Focusing on the lifeblood of liquidity, Pundi AI MM Agent is about to launch.

Written by: Deep Tide TechFlow

In the first quarter of 2025, the crypto hot search is dominated by token issuance:

After the announcement of TGE by Berachain, Story, Solayer, and MyShell, several top-tier projects, including Initia and Lens, have hinted at the upcoming mainnet/TGE on their social media platforms.

The community is excited about the hidden wealth opportunities, and at the same time, a significant update surrounding a token has sparked widespread discussion and attention:

According to official social media announcements, the decentralized AI project Pundi AI will undergo a brand transformation and token upgrade on February 25, 2025. The previous ecosystem token $FX will officially upgrade to $PUNDIAI at a ratio of 100:1.

This milestone, comparable to token discovery, has already caught the attention of astute investors who sense the enormous opportunities brought by the token upgrade process.

Beyond the token upgrade, the upcoming launch of the AI MM Agent, a new product similar to Virtual, will further complete Pundi AI's puzzle of "providing services throughout the entire lifecycle of AI development," raising community expectations for its future development.

As the token swap approaches, why should we pay attention to this Pundi AI token upgrade?

What fresh gameplay will the upcoming AI MM Agent bring?

From data, AI Agent issuance to liquidity optimization, how will Pundi AI build a complete product matrix around the vision of "providing AI development lifecycle services"?

In the face of these questions, this article aims to explore.

Token Upgrade: Will Pundi AI Bring the Next Hundredfold Opportunity in 2025?

What exactly is the token upgrade for Pundi?

First, the token upgrade is confirmed to take place on February 25, when the $FX token will upgrade to the $PUNDIAI token at a ratio of 100:1.

In this process, Pundi AI aims to provide holders with a seamless and effortless upgrade experience:

For users of Pundi AIFX Omnilayer "original F(x) Core," their $FX will automatically upgrade to $PUNDIAI without any additional action, and users' staked tokens will continue to earn rewards after the upgrade;

For users on the Base and Ethereum networks, although holders need to manually visit a designated page for the upgrade, they can also choose to bridge their tokens back to Pundi AIFX Omnilayer for automatic upgrading;

For exchange users, this token upgrade has received support from several well-known exchanges, including Upbit, Coinbase, Bithumb, Kucoin, Gate.io, and CoinEX, to facilitate the automatic upgrade from $FX to $PUNDIAI. Currently, Upbit has announced that it will suspend Function X (FX) deposits/withdrawals/trading to better prepare for this upgrade, with specific dates for other exchanges yet to be determined.

Beyond the specific upgrade methods, a more worthy topic to discuss is: why do we need to pay attention to this token upgrade?

First, there is an almost obvious reason:

$$FX will officially upgrade to $$PUNDIAI at a ratio of 100:1, which equates to a 100-fold* deflation*. Generally, according to the law of supply and demand, if the quantity of an asset decreases, its intrinsic value per unit will increase. Therefore, deflation is usually accompanied by an increase in token value. The 100-fold deflation of $PUNDIAI brings a 100-fold potential increase in value.

This situation has historical precedent:

Back in April 2021, the Pundi team conducted a token upgrade at a ratio of 1000 NPXS = 1 PUNDIX in its PayFi product line, achieving a hundredfold performance. How much opportunity will the upgrade from $FX to $PUNDIAI bring? The community is eagerly awaiting.

More importantly, in the current wave of AI sweeping the crypto ecosystem: on one hand, the $PUNDIAI, focusing on the AI track, as a new brand and token launch, may bring early investors opportunities to capitalize on AI; on the other hand, among AI projects listed on Upbit and Coinbase, $PUNDIAI, as one of the smallest market cap AI projects, has greater growth potential.

Of course, with the arrival of the token upgrade, the positive sentiment towards $PUNDIAI comes not only from market trends but also from the project's fundamentals:

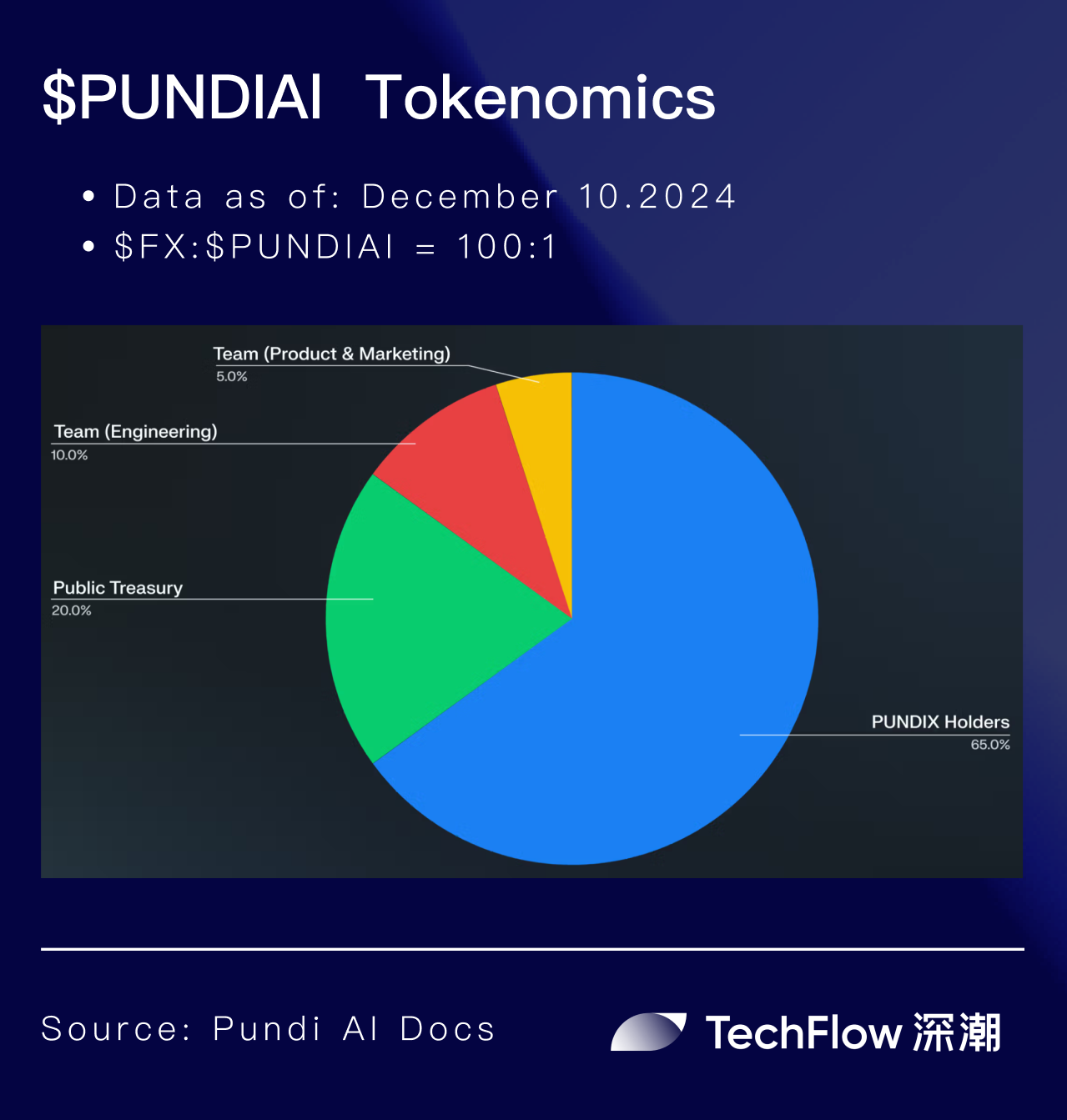

It is worth noting that in this round of cycles where VC Tokens have generally underperformed, $PUNDIAI has never received financing and has no future financing plans, aiming to build a purely community-driven and fully decentralized AI community;

In this context, compared to many VC Tokens that will soon face massive unlocks, $PUNDIAI is already fully unlocked, with FDV representing the actual circulating market value, further alleviating community concerns.

On the other hand, products are the main vehicle for growth and the ultimate endpoint. With several core products set to launch in 2025, not only will this attract more industry attention to this token upgrade, but it also raises expectations for Pundi AI's performance in 2025.

Focusing on the lifeblood of liquidity, Pundi AI MM Agent is about to launch

From the initial vision of "becoming the world's largest decentralized AI data layer" to now shouting "building services throughout the entire lifecycle of AI development," after years of groundwork, Pundi AI's AI product matrix is gradually becoming clearer:

AI Data Layer:

Pundi AI Data platform

PURSE+ browser extension

Pundi AI data marketplace

AI Agent Issuance Layer:

- Pundi Fun AI Agent Launcher

AI Agent Liquidity Layer:

- Pundi AI MM Agent

Underlying Infrastructure Support:

- Pundi AIFX Omnilayer

We know that data is the fuel for AI development. Pundi AI's initial product design revolves around data, aiming to create a decentralized AI data layer that allows fair participation and rewards for labor, from data acquisition, data labeling to data trading.

In terms of data acquisition, Pundi AI aims to aggregate rich data sources from Web2 + Web3: users can upload data to contribute through the Pundi AI Data platform. Additionally, Pundi AI has launched a browser extension product, PURSE+, which allows users to contribute data by completing tasks such as labeling content from X (Twitter) and other Web2 social media.

In terms of data processing, Pundi AI is committed to creating a decentralized data labeling crowdsourcing market: AI products that need data can create data requests through the Pundi AI Data platform, while users can participate in data labeling through the Pundi AI Data platform and earn rewards through a token incentive mechanism, encouraging widespread participation.

In terms of data trading, Pundi AI advocates that "labeled data = intellectual property": data is an asset, and users can place data in the Pundi AI data marketplace, where buyers can efficiently search and pay to download data by category. Moreover, the known earnings, future earnings, and dividends generated throughout the data's circulation, trading, and usage will allow data contributors to receive corresponding rewards.

Months ago, leveraging the opportunity of Pundi X launching the new brand Pundi AI and accelerating its business expansion into the DeAI track, we also wrote an article detailing Pundi AI's transformation and upgrade journey, including the Pundi AI Data platform, PURSE+ browser extension, Pundi AI data marketplace, and Pundi AIFX Omnilayer. We will not elaborate further here; interested users can click the article link below for more in-depth understanding:

After addressing the issues of the AI data layer, what will be the next step for AI development?

With the rapid development of AI Agents, AI Agents have become the focal point of attention, and their issuance and liquidity have become key to competition in crypto AI. Pundi AI is about to officially launch Pundi Fun AI Agent Launcher and Pundi AI MM Agent, which will be the focus of our discussion next.

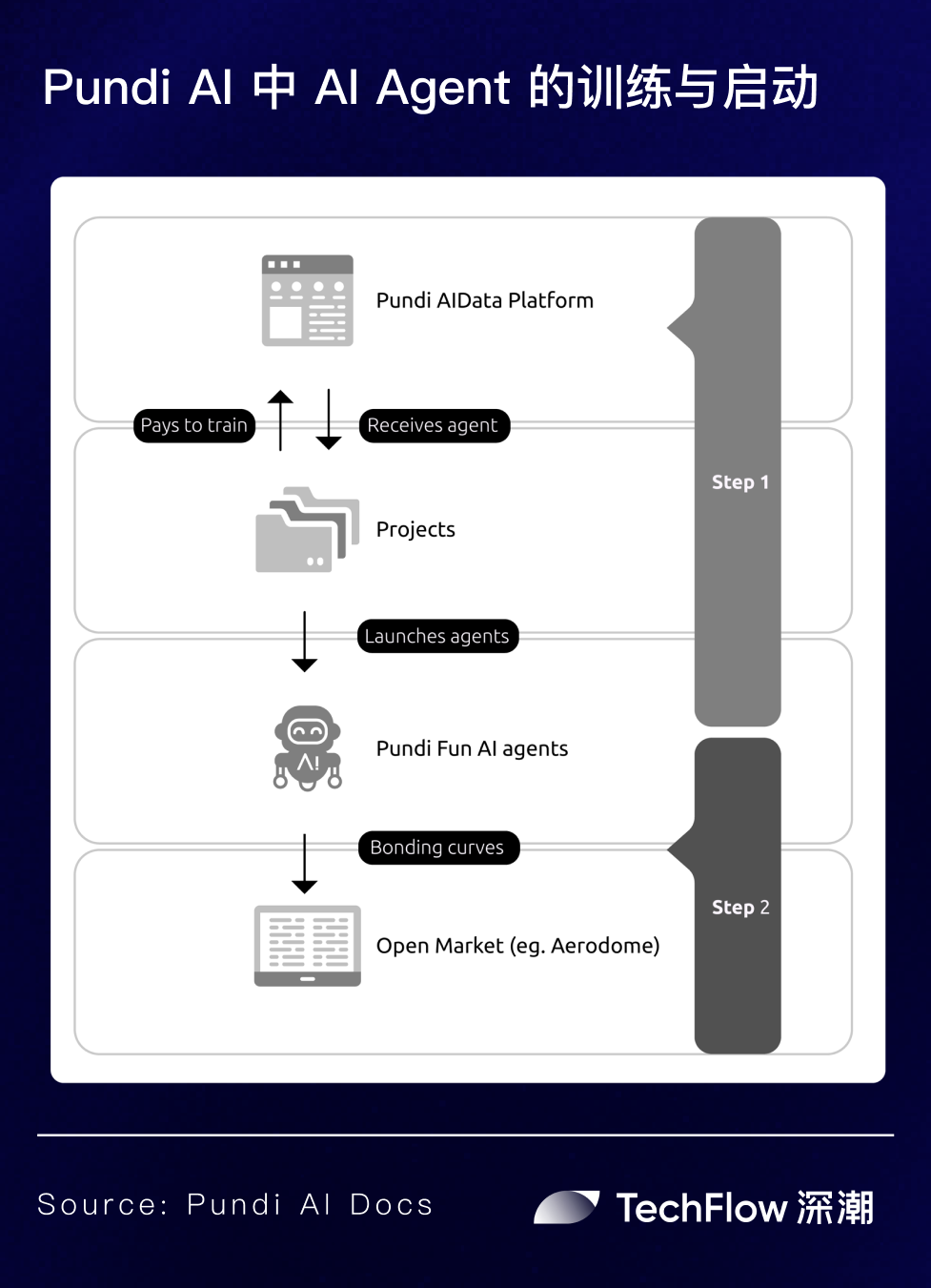

As the name suggests, Pundi Fun AI Agent Launcher focuses on the issuance of AI Agents.

If you are familiar with Virtuals, you won't find the gameplay of Pundi Fun AI Agent Launcher unfamiliar.

Through Pundi Fun AI Agent Launcher, you can efficiently create your personalized AI Agent in just a few minutes, with the product designed to provide a simple, intuitive, and seamless experience.

At the same time, whenever an AI Agent is created, its corresponding AI Agent DAO token will also be launched, representing the holder's rights to that AI Agent, with 100% of the tokens placed in the pool. When the FDV of the DAO token exceeds $65,000, liquidity will be injected into public markets like Aerodrome.

At this point, the gameplay seems to be no different from the well-known Virtuals. How will Pundi AI endow its products with differentiated competitiveness?

On one hand, in conjunction with the previously constructed data segment products, you can purchase high-quality data on the Pundi AI data platform to train your AI Agent, making it smarter and enhancing its service capabilities by paying a fee.

On the other hand, the issuance of AI Agent assets is essentially a competition for on-chain liquidity; those who possess liquidity will dominate the market. Therefore, ensuring that the market has sufficient liquidity and deep market-making is inevitable.

In the broader context of decentralized AI, the centralized issues of traditional market-making cannot be ignored. Although AMM performed brilliantly during the DeFi Summer, we must also acknowledge the current challenges faced under the AMM mechanism, such as low capital efficiency, LP positions exceeding limits, difficulties in cross-exchange or cross-chain arbitrage, and rebalancing.

Pundi AI MM Agent is specifically designed to optimize AI Agent liquidity: it aims to combine the flexibility of traditional market-making with the accessibility advantages of AMM, optimizing capital efficiency while striving to become a machine that maximizes benefits through features like dynamic liquidity allocation, adaptive rebalancing, and MEV capture.

Specifically:

The Pundi AI Foundation will provide funding for AI Agents by purchasing AI Agent DAO tokens and injecting liquidity into AI Agents in the form of AI Agent tokens / $PUNDIAI.

At the same time, the Pundi AI MM Agent will continuously scan the market and adjust parameters based on performance, maintaining efficient liquidity while better seizing market opportunities.

As a result, compared to other AI Agents, the AI Agent projects issued by the Pundi Fun AI Agent Launcher will have a prominent liquidity advantage with the assistance of the Pundi AI MM Agent, laying a solid foundation for the long-term healthy development of the projects and the protection of holders' interests.

However, some details remain unclear, such as:

Among so many AI Agents, how will the Pundi AI Foundation choose which ones to fund?

Where does the funding for the Pundi AI Foundation come from?

Since liquidity is injected in the form of AI Agent tokens / $PUNDIAI, how will this mechanism empower $PUNDIAI holders?

Everything starts with the clever economic model design of $PUNDIAI.

Dual-token design under the ve model, $PUNDIAI is highly useful

In addressing the important aspect of token economics that touches the soul of project development, Pundi AI has adopted a ve model design.

In simple terms, Pundi AI has a dual-token system:

$PUNDIAI: is the utility token of the Pundi AI ecosystem, with a wide range of uses in many scenarios within the Pundi AI ecosystem, such as in Pundi AI Data, Pundi AI data marketplace, Pundi AIFX Omni Layer, Pundi Fun AI Agent Launcher, etc. Contributors participating in these products will receive $$PUNDIAI rewards and can also use $$PUNDIAI to pay for services.

$vePUNDIAI: is the governance token of the Pundi AI ecosystem, allowing holders to obtain $vePUNDIAI by locking $PUNDIAI, enabling participation in the liquidity governance of the Pundi AI MM Agent. Pundi AI encourages the creation of long-term value, with longer lock-up periods resulting in higher reward weights.

After understanding the respective functions of the dual tokens, let's address the specific operational questions under the innovative mechanism of the Pundi AI MM Agent.

First, how does the Pundi AI Foundation choose which AI Agent to support?

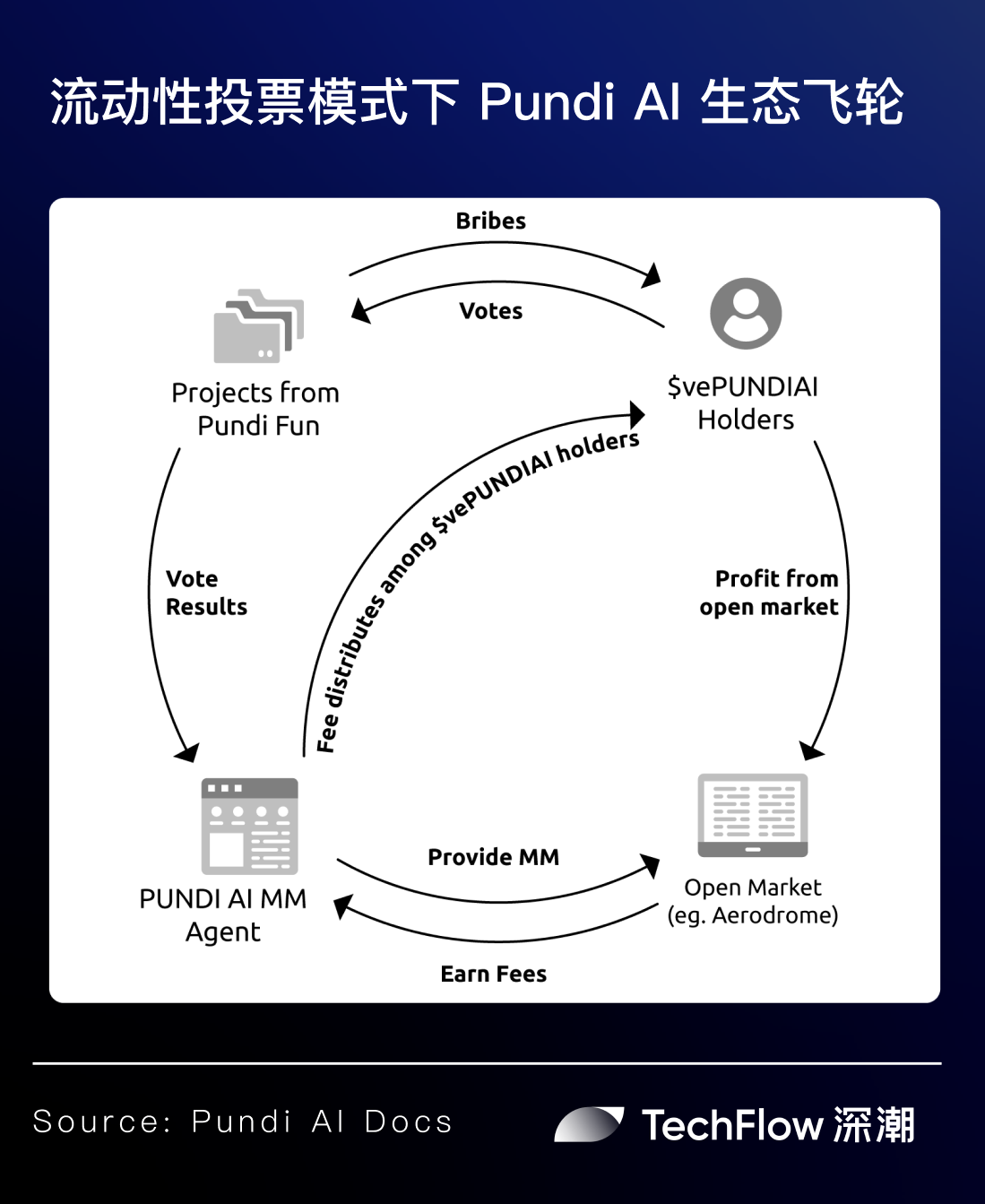

It's simple: through $vePUNDIAI to complete liquidity governance for the AI MM Agent.

On a weekly basis, $vePUNDIAI holders can vote for their favorite AI Agents. Based on the voting results, the Pundi AI Foundation will inject liquidity into the AI Agents in the public market.

So, what motivates $vePUNDIAI holders to participate in the voting?

In addition to maintaining the healthy development of the ecosystem, $vePUNDIAI will also yield substantial rewards.

On one hand, AI Agent creators must pay a certain fee to request their tokens (or pools) to be whitelisted for liquidity incentives, with 10% of this fee being returned to $vePUNDIAI holders through the protocol pool.

On the other hand, to attract $vePUNDIAI holders to vote, AI Agents need to exert effort to enhance their own capabilities while also sharing part of their rewards with voters. The more generous the rewards for voters, the stronger their willingness to vote.

Most importantly, where does the funding for the Pundi AI Foundation come from?

Pundi AI has designed a Pundi AI protocol pool.

According to the official Pundi AI Gitbook, 10% of the revenue generated from data purchases on the Pundi AI data platform and 10% of the trading volume in the Pundi AI data marketplace will enter the protocol pool.

Additionally, in the Pundi Fun AI Agent Launcher segment: 10% of the shares used by AI Agents to "bribe" $vePUNDIAI holders to increase support will enter the protocol pool; 1% of transaction fees will enter the protocol pool; at the same time, the foundation will earn ongoing fees from LP trading of AI Agent tokens / $PUNDIAI, which will also enter the protocol pool.

Multiple revenue streams from the ecosystem accumulate in the Pundi AI protocol pool and empower the ecosystem through the foundation. This also answers the question of "how to deeply bind the development of AI Agents with $PUNDIAI holders." The mechanism of voting to determine liquidity allocation allows AI Agents to passively participate in "bribery" to form healthy competition while encouraging broad governance participation, enhancing the governance rewards for holders and creating a positive feedback loop for the Pundi AI ecosystem.

Multiple core products are on the way, and 2025 may be a key year for Pundi AI's vision to take shape

2025 may be a key year for Pundi AI's vision to take shape.

For Pundi AI, which is about to reach multiple milestones, this statement is not an exaggeration.

On February 25, 2025, the $FX → $PUNDIAI token upgrade will officially commence, and the wealth opportunities hidden under 100-fold* deflation* will undoubtedly attract more attention to Pundi AI.

Pundi AI is also prepared to seize this critical time point, with multiple products in the ecosystem ready to launch.

According to the official roadmap, in the first two quarters of 2025: the Pundi AI data labeling platform will launch a whitelist test version; the Pundi AI Marketplace will release an Alpha version; the Pundi Fun AI Agent Launcher and Pundi AI MM Agent will also officially meet everyone; in addition, data labeling tools will launch browser and mobile applications to facilitate more users' simple participation.

At the same time, Pundi AI has designed engaging and rewarding gameplay based on its products, aiming to provide users with a rich ecosystem participation experience:

On one hand, Pundi AI will introduce a "Tag-to-Earn" model to help users earn rewards through interactive participation; on the other hand, Pundi AI will launch a referral program to attract more incremental users into the ecosystem. Additionally, the AI Marketplace will introduce staking pools.

From AI data acquisition, labeling, trading to AI Agent training, issuance, and liquidity support, every step of Pundi AI demonstrates its profound understanding and forward-looking layout for a decentralized AI ecosystem.

Standing at the intersection of the AI wave and blockchain technology, as stated in the vision of "providing services throughout the entire lifecycle of AI development," with the arrival of various core products and important functions, can Pundi AI become a significant participant in decentralized AI in 2025, bringing long-term value to the market, investors, and participating users?

Starting from the brand transformation and token upgrade on February 25, we look forward to witnessing this journey together with the community.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。