Author: ChandlerZ, Foresight News

On February 24, the on-chain Gas fees for Bitcoin saw a significant increase after a prolonged period of low levels, rising from an average of 1-2 satoshis per byte to over 12 satoshis per byte for high priority transactions. A few weeks ago, the Bitcoin mempool was completely cleared for the first time in two years, but the number of unconfirmed transactions has now climbed back to over 100,000.

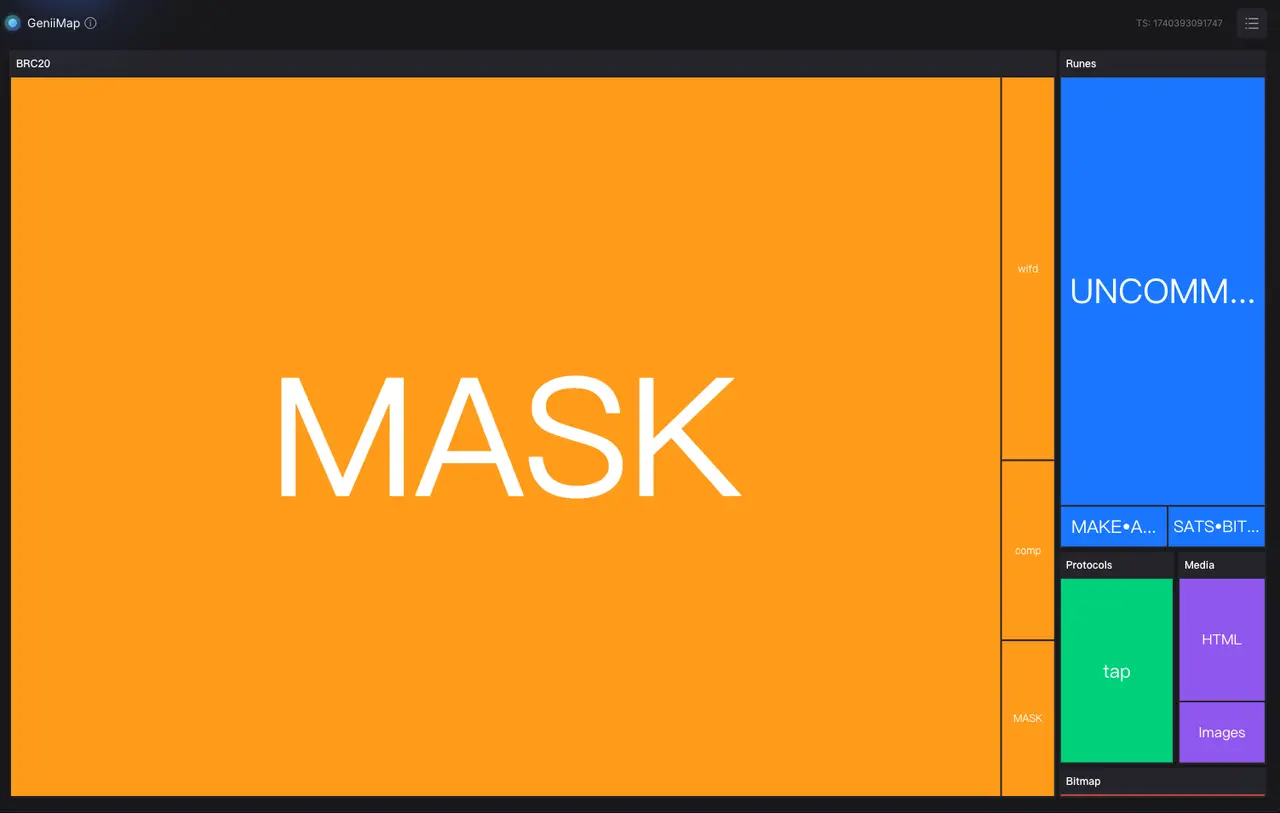

According to Geniidata's data monitoring, on-chain minting activity has shown a highly concentrated characteristic over the past 24 hours, primarily focusing on the MASK project.

The total minting volume of MASK is 2.1 million, with each containing 10 tokens, and the current market price is around $0.18, giving it a total market capitalization of approximately $3.06 million. As of the latest data, the minting progress of this project has reached 82.69%, and this increase in activity has sparked widespread discussion in the market about a potential new round of recovery for the BRC-20 ecosystem.

From a deeper market logic perspective, the current cryptocurrency market is at a unique time point. As the conspiracy theories surrounding the Solana and BSC ecosystems are widely questioned, the BRC20, which somewhat symbolizes "fairness," seems to have rekindled market interest. However, the market's memory has not faded with time; the previous extreme volatility in the Bitcoin ecosystem still casts a shadow over the market.

Watching Him Build High Towers, Watching Him Collapse

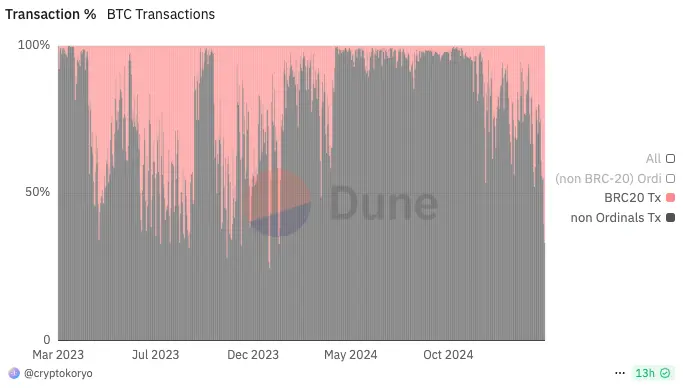

According to data from The Block, since April 20, 2023, driven by the BRC-20 ecosystem, the number of transactions on the BTC network began to rise sharply, with transaction volume increasing by nearly 100% in less than a month. The rise in transaction fees has been even steeper, increasing nearly tenfold in less than half a month. During the most active phase of the BRC-20 ecosystem, over 70% of transactions on the Bitcoin chain were related to BRC-20 projects.

Behind this facade of prosperity lies a fragile ecological foundation. Entering 2024, the Bitcoin ecosystem has gradually entered a period of stagnation, and this shift actually reflects the market's deep-seated dilemmas regarding the application layer of Bitcoin. Although the market once had high hopes for the Bitcoin ecosystem, believing that innovations based on the inscription protocol could inject new vitality into the Bitcoin network, the actual development trajectory has significantly deviated from expectations.

Looking back at the development history of the BRC20 ecosystem, we must confront a harsh reality: most of the early popular projects have experienced significant price retracements. ORDI has fallen from a high of $87 to $11, Sats from 0.00000086 to 0.00000012, and other projects, including NFTs in the Bitcoin ecosystem, have seen declines of up to 90%, with many having "gone to zero," leaving only projects like 𝛑 that are heavily reliant on ground promotion culture.

This phenomenon is not coincidental but rather an external manifestation of deep-seated structural issues in the market. The BRC20 protocol was designed with "real fairness" as its core concept, aiming to provide truly equal participation opportunities for all market participants through a completely transparent on-chain mechanism, eliminating reserved allocations and scientist mechanisms. This design theoretically achieves the highest degree of decentralization, but in practice, it exposes significant limitations.

The Paradox of Fairness and Control

From the perspective of market structure, the scientist mechanisms and initial chip allocation systems in traditional crypto projects are essentially market adjustment tools. Although these mechanisms are often criticized as manifestations of centralization, they play an indispensable role in maintaining market stability. Project teams can use these mechanisms to regulate market fluctuations to some extent, providing necessary price support for the long-term development of the project.

However, the completely open minting mechanism of the BRC20 ecosystem, while maximizing participation fairness, has also led to a highly dispersed chip structure. In the absence of effective price support mechanisms, market fluctuations tend to be more pronounced. In such cases, when market sentiment shifts, it is easy to trigger a chain reaction, leading to rapid price declines.

A deeper issue lies in the motivations of large capital participants. In traditional crypto projects, large funds can influence market trends through various mechanisms to gain profits. But under the inscription mechanism of BRC20, this operational space is greatly compressed. When these so-called "whales" or "institutions" find it difficult to establish effective chip control, they naturally choose to turn to other markets where capital management is easier. This creates a paradox: the pursuit of absolute fairness may lead to market instability, thereby harming the interests of all participants. In this situation, the market needs to find a balance between complete fairness and necessary market stability.

The resurgence of the MASK project somewhat indicates that the market's yearning for fair mechanisms has not completely faded, regardless of whether this project will still become a "shooting star." However, how to establish effective market stability mechanisms while maintaining basic fairness remains a core challenge facing the entire crypto ecosystem. This requires innovation at the protocol design level and may necessitate the introduction of new mechanisms to balance the seemingly contradictory goals of decentralization and market stability.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。