The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui who talks about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome everyone's attention and likes, and refuse any market smoke bombs!

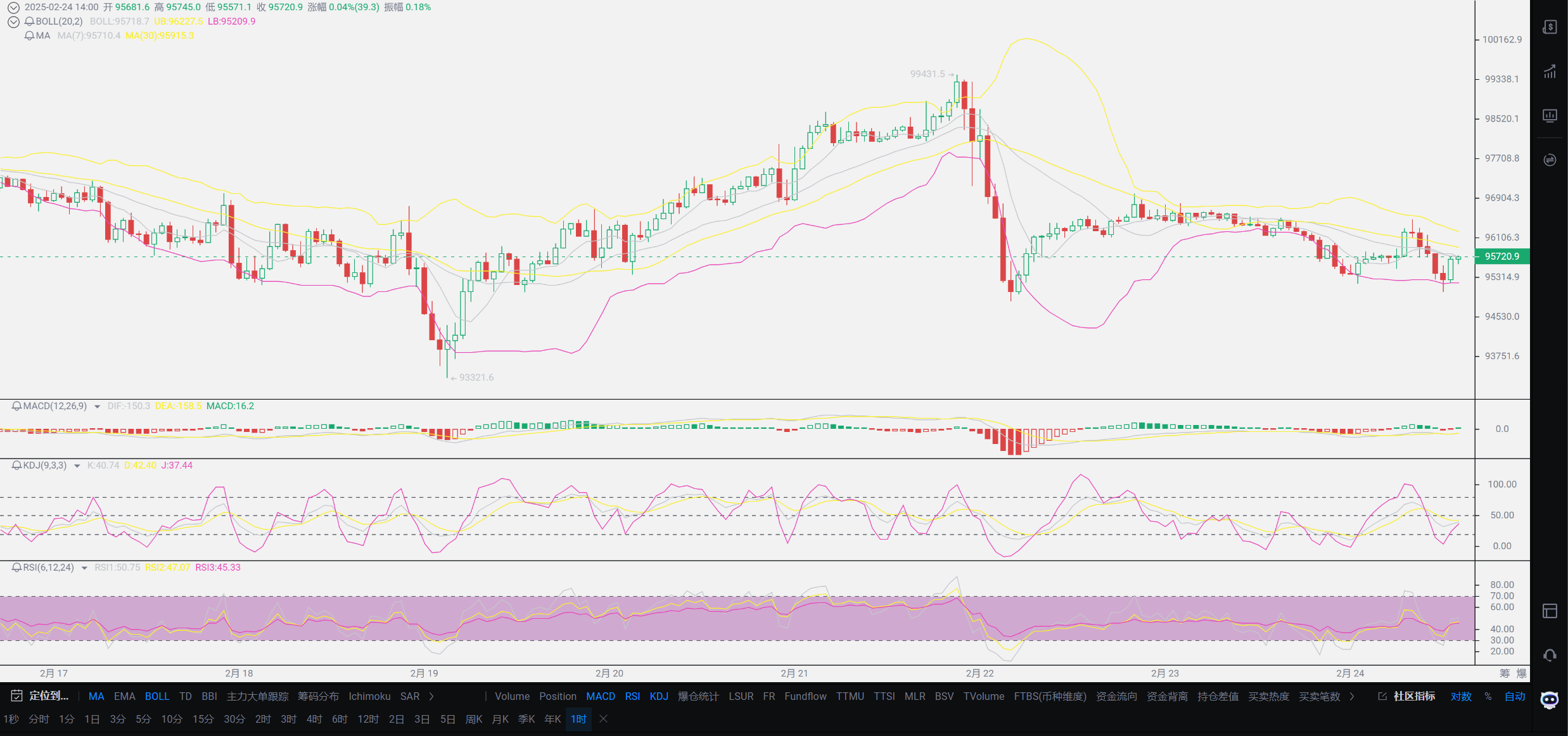

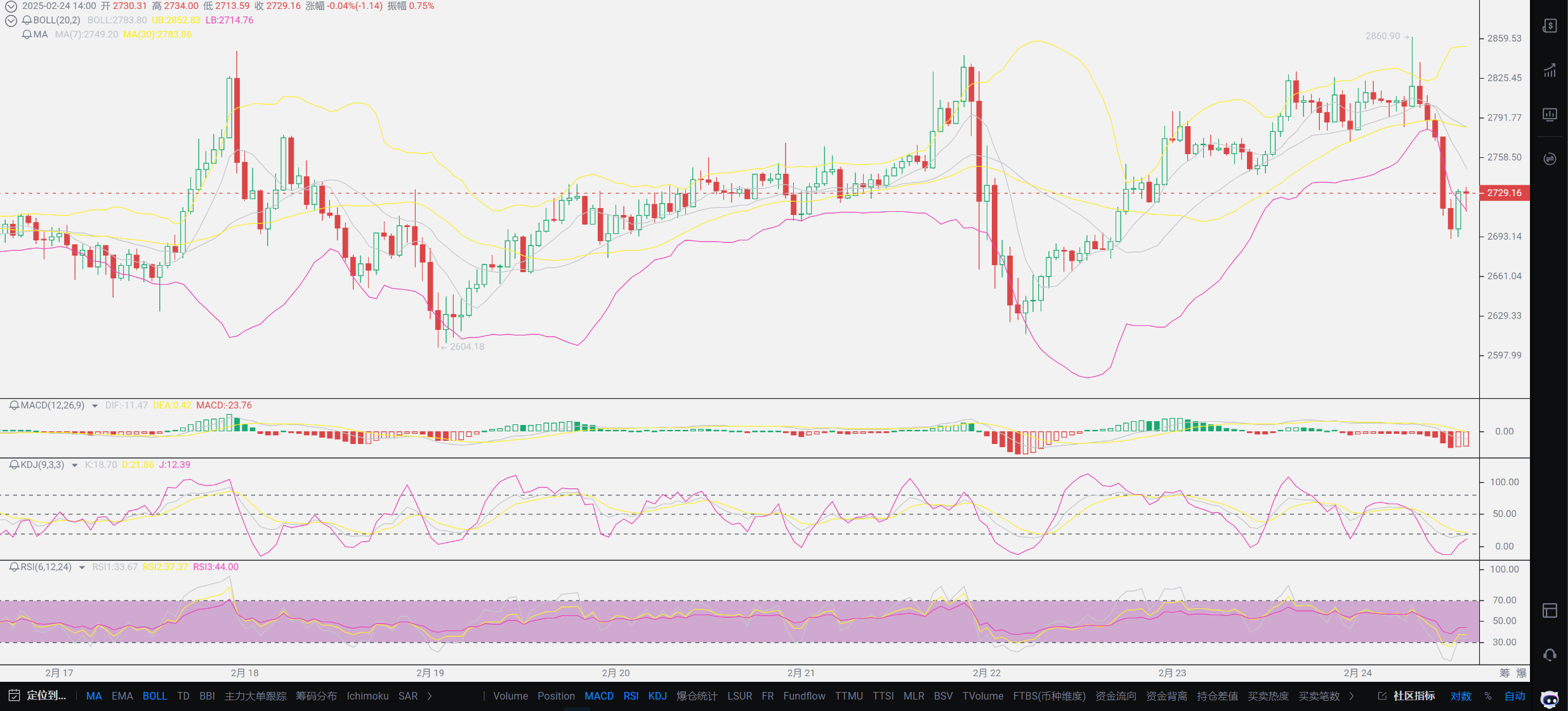

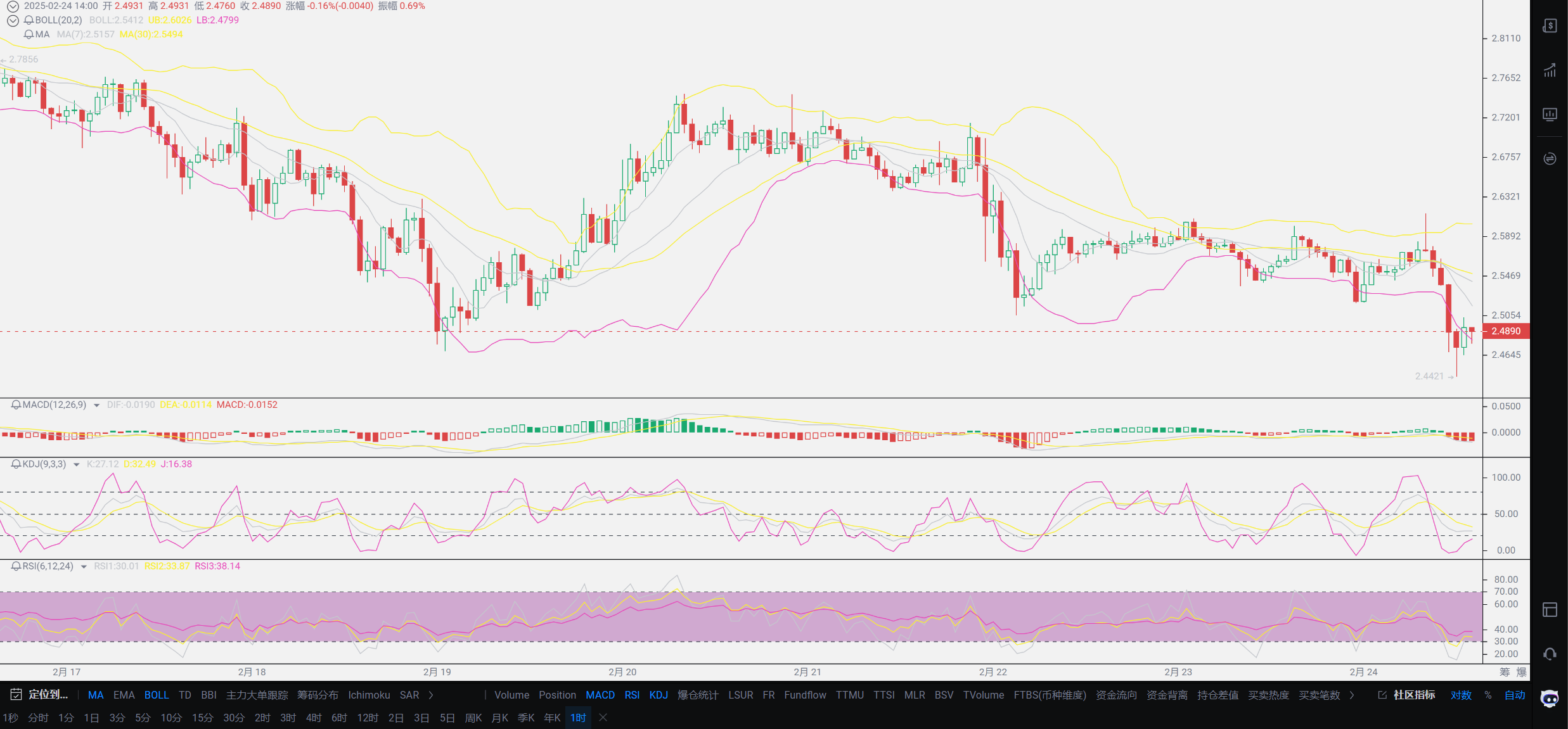

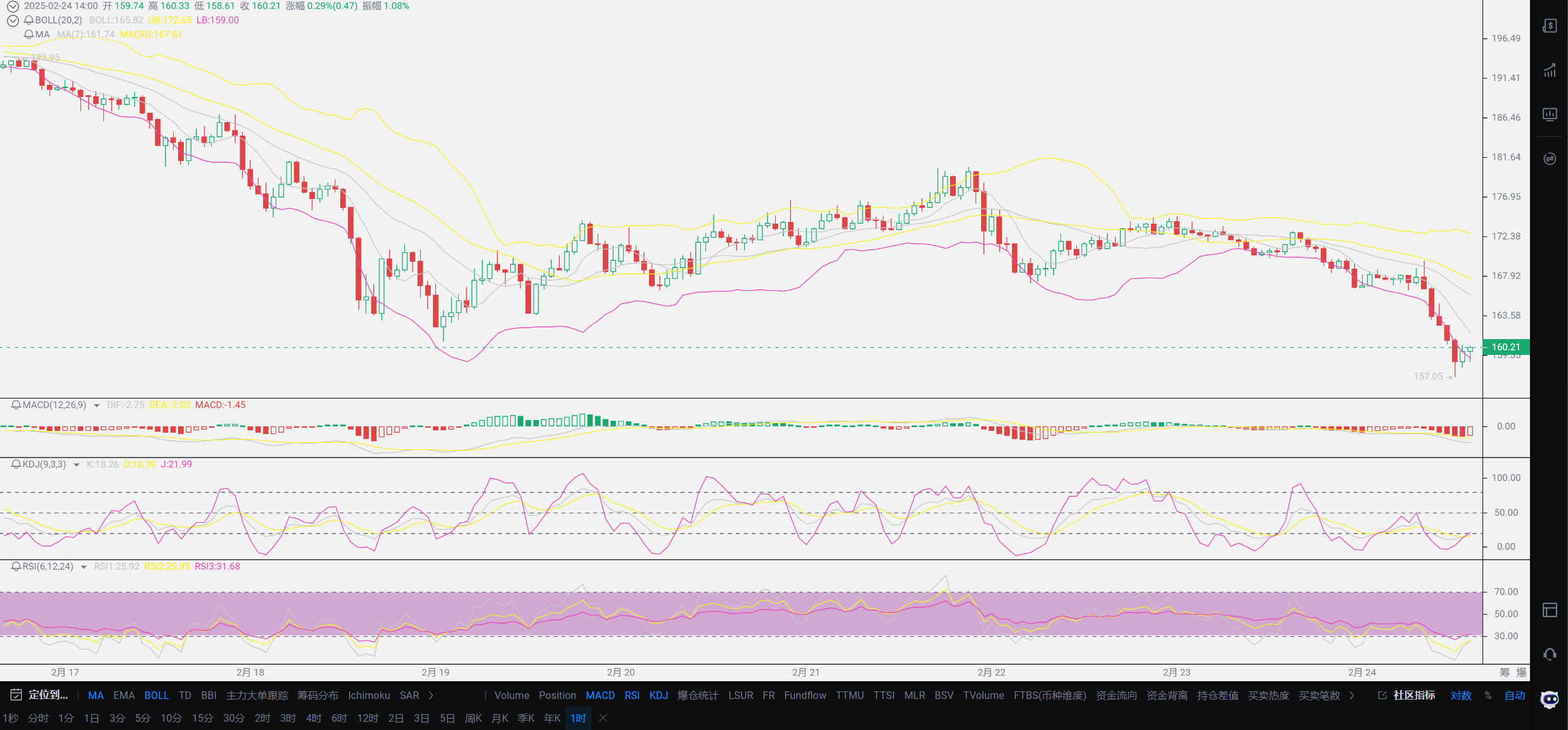

Having discussed the trend of Bitcoin, I believe everyone has a certain understanding of it. Recently, I will put Bitcoin aside and talk to you about how to respond under such market conditions. It’s quite basic and requires a bit of your patience to watch. The end of yesterday's article also mentioned it briefly, basically divided into two types: one is the users who have already followed Lao Cui and are profiting from long positions around 70,000, and the other is the users who have just seen Lao Cui's article recently. These two are essentially choices between expanding profits and sustaining profits. It is clear that users who are already in profit have a larger range of potential losses in the current market, meaning they can withstand more price fluctuations. The current approach is to prioritize ensuring early profits. In a volatile market, one can choose to hold positions back and forth for profit. The trend is also very clear; the lower points will basically not be touched, and even if they are touched, they will quickly recover. This tests everyone's patience and trust, and the profits can just offset the losses in the spot market. For users who have not entered the market, the focus will definitely be on long positions, buying on dips, especially in the 94,000-95,000 range, or even lower points. Everyone should not feel hesitant to buy at low points; Bitcoin and Ethereum are considered stable entities in the crypto world, and one must definitely avoid small altcoins. Looking at the trend of SOL, the lows keep setting new lows; choosing small altcoins cannot yield contract profits.

Choosing small altcoins also tests everyone's vision. Currently, the mainstream small altcoins are all speculating on the next listing plans, with almost all coins claiming they will be the third to be listed. Currently, the most competitive coins are SOL, Litecoin, and XRP. Basically, XRP can be excluded, and Lao Cui is more willing to choose SOL; it’s just a matter of time before this coin gets listed. The other two not only need to overcome the listing issue but also lack a certain level of synchronicity. The biggest dark horse is the Trump coin; these few coins can be taken over by spot users at low points. It’s more about the timing of growth, which is something everyone needs to analyze seriously. First, the interest rate cuts in the first half of the year are almost impossible. Trump's tariff increases, combined with the lack of interest rate cuts, may affect the domestic standard of living to some extent. Trump is certainly determined to focus on interest rate cuts. However, these two belong to different camps, and Powell has clearly stated that he will not follow Trump's orders, making the chances of interest rate cuts increasingly slim. This also has an indelible impact on the crypto world, so short-term capital will definitely become an issue. Not just in the crypto world, other markets with financial attributes also need to pay attention to the impact. Real growth may have to wait for half a year; one should not view the crypto market in a one-sided manner, as it does not mean there are no short-term breakthroughs. As long as short-term breakthroughs are not aimed at stabilization, there will definitely be fluctuations.

Regarding the exchange rate, for users holding US dollars, it is certainly good news. This year is extremely challenging for exchange rates. The impact of Trump's tariffs, including the no interest rate cut strategy, will definitely affect the exchange rate, while the domestic monetary easing strategy will also undergo some adjustments. Adding these factors together, the real estate market may still decline, and users with idle properties must pay attention. The CNY will also trend towards depreciation, and users with assets should try to convert them. The exchange rate for the crypto world, the strength of USDT, will not be a good thing; this again points to the fact that the exchange rate will cause a decline in market value, but the overall value remains unchanged. This comparison can be simply understood from this year's GDP; when converted to US dollars, the domestic production value has clearly declined, but from the perspective of RMB, there has been no change. At the same time, the purchasing power of the RMB domestically far exceeds that of the US dollar. These two are essentially a duel between market value and purchasing power, with purchasing power far exceeding total market value. All these aspects benefit from the manifestation of industrial capacity and low labor costs, which are both an advantage and a disadvantage. Reflected in the crypto world, it means a decline in total market value, and the exchange rate will provide some support; perhaps the best way and solution direction is to store USDT to hedge against the decline of CNY.

At the same time, the decline in market value will certainly cause a significant impact on the prices of small altcoins, and more funds will choose industry leaders. The trend in the crypto world this year is likely to become polarized. This also includes the competition between US stocks and the A-share market. From the perspective of capital allocation, it is already quite remarkable that 2 trillion can flow into the crypto world this year. Whether this 2 trillion can pull Bitcoin's price above 150,000 is a huge question mark. The competition for Ethereum, SOL, and Trump coins will also become increasingly fierce, and how to allocate them has become a huge issue. Looking at the short-term level, in the past thirty days, the market has shown a state of outflow; as long as there are no continuous positive news coming in, it will likely become a paradise for bears. Bitcoin outflow has clearly reached 5.3 billion, while Ethereum has seen an inflow of 1.7 billion, with the overall outflow in the crypto world nearing 10 billion in market value. The short-term gap is very obvious; unless there is significant capital intervention later, it is likely to maintain a short-term level of volatility. Everyone needs to be cautious; the high points can be said to be getting higher and higher, showing signs of recovery, but there is no capital for recovery, so one must be cautious about long positions.

Lao Cui's summary: Overall, the challenges facing the crypto world are that there is basically no substantial capital intervention. At the same time, everyone can observe the performance of US stocks; these two are almost the same. This is no longer just an issue explained by K-line charts; the global crisis has not yet passed. It can also be said that the problems brought about by excessive currency issuance have already become prominent, and the global competition for capital has entered a heated stage. The competition between markets is also becoming increasingly evident. Currently, the issue of cashing out Bitcoin in China has almost been completely resolved, and future market crashes will have nothing to do with the domestic situation. The traditionally strong gold has also shown a significant decline, which is indeed unfavorable at the beginning of the year. Many users reading this article are eager to know when a bull market will appear. Judging from the capital perspective is indeed difficult; at this stage, one can only smooth out losses through short-term fluctuations. In summary, interest rate cuts are almost an issue to be resolved in the second half of the year, and the listing process is worth paying attention to. If nothing unexpected happens, there will be results within three months, including strategic reserves, which may also show signals within three months. The growth in the first half of the year can only be hoped for from these two pieces of news. Other industries are unlikely to see significant changes in the first half of this year; it depends on whether technology can achieve certain breakthroughs. Finally, I remind everyone that the current market is extremely suitable for contracts; be sure to seize this opportunity. The range has already been given to you; how to grasp it is up to you to consider!

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation, strategizes for the big picture, and does not focus on individual pieces or territories, aiming for the ultimate victory. The novice, on the other hand, fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。