No matter in China or the United States, the best era for VC as an investment asset class has already passed.

Author: YettaS

The biggest takeaway from my trip to Consensus HK is that VC is incredibly difficult; saying that it’s a lamenting scene would not be an exaggeration, especially in stark contrast to the P marshals. Some VCs are unable to raise the next round of funding, some have lost half their team, some have shifted to strategic investments and no longer invest independently, and some VCs are even considering issuing memes to raise funds…

Many VC peers have also chosen to exit; some have joined project teams, and some have transitioned to become KOLs, seemingly these are all more cost-effective choices. In this changing landscape, everyone is searching for new ways to survive. I am also pondering, what exactly went wrong with VC? And how can we break through the impasse?

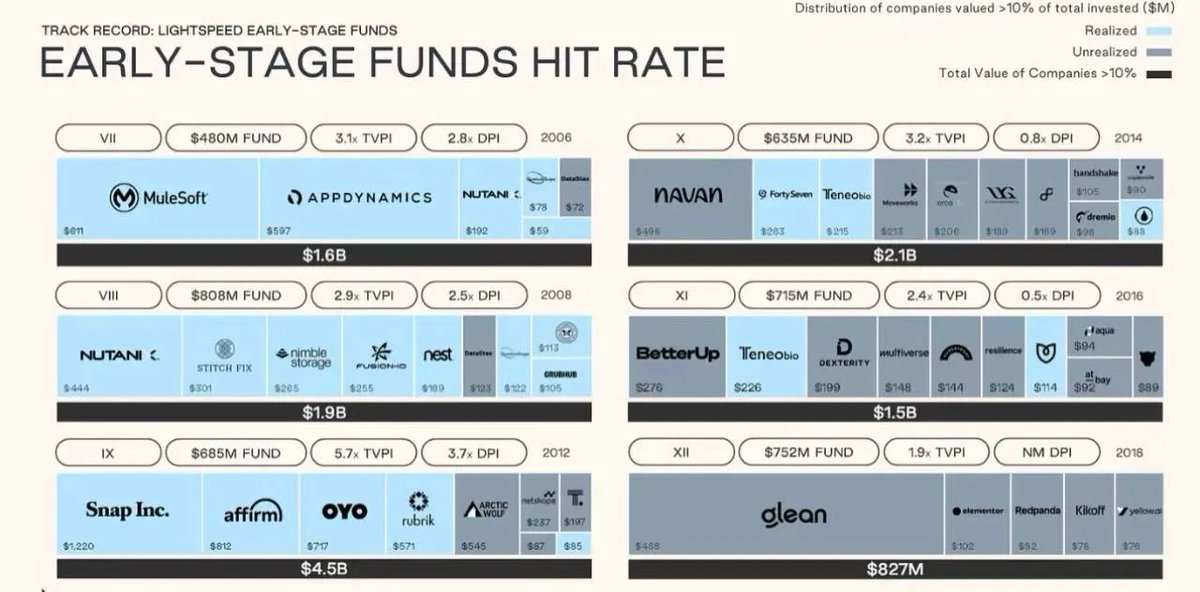

First of all, we must admit that, whether in China or the United States, the best era for VC as an investment asset class has already passed. The following chart shows the return data of several funds from Lightspeed; the best fund achieved a DPI of 3.7X by investing in Snap, Affirm, and OYO in 2012 (DPI is the distributed return multiple, which does not rely on valuation and measures the actual return of exited funds). Of course, this cannot be compared to directly buying BTC, and since 2014, even breaking even has become a challenge.

Chinese VCs have also experienced a similar trajectory. Relying on demographic dividends, the rapid growth of mobile and consumer internet has spawned billion-dollar companies like Alibaba, Meituan, and ByteDance. 2015 was the last shining moment; afterward, tightening regulations, liquidity constraints, declining industry dividends, and changes in the industrial cycle faced growth bottlenecks, and the IPO exit channels became restricted, leading to a significant decline in the return rates of VC institutions, with many professionals exiting the field.

Crypto VCs are no exception; with changes in the macro environment, the evolution of market structures, and declining capital returns, VCs are facing enormous survival dilemmas.

Everything is about cost and liquidity

In the past, the value chain of VC investment was clear: project teams brought innovative ideas, VCs provided strategic support and resources, KOLs amplified market voices at critical moments, and finally, value discovery was completed on CEX. Everyone provided different values and bore different risks at different stages, receiving matching returns, which formed a "relatively fair" value chain.

For example, as VCs, the value we provide has never been as simple as just investing a sum of money in the early stages. It involves helping project teams quickly connect with key resources in the ecosystem to drive business development, providing timely advice when market winds change, helping project teams adjust strategies, and even assisting in building core teams. Moreover, to establish a long-term bond with project teams, let alone when TGE will happen, even after TGE, we generally face a one-year lock-up and 2-3 years of vesting, and to a large extent, we hope to play a PVE non-zero-sum game together with the project teams.

However, in the current market environment, the core contradiction lies in the extreme lack of liquidity and intensified market competition, making the VC model difficult to sustain.

The changing landscape of capital flow: Where does the VC dilemma come from?

The main driving force of this bull market is the U.S. Bitcoin spot ETF and the strong entry of institutional investors. However, the path of capital transmission has undergone significant changes:

Institutional funds mainly flow into BTC, BTC ETFs, and even Indexes, but do not spread to the broader altcoin market;

The lack of genuine technological/product innovation support makes it difficult for altcoins to maintain high valuations.

This directly leads to the VC model being highly FUDed in the current market environment. Retail investors believe that VCs enjoy an unfair advantage, being able to acquire chips at a lower cost and possessing key market information. This information asymmetry leads to a collapse of market trust and further depletion of liquidity. In a PvP environment, retail investors demand "absolute fairness." In contrast, the strategies of secondary funds do not create strong opposition to market sentiment, as retail investors can also enter the market with the same chips, after all, they were once given an opportunity for absolute fairness.

The current overwhelming FUD against VCs is a counterattack of "absolute fairness" against "relative fairness" in the context of liquidity scarcity.

The rise of meme financing models

If the last time I viewed memes as a cultural phenomenon, then this time, we need to see it as a brand new financing method. The core value of this financing method lies in:

Fair participation mechanism: Retail investors can track information through on-chain data and obtain early chips under a relatively fair pricing mechanism;

Lower entry barriers: During the DeFi Summer, we supported many solo developers who relied on product innovation to drive value capture. Now, the meme model further lowers the barriers, allowing developers to "have assets first, then have products."

This logic itself is not problematic. Looking back, many public chains conducted TGE without a mature ecosystem or mainnet; why can't memes use the same approach to attract enough attention first and then advance product development?

Essentially, the evolution of the "assets first, products later" path is a wave of populist capitalism sweeping through the entire financial ecosystem. The prevalence of attention economy, catering to the public's desire for quick wealth, breaking the monopoly of traditional financial institutions, lowering capital thresholds, and ensuring information transparency are all unstoppable trends of the populist new era. The GameStop retail battle against Wall Street, the evolution of fundraising methods from ICO to NFT to memes, are all financial interpretations under the tide of the times.

So I say, Crypto is just a microcosm of this era.

The role of VCs in the new model

No financing model is perfect. The biggest problem with the meme financing model is its extremely low signal-to-noise ratio, which brings unprecedented trust challenges—

Extremely low signal-to-noise ratio: Fair launches make the cost of asset issuance very low, leading to a flood of junk.

Insufficient information transparency: For high liquidity meme projects, everyone in the market can enter early, which means that whether the project is built for the long term has become less important; what matters is how to profit in the competition.

Soaring trust costs: High liquidity means high competition. The first day of circulation means we have no mechanism to bind interests with the founders for long-term win-win outcomes; everyone can easily become opponents, turning into each other's exit liquidity, making this trust structure dangerous and unsustainable.

I strongly agree with @yuyue_chris writing about the differences in mindset among different participants:

Those playing with memes believe: narrative > chip structure ~ community or sentiment > product technology;

The primary market believes: narrative > product technology ~ chip structure > community or sentiment;

The meme model is essentially a darker on-chain world than the VC model. Due to the lack of product and technological support, "absolute fairness" is often just a facade. Look at Libra; every carefully planned public benefit by the cabal behind the market ultimately made us targets for precise harvesting. They can always predict your predictions, and in a highly competitive environment, true long-term builders become difficult to identify.

I do not believe that VCs will disappear, as this world is full of significant information asymmetry and trust asymmetry. For example, resources like ARC are absolutely not something an ordinary developer can access.

However, in the face of such a wave of populist capitalism, it is unrealistic for VCs to simply leverage information asymmetry to make money as easily as in the past. Adapting to change has never been easy, especially when market paradigms are completely restructured, and previously effective methodologies are rapidly eliminated. The rise of meme financing is not coincidental but rather a result of deeper liquidity transformations and the reshaping of trust mechanisms.

When the high liquidity of memes and short-term competitive thinking collide with the long-term support and value empowerment of VCs, finding a balance between the two is a problem that current VCs must face. On one hand, Primitive is fortunate to have the freedom and flexibility to respond to market changes, but recognizing structural changes and adjusting investment strategies is by no means an easy task.

But no matter how the market changes, one thing remains unchanged—what truly determines long-term value are those visionary founders with strong execution capabilities who are willing to continue building.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。