Original | Odaily Planet Daily

Author | Azuma

Trading cryptocurrencies is really difficult, with altcoins continuously declining and PVP facing repeated defeats. Instead of persisting, it might be better to turn back.

As the difficulty of market operations rises sharply, more and more users are starting to focus on more controllable money-making opportunities. In response to this demand, Odaily Planet Daily has decided to launch the column "U-Based Financial Strategies More Suitable for Lazy People." This column will cover relatively low-risk (systemic risk can never be completely eliminated) yield strategies centered around stablecoins (and their derivative tokens) currently available in the market, aiming to help users who wish to gradually increase their capital through U-based financial management find more ideal earning opportunities.

This column is tentatively scheduled for weekly updates. If reader feedback is high, we will also release related strategies for BTC, ETH, and SOL in the future.

Here's a "hot" piece of knowledge: In the past 20 years (from October 15, 2004, to October 14, 2024), "stock god" Warren Buffett's average annualized return has been about 10.96%. In the still-early structured and systematic cryptocurrency market, any ordinary person can "easily" surpass this number.

Basic Interest Rate (Lowest Efficiency)

The so-called basic interest rate tentatively covers single-coin financial products from mainstream CEXs, as well as mainstream on-chain lending, DEX LPs, RWA, and other DeFi deposit schemes.

CEX Side

Binance: USDT single-coin financial product (apy) currently reports 2.7%, with an additional 5% bonus for amounts between 0 - 500 USDT; USDT single-coin financial product currently reports 1.89%, with an additional 7% bonus for amounts between 0 - 500 USDC;

OKX: USDT single-coin financial product currently reports 2%; USDC single-coin financial product currently reports 2%;

Bitget: USDT single-coin financial product currently reports 4.12%, with an additional 8% bonus for amounts between 0 - 500 USDT.

On-Chain

- Ethereum

Aave: USDT 4.18%; USDC 4.27%; DAI 5.13%;

Fluid: USDT 9.43%; USDC 8.07%;

Ethena: sUSDe 9%;

Sky: sUSDS 8.75%;

- Solana

Kamino: USDT 4.72%; USDC 6.53%; PYUSD 6.56%; USDS - USDC LP 11.24%;

margin.fi: USDT 5.69%; USDC 5.87%; PYUSD 6.41%;

- Base

Aave: USDC 5.04%;

Aerodrome: USDC - USDT LP 13.88%.

Pendle Zone (Core Strategy)

Currently, to amplify the yield of stablecoins, one cannot avoid structured or leveraged products. Considering safety and liquidity, Pendle is undoubtedly the most suitable platform.

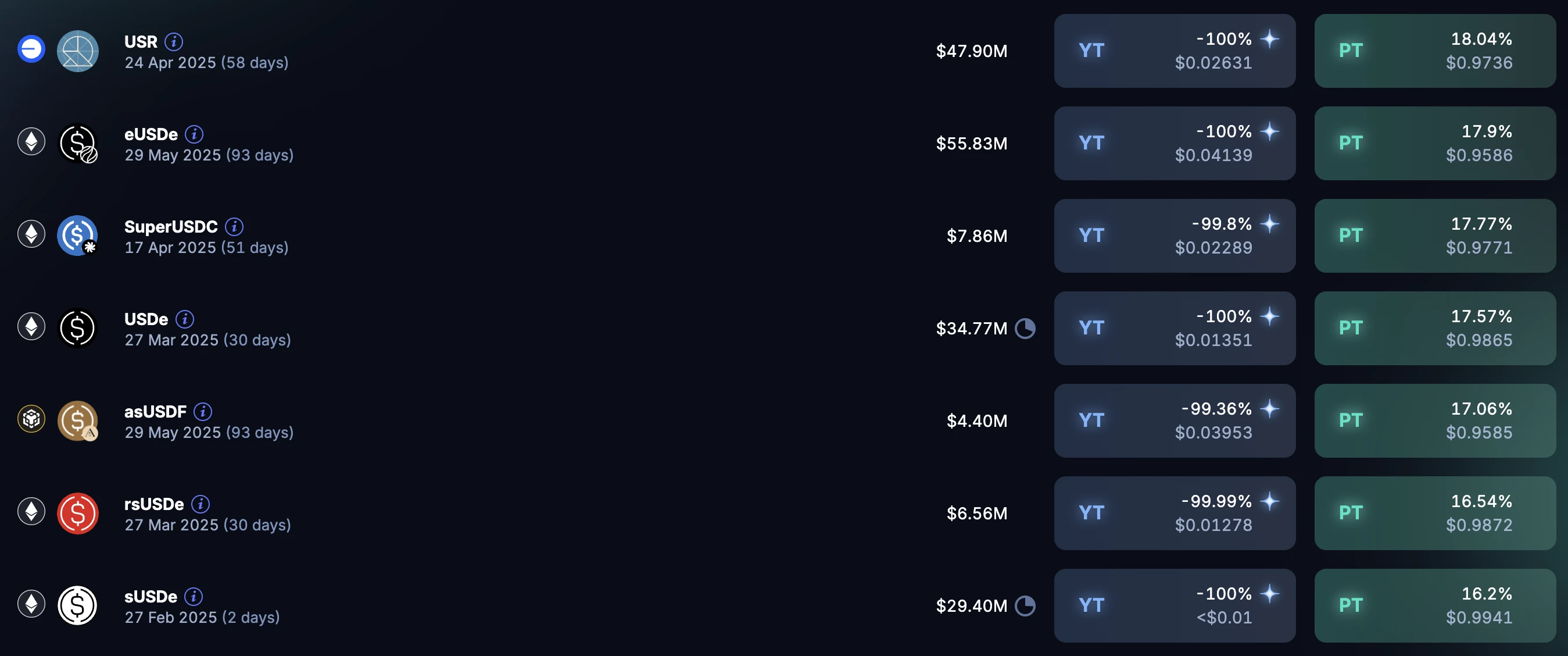

As shown in the image above, multiple stablecoins on Pendle can achieve PT yields of up to 15% or even higher, significantly exceeding the industry's basic interest rate level.

A recently popular pool is the eUSDe (Ethreal's USDe deposit certificate) pool expiring on May 29, with a current price directly buying PT corresponding to an apy of 17.9%, yielding approximately 4.56% by the expiration date.

You can also choose to go for the LP of this pool (eUSDe - eUSDe PT). Although the corresponding yield will drop to 7.546% (which can increase to 9.09% with sufficient PENDLE staking), you will additionally receive a 1.6x Ethreal points bonus and a 50x Ethena Sats points bonus — early withdrawal will incur impermanent loss, but holding until expiration will gradually offset that loss.

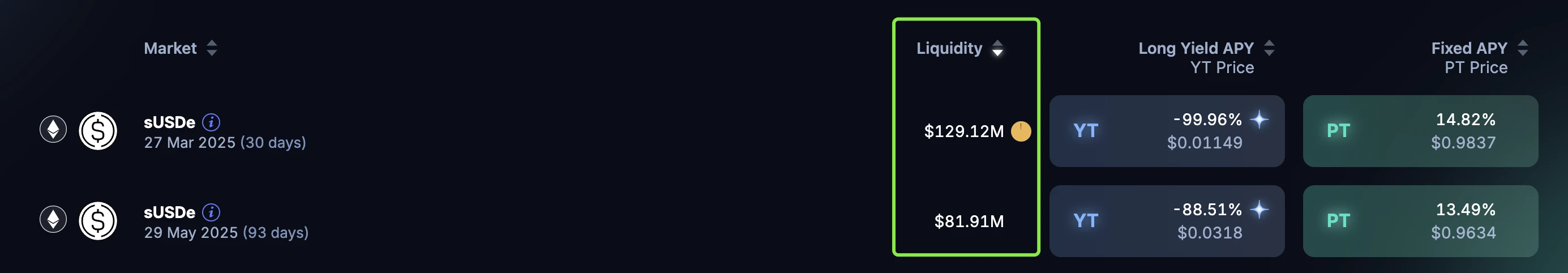

Additionally, the "old gold pool" sUSDe (Ethena, staked USDe) remains very popular. The pool expiring on March 27 currently offers a direct purchase of PT corresponding to an apy of 14.8% (with a sUSDe yield of 1.21% at expiration), while the pool expiring on May 29 offers a direct purchase of PT corresponding to an apy of 13.49% (with a sUSDe yield of 3.44% at expiration). When combined with the 9% apy of sUSDe itself, the overall apy can exceed 20%.

Ecological Incentives (Opportunities and Volatility Coexist)

This section mainly covers currently popular ecosystems, especially those executing incentive programs in various forms. A common characteristic of these ecosystems is that early paper yields are often very high, but the rewards are generally in the form of ecological tokens or protocol tokens, with final yields linked to token price performance.

For example, the currently popular Sonic, taking the mainstream DEX protocol Shadow as an example, has an apr (note that this is apr, not apy) of 38.2% for the USDC.e - scUSD LP, and an apr of 57.3% for the USDC.e - USDT LP.

However, the rewards for such pools are mainly composed of incentives from xSHADOW and GEMS — to redeem xSHADOW 1:1 for SHADOW requires a duration of 6 months; GEMS serves as a future airdrop certificate for Sonic, but according to official disclosures, the first season's end will require waiting until around June 2025. Overall, while the yield numbers are tempting, the realization of incentives still carries a degree of uncertainty.

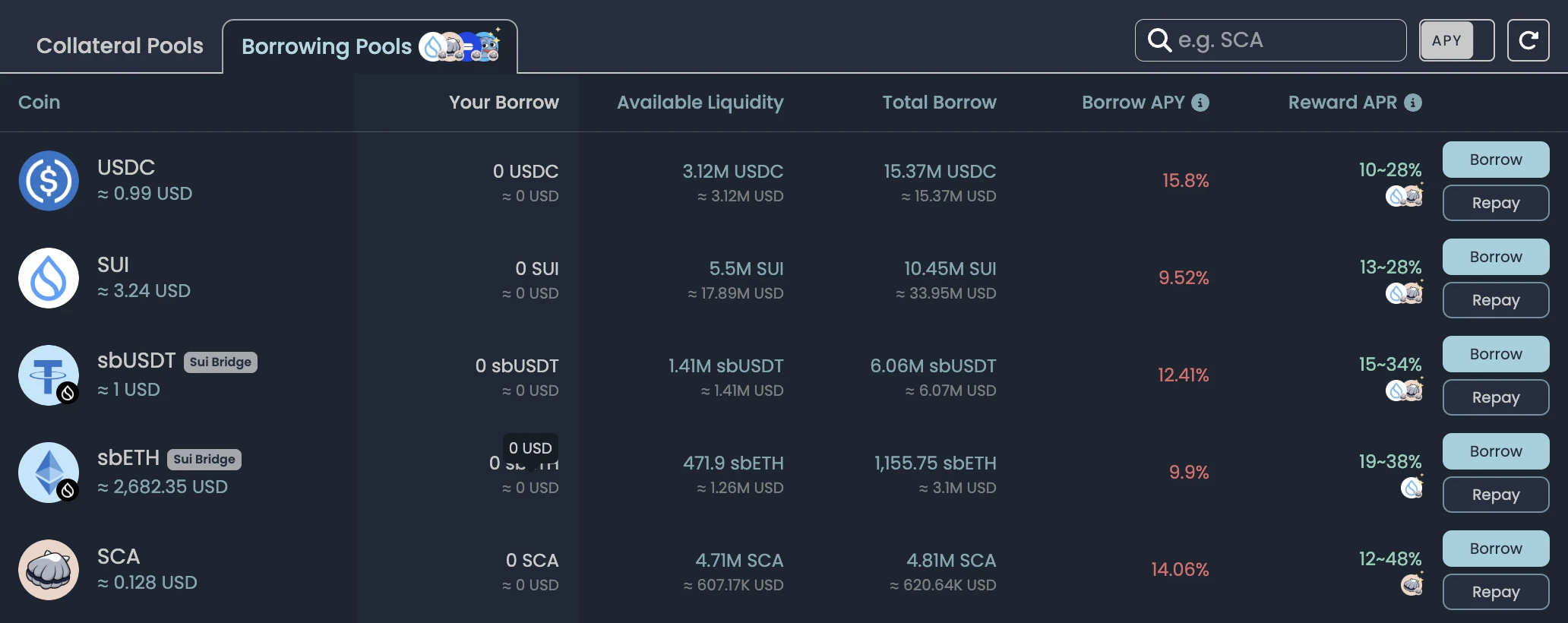

Another interesting ecosystem is Sui. Recently, Sui has opened incentive subsidies for some protocols within the ecosystem, leading to a rare phenomenon of borrowing costs and yields being inverted in lending protocols like Scallop — that is, the additional incentives for lending funds exceed the borrowing costs. As shown in the image below, without the staking boost, the lending incentives for SUI, sbETH, and sbUSDC within Scallop are all higher than the borrowing interest rates, meaning users can profit from both deposits and loans.

Blind Mining Opportunities (Recommended "Two Birds with One Stone")

This section mainly focuses on projects that have not yet had their TGE but have opened deposit channels. Due to the uncertain size of future reward pools (airdrops), the yield situation of this strategy fluctuates greatly. It is relatively recommended to invest in those that already have certain earning capabilities while also considering the "two birds with one stone" opportunity for airdrops.

For example, the previously mentioned Ethreal, which the community likes to call Ethena's "favorite child," currently allows direct deposits of USDe in Ethreal to obtain the certificate token eUSDe. However, this scheme does not generate yield and lacks points acceleration, so it is more advisable for long-term deposit users (actually just three months) to switch to Pendle LP.

Other opportunities I am currently participating in include 1) Symbiotic, which mainly operates in the form of sUSDe, allowing users to earn 9% apy while accumulating points; 2) Soneium has just launched, aiming to earn the upcoming ASTR incentives while also vying for potential airdrops; 3) Berachian has also deposited some sUSDe through Concrete, but I currently regret it slightly due to high competition and temporary withdrawal restrictions; 4) I previously placed some funds in the LP pool of Perena, but I have withdrawn recently due to low apy; 5) I have also placed some funds in Meteora to earn points, but not limited to stablecoins.

Leverage Ratio

Risk is always present in the crypto world, so never put all your eggs in one basket (even though these baskets are often in the same vehicle…). My current stablecoin allocation plan is as follows, for reference only.

I still keep about 30% in basic interest rates, with some in CEXs and some in popular on-chain options like Solana, mainly for easy trading at any time;

Pendle is currently my main battlefield, with an investment scale of about 40%, but it will be distributed across different pools, with some in PT and LP;

The investment in ecosystems with incentives is relatively small, less than 10%. I have some biases against AC and Fantom's past, so I probably won't heavily participate in Sonic;

I have left about 20% for blind mining across various projects, with specific investment ratios depending on project conditions (basic yield rates, team background, audit status) and personal preferences.

I may adjust this further in the near future, and will follow up with updates later.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。