Original | Odaily Planet Daily (@OdailyChina)

Is the inscription that once stood at the starting point of this bull market about to be revived?

In the recent downturn of the market, with a sluggish altcoin market and memes trapped in a lifeless "garbage market," the BRC-20 and the new L1 star Hyperliquid's on-chain inscription protocol HRC-20 have sparked interest within the community.

With a total supply of 21 million, requiring 2.1 million mints (10 per mint) for the BRC-20 "big truck" token MASK, on the evening of February 23, it briefly raised the Bitcoin network gas to 14 satoshis/byte, marking one of the few hopes in months to complete the minting and surpass 10,000 addresses for the "inscription big truck." (Odaily Note: The inscription big truck refers to BRC20 tokens that require an enormous number of mints, consuming a lot of funds and time.)

Meanwhile, the first HRC-20 token HYPI on Hyperliquid L1 opened for minting at 5:00 on February 21, with a total supply of 21 million, which was completely minted in 5 hours. The official team has spent $109,154.01 to secure a spot for trading on Hyperliquid and opened trading at 5:00 AM today, launching the corresponding wrapped asset wHYPI on the Hyperliquid spot trading market.

Revival of inscriptions or a false resurrection?

The short-term increase in FOMO sentiment often leads those involved to develop illusions.

The popularity of MASK comes quickly and goes quickly

The deployment date of the BRC-20 token MASK is March 10, 2023, and it was not fully minted even during the peak of BRC-20 inscriptions, with some players getting stuck at the highest minting fee of 30 satoshis/byte last year.

Why has this "old antique" become popular again? Speculations circulating in the community fall into two categories: one is that MASK is a genuine "miner conspiracy," where miners mint a large amount of MASK to create a false sense of on-chain prosperity, enticing players to FOMO in and earn more Bitcoin fees; the second speculation is that MASK is a new "inscription ground promotion," relying on "mysterious Eastern powers." Regardless of which it is, as long as it brings sustained traffic and popularity to inscriptions, it is a good thing.

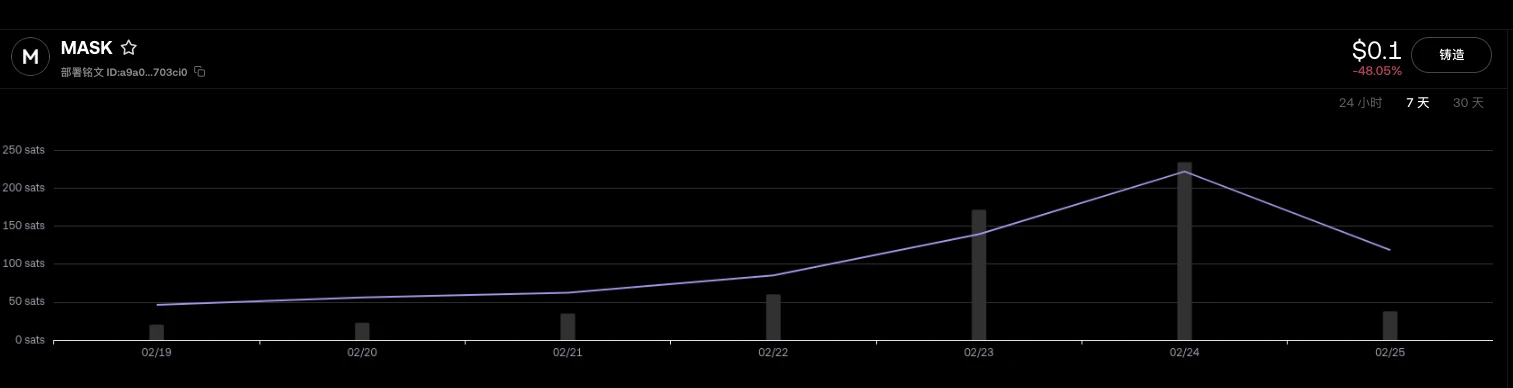

On February 23, the minting progress of MASK reached 70%, at which point the price of MASK on the OKX inscription market was $0.3. It was initially thought that with community sentiment, MASK would be fully minted by February 24 and continue to push prices higher, but the decline in MASK's popularity came faster than expected. As of today (February 25), its progress has only reached 88%, and the price of MASK has dropped to $0.1, making the price on February 23 seem like a peak.

Perhaps MASK will eventually be fully minted, but the final outcome is likely to be similar to the inscription big truck eorb, gradually fading away.

HRC-20 performance below expectations

HRC-20 is a fungible token standard launched by the inscription protocol HPS Protocol on Hyperliquid L1, which introduces the concept of Hyperscriptions on Hyperliquid L1 and HyperEVM. HYPI is the first HRC-20 token officially issued and currently the only HRC-20 token, with 2,231 holding addresses.

Currently, almost all functions of the HPS Protocol platform are unavailable, and users cannot independently deploy or transfer HRC-20 tokens. Therefore, to quickly initiate trading, HPS Protocol chose to first launch the wrapped asset wHYPI for HYPI on the Hyperliquid spot trading market, with addresses holding HYPI receiving a 1:1 airdrop of wHYPI when trading opens. Once the official HRC-20 market is launched, users can directly redeem wHYPI for HYPI, maintaining a total circulation of 21 million for both HYPI and wHYPI.

The minting cost for a single HYPI (100 per mint) is $2-3. Before the launch on the Hyperliquid spot market, the highest off-market double betting transaction price reached $25 per piece, with an estimated market value of $5.25 million, which is about 10 times the minting cost.

I initially thought that after the launch on the Hyperliquid spot market, HYPI, as the first inscription on the Hyperliquid chain, would have some room for growth. However, disappointingly, like MASK, wHYPI entered a downward trend after its launch, currently priced at $0.024 (or $2.4 per piece), with a market value of $540,000, having fallen below the minting cost. Players who bought in at $25 per piece are now "crying in the bathroom."

Market vitality withers, but speculative demand remains

This morning, the overall cryptocurrency market fell again, with BTC briefly dropping below 91,000 USDT (falling to a low of 90,888 USDT). The altcoin market is even more devastated, with ETH dropping below 2,500 USDT and SOL falling below 140 USDT. The meme market's vitality is even more dismal, with only 1 token surpassing a market cap of 1 million dollars in the past 24 hours on pump.fun on February 24, a stark contrast to last month when several memes reached tens of millions in market cap daily.

However, I believe that the more sluggish the market, the more desperate the funds become, the stronger the speculative demand, and the more eager small and medium players are to "turn things around." At this time, any new speculative opportunity, no matter how small, can attract significant attention, but the downside is that if there are no returns in the short term, funds will quickly exit. The BRC-20 inscription MASK and the HRC-20 inscription on Hyperliquid L1 are phenomena arising from the current market slump and lack of speculative opportunities.

At this point, inscriptions have become a very small angle in the market, so small that the number of people discussing it is far less than the number of comments on a bizarre post released by the imprisoned SBF two years later. Only a few diamond-handed enthusiasts (or those with obsessions) continue to persist.

Only things that have failed can talk about revival; to put it harshly, today's inscriptions are yesterday's memes. But as long as speculative demand exists in Web3, we will eventually see the next asset distribution model that stirs the market. However, those who dive in must remember not to "fall in love" with their investment projects again.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。