Idle funds participation may yield unexpected rewards.

Author: Ice Frog

As the leader in the re-staking sector, Babylon has registered its foundation account tonight, indicating that the TGE is imminent. Below, we will delve into the project details of Babylon and the value of participating in the airdrop.

I. Project Overview: Strong Team, Luxurious Investment Lineup

1.1 Founding Team

The founding team of the project has a strong academic background. Although there are many Chinese faces in the team configuration, most of the key management personnel are overseas individuals. Here is a brief introduction to the main founding team and core management.

David Tse (Co-founder): Top academic credentials, a member of the National Academy of Engineering, and a professor at the University of Chicago and Stanford University.

Mingchao (Fisher) Yu (CTO and Co-founder): Former lecturer at the Australian National University, later served as a senior research engineer and principal engineer at Dolby Laboratories.

Dong Xinshu (Chief Strategy Officer): Co-founder of RockX and Zilliqa, and a well-known VC technical partner at IOSG Ventures.

Sankha Banerjee (Chief Protocol Economist): Graduated from MIT and previously worked at Nibiru.

Spyros Kekos (Community Head): Previously served as the community head at the exchange Gate.io.

In addition to the above personnel, a detailed look at the project management team reveals that most core members have at least 3-5 years of relevant experience in their positions or have worked in well-known projects or exchanges. This reflects that the entire management team of Babylon has rich blockchain experience, which will make the project's operation more mature and aligned with industry development.

Moreover, David Tse's status as an academician and his extensive academic background instill confidence in the project's technical capabilities. Additionally, many core team members have investment backgrounds, indicating that the project has ample channels for investment resources, which is directly reflected in its financing situation.

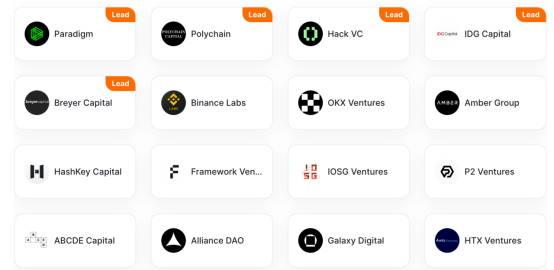

1.2 Investment and Financing Situation

From the perspective of financing rounds, Babylon took a full year from seed round to Series A, but the speed and amount of financing from Series A to the mainnet launch increased rapidly. This indicates that during the early development stage, the project invested considerable effort into the testnet before starting the next round of financing. The last round of financing in May 2024 amounted to $70 million, with a total financing scale of $96 million, which is quite substantial.

The investment team is also very luxurious, with a diverse investment background.

As shown in the image above, in addition to traditional top VC funds like Paradigm and Polychain, the exchanges represented include leading platforms like Binance and OKX.

On the individual investor side, notable figures include Ajit Tripathi (former ConsenSys fintech partner), Ryan Fang (former co-founder of Ankr), and Jia Yaoqi (founder of AltLayer).

It can be seen that the financing background is indeed luxurious, encompassing various types and backgrounds of investment funds, which means that the project has abundant resources.

In summary, the project places great emphasis on team experience and technical reserves, while also being comprehensively configured. It represents a high-profile yet realistic team setup, ensuring the sustainability of the project's operations and its long-term development. From a financing perspective, the diverse backgrounds of VCs provide comprehensive support for the project in various resources, indicating that capital is optimistic about the sector in which the project operates and suggesting that the project has significant growth potential.

II. Project Advantages: Leveraging POW Security to Activate BTC

There have been many analyses regarding re-staking and Babylon. In summary, there are several points of consensus regarding Babylon, which are also its main advantages.

1. Focus on Activating Idle Assets in the BTC Network to Promote BTC Ecosystem Prosperity

BTC is BTC, and cryptocurrency is cryptocurrency. As BTC accounts for a significant portion of the entire crypto market, how to make BTC assets flow and operate has always been a major challenge.

Historically, BTC holders have been reluctant to move BTC from their wallet accounts due to security concerns. After all, in a custodial model, the asset loss caused by private key leakage is something no BTC holder can bear or accept. They would rather let their assets sit idle than take any risk, especially since the BTC mainnet itself is Turing incomplete and cannot use smart contracts for secure cross-chain operations like Ethereum. Therefore, under the influence of this inherent perception and the shortcomings of the BTC network, the asset value of BTC and its utilization rate have always been highly disproportionate.

Babylon addresses this pain point by creating a trustless self-custody staking protocol. In simple terms, under this solution, users can achieve secure staking while retaining control over their assets. The staking process utilizes the security of the POW mechanism on BTC to enhance the security of various POS chains, thereby achieving mutual benefits. To realize this, Babylon has its unique technology, which is one reason it is widely recognized in the market.

2. Bitcoin Timestamp and Staking Protocol as the Two Pillars of Technology

For POS chains, especially those using Byzantine fault tolerance mechanisms, most require a 2/3 vote to confirm blocks. Although most POS chains avoid fork attacks through penalty measures, without additional trust sources, such attacks are nearly impossible to prevent.

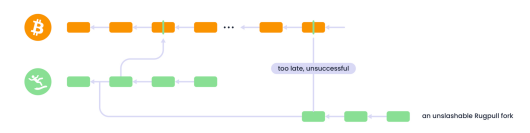

Therefore, some POS chains bind security to stakeholders, which leads to longer un-staking times. In light of this, Babylon's main solution is to migrate the block checkpoints of the entire POS chain to the Bitcoin network. Due to the POW characteristics, if an attacker chooses to fork for an attack, their timestamp on the Bitcoin chain will be later, effectively preventing remote attacks through the Bitcoin timestamp.

A more vivid analogy is that the Bitcoin network's timestamp acts as a race record system, where all participants' finishing times are recorded. If a participant attempts to tamper with their finishing time, the Bitcoin network will detect the inconsistency and reject it. If they forcefully tamper, they must create a fork longer than the Bitcoin network, which is nearly impossible in terms of cost. Another benefit of this technology is that it can significantly shorten the un-staking time on POS chains while providing stronger resistance to censorship.

In terms of the specific staking protocol, the project employs remote equity staking, which means locking the staked Bitcoin in a contract on the Bitcoin chain. If the staker violates the PoS chain protocol, the Bitcoin they staked will be penalized on the Bitcoin chain. The main technology used is Bitcoin covenant emulation, which is based on improvements to the UTXO characteristics of Bitcoin. Specific technical details will not be elaborated here, but according to the official website, the main path can be referenced as follows.

As shown in the path above, specific rules based on Bitcoin covenant technology can ensure the execution of unbinding and penalty of Bitcoin staking.

3. Cross-Chain Between BTC and Various EVM Chains, Empowering the Security of the Cosmos Ecosystem

To some extent, Babylon does not belong to crypto asset equity staking, nor does it resemble Eigenlayer's characteristic layer network for security. It is more akin to an innovative use case of cross-chain equity staking protocols. In fact, the empowerment of POS chains does not rely on Bitcoin assets but rather on the POW computing power mechanism of the Bitcoin network.

Since Babylon's cross-chain communication technology and security sharing come from Cosmos, the project itself leverages the security sharing of the Bitcoin network, which greatly promotes the Cosmos ecosystem. For Cosmos chains, they will actively embrace the security sharing brought by Babylon's innovations, benefiting the entire ecosystem.

III. Development Prospects: Potential Scale is Promising, but There Are Many Challenges

As the current largest re-staking project in the BTC ecosystem, Babylon currently has over $5.5 billion locked in value, with 56,000 BTC staked. Compared to the total supply of 21 million BTC, the overall participation rate is only 0.26%. Even if the participation rate reaches 1%, the overall TVL still has more than four times the growth potential. From the perspective of the overall upper limit scale, there is indeed significant room for improvement, which may also be why many investors are willing to provide substantial financing.

From another unfavorable perspective, Babylon faces numerous challenges and growth dilemmas. Whether it is the recognition of POS chains or the participation of BTC holders, continuous education costs and habit formation are required. This is especially true for large BTC holders, who will be more cautious in their participation.

Additionally, a key consideration is that as Bitcoin ETFs and publicly listed companies begin to accumulate Bitcoin reserves, Bitcoin in the market is gradually shifting towards institutions and large holders. If Babylon wants to further increase its participation level, it still needs to continue innovating and operating to create more attractive solutions for institutions and large holders.

IV. Airdrop Opportunities and Risk Analysis: Idle Funds Participation May Yield Unexpected Rewards

From the previous analysis, we can see that Babylon has its unique strengths in terms of technology, financing, and team. It also has ample upper limits in the long-term space. As an industry leader, with the TGE approaching, for many users looking to participate in airdrops, the question of whether there is value in participation will be further analyzed with data.

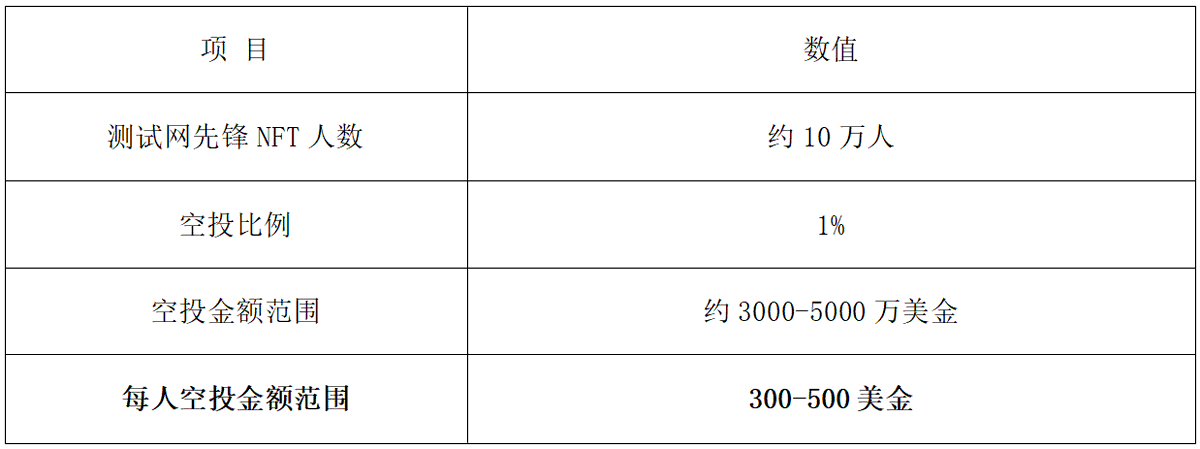

4.1 Testnet: Officially Clarified No Incentives, but Considering Zero Cost, Participation Can Be Appropriate to Prevent Missing Out

On January 8, the project launched the second phase of the testnet, with official documents repeatedly emphasizing that there are no incentives for the testnet. Given the zero cost, it can be appropriate to participate to prevent missing out. Based on estimated airdrop shares, if there are subsequent airdrops, early testnet participants may receive an average of $300-500.

4.2 Mainnet Points: Annualized Yield is Good, Idle Funds Can Participate

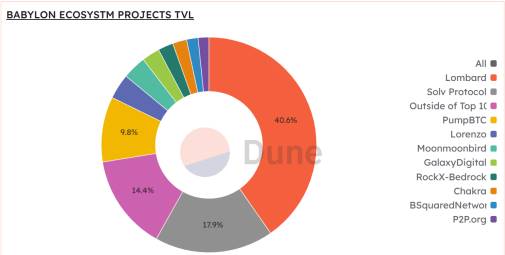

Currently, to obtain airdrops, one can only earn points through associated projects. These points can be exchanged for future airdrops, with the main staking projects being Lorenzo, Solv, etc. Lorenzo accounts for 40% of the total staking volume and is also a project that has received significant funding without issuing tokens.

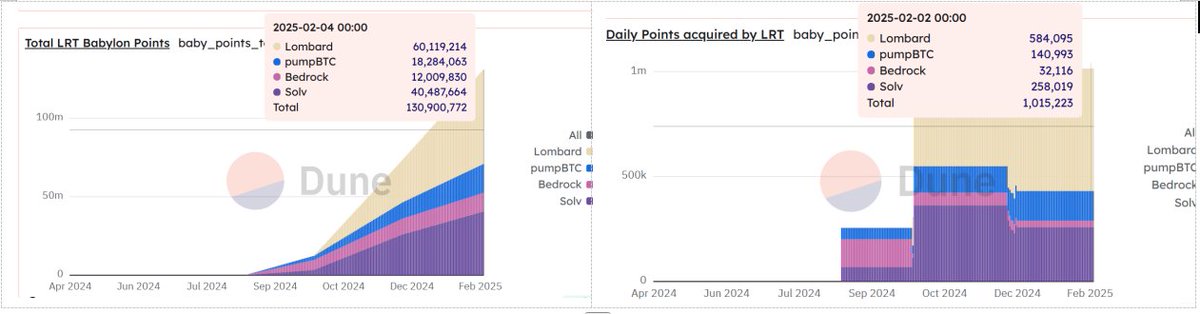

According to Dune dashboard data, the current total points are approximately 130 million, growing by about 1 million points daily. Assuming a TGE within a month, the final points would be around 160 million.

4.3 Points Value Calculation

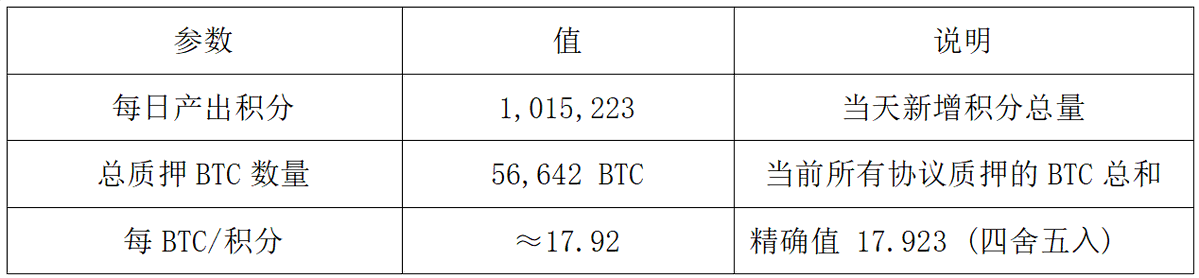

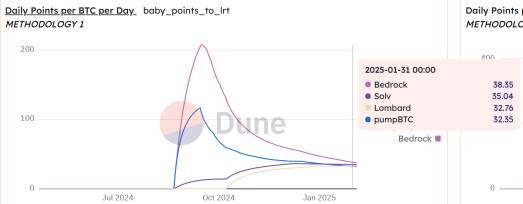

Method 1: Calculate the total daily points output divided by the total staking amount (approximately 17.92 daily)

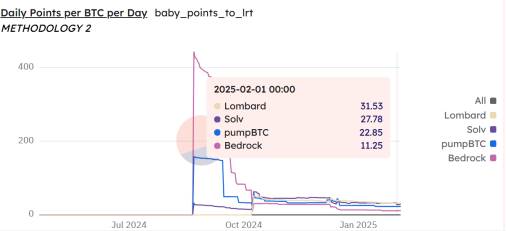

Method 2: Calculate points based on the time distribution of the total supply (approximately 38.35 daily)

The time-distributed total supply over time (calculated by the ratio of LRT's Babylon BTC deposits to total BTC deposits, then multiplying that ratio by the Babylon points issued that day to calculate the points earned. The supply points are calculated by summing the daily token supply over a period.)

Method 3: A simple ratio of Babylon points earned by the protocol to the total BTC balance of the protocol (approximately 31.53 daily)

According to the above three methods, the daily output points are: 17.92, 38.35, and 31.53.

4.4 Comprehensive Yield Estimation

Due to Babylon's high staking amount and its leading position, the conservative FDV after launch is estimated to be between $3-5 billion. There are precedents for token issuance in BTC re-staking protocols, with the Solv Protocol's airdrop share being 7.65%. To solidify its leading position, Babylon estimates the airdrop share to be around 10%, or $300-500 million. (Due to poor market conditions, this is a conservative estimate; the normal valuation should be between $5-10 billion.)

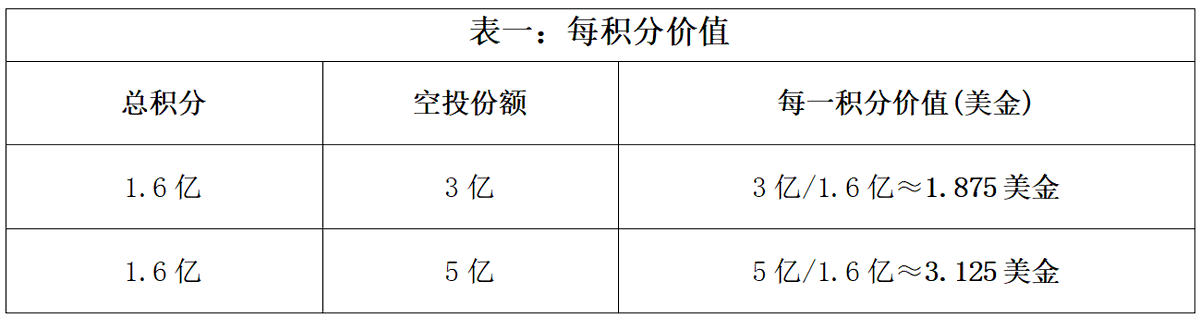

Table 1: Value per Point

Table 2: Staking BTC Monthly Rate Comparison (BTC price as of the time of writing: $98,522)

In terms of comprehensive returns: the current staking monthly rate is calculated to be around 1.02%-3.66%, making it a good choice to deposit idle BTC.

Main Airdrop Risks: Overall end time is unknown, airdrop rules are not clear, and there are certain potential risks.

Overall, as a VC project with significant funding, support from exchange funds, and a high ceiling in its sector, both the maturity of operations and the current progress appear to be relatively smooth, with considerable growth potential. This lays the foundation for high market enthusiasm following the project's TGE. Based on the currently limited information, participating at this stage still offers a certain cost-performance ratio, and individuals can participate as needed based on their own circumstances.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。