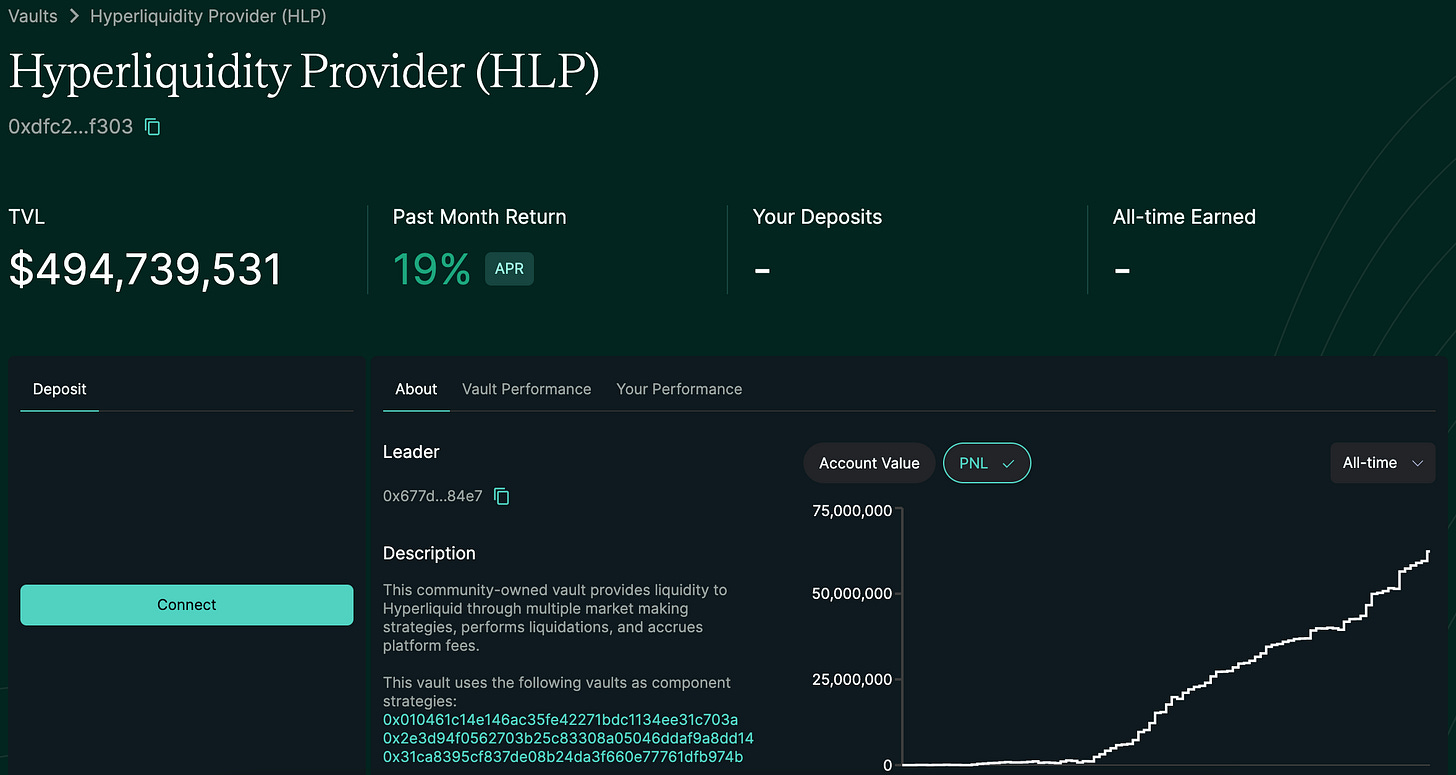

Currently, the Hyperliquid platform's Hyperliquidity Provider (HLP) vault offers an 18.61% yield, serving as a source of consistent and stable returns. According to official descriptions, HLP provides liquidity to Hyperliquid through various market-making strategies while executing liquidation operations and accumulating platform trading fees.

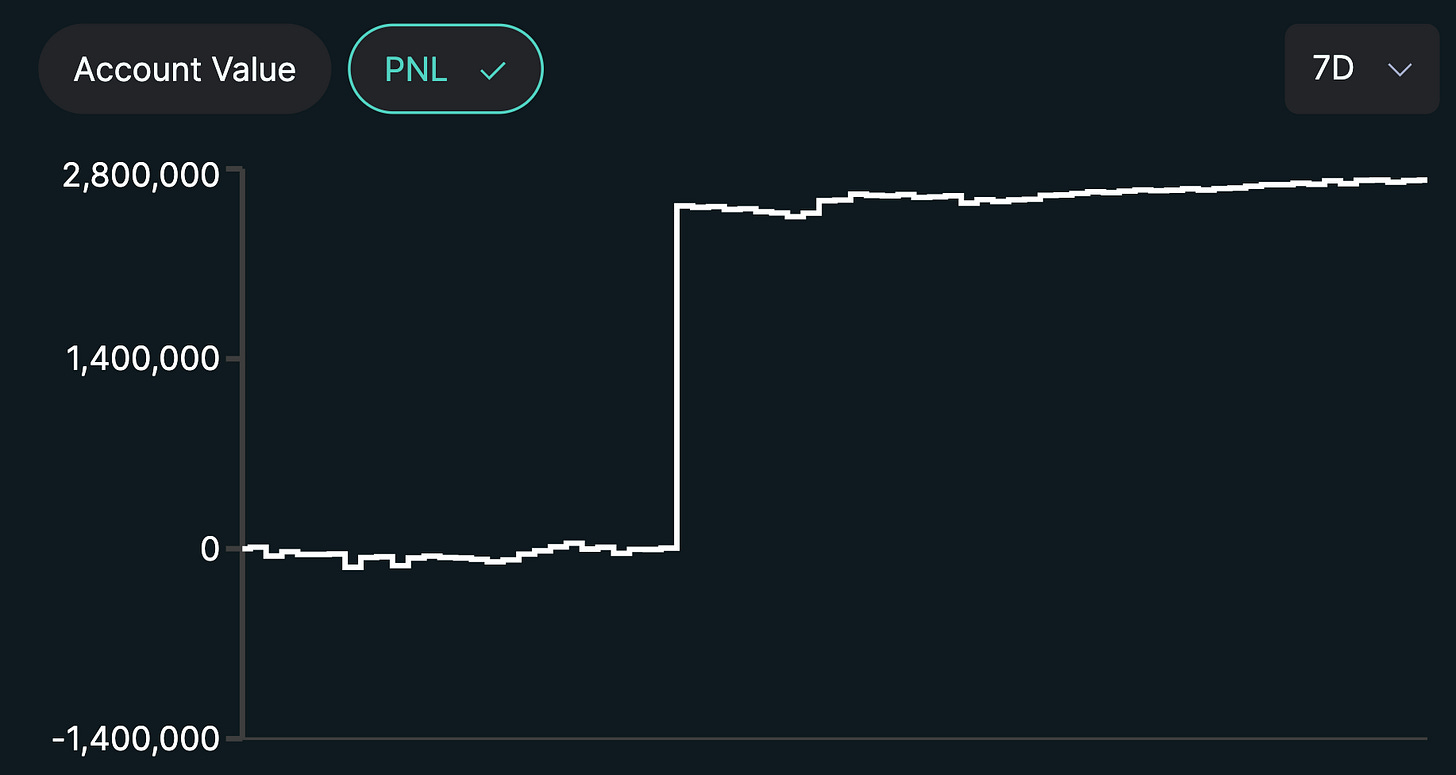

It is important to note that HLP's yield performance is typically uneven. Over longer periods, yields may remain stable or slightly increase, but during liquidation events, significant single-day returns often occur:

However, due to HLP's relatively closed operational mechanism, depositors are entirely reliant on the expertise of the Hyperliquid team, which introduces a certain level of "black swan risk" (i.e., potential losses from extreme events). Nevertheless, it is reassuring that data shows traders generally incur losses, suggesting that HLP vaults may have sustainable profitability in the long run. Additionally, depositors should be aware that funds deposited into HLP must be locked for 4 days before withdrawal.

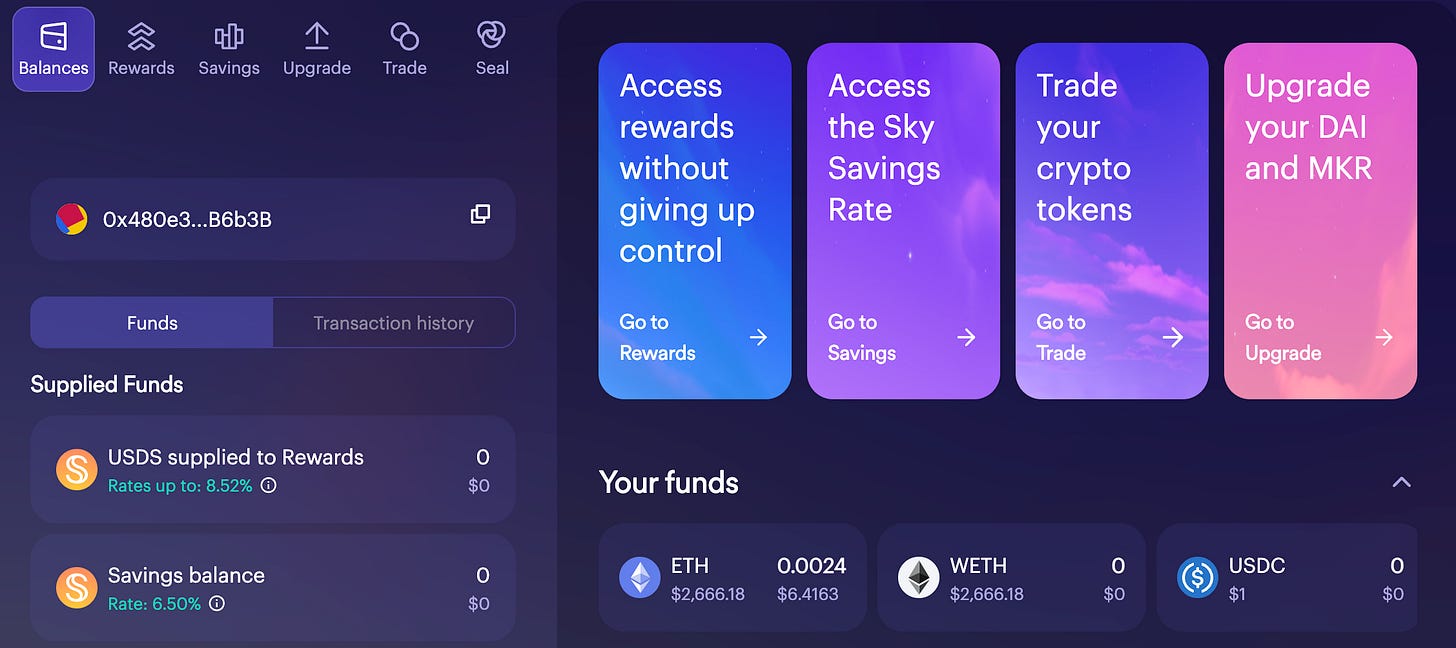

Sky Money

Sky Money is a new brand from MakerDAO, currently offering the following two options for stablecoin depositors:

Depositing into the Rewards Vault can earn an 8.52% yield, paid in SKY.

Depositing into the Savings Vault can earn a 6.5% yield, paid in USDS (which is also the new DAI savings rate).

In comparison, the high yield of the Rewards Vault is clearly more attractive, and the risk levels of both options are comparable. Depositors in the Rewards Vault can also accumulate SKY tokens, which we believe are currently undervalued by the market. If one chooses to hold and accumulate SKY instead of simply "mining and selling," it may provide additional growth potential for nominal yields.

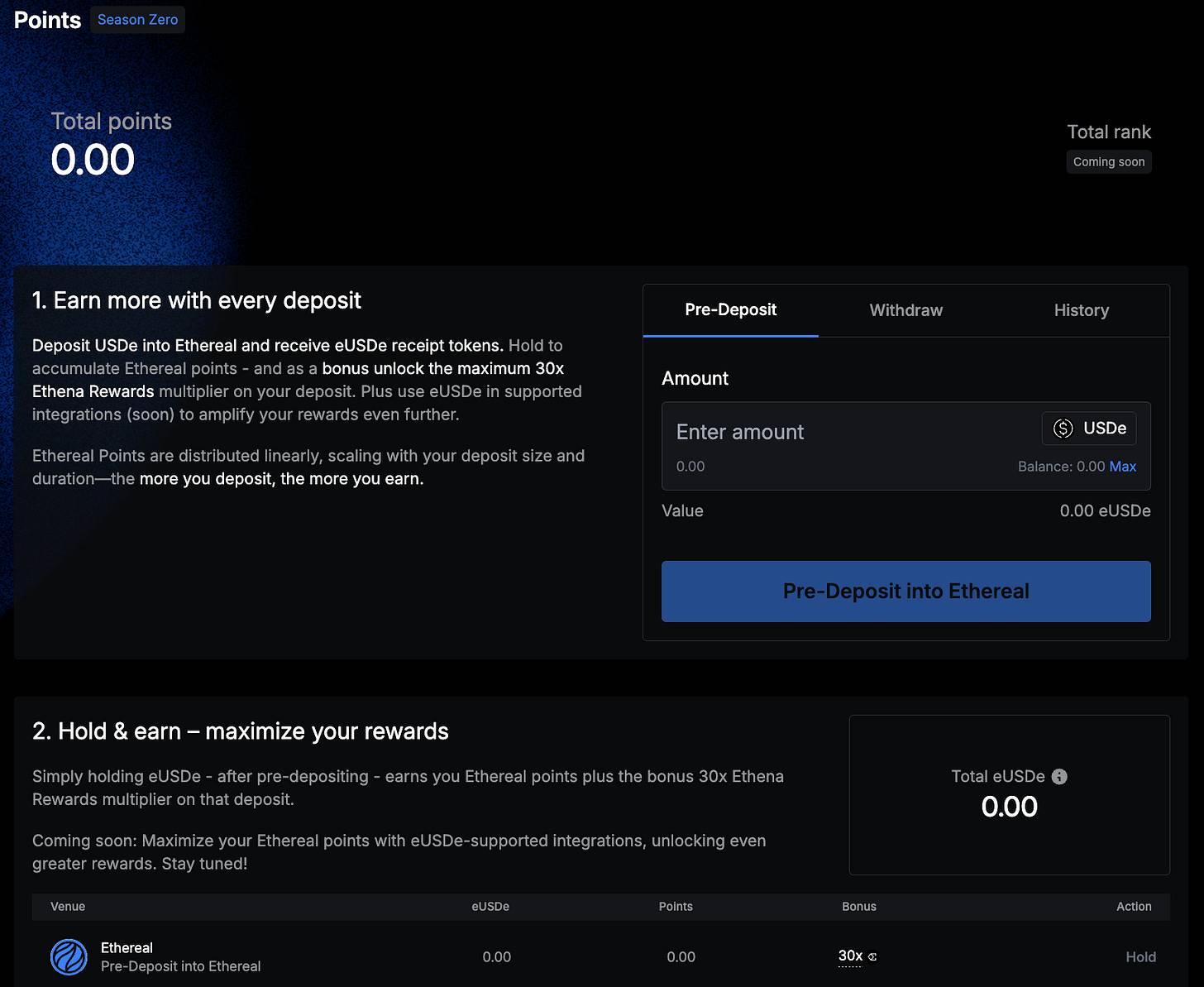

Ethereal

Ethereal is a decentralized perpetual contract trading platform closely related to the Ethena team and supported by them. It is reported that the platform will launch on the "Ethena Network," serving as a tool for the Ethena team to hedge spot long positions, thereby reducing capital flow to centralized exchanges (CEX).

Currently, Ethereal is conducting a points activity called "Season Zero," where users depositing USDe can accumulate Ethereal points and receive 30 times Ethena rewards (the specific benchmark is unclear, but it can be assumed that some $ENA tokens will be rewarded to depositors).

The annualized yield (APR) for this opportunity has not yet been clarified, but I expect it to be between 15%-20%, depending on the issuance price of Ethereal tokens. Due to the lack of transparency in yield information, there may be certain risks from an opportunity cost perspective. Nevertheless, I believe this is an opportunity worth noting in the stablecoin yield portfolio.

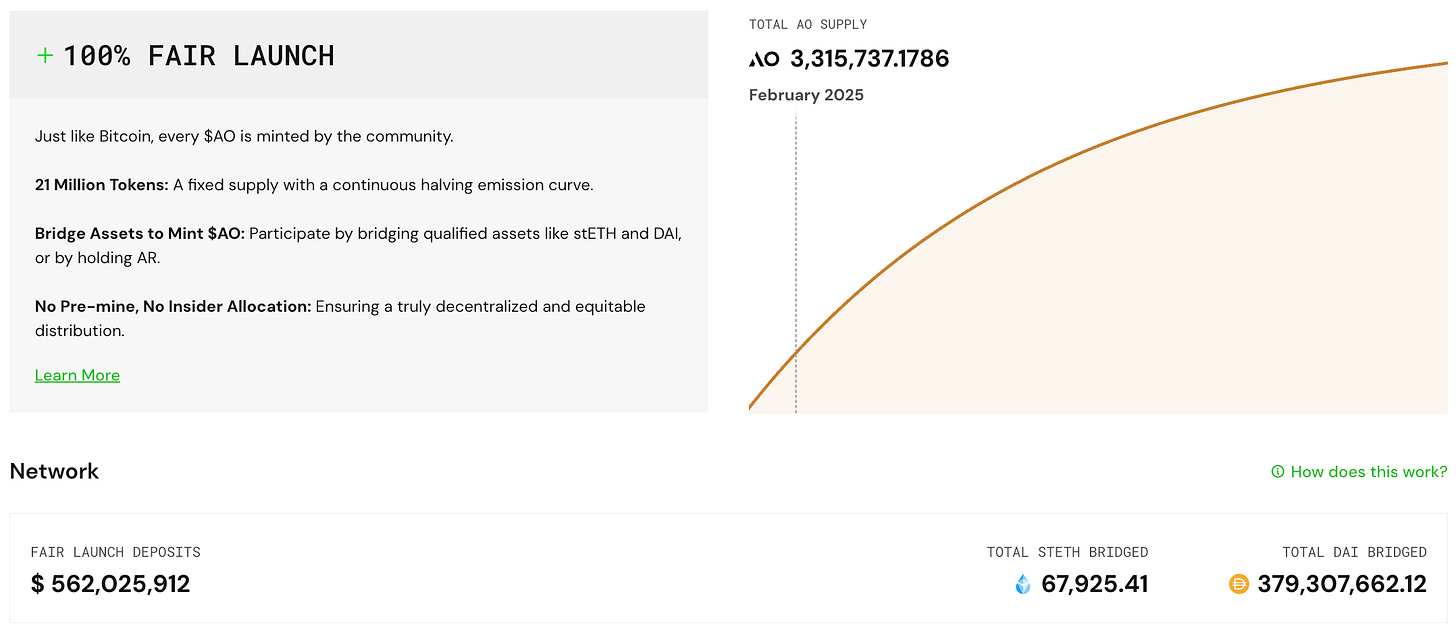

AO

AO remains a low-profile project for many market participants. In fact, we reported on this as early as May 2024 in this article. AO has long operated a mining activity similar to pre-deposits, but with the recent completion of the token generation event, its annualized yield has been confirmed:

1 DAI can earn 0.004424 AO per year, resulting in an APR of 14.37% based on the current AO price ($32.49).

Similar to Sky and Ethereal, mining AO can currently yield decent returns through a "mine and sell" approach, while also allowing the option to hold AO. If one chooses to hold, there may be greater appreciation potential in the future, providing additional upside for the current APR.

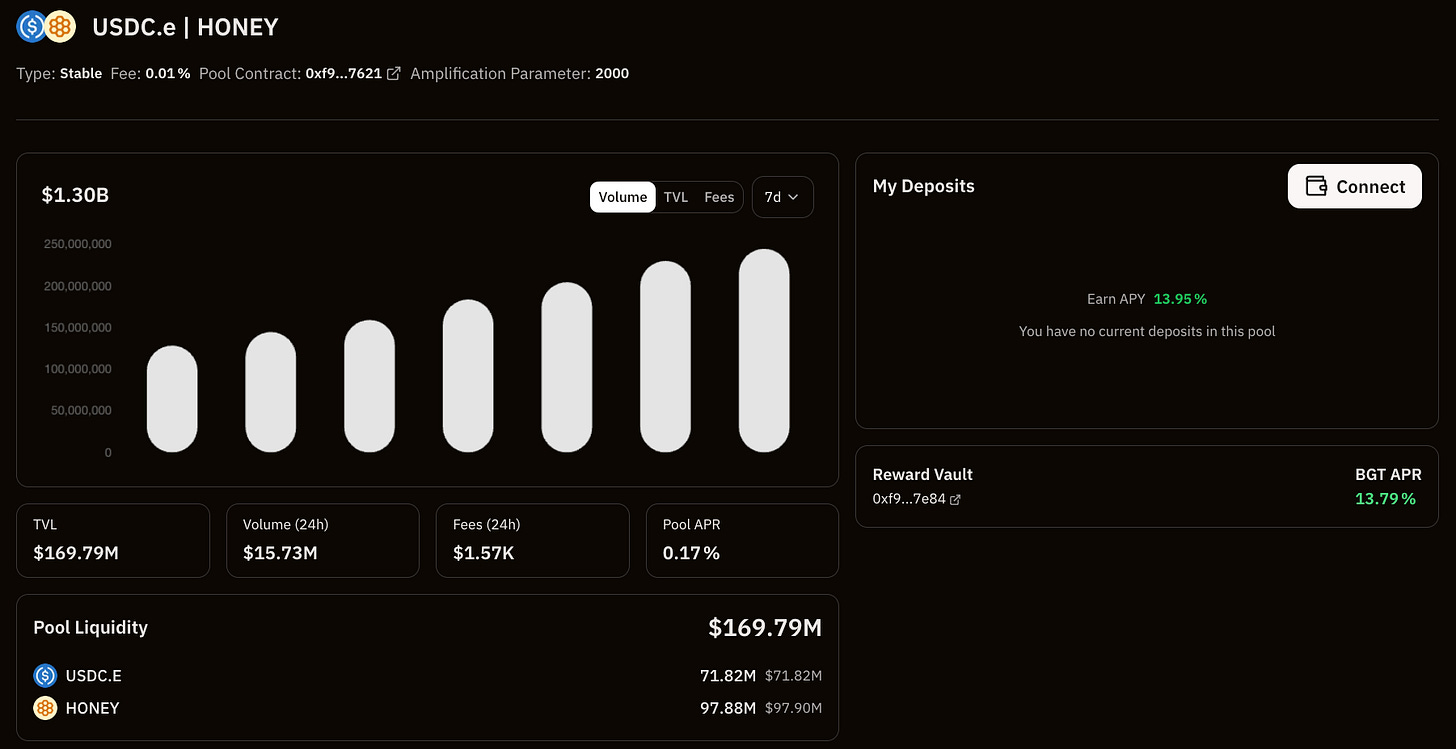

Berachain

Berachain's native DEX offers some interesting opportunities, such as the USDC.e/HONEY liquidity pool, which currently pays a yield of 13.79%, in the form of BGT. BGT is a soulbound token (non-transferable) but can be burned at a 1:1 ratio for BERA. Miners can choose to sell immediately to realize the current APR or accumulate BGT, betting on the future development of the Berachain ecosystem (which has been gradually heating up recently).

Sonic

Sonic is conducting a large-scale airdrop mining activity, distributing hundreds of millions of S tokens to incentivize ecosystem growth. This creates some unique opportunities for yield miners that are worth further attention and research.

Shadow Exchange is a native decentralized exchange (DEX) within the ecosystem, offering many attractive stablecoin investment opportunities. Among them, the following two options are particularly noteworthy:

USDC.e/scUSD: Annualized yield of 28.9%

USDC.e/USDT: Annualized yield of 35.3%

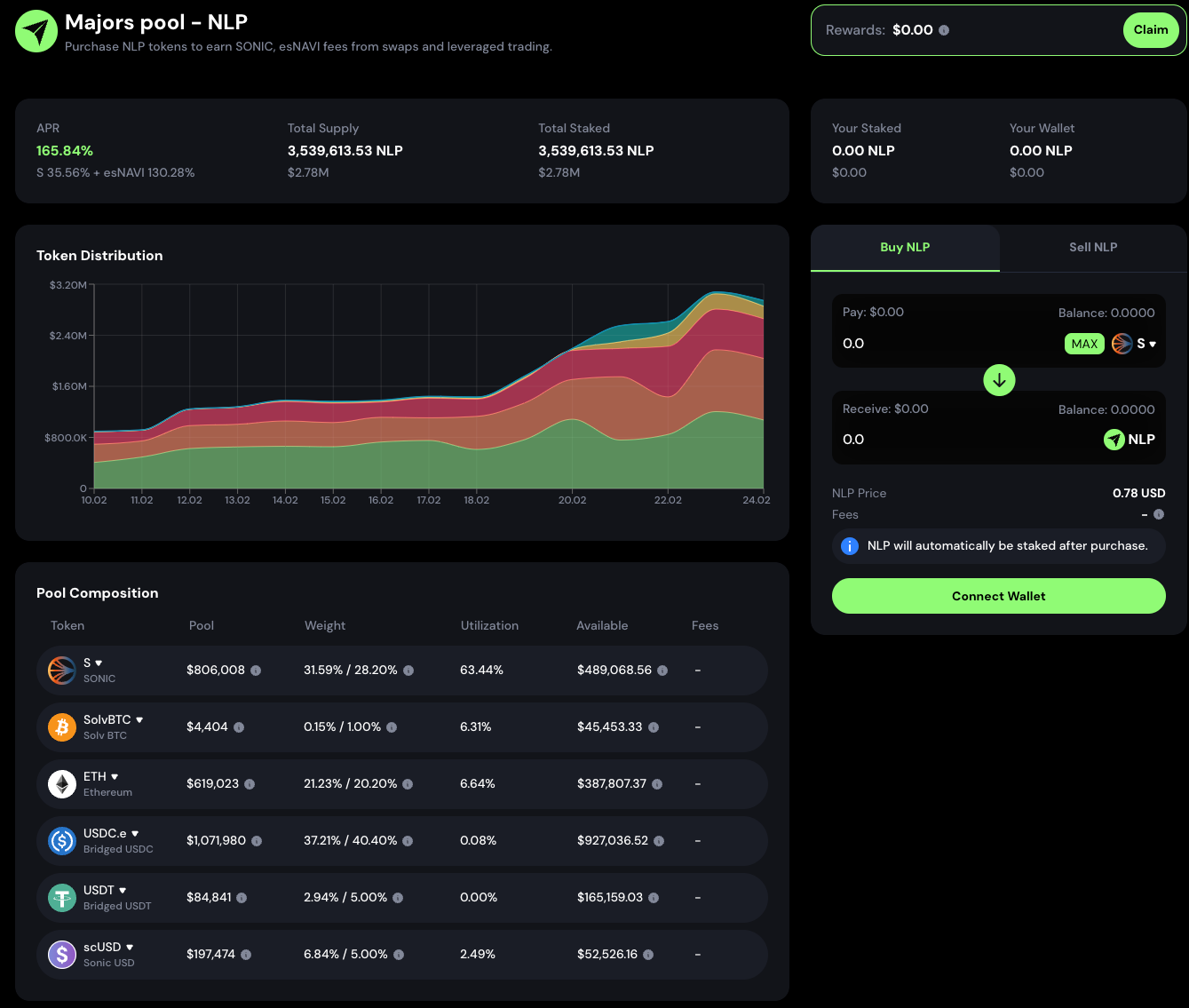

Navigator Exchange is a fork project based on GMX, which has also launched a product similar to GLP/JLP, called NLP. It is important to note that due to its portfolio containing S, BTC, and ETH, it may face certain price volatility risks (Delta risk). Currently, the returns offered by NLP are as follows:

35.60%, paid in S tokens

131.71%, paid in esNAVI tokens

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。