Original author: @RyskyGeronimo

Original translation: Ashley

Editor's note: This article introduces the Hyperliquid HLP vault, showcasing its low volatility, high Sharpe ratio, and negative correlation with Bitcoin, indicating that a portfolio strategy can significantly enhance returns. HLP's volatility converges with the growth of TVL, and the Sharpe ratio improves, potentially becoming a quality use case for HyperEVM in the future.

The following is the original content (reorganized for better readability):

I am pleased to share an analysis of the risk and return of the Hyperliquid HLP vault.

Conclusion:

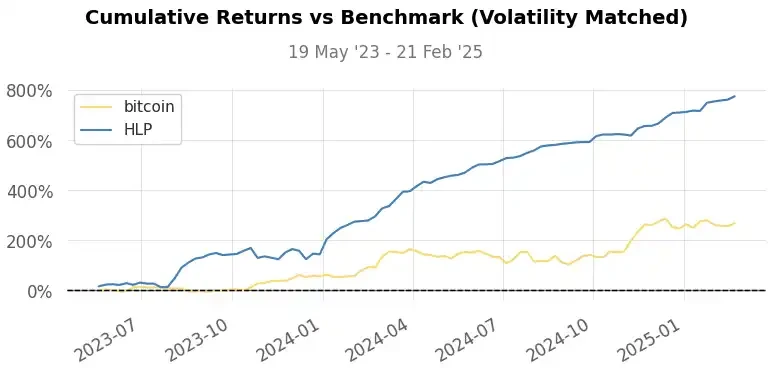

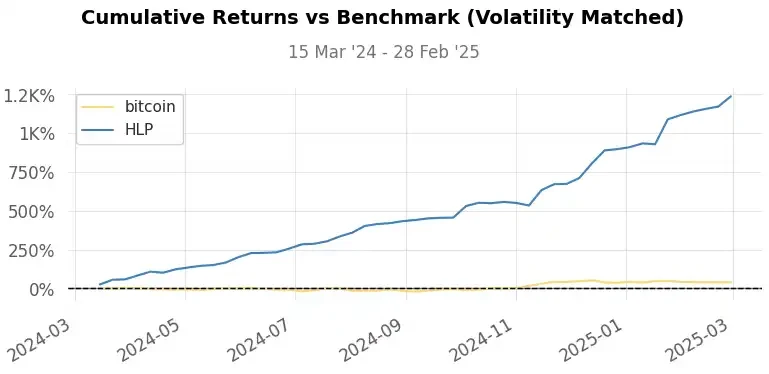

Cumulative return: 143% (HLP) vs 264% (BTC)

Annual volatility: 17.89% (HLP) vs 45.67% (BTC)

Sharpe ratio: 2.89 (HLP) vs 1.80 (BTC)

Maximum drawdown: -6.6% (HLP) vs -23% (BTC)

Leverage amplifies both gains and losses. Due to HLP's lower volatility, it can withstand higher leverage (2.5 times) before reaching the same risk level as Bitcoin. By adjusting HLP's risk to match Bitcoin's volatility, overall returns are significantly enhanced.

HLP exhibits a -9.6% negative correlation with Bitcoin. In other words, when Bitcoin (and the overall crypto market) declines, HLP often shows an inverse trend. This negative correlation creates opportunities for enhanced returns.

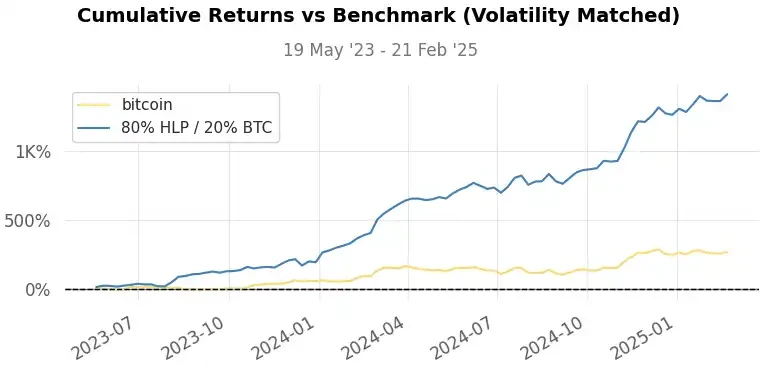

An 80% HLP + 20% BTC portfolio increases cumulative returns to 175%, while reducing volatility to 16%, achieving a Sharpe ratio of 3.6. If this portfolio is leveraged to match Bitcoin's volatility, cumulative returns could exceed 1000%.

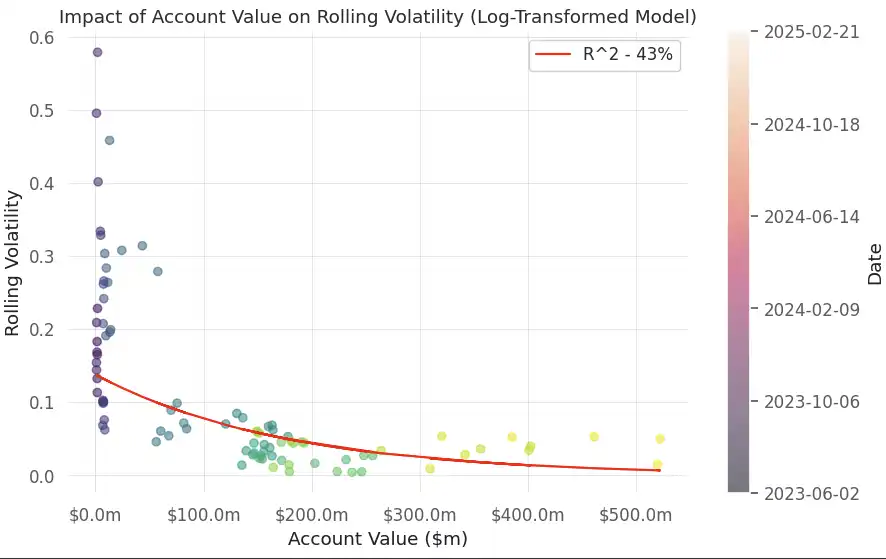

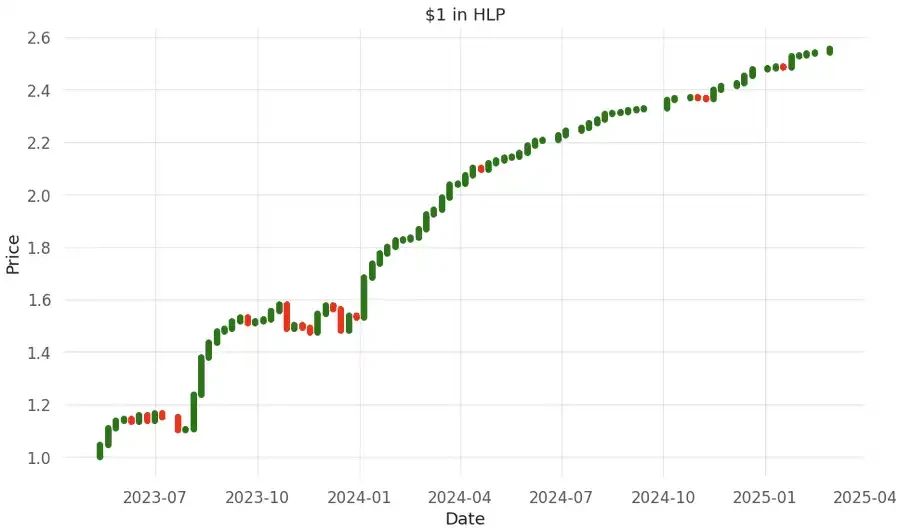

HLP experienced higher volatility in its early stages, but as TVL has grown (now exceeding $500 million), volatility has continued to converge.

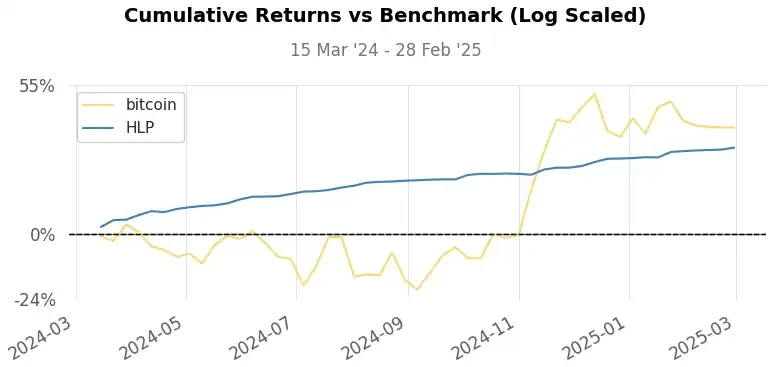

Data from the past 52 weeks shows that while HLP's full-cycle compound annual growth rate (CAGR) is 42%, the recent 12-month CAGR has dropped to 22%. Correspondingly, the annualized volatility has decreased to 4.5%, driving the Sharpe ratio up to 5.2!

The Hyperliquid team had anticipated this: "The addition of more market makers will have a positive impact on HLP. As HLP no longer needs to bear all the risks, the strategy's Sharpe ratio will further improve."

Through a cycle of double-digit returns and low volatility, HLP may become an interesting use case on HyperEVM.

As the capital base of the vault expands, we can expect the growth rate to slow down. With the increase in scale, monthly returns have become more stable. The recent average monthly return of about 1.75% remains attractive, especially compared to the volatility of the tokens.

It is important to note that the vault's lifetime data is provided in 4-day intervals rather than daily data, so the data needs to be resampled to weekly intervals, which will almost certainly introduce some tracking error.

Since mid-2023, the HLP vault has made significant progress, evolving from a niche market-making vault to a strategy with a TVL exceeding $500 million.

Looking ahead, further transparency—especially daily return data—will help users track HLP's performance more accurately. HLP is a typical example of how decentralized market making can achieve stable risk-adjusted returns and provide differentiated sources of on-chain returns.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。