Since 2024, the "passive income" (token appreciation + new listing rewards) from holding BNB has exceeded Bitcoin's performance by 50% during the same period.

Authors: Linda Zhengzheng (@lindazhengzheng), Jessica Feng (@Jf4172)

The cryptocurrency market at the beginning of 2025 is relatively bleak. While most tokens have yet to recover from the crash, BNB's price quickly rebounded, increasing by 41% in just 10 days_, driving the CeFi sector into an upward trend. Recently, the BNB Chain ecosystem has been in the spotlight, attracting significant attention. Is this recent increase in BNB's price a _"flash in the pan" driven by events_ or a reassessment of long-term value? _ Through historical tracking and dissection of returns, we discovered a hidden data fact: since 2024, the "passive income" (token appreciation + new listing rewards) from holding BNB has exceeded Bitcoin's performance by 50%. This article will re-examine BNB from the perspective of asset value logic, revealing the underlying logic behind the price increase.

Surpassing Bitcoin: The Invisible Winner in the Crypto Market

Throughout 2024, Bitcoin attracted global investors with a remarkable increase of 128%. In today's narrative-scarce environment, Bitcoin seems to be the only consensus in the crypto industry. However, aside from the glamorous Bitcoin, a fact that most investors may not be aware of is that BNB, which has consistently ranked among the top in market capitalization, not only outperforms Bitcoin in compound returns but also shows greater resilience during market cycles of bull and bear transitions. If there is a myth in the crypto market that surpasses Bitcoin, BNB is undoubtedly one of the invisible winners in that myth.

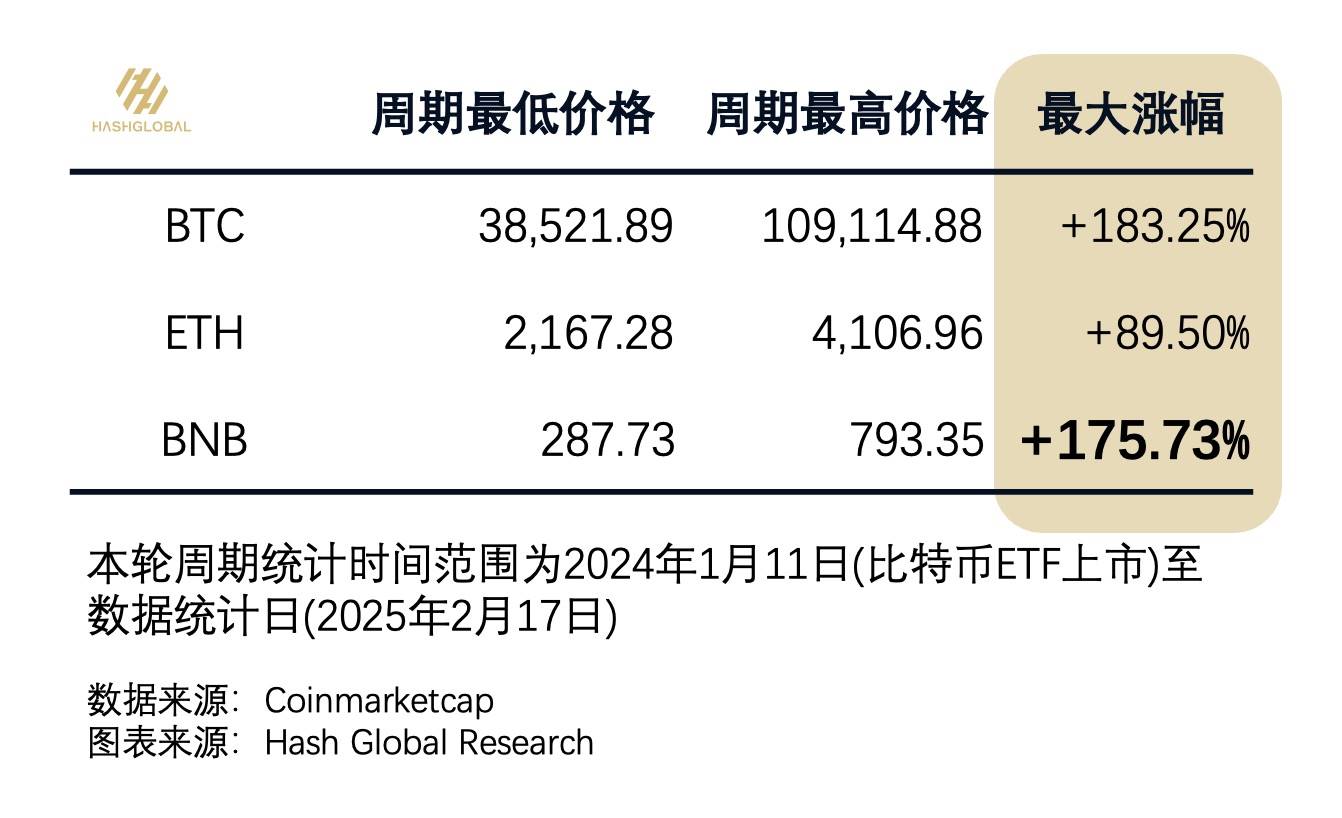

- This cycle's increase is close to Bitcoin's, often leading the way According to historical data tracking from CoinMarketCap, since the listing of the Bitcoin ETF on January 11, 2024, the price increase curve of BNB has consistently led BTC for over 60% of the statistical period, with a maximum increase of 175.73%, nearly on par with BTC.

- Market performance far exceeds that of Ethereum and other altcoins Since the approval of the Bitcoin spot ETF, the market has shown significant polarization: traditional institutional funds have flowed into Bitcoin ETFs, pushing BTC's market cap share to over 60%, creating a "vampiric effect" on altcoins, with most tokens in the market languishing. In contrast, BNB's maximum increase of 175.73% far outperformed Ethereum's performance during the same period.

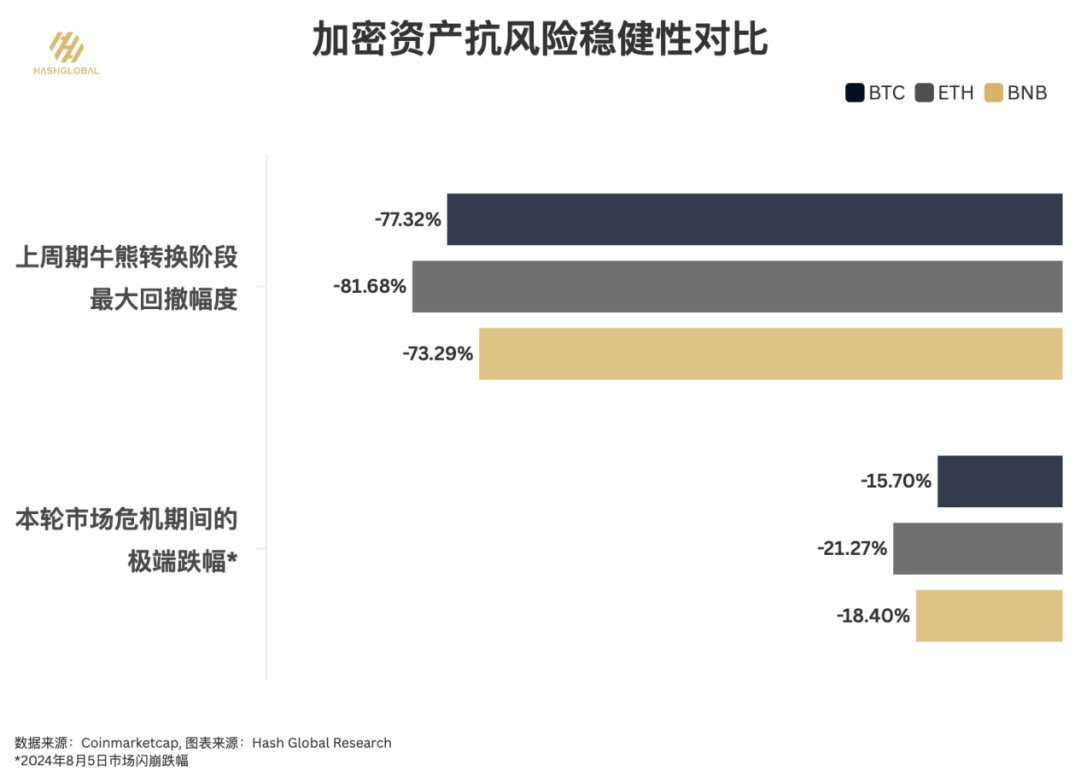

- During the bull-bear cycle transition, BNB's resilience outperformed Bitcoin We backtested the price performance of BTC, ETH, and BNB during the previous bull-bear transition cycle of 2021-2022. BNB demonstrated unexpectedly strong resilience during the bear market:

- Maximum drawdown: BNB (-73.29%) Bitcoin (-77.32%) Ethereum (-81.68%), during the bear market, BNB's decline was lower than both;

- Recovery cycle efficiency: BNB took 237 days to recover its previous high, only 45.8% of Bitcoin's (517 days), showing significant rebound momentum.

- In a bull market flash crash, BNB's performance was slightly inferior to Bitcoin but better than Ethereum Although this round of the crypto market cycle has experienced several corrections (January GBTC sell-off, March Fed's hawkish turn, June Mt. Gox repayment impact), the most challenging test came during the global financial market turmoil on August 5, 2024, when a brief dollar liquidity crisis impacted the crypto market. During this crisis, BNB's maximum drawdown was 18.40%, slightly worse than Bitcoin's (15.70%) but better than Ethereum's performance.

US Stock Genes: An "Ultra-Scarce Asset" Among the Top Ten by Market Cap

BNB is currently the only token among the top ten mainstream digital assets by market cap that has deflationary characteristics, making its value scarcity even greater than that of Bitcoin, often referred to as "digital gold." According to its economic model design, BNB continuously reduces its circulating supply through a quarterly burn mechanism—its most recent burn occurred on January 23, when the BNB Foundation announced the completion of the 30th quarterly burn of BNB tokens on the BNB Chain, destroying 1,634,200.95 BNB, valued at approximately $1.16 billion at the time of the burn. Since the issuance of BNB in 2017, the total supply of BNB has decreased from the original 200 million to 142 million, a reduction of nearly 30%, with an annual deflation rate of 4.77%. The decreasing supply supports the rapidly growing commercial value, making BNB one of the most long-term investment-worthy scarce assets in the digital asset space (Hyper-Scarce Asset). In contrast, other top ten cryptocurrencies like Bitcoin (fixed cap of 21 million), Ethereum (dynamic issuance), and USDT (pegged issuance) all adopt inflationary or neutral supply models, while Solana, XRP, and others, although lacking a total supply cap, also lack an active burn mechanism. If the long-term upward momentum of US stocks comes from strong profitability and stock buybacks, then BNB is the cryptocurrency that most closely resembles traditional finance's value expression, embodying the genes of US stocks. BNB achieves deflation through a series of buyback and burn mechanisms, similar to the market value management behavior of publicly traded companies—buying back and canceling stocks to enhance shareholder equity. This mechanism retains the transparency characteristic of cryptocurrencies while embedding the value creation logic of traditional financial markets, making BNB a token that combines scarcity and profit feedback, consistently ranking among the top ten by market cap, confirming the market's recognition of BNB's model with more "US stock genes."

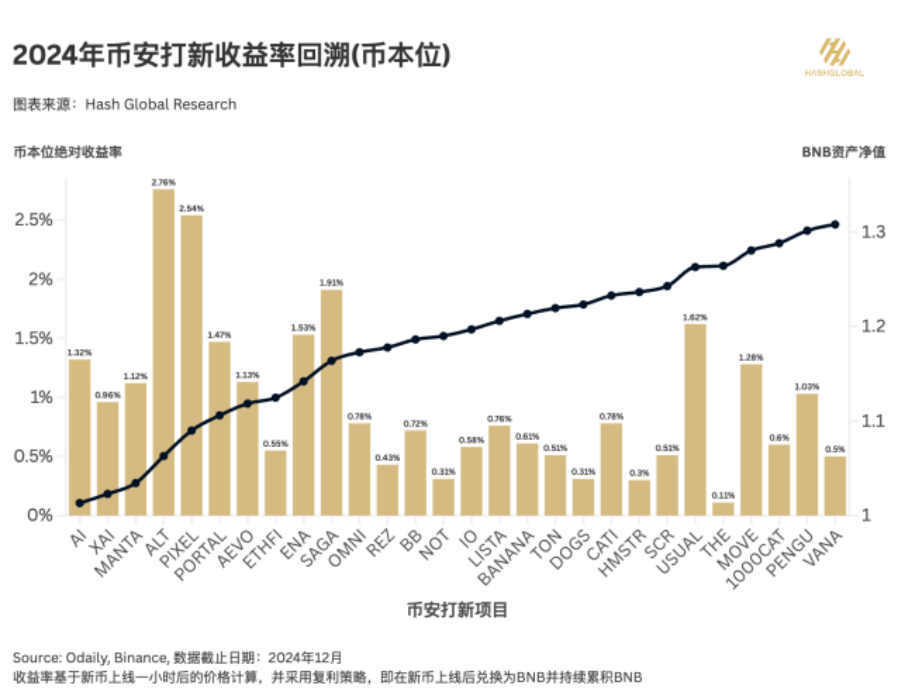

Holding Tokens for New Listings: An Industry Benchmark Prioritizing Users Binance co-founder He Yi mentioned in a speech during Binance's 7th anniversary that "Binance has always been user-centric, creating value for BNB holders through product design." Binance pioneered the concept of IEO (Initial Exchange Offering) in the industry, allowing users holding BNB to participate in new project launches first, thus gaining early opportunities, which has created compound returns for BNB holders far exceeding the market average. Since 2024, Binance has further directed platform growth dividends precisely to BNB holders through activities like Launchpool, HODLer, and Megadrop, rewarding loyal users of the platform. In 2024, Binance launched a total of 28 new listing projects, including 21 Launchpool sessions, 2 Megadrop sessions, and 5 HODLer airdrops. Assuming a long-term investor in BNB adopts a token-based reinvestment strategy (i.e., selling new tokens for BNB after they launch and continuously rolling over investments), combined with BNB's own price growth, the overall return by the end of the year would be approximately 284%, a figure that far exceeds Bitcoin's 183% increase during the same period. This data directly confirms what He Yi mentioned, that the mechanism of Launchpool aims to "allow the community to share in the platform's development dividends."

In 2025, the frequency of new listings and airdrops on Binance is expected to further increase, with six sessions launched by mid-February. The "holding tokens for new listings" model is a win-win situation, as it not only reduces market selling pressure by locking up BNB but also provides new asset airdrops for token holders, creating a flywheel effect of "holding tokens for interest - reducing selling pressure - price increase."

SEC Settlement Signals: An Accelerator for Community Ecosystem Innovation

Recently, the tug-of-war between Binance and the US SEC has finally seen a glimmer of hope—both parties submitted a joint application to the court to pause the lawsuit. Binance seized this opportunity to go all out, running on both compliance and innovation tracks. First, there were significant technical upgrades to the BNB Chain: optimizing performance for second-level confirmations, launching an AI ecosystem (Agent platform + AI project incubation), and upgrading Meme launchpad infrastructure. The effects of these three moves were immediate, with BNB Chain's on-chain transaction volume surging. On February 13, BNB Chain's daily transaction fees exceeded $5.8 million, surpassing Solana's $3.3 million and more than five times Ethereum's fees. This marked the first time since October 31, 2024, that a blockchain other than Ethereum and Solana led the industry in daily transaction fees.

Accompanying this was the operation of the content ecosystem, with updates to Binance Square serving as a "guide to prevent retail investors from being cut"—KOLs can not only share and compete on investment strategies online but also choose to display their real-time holdings. Now, when you open a major influencer's profile, the holding ratios and trading records are transparently visible. These feature updates have received widespread praise from users, satisfying the underlying psychological needs of trading users for "curiosity" and "showing off." Binance Square is expected to further become the leading portal in the crypto space, significantly enhancing user stickiness.

We observe this combination of strategies: technical upgrades attract developers → user surges boost on-chain data → community transparency enhances holding confidence. The BNB ecosystem is breaking the pessimistic narrative that crypto is only about "memes," and it is expected to become the "third pole" of digital assets.

Conclusion

If Bitcoin is the gold of the crypto world, then BNB is writing its own value narrative: it is not only the "fuel" of the platform ecosystem but also a "value container" that deeply binds user interests, technological evolution, and compliance frameworks through its mechanism design. As the market eventually returns to rationality, this experiment concerning the creation of scarcity, capturing compound returns, and building institutional trust may become a milestone annotation for the transition of crypto assets from the wild to the mainstream.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。