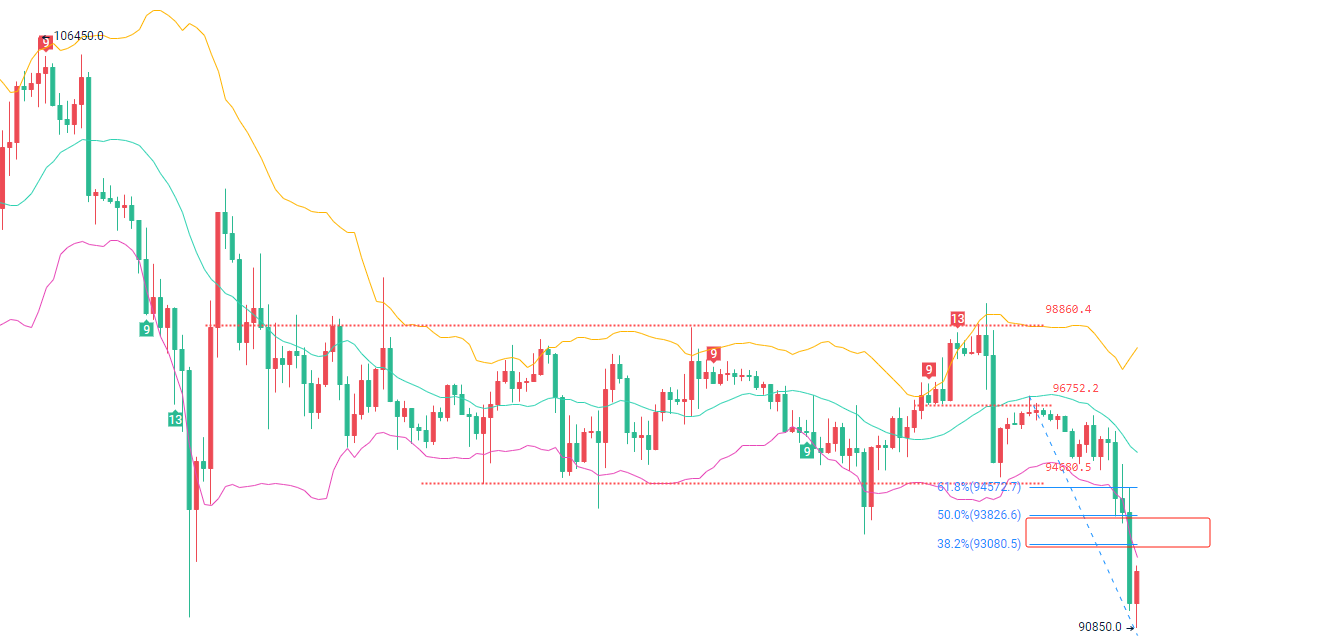

After a significant drop on Monday, although there was a rebound of a thousand points in the evening, it still failed to stabilize at 9.4, ultimately leading to a second decline.

The bottom of 9.4, formed after a month of fluctuations in February, has been broken, which essentially indicates that the distribution of chips has started again, initiating a downward trend in this round.

The intraday rebound resistance is expected to manifest at the two levels of 9.3/9.38. For the short term, a phased entry strategy is recommended, first focusing on the resistance near 9.3. If the resistance fails, the second step is to look at 9.38 for a second entry opportunity.

Ethereum also failed to gain a foothold yesterday, with the trend further breaking below the upward trend line. Currently, the two major previous support resistances above are 2550/2600.

Therefore, in terms of intraday transition layout, the strategy is to seek entry opportunities around the 2550-2600 range:

Enter with two batches of short positions. The first batch should focus on entering between 2530-2550, with a stop loss near 2570. After breaking this level, look for the second batch to enter between 2590-2600 for the final medium to long-term short position layout.

Initially build a partial position near 2550, then keep some positions to look for replenishment opportunities at 2600, with the overall stop loss set near yesterday's reversal point at 2650.

This section primarily focuses on sharing major mainstream cryptocurrencies such as BTC/ETH/EOS/XRP/ETC/LTC/DOGE. Follow the public account "Yanbi" to avoid getting lost and enjoy more service guidance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。