Author: Deep Tide TechFlow

"To everyone who has, more will be given; and he will have an abundance. But from the one who has not, even what he has will be taken away."

--- Matthew

On-chain, the Matthew effect of the strong getting stronger has never ceased.

For example, Pump.fun has quietly started doing the work of Raydium: today it stealthily launched a self-built AMM pool, attempting to siphon off the liquidity revenue that originally belonged to Raydium.

Currently, this self-built AMM (http://amm.pump.fun) page is very simple, allowing you to swap any token just like other DeFi products.

However, the intentions behind this product may not be simple.

Everyone knows that Pump.fun attracts a large number of Degens with its unique internal and external market mechanism and memecoin culture.

User transactions are first matched in Pump.fun's internal market, relying on the platform's liquidity to complete trades; when the internal market is full, transactions are routed to the external market, which actually relies on Raydium's liquidity pool.

In this model, Pump.fun has always been a "traffic provider" for Raydium, but is also constrained by Raydium's rules. Every time a transaction flows to the external market, Pump.fun has to pay a portion of the transaction fees, and this profit ultimately flows to Raydium's liquidity providers (LPs).

Raydium itself is one of the most important AMM platforms in the Solana ecosystem and serves as a crucial infrastructure for DeFi users to access liquidity. It also provides liquidity pool services for many projects on Solana, with its TVL (Total Value Locked) consistently ranking among the top in Solana.

As the "liquidity center" of Solana, Raydium occupies a pivotal position in the ecosystem. However, Pump.fun's new moves are challenging this pattern:

Pump.fun is no longer satisfied with being Raydium's "traffic provider," but is trying to become the "controller" of liquidity.

The Business Behind the Self-Built AMM Pool

By building its own AMM, Pump.fun can transfer external liquidity from Raydium to its own platform, thus completely controlling the distribution of transaction fees.

If Pump.fun's strategy succeeds, Raydium will not only lose a portion of its liquidity source, but its revenue model and ecological status will also be impacted.

So, how is this calculated?

1. Raydium's Revenue Model: Pump.fun's "Invisible Costs"

In the existing model, Pump.fun's external transactions rely on Raydium's liquidity pool, and each transaction incurs a certain fee, which ultimately flows to Raydium's ecosystem.

Raydium's standard fee: a 0.25% fee is charged on each transaction, of which:

0.22% is allocated to Raydium's liquidity providers (LPs).

0.03% is used for $RAY buybacks and ecosystem support.

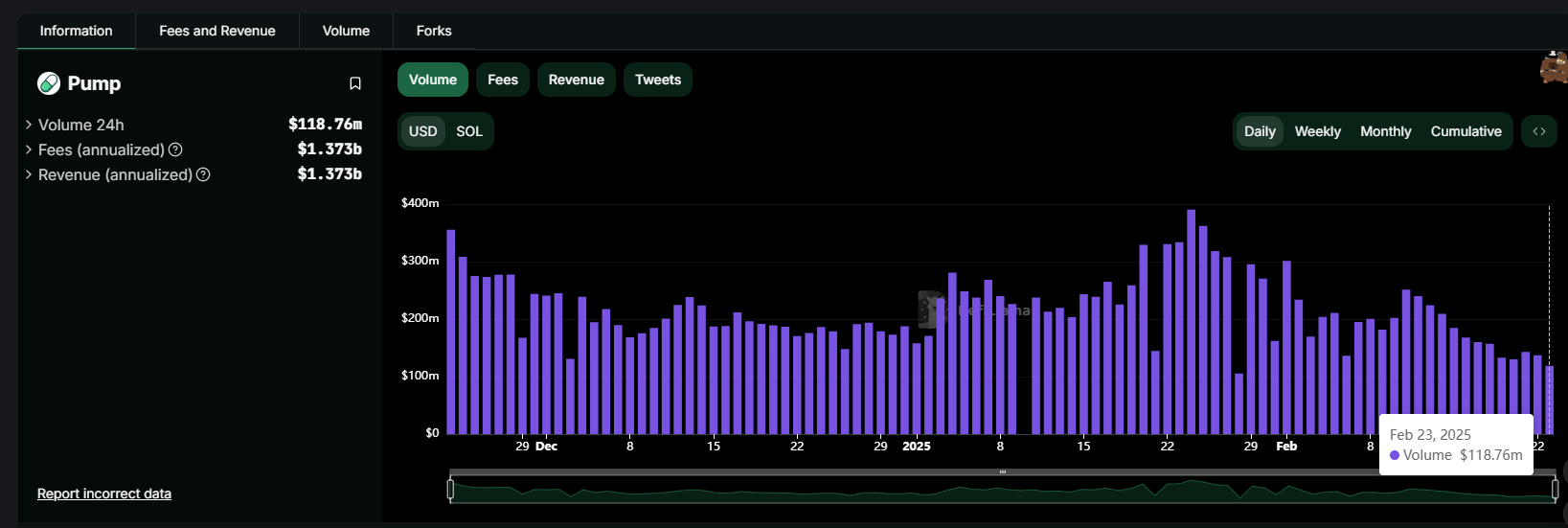

Pump.fun's trading volume: Assuming Pump.fun has a daily trading volume of $100 million, with 5% of the trading volume (about $5 million) routed to Raydium's external market.

Pump.fun's invisible costs: Based on a 0.25% fee, Pump.fun needs to pay Raydium $12,500 daily, amounting to about $4.5625 million annually.

For a rapidly growing platform, while this fee has decreased compared to before, it still represents a dependency on an external platform.

2. Potential Earnings from Self-Built AMM

By building its own AMM, Pump.fun can transfer external liquidity from Raydium to its own platform, thus completely controlling the distribution of transaction fees. So, how much potential revenue can this move bring?

New revenue model: Assuming Pump.fun's self-built AMM charges the same fee as Raydium (0.25%), but all fees belong to the platform:

The daily external trading volume remains $5 million.

Based on a 0.25% fee, Pump.fun could directly earn $12,500 daily.

Annual cumulative revenue would be about $4.5625 million.

Net earnings after removing LP costs: If Pump.fun's AMM does not rely on external LPs but instead provides liquidity itself, this revenue will belong entirely to the platform, with no need to distribute to other liquidity providers.

3. Beyond Money, What Else Does Pump.fun Aim For?

Building a self-owned AMM not only brings direct revenue increases but also significantly enhances Pump.fun's control over the ecosystem, laying the foundation for future development.

In the existing model, Pump.fun's external transactions rely on Raydium's liquidity pool, meaning Raydium controls the user trading experience and liquidity stability.

After building its own AMM, Pump.fun will completely control the rules and fee distribution of the liquidity pool, thereby enhancing its control over users.

With control over liquidity, Pump.fun can further launch more DeFi products (such as perpetual contracts, lending protocols, etc.), thus constructing a closed-loop ecosystem.

For example, Pump.fun can directly support the issuance and trading of memecoins through its AMM pool, providing more play options for its community.

Related Token Price Changes

After Pump.fun announced the launch of its self-built AMM, Raydium's token $RAY fell sharply, with a daily drop of 20%.

This phenomenon may reflect market concerns about its future revenue and status.

Pump.fun's strategy could pose a long-term threat to Raydium, especially in terms of liquidity migration and fee income.

On the other hand, after Pump.fun built its AMM pool, a MEME token called Crack, which was tested for this liquidity pool, saw its price surge rapidly, with a market cap reaching as high as $4 million at one point.

CA:

CitRGsrgU7NjaXsxdMFc7sfsxtSnPdtkhHJqbPvhpump

Among the few market hotspots, the test token for the AMM pool may still soar for a while.

The Challenge is Clear

After building its own AMM, if it runs smoothly, Pump.fun will completely control external liquidity, significantly increasing its revenue.

By integrating internal and external liquidity, Pump.fun can construct a fully self-consistent on-chain Meme DeFi ecosystem.

From seizing attention traffic to capturing funding sources, Pump.fun is clearly transitioning from "relying on external liquidity" to "owning liquidity."

An innovative platform, after gaining a larger user base, certainly has the opportunity to shake the traditional DeFi status and on-chain ecological pattern through strategic adjustments.

However, whether Pump.fun can truly shake Raydium's position in the future will depend on its ability to balance liquidity strategies and user growth; more critically, whether the bull market is still present.

Timing and opportunity.

Not only are the retail investors in PVP, but projects are also engaged in fierce competition against each other.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。