Choosing comfort and ease means you don't have to envy others' brilliance; choosing to face storms means you don't need to long for peaceful times. Different choices give you different life paths. As long as you are certain about what your heart truly desires and continue to work hard for it, everyone can be the winner of their own life!

Hello everyone, I am trader Gege. Following up from last time, after Friday's plunge, Gege anticipated a rebound, but over the weekend, Bitcoin's rebound was limited without breaking Friday's low, getting stuck around the 96500 level and entering a period of fluctuation. Although Ethereum had a slow rise of about 200 dollars over the weekend, today, Monday, it fell back to near the starting point, briefly breaking the previous high before testing support again, which is indeed intriguing. Let's return to the technical analysis briefly.

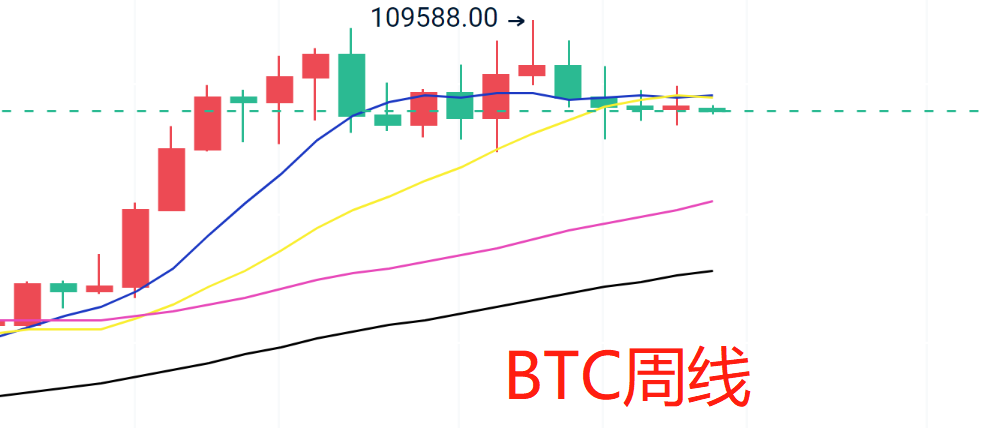

On the weekly level, Bitcoin briefly broke below the MA7 and MA14 lines last week but closed back below them. This week, we will continue to focus on whether it can break through these levels, which is crucial for the short-term bulls to return and continue. The middle track below is also a key support point where the K-line previously formed a platform. If it touches and rebounds or briefly breaks below and then closes back above, it will be favorable for the short-term bulls. Conversely, if it breaks down, the probability of maintaining a weak downward trend will increase, and the bullish trend will need to wait for new support confirmation or another oversold situation to enter on the left side.

From a technical perspective, if a price is tested multiple times without opening a new channel, the probability of breaking down increases, whether in support or resistance areas. If it breaks through the MA7 and MA14, where can we see above? Gege believes it is not a problem to touch above the 102000 level.

On the daily level, it is currently under pressure from the middle track, and the upper boundary of the box, which is around the MA60 and upper track, is key. If it can test the upper boundary again, I am optimistic about a breakout upwards. The lower level of 95000 is currently the short-term key support to watch. As long as the resistance near the EMA200 on the 4H level is broken, this rebound can continue to break the box and return above 100000.

On the weekly level for Ethereum, as long as it does not break below the lows of the previous two K-lines, we look for a rebound. Conversely, if it effectively breaks down, the probability of testing near the EMA200 again increases to 90%. In the short term, I shared my view at noon: as long as it does not break 2660-2630, we look for a rebound in the US market, and I still maintain this view. Once it breaks down, the defense line around 2500 will be in jeopardy. The overall trend view remains unchanged; Gege believes the bull market has not ended, so if it breaks key support, the bullish positions will get better price chips.

Short-term suggestions for Bitcoin from 2.24-25: Buy around 95800-95300, with a stop loss of 600 points, looking for 1000-2000 points.

Short-term suggestions for Ethereum from 2.24-25: Buy around 2660-2630, with a stop loss of 50 points, looking for 80-120 points.

These suggestions are for reference only. Please manage your risk when entering the market, and control your profit and stop-loss space accordingly. Specific strategies should be consulted in real-time.

Alright, friends, we will say goodbye until next time. I wish everyone continued success and smooth sailing in the crypto world! More real-time suggestions will be sent internally. Today's brief update ends here. For more real-time suggestions on Bitcoin and Ethereum, find Gege.

Written by/ I am trader Gege, a friend willing to accompany you in your resurgence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。