Original Title: Hello World. Hello Sonic.

Original Author: Foxi_xyz, DeFi & AI Researcher

Original Compilation: Blockchain Rhythm

Editor's Note: The author introduces the background of Sonic, the design of its Tokenomics, and the operational principles of the DeFi flywheel, analyzes the potential risks within the ecosystem, and explains in detail how to profit from this mechanism. By screening multiple projects within the Sonic ecosystem, the author recommends opportunities in areas such as DEX, lending, derivatives, and memes, aiming to help readers seize high-potential projects.

The following is the original content (reorganized for better readability):

I have created the ultimate guide to Sonic for you, especially if you are not familiar with the DeFi flywheel. Andre Cronje promotes over 20 projects daily, so I have filtered out the good ones for you.

I started playing with crypto because of the DeFi summer in 2020, and I am glad that AC and its chain are finally back. Like most tutorials, this article will delve into the development of Sonic. However, I first want to introduce the risks in the DeFi flywheel ecosystem. I am not responsible for your losses, but I hope to explain the mechanisms behind the DeFi flywheel to newcomers. (If you just want to know about "CA," please skip to section four.)

Flywheel = Ponzi Scheme? When to Exit?

The core of many DeFi flywheels lies in the mismatch between the timing of capital deployment and the recognition of its true value—this phenomenon is often summarized as "enter when no one knows, exit when everyone knows."

Early liquidity injections create momentum, attracting more participants and generating a self-reinforcing growth loop. Essentially, early participants benefit from compounding rewards as liquidity accumulates and the system gains recognition.

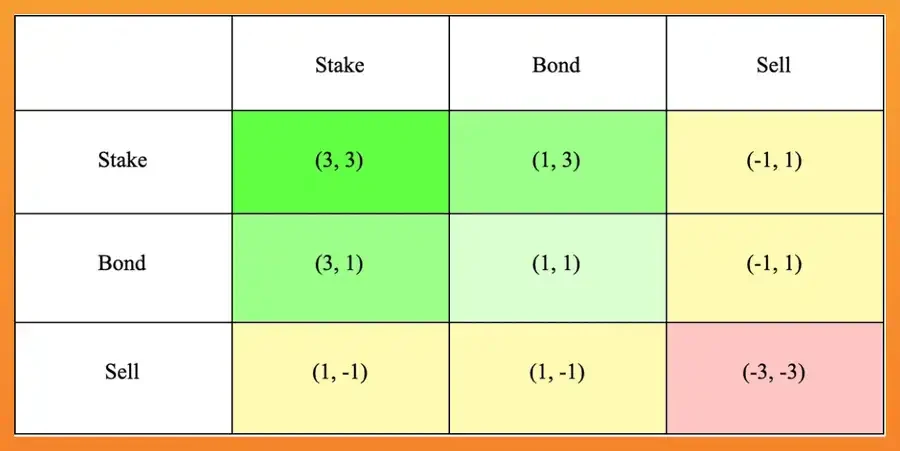

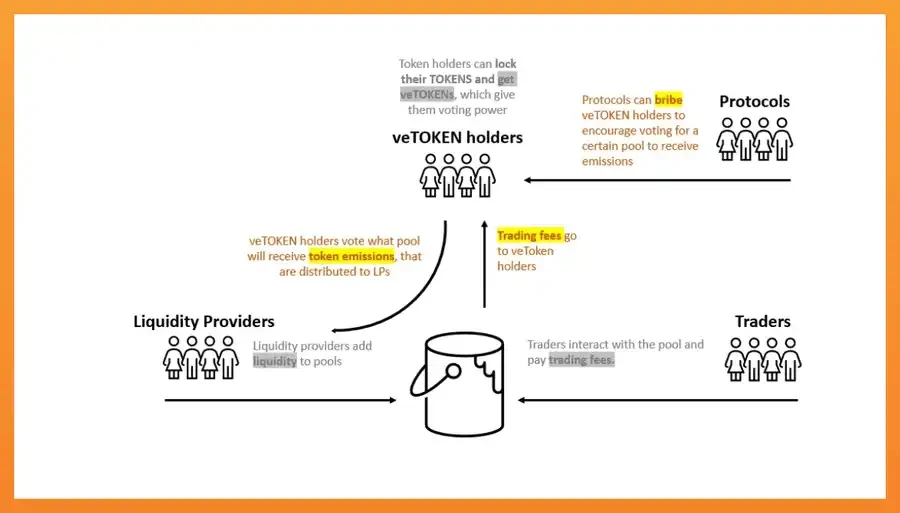

Andre Cronje introduced the ve(3,3) tokenomics model through Solidly Exchange on Fantom. This model combines Curve Finance's voting escrow (ve) and Olympus DAO's (3,3) game theory, adjusting the incentive mechanisms for token holders and liquidity providers, reducing sell pressure and enhancing sustainability.

The goal of the ve(3,3) model is to reduce sell pressure and enhance liquidity by rewarding users who lock up their tokens with trading fees. It aims to address the unsustainable inflation issues brought about by liquidity mining, focusing on fee generation rather than passive issuance.

Since Fantom has now been renamed to Sonic, you can expect that ve(3,3), i.e., the DeFi flywheel, will still be the core concept of Sonic DeFi.

The flywheel is one of the driving forces behind the DeFi boom, and one of Andre Cronje's products is @yearnfi. Its token YFI rose from $6 to over $30,000 in less than two months. And as you know, like many other meme coins, it will eventually come to an end. Essentially, aside from Bitcoin, the most important aspect of any crypto project is when to enter and when to exit.

What is Sonic and Why Choose Sonic

No one cares, but Sonic was originally named Fantom. It is a high-performance Layer-1 solution with over 10,000 transactions per second and sub-second finality. Its native token $S is used for transaction fees, staking, and governance, and existing Fantom users can upgrade their $FTM tokens to $S at a 1:1 ratio.

Most people don't really care about another low-latency Layer 1, as we already have many similar projects in this space. Therefore, Sonic stands out for three practical reasons:

Andre Cronje, as a DeFi OG, is back to lead his project.

Airdrop plan: Sonic distributes 190.5 million $S (about 6% of the total supply) through a reward program to attract new users (more information in section three).

People are tired of meme coins and are starting to return to more fundamental DeFi games, as evidenced by the price slump of $SOL.

Recent capital inflows also indicate market interest in Sonic, specifically reflected in:

The native token $S rose by 113.5% in 14 days.

Sonic's TVL increased by 70% in 7 days, performing the best among all reasonably sized chains.

The FDV/Fee ratio is 283x, 57% lower than peers, indicating that Sonic may be undervalued relative to its income generation.

New Tokenomics (Boring but Important)

Supply and Inflation

Fantom's FTM has a maximum supply of about 3.175 billion tokens (most of which are fully diluted). Sonic's $S token has the same genesis supply, ensuring that existing FTM can be exchanged at a 1:1 ratio. However, $S is not a fixed supply token; it has controlled inflation to fund growth. About 6% of the total supply of $S will be minted for user and developer incentives (airdrops). This means that approximately 190.5 million $S will be airdropped about 6 months after launch. Therefore, there will be no new supply (unlocking) before June 2025, which may be a good time for short-term trading.

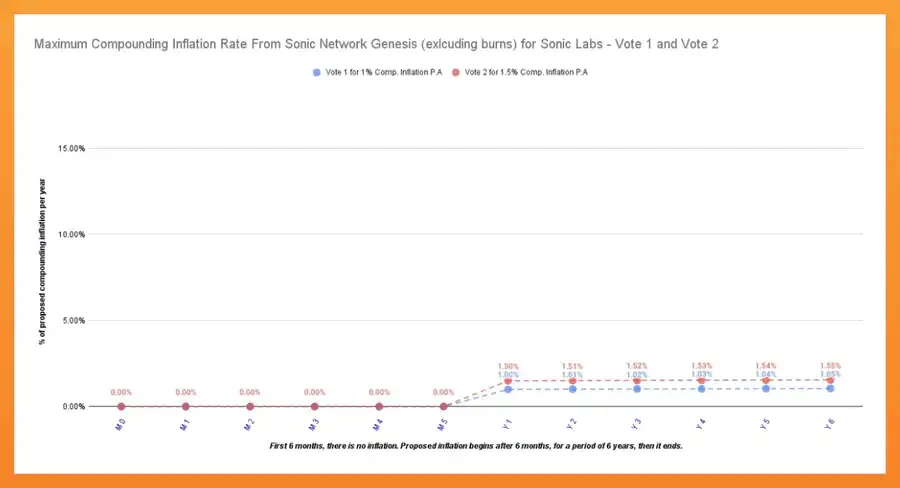

Additionally, $S will experience an annual inflation of 1.5% for the first 6 years (approximately 47.6 million $S in the first year) to support ongoing ecosystem funding. If fully utilized, the supply could reach about 3.66 billion tokens after 6 years. In contrast, FTM's issuance is basically complete, with no new token rewards (excluding any remaining staking rewards). Sonic's approach intentionally introduces moderate inflation to invest in growth but is strictly controlled—any unused funding tokens will be burned to avoid excessive inflation.

Fee Burn and Deflation

FTM's economic model does not include significant fee burning—on Opera, gas fees are distributed to validators (15% to developers after 2022), so FTM is generally inflationary (staking rewards exceed any token burns).

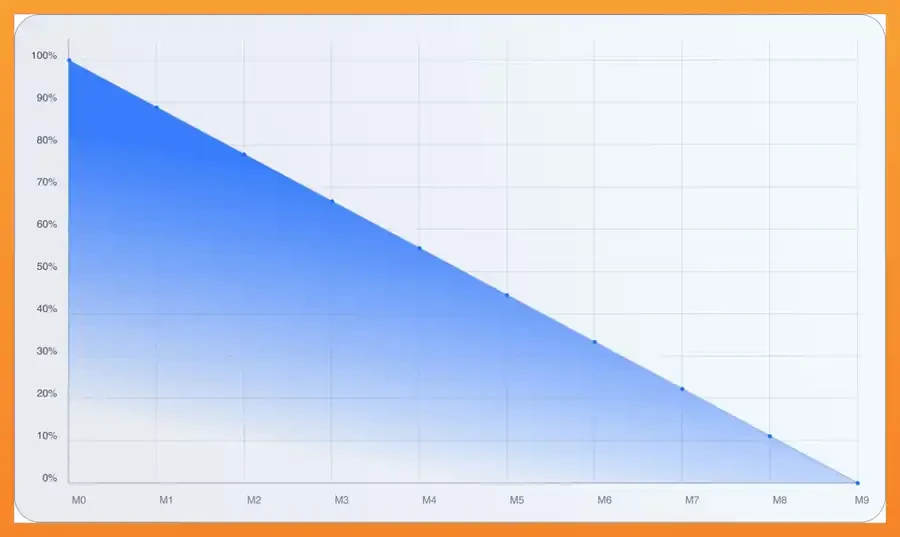

Sonic introduces multiple deflationary pressures to balance new issuance. As mentioned, 50% of all transaction fees on Sonic will be burned by default (transactions not in the gas reward program). If network usage is high, this could make $S net deflationary. Additionally, the airdrop design uses a "vesting with burn" mechanism: users can claim 25% of the airdrop immediately but must wait for the remaining portion. If they choose a faster vesting method, they will forfeit a portion as a penalty for short-term selling.

Finally, any unused 1.5% annual ecosystem funding will be burned. Overall, these burn and controlled release plans may offset most of the inflation over the 6 years, helping $S gradually move towards deflation after the initial growth phase ends.

User Incentive Program

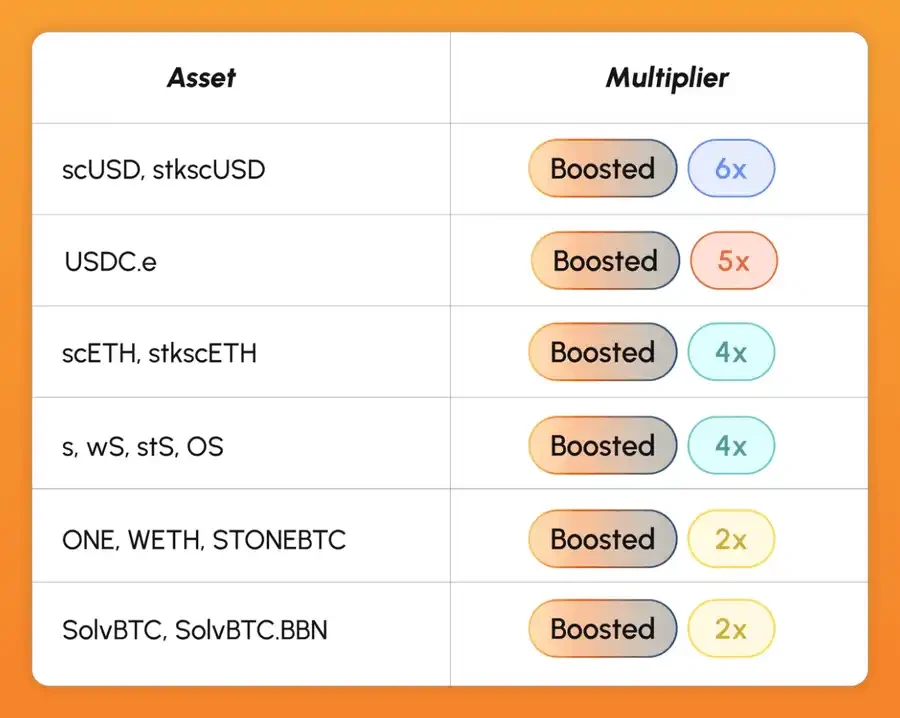

As mentioned, Sonic is distributing 190.5 million $S tokens to reward users. You can earn airdrops in the following ways:

Hold assets on the whitelist, ensuring they are not assets in CEX wallets.

Use Sonic's DeFi protocols, including staking $S, providing liquidity on DEX, yield farming, etc. DeFi activity points are weighted at 2 times that of merely holding assets.

Opportunities in the Ecosystem

You can earn $S airdrops by holding assets or participating in Sonic's ecosystem. Sonic is a new ecosystem, so many new projects may carry higher founder risks, but they could also become alpha opportunities for 10-100x returns. Here are the potential projects I have carefully selected from four areas (DEX / Lending / Derivative / Meme). (All of these are unpaid, just my personal sharing)

There seems to be a lot in the picture, but most are not "opportunities." They are not native to Sonic or have been online for a while. Here are the actual opportunities.

DEX

@ShadowOnSonic

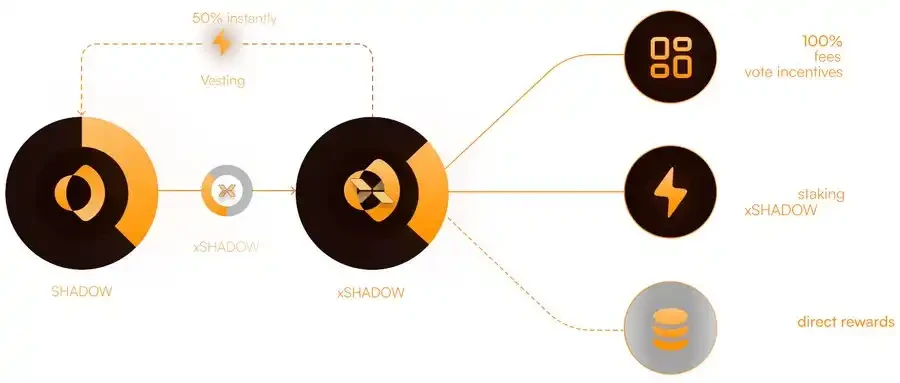

The leading native DEX on Sonic, with a TVL of over $150 million and weekly incentives of $13.73 million. Its x(3,3) token model provides users with flexibility, allowing for instant exits or vesting over a selected time, unlike the long-term locking in ve(3,3). It also features a PVP rebasing mechanism that imposes a 50% voting power penalty on early exiters to protect against dilution and encourage long-term holding.

@MetropolisDEX

A DEX on Sonic featuring a Dynamic Liquidity Market Maker (DLMM) protocol that combines AMM and order book characteristics. Players from Solana and farmers from Meteora will love this.

@vertex_protocol

A DEX offering spot, perpetual contracts, and money markets with cross-margin functionality. It has low fees (0% maker, 0.02% taker), fast order execution, and cross-chain liquidity. It is a true DeFi OG team.

@wagmicom

One of the native DEXs on Sonic with high trading volume. It processed $1.2 billion in less than two months. Users earned over $3.6 million in fees through LP strategies, enhanced by Sonic's speed and scalability. It could become a strong competitor to Shadow.

Lending

@SiloFinance

Offers permissionless and risk-isolated markets. It supports the rapid deployment of new trading markets without integration, with a daily trading volume peaking at $125 million.

@eggsonsonic

Provides collateralized lending executed by smart contracts, featuring buy/sell fees and liquidation events.

@eulerfinance

A modular lending protocol supporting permissionless lending, similar to Ethereum's Morpho.

@VicunaFinance

Offers leveraged yield farming and provides unsecured loans.

Derivatives

@Rings_Protocol

A meta-asset protocol for yield-bearing stablecoins. It provides deep liquidity for Sonic DeFi and funds projects through locked capital.

@spectra_finance

An interest rate derivatives protocol that allows yield trading and fixed rates. It provides liquidity providers with hedging against yield volatility and earns additional interest.

@vfat_io

A yield aggregator that simplifies yield farming and rebalancing.

@GammaSwapLabs

A volatility trading platform that does not require oracles. It offers commission-free token trading and liquidity through AMM.

@NaviExSonic

A derivatives trading platform offering preparatory contracts.

Meme

@derpedewdz

The main NFT in the Sonic ecosystem.

@LazyBearSonic

The native NFT issuance platform for Sonic.

@TinHat_Cat

A Sonic meme with a good community.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。