In recent years, there has been an ongoing debate in the market about "integrated networks vs. modular networks."

The advantage of integrated networks lies in their more unified architecture, ecosystem, and liquidity, making it easier to create network effects. However, the downside is the difficulty in scaling and relatively less flexibility. Modular networks, by decoupling layers such as consensus, data availability (DA), execution, and settlement, can achieve more efficient scaling and flexible adjustments, but the layered architecture struggles to resolve the disconnection issues of applications, liquidity, and security.

Solana and Ethereum can be seen as the main representatives on the paths of integration and modularity, respectively. The former consistently adheres to a single-chain logic and has successfully nurtured the most vibrant and wealth-generating single-chain ecosystem in the industry; the latter focuses its development on the Rollup layered route, aiming to create a generalized Ethereum ecosystem of Layer1 + Layer2.

In this cycle, the secondary performance of SOL and ETH has shown a stark contrast, suggesting that the market is gradually growing weary of the fragmented modular architecture and is increasingly leaning towards integrated solutions. On January 24, even Ethereum co-founder Vitalik subtly acknowledged the Layer2 route in a personal article, suggesting that Ethereum itself as Layer1 should also accelerate scaling.

At least at this stage, the debate of "integrated networks vs. modular networks" has seen the former gaining the upper hand.

However, Solana, as a representative of integrated public chains, is not without its flaws. Its core limitation lies in the lack of native data availability, relying on external storage to save historical transaction data, leading to delays and reliability issues in data access. Additionally, under high load, Solana still faces risks of network congestion or downtime, affecting overall stability. Therefore, the market's demand for integrated architecture is not only for high throughput but also requires optimization in performance, data availability, and ecosystem integration.

Against this backdrop, Supra has emerged with a more thorough concept of "integrated public chain." While ensuring high performance, Supra natively supports data availability, fundamentally addressing the shortcomings of integrated architecture. Its goal is to build a fully vertically integrated public chain that provides complete blockchain infrastructure within a single network, including consensus, execution, data storage, oracles, and cross-chain interoperability, ensuring that developers and users can enjoy a smooth and seamless experience. As the market's demand for more stable and efficient infrastructure continues to grow, Supra is becoming a new direction for the development of integrated public chains.

Supra: The Ultimate Form of Integrated Network

Supra itself is a high-performance blockchain that achieves a throughput of 500,000 transactions per second through a new Moonshot consensus protocol, with sub-second consensus latency, but its greatest feature lies in its integrated architecture.

The basic development philosophy of Supra can be highly summarized as "fully vertically integrated," meaning it provides almost all blockchain-related services on a single network, ensuring a unified and smooth user experience for both users and developers.

As a latecomer public chain, Supra can evaluate the previous "integrated networks vs. modular networks" game from a higher-dimensional perspective and directly absorb the lessons learned. In Supra's view, the key to the integrated network gradually winning the market lies in the unification of development (to developers) and usage (to users) experiences. However, Supra more aggressively believes that "the level of unification in traditional integrated networks is still insufficient"—in real development and operational environments, most DApps still rely on multiple third-party services providing oracles, cross-chain communication, on-chain randomness, etc., which objectively increases integration complexity, security risks, and development costs. Therefore, Supra aims to build a "fully vertically integrated" blockchain that supports native oracles, randomness, automation, and cross-chain communication, providing developers with a more powerful, coordinated, and user-friendly underlying network.

To further enhance the applicability of a single network, Supra will support multiple mainstream virtual machines, including EVM, SVM, MoveVM, and Cosmos, allowing developers from different ecosystems to migrate directly to Supra without the need for secondary construction.

Additionally, to address the lack of flexibility in traditional integrated networks, Supra offers an application chain solution known as "containers." Each Supra "container" allows developers to customize governance models, gas tokens, and economic incentive models. However, to prevent liquidity fragmentation issues similar to Ethereum Layer2, each Supra "container" supports sharing the liquidity pool of Supra Layer1, allowing for the on-demand use of resources from the Supra mainnet. This way, developers can build dedicated application environments using Supra "containers" without worrying about liquidity fragmentation that could compromise "unity."

Dissecting the Core Architecture of Supra

To understand the architecture of the Supra network, we can start from the following key innovations:

Moonshot Consensus Engine: Moonshot is Supra's original consensus protocol, where the transmission, ordering, and execution of transactions can run in parallel, effectively reducing processing time and achieving a throughput of 500,000 transactions per second with sub-second consensus latency.

"Tribe and Clan" Node Architecture: Supra employs a hierarchical architecture for node management known as "tribe and clan," where tribes consist of numerous large nodes, and clans refer to randomly selected small node collections within the tribe. This is a dynamic node management and coordination system designed to achieve efficient parallel processing in multi-task scenarios.

Distributed Oracle Protocol (DORA): Supra will provide demand-based (pull) and streaming (push) data services through its DORA, including cryptocurrency price oracles, foreign exchange rates, stock indices, and weather data. This data not only serves the Supra blockchain but also supports other blockchain networks.

Distributed Verifiable Random Function (dVRF): Similar to DORA, Supra will also provide demand-based and streaming distributed verifiable random functions (dVRF) for generating and distributing random number services.

Automation: Supra supports automated trading preset for specific time points or on-chain events (including off-chain events transmitted by DORA), allowing users to set operational strategies in advance for potential different scenarios.

IntraLayer: Supra can connect to other Layer1 and Layer2 ecosystems using the multi-signature cross-chain protocol HyperLoop and the trustless interoperability solution HyperNova, achieving multi-chain interconnectivity in a more secure manner.

Multi-VM: As mentioned earlier, this refers to the support for multiple virtual machines, including EVM, SVM, MoveVM, and Cosmos, covering all mainstream development environments in the industry.

Containers: The previously mentioned application chain solution allows developers to create dedicated application execution spaces (DappSpace), freely customizing execution environments without the need for bridging or liquidity fragmentation.

The Development Journey of Supra

What many people may not know is that Supra is actually an academic blockchain, led by Chief Research Officer Dr. Aniket Kate, one of the inventors of KZG Polynomial Commitments, a technology widely recognized in the field of cryptography and extensively used in the scaling routes of several projects, including Ethereum.

Supra's predecessor was the oracle service SupraOracles and the middleware service layer IntraLayer. However, during the actual development process, the Supra team gradually discovered that relying solely on isolated services was insufficient to meet the complex demands of a complete blockchain infrastructure. Therefore, the team decided to take a step further and build a blockchain capable of supporting large-scale applications, users, and liquidity from the most fundamental dimensions of architecture and consensus.

Supra has previously raised $42 million through multiple rounds of financing, with investors including well-known institutions such as Animoca Brands, Coinbase Ventures, Galaxy Interactive, Hashed, HashKey, and Huobi.

In August 2024, Supra launched its incentive testnet and processed over 9 million transactions through interactive tools like Dice Vision and Astro Predictions, with its Blastoff event attracting over 510,000 users.

In November 2024, the native token of the Supra network, SUPRA, officially underwent TGE and quickly listed on major exchanges such as ByBit, Kucoin, Gate, and MEXC. According to CoinGecko data, as of the time of writing, SUPRA is priced at $0.01037, with a circulating market cap of approximately $75.89 million and a total market cap of about $823 million.

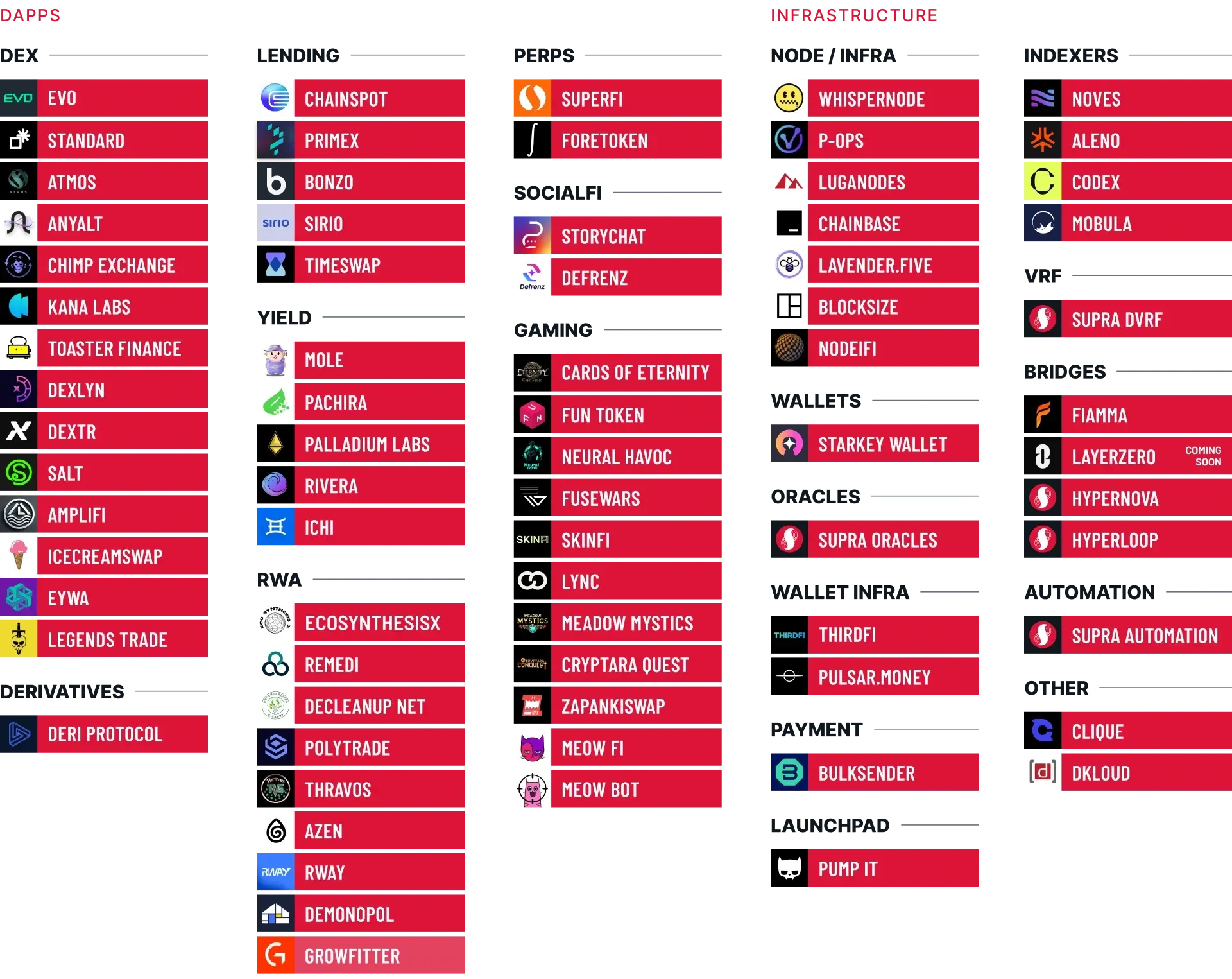

The historical patterns of industry development have proven that high-quality underlying networks can always attract more developers, thereby nurturing a more diverse ecosystem. Official data from Supra shows that although it has only been about half a year since the testnet went live, over 70 projects are currently under continuous development on Supra, covering various categories including infrastructure, wallets, nodes, payments, lending, DEX, Launchpad, Yield, RWA, derivatives, social, and gaming.

Accelerating Industry Development, Supra is Ready to Launch

Entering 2025, the market trend has surprised many. Despite continuous macro-level benefits, the overall market deleveraging and the fading of meme speculation have led to significant corrections in the altcoin market, excluding Bitcoin, and SUPRA has not been spared.

However, it is undeniable that with the "crypto-friendly" Trump cabinet taking office, the advancement of cryptocurrency strategic reserves, and the continuous inflow of major cryptocurrency ETFs, the industry is moving towards compliance and mainstream acceptance in an irreversible trend.

Looking ahead, the next few years may be the most favorable growth environment in the industry's history, with the most friendly operational conditions. During this "golden time," it is expected that more and more users and funds will continuously enter the market, bringing new challenges to the existing blockchain's load capacity and development applicability.

Supra is already prepared for this. When the demand for performance and experience in underlying networks is relatively low, the differences between major blockchains may not be significant. However, as demand expands exponentially, Supra's latecomer advantage will gradually become apparent. At that time, it may be the true value discovery period for Supra.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。