Enter before others notice, exit when everyone knows.

Author: Foxi (DeFi / AI)

Compiled by: Deep Tide TechFlow

Someone has to do this!

I have created the ultimate Sonic guide for everyone (especially for those who are not yet familiar with the DeFi Flywheel).

@AndreCronjeTech has been recommending over 20 projects daily recently, and I have filtered out some high-quality projects worth paying attention to share with you.

I started getting into cryptocurrency during the DeFi Summer craze in 2020, and I am very excited to see AC and its chain making a comeback!

This article will delve into the latest developments of Sonic, just like previous tutorials. However, before we officially start, I will first introduce the risks that newcomers may face when participating in the DeFi Flywheel ecosystem.

Important Reminder: I will not be responsible for your investment losses, but I hope this article helps you understand the mechanisms of the DeFi Flywheel.

(If you only want to know about "CA," you can jump directly to section four.)

This article includes the following content:

I. Flywheel = Ponzi Scheme? When to Exit?

II. What is Sonic, and why choose Sonic?

III. New Tokenomics

IV. Selected Ecosystem Opportunities (Recommended by Foxi)

I. Flywheel = Ponzi Scheme? When to Exit?

In many core mechanisms of the DeFi Flywheel, there is a common phenomenon: the timing of capital input is mismatched with its true value being recognized by the market. This phenomenon can be simply summarized as—“Enter before others notice, exit when everyone knows.”

Early liquidity injections often generate potential energy, attracting more users to participate, thus forming a self-reinforcing growth cycle. In simple terms, early participants can gain compound returns through the accumulation of liquidity and the increased awareness of the system.

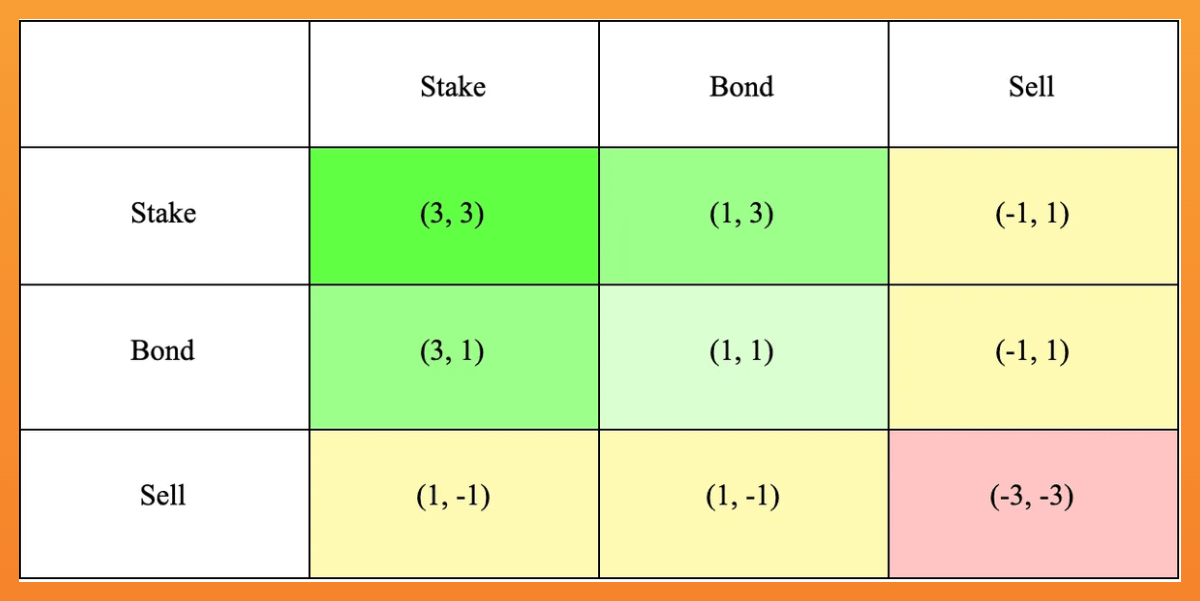

The classic ve(3,3) model is designed to ensure that everyone is willing to "stake" tokens.

@AndreCronjeTech launched the ve(3,3) tokenomics model through the Solidly Exchange on the Fantom network in the previous cycle.

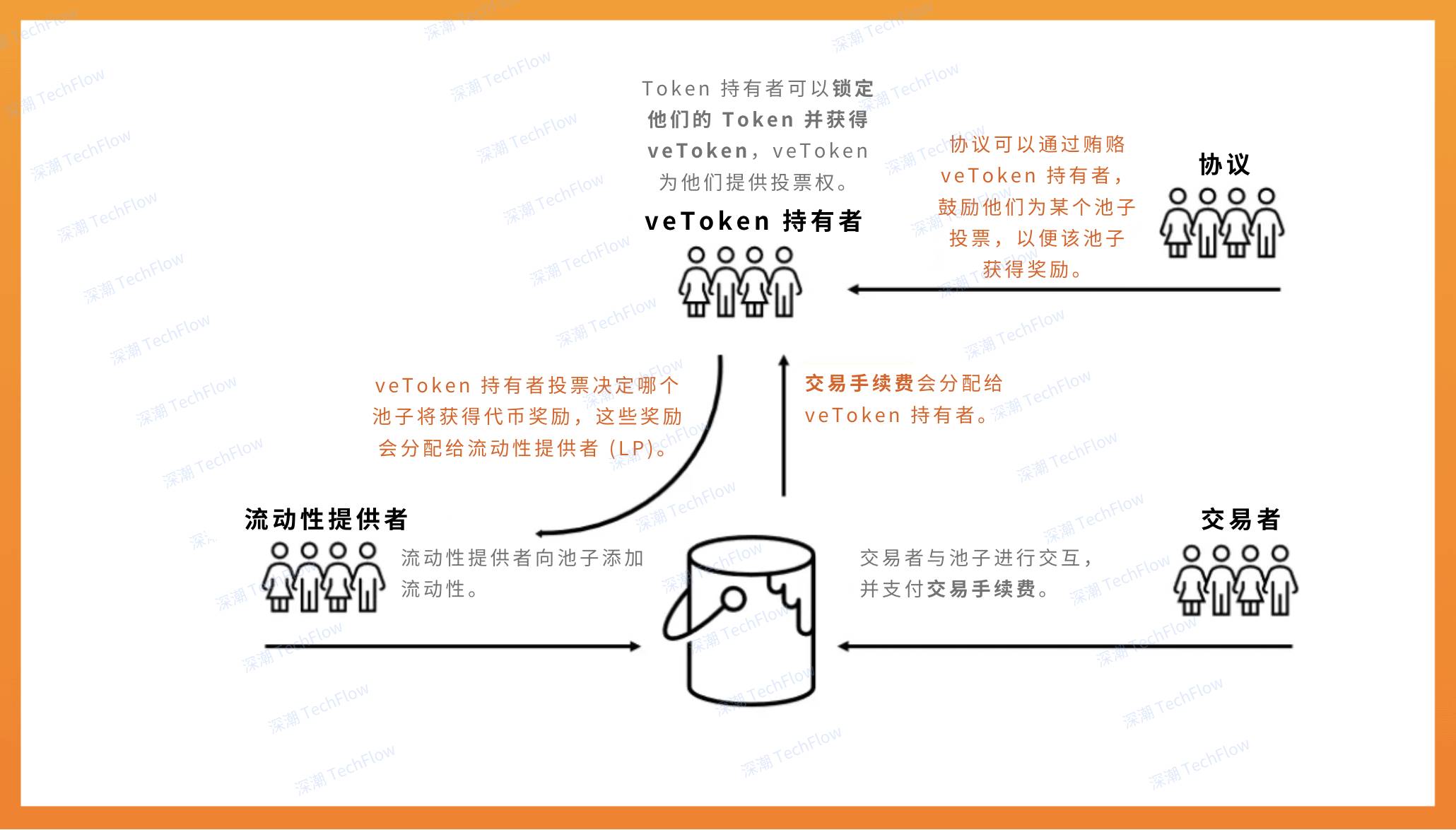

This model combines the voting escrow mechanism (ve) of Curve Finance and the (3,3) game theory of Olympus DAO, reducing sell pressure while enhancing the sustainability of the system through incentive designs for token holders and liquidity providers.

The core of the ve(3,3) model is to reward those who lock up their tokens with trading fee rewards, thus aligning the incentive mechanisms within the system. It aims to address the high inflation issues caused by liquidity mining, shifting the focus to creating value through trading fees rather than relying solely on the passive issuance of tokens.

As Fantom rebrands to Sonic, the ve(3,3) (also known as the DeFi Flywheel) remains the core concept of Sonic DeFi.

How ve(3,3) works. Original image from Foxi (DeFi / AI), compiled by Deep Tide TechFlow

The Flywheel is one of the important engines driving the DeFi craze. For example, Andre Cronje's product @yearnfi is a typical case, with its token YFI skyrocketing from $6 to over $30,000 in less than two months. However, like many other memecoins, this craze eventually calms down. For most crypto projects (excluding Bitcoin), the most important question remains: When to enter, when to exit.

As a classic summary states: “Enter before others notice, exit when everyone knows.”

II. What is Sonic? Why choose Sonic?

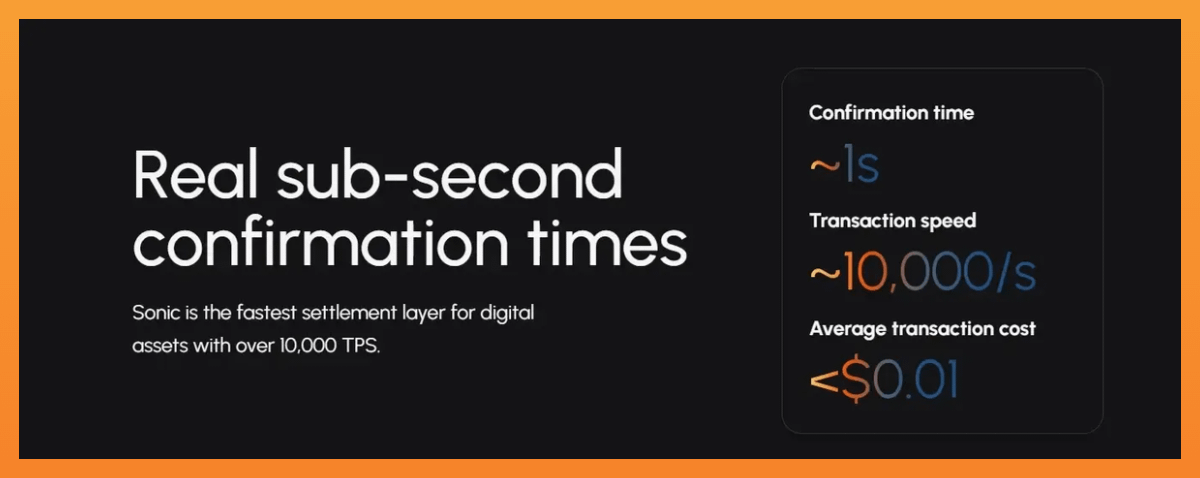

You may not have noticed, but Sonic was formerly known as Fantom. It is a high-performance Layer-1 blockchain network that supports over 10,000 transactions per second and has sub-second finality. Its native token $S can be used to pay transaction fees, participate in staking, and governance, and existing Fantom users can upgrade $FTM to $S at a 1:1 ratio.

Although there are many low-latency Layer-1 solutions on the market, Sonic's rise is attributed to three core reasons:

The return of DeFi OG Andre Cronje, who is personally leading the project.

Airdrop Plan: Sonic plans to distribute 190.5 million $S (about 6% of the total supply) through reward activities to attract new users (details in section three).

DeFi Comeback: As enthusiasm for memecoins gradually fades, people are starting to refocus on DeFi projects with more fundamental value, as evidenced by the poor performance of $SOL.

Recent capital inflows also show market interest in Sonic:

The native token $S rose by 113.5% in just 14 days.

Sonic's Total Value Locked (TVL) grew by 70% in 7 days, making it the best performer among all reasonably sized chains.

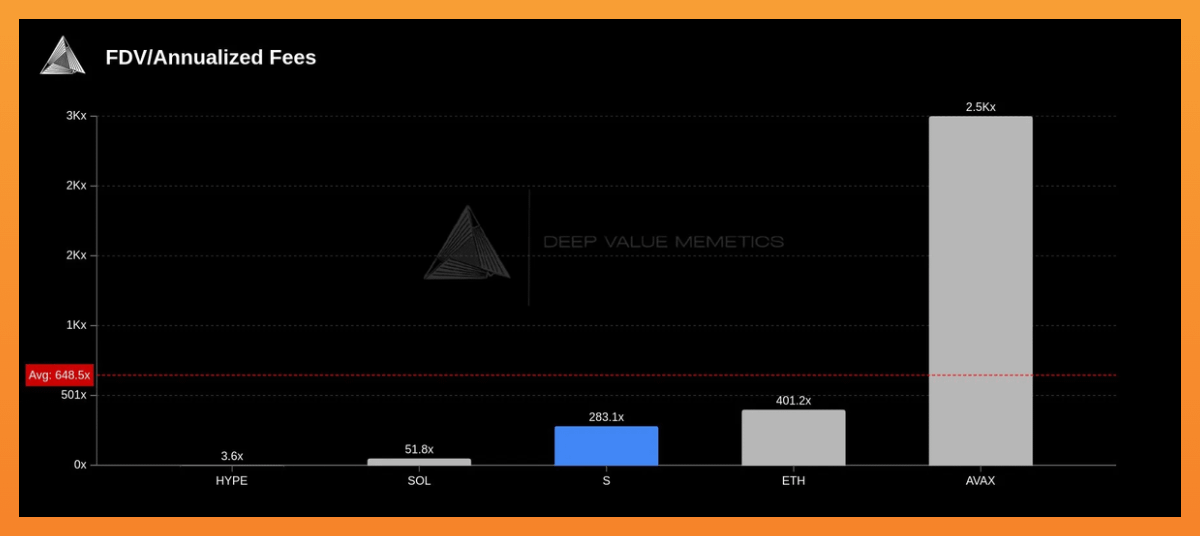

The FDV/Fee ratio is only 283 times, which is 57% lower than similar projects, indicating that Sonic's valuation may be underestimated.

Source: @DV_Memetics

Sonic ranks first in the 7-day TVL growth leaderboard.

III. New Tokenomics (Important Information Worth Noting)

Supply and Inflation Mechanism

The total supply of Fantom's FTM token is approximately 3.175 billion (almost fully diluted). Sonic's initial supply is the same, ensuring that existing FTM users can exchange it for $S at a 1:1 ratio. However, $S is not a fixed supply token; it supports the continuous growth of the ecosystem through a controlled inflation mechanism.

Approximately 6% of the total supply of $S (about 190.5 million $S) is minted for user and developer incentives, and these tokens will be distributed through airdrops within about 6 months after the project launch. Therefore, there will be no new token supply (unlocking) before June 2025, which may be a good time for short-term trading.

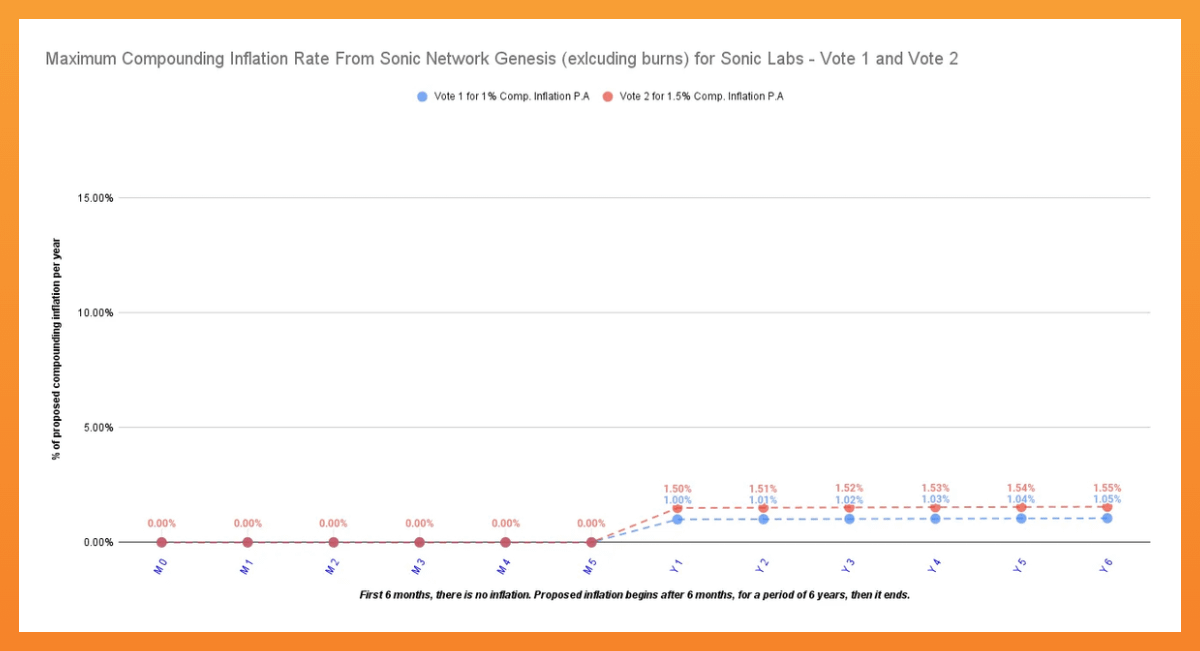

Inflation Plan

To support the continuous development of the ecosystem, $S will experience an inflation rate of 1.5% per year for the first 6 years (approximately 47.6 million $S added in the first year). If all these tokens are utilized, the total supply of $S may reach approximately 3.66 billion after 6 years. In contrast, the issuance of FTM tokens is nearly complete, and there are no new token distribution plans (except for remaining staking rewards). Sonic, on the other hand, adopts a different strategy, moderately introducing inflation to support ecological growth while setting strict limitation mechanisms—any unused ecological fund tokens will be burned, thus avoiding the risk of excessive inflation.

Fee Burn and Deflationary Mechanism

The economic model of FTM did not introduce a large-scale fee burn mechanism. In Fantom's Opera network, gas fees are mainly allocated to validators (after 2022, 15% is allocated to developers), so FTM is actually inflationary (the issuance of staking rewards exceeds token burns).

In contrast, Sonic's $S introduces various deflationary mechanisms to balance the issuance of new tokens. For example, 50% of transaction fees on Sonic will be burned by default (transactions not participating in the gas reward program). If network usage is high enough, $S could even become a net deflationary token.

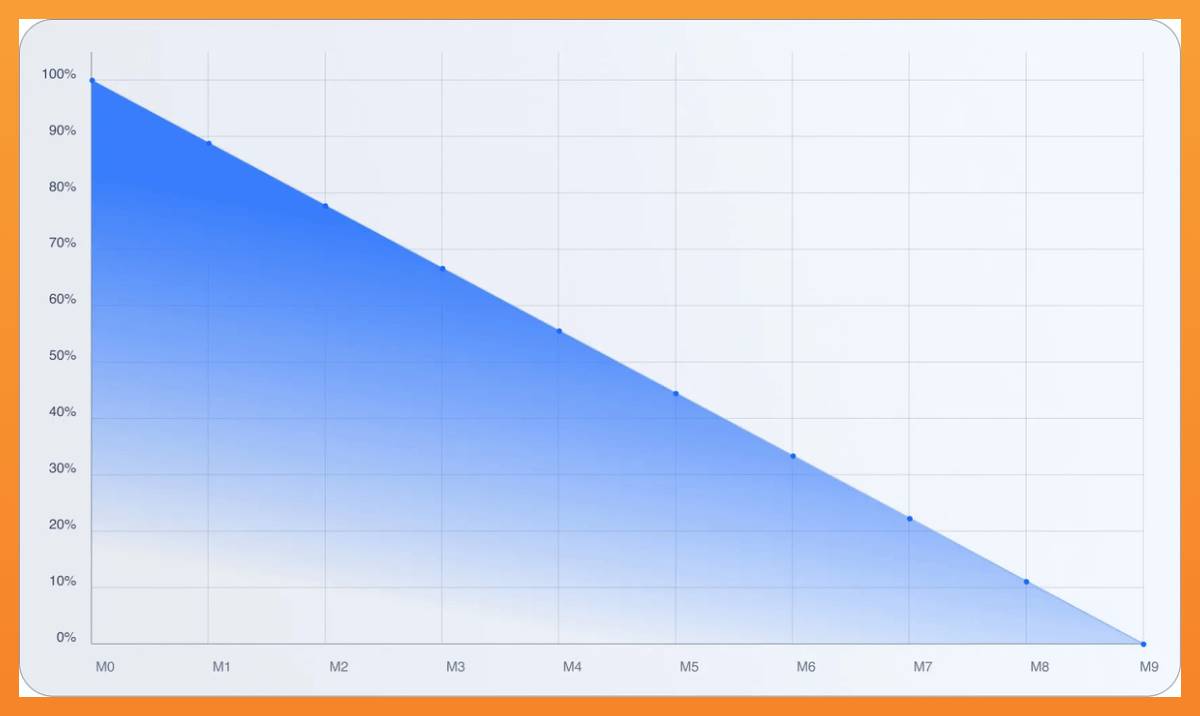

Additionally, Sonic's airdrop design employs a "unlock and burn" mechanism: users can immediately claim 25% of the airdrop tokens, but the remaining portion must be claimed in stages. If users choose to unlock faster, they will need to forfeit some tokens as a penalty to reduce short-term selling behavior.

Burn mechanism for airdrop distribution

Finally, any unused 1.5% annual ecological funds will be burned. These burn mechanisms, combined with a controlled token release plan, are expected to significantly reduce the circulation pressure of tokens during the 6-year inflation period, helping $S gradually shift towards a deflationary trend after the initial growth phase.

User Incentive Program! (Airdrop Benefits)

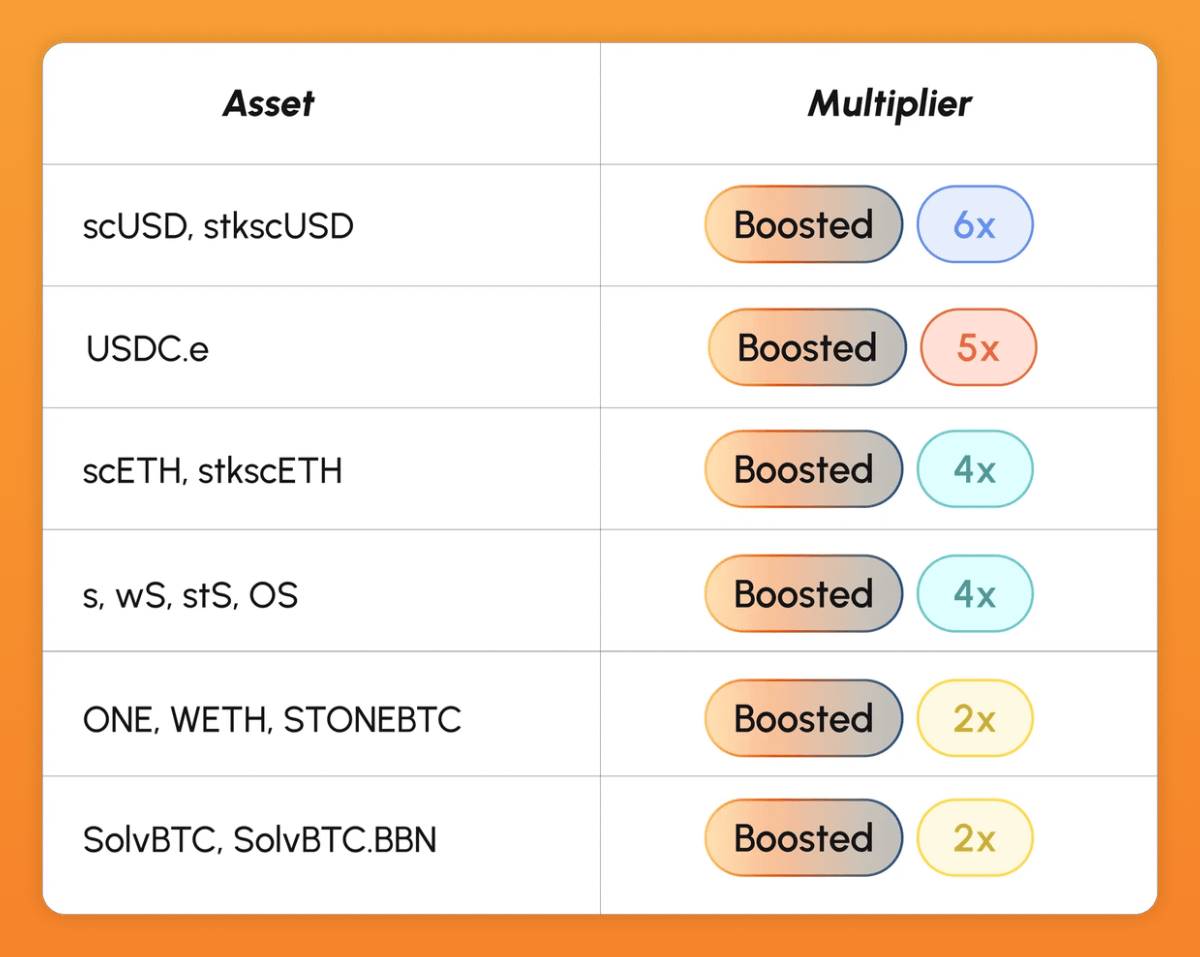

As mentioned earlier, Sonic will distribute 190.5 million $S tokens as user rewards. You can participate in the airdrop by:

Holding Whitelisted Assets: Store eligible assets in your wallet (Note: Do not store assets in centralized exchange wallets).

Participating in Sonic's DeFi Protocols: For example, staking $S, providing liquidity (LP) on DEXs, participating in yield farming, etc. It is important to note that the points weight for DeFi activities is twice that of merely holding assets, meaning users who actively participate in DeFi activities can earn more rewards. (For details, please visit: Sonic Labs Platform)

Make sure your tokens are stored in a non-centralized wallet to avoid missing the airdrop opportunity!

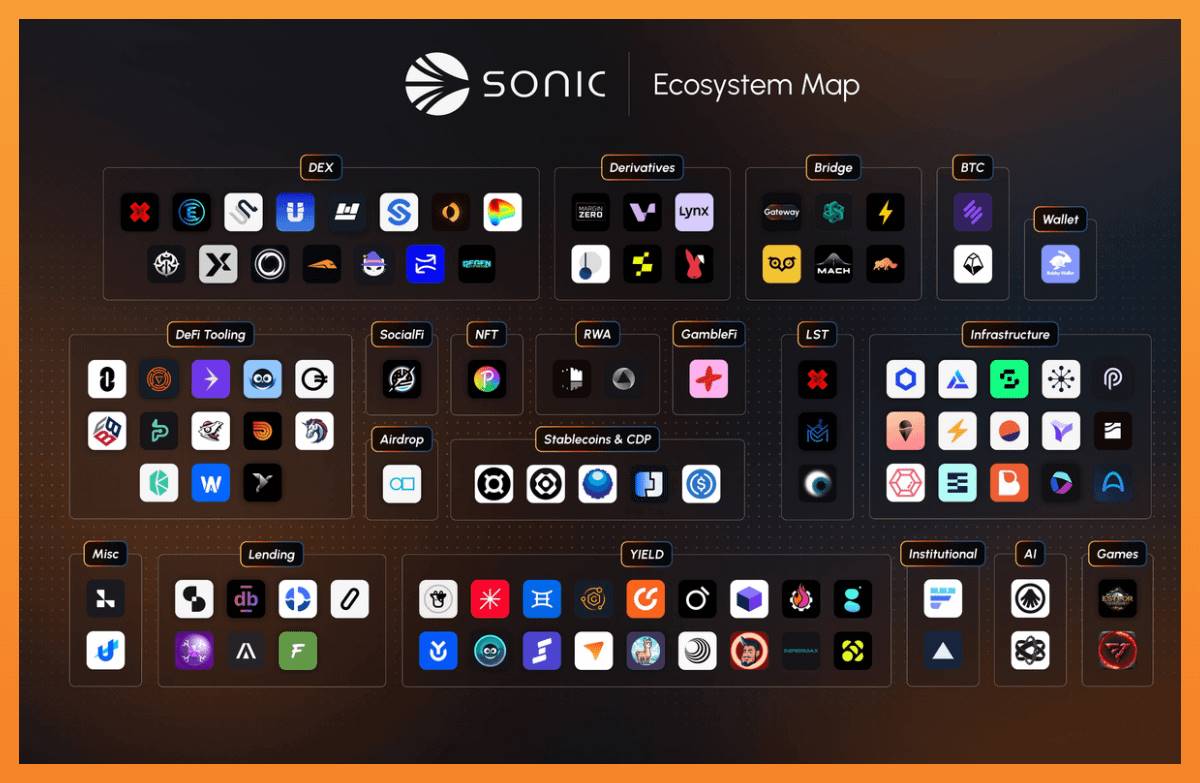

IV. Ecosystem Opportunities

You can obtain $S airdrops by holding eligible assets or participating in Sonic's ecosystem activities. As a brand new ecosystem, many new projects in Sonic may come with higher founder risks, but they may also bring you returns of 10 times or even 100 times. Here are a few carefully selected potential opportunities covering four areas: decentralized exchanges (DEX), lending protocols, derivatives, and meme projects (these recommendations are non-paid and for personal reference only).

It is important to note that while there are many projects on Sonic, most are not true "investment opportunities." They are either not native Sonic projects or have been online for a while. Here are a few potential projects worth special attention:

DEX

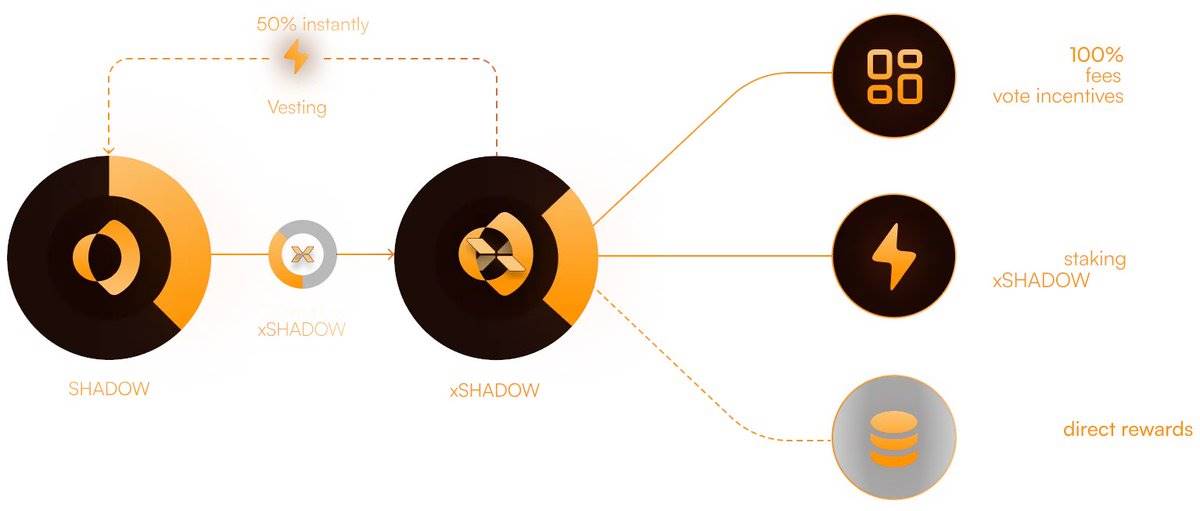

This is the main native DEX on Sonic, with a current total locked value (TVL) exceeding $150 million, providing incentives of up to $13.73 million weekly. Its innovative x(3,3) token model offers users greater flexibility: users can choose to exit immediately or unlock in stages to gain more rewards, without the need for long-term locking like the ve(3,3) model. Additionally, the protocol employs a "PVP rebasing mechanism," imposing a 50% voting power penalty on users who choose to exit early, reducing token dilution and encouraging long-term holding.

The highlight of this mechanism is the "penalty" design: users can choose to exit early by sacrificing part of their rewards, thus achieving a balance between flexibility and stability.

MetropolisDEX is a decentralized exchange on Sonic that uses a dynamic liquidity market maker (DLMM) protocol, combining the advantages of automated market makers (AMM) with order book functionality. This design provides users with a more efficient trading experience, especially suitable for those familiar with the Solana ecosystem and investors who participated in the Meteora project.

Vertex Protocol is a comprehensive DEX offering spot trading, perpetual contracts, and currency market services, while supporting cross-margin trading. Its main advantages include extremely low trading fees (0% maker fee, 0.02% taker fee), fast order execution speed, and cross-chain liquidity support. The development team behind it is experienced and a trusted player in the DeFi space.

This is a native DEX on Sonic that has performed exceptionally well. In less than two months, the platform processed up to $1.2 billion in trading volume. Users earned over $3.6 million in fee revenue through liquidity provision (LP) strategies. The protocol leverages Sonic's speed and high scalability to offer users higher-yield strategies. With these advantages, @wagmicom has the potential to become a strong competitor to Shadow.

Lending

This is a permissionless and risk-isolated lending protocol that allows users to quickly create new trading markets without additional integration. Its peak daily trading volume reached $125 million, demonstrating strong market activity.

A smart contract-based lending platform that supports collateralized lending. The protocol also features trading fees and liquidation events, providing users with diverse lending options.

This is a modular lending protocol that supports permissionless lending operations, similar to the Morpho protocol on Ethereum, suitable for advanced users and developers.

A lending protocol focused on leveraged yield farming, while also supporting low collateral loans, providing users with more flexible financial tools.

Derivatives

This is a meta-asset protocol focused on yield-bearing stablecoins. It provides deep liquidity for Sonic's DeFi ecosystem and funds ecological projects through a locking mechanism.

An interest rate derivatives protocol that allows users to trade yields and supports fixed-rate functionality. It not only helps users hedge yield fluctuations but also provides additional interest rewards for liquidity providers.

A yield aggregator that helps users simplify yield farming operations while achieving automatic rebalancing of assets.

This is a platform focused on volatility trading, fully decentralized and without relying on oracles. Through the AMM model, it offers users commission-free token trading and liquidity services, making it an innovative choice.

This is a derivatives trading platform that supports perpetual contracts (Preps), focusing on providing users with efficient trading tools.

Meme

This is one of the most important NFT projects in the Sonic ecosystem, receiving significant community attention.

A native launch platform for Sonic that has also launched its own NFT series, providing users with more diverse participation options.

A meme project based on the Sonic ecosystem, with an active and loyal community, playing an important role in the ecological culture.

Finally

Do you remember the phrase we started with? “Enter before others notice, exit when everyone knows.”

As more and more people discover and participate in the growing ecosystem of Sonic, the virtuous cycle of this ecosystem will become stronger and more sustainable. For every participant, this means deeper liquidity, more solid consensus, and more opportunities, rather than getting caught up in the scams and short-term speculation of memecoins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。