Author: Aaron Wood

Source: Cointelegraph

Translation by: Ada, MetaEra

It has been a month since U.S. President Donald Trump was sworn in and began implementing comprehensive and controversial reforms, many of which directly impact the cryptocurrency industry.

Just 30 days into his presidency, Trump appointed several executives who support cryptocurrencies to senior regulatory positions and established the Department of Government Efficiency (DOGE), a temporary organization led in practice by Musk.

In an interview on February 18, Trump and Musk stated that DOGE and Musk's personal goal is to provide "technical support" to the government, streamline wasteful government spending, and fundamentally restructure federal agencies.

Here are the significant events related to cryptocurrency during Trump's first 30 days in office.

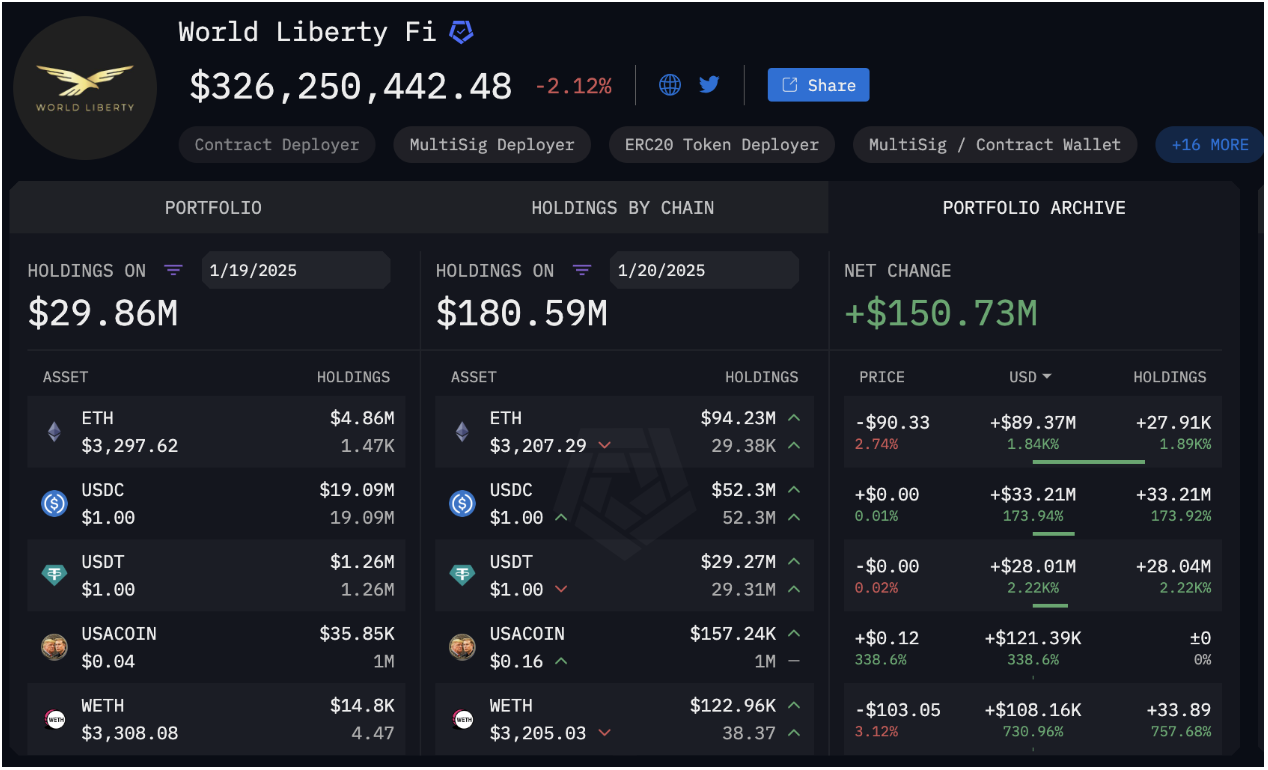

January 20 — Trump's World Liberty Financial purchases tens of millions in cryptocurrency on inauguration day

On his first day in office, Trump issued a series of executive orders—specifically, 42 of them. The cryptocurrency industry was disappointed to learn that none were aimed at them, but cryptocurrency supporters did not have to wait long.

On inauguration day, Trump's family's decentralized finance company, World Liberty Financial (WLFI), purchased nearly $47 million in cryptocurrency to commemorate the occasion. This purchase brought WLFI's total holdings to $326 million.

January 21 — SEC leadership changes and cryptocurrency strategy shifts

On January 21, the Trump administration began adjusting the leadership of major federal agencies, including the U.S. Securities and Exchange Commission (SEC), nominating SEC Commissioner Paul Atkins to replace Gary Gensler.

While Atkins awaits Senate confirmation—he had not been confirmed at the time of publication—acting chair Mark Uyeda is leading the agency to adopt a more friendly approach toward the cryptocurrency industry.

Uyeda criticized the SEC's enforcement actions under Gensler's leadership, stating they "are neither conducive to capital formation nor protective of investors."

January 21 — SEC working group begins addressing cryptocurrency policy issues

On January 21, the SEC established a cryptocurrency working group under the guidance of cryptocurrency-supportive Commissioner Hester Peirce, quickly beginning to refine cryptocurrency regulatory frameworks.

Acting Chair Ayuda stated that the group's main goal is to "help the commission delineate clear regulatory pathways, provide practical avenues, develop reasonable regulatory frameworks, and wisely deploy enforcement resources."

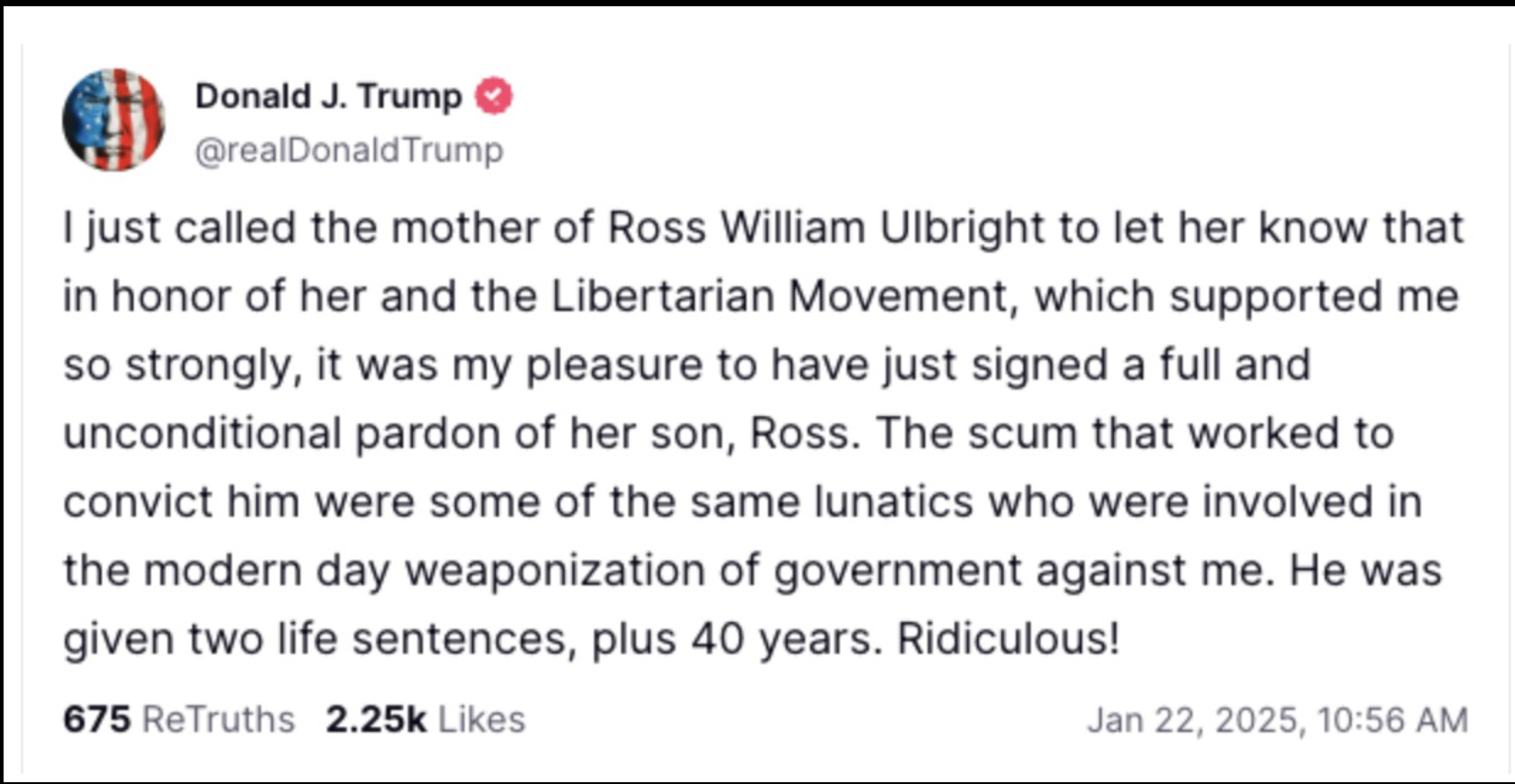

January 22 — Silk Road founder receives clemency

On January 22, Trump granted clemency to Silk Road founder Ross Ulbricht, who had been serving nearly ten years in federal prison. After years of efforts from prison reform advocates, libertarian groups, and cryptocurrency insiders, the president finally pardoned him.

Ulbricht began serving his sentence in 2015, and Trump fulfilled his campaign promise to release him immediately upon taking office.

January 23 — Trump establishes cryptocurrency working group

On January 23, Trump established an "internal working group aimed at making the U.S. the world capital of cryptocurrency" through an executive order. The group's task is to study the feasibility of establishing a national cryptocurrency reserve and to develop a regulatory framework for cryptocurrencies. It also prohibits the creation of central bank digital currencies.

The working group consists of the U.S. Secretary of the Treasury, the Attorney General, the SEC Chair, the Commodity Futures Trading Commission (CFTC) Chair, members of Trump's cabinet, and heads of other relevant agencies.

Notably, the order explicitly excludes the Federal Reserve and the Federal Deposit Insurance Corporation.

The group will report to the government's official AI and cryptocurrency czar, David Sacks.

January 27 — U.S. Senate confirms cryptocurrency-supporting Treasury Secretary

On January 27, the U.S. Senate confirmed Scott Bessent as Treasury Secretary with a vote of 68 to 29.

When Trump first nominated Bessent in November 2024, Fox Business reporter Eleanor Terrett described him as "very supportive of cryptocurrencies, especially Bitcoin."

He reportedly stated, "I am very excited about the president's support for cryptocurrencies, which aligns very well with the Republican Party; cryptocurrencies represent freedom, and the cryptocurrency economy will always exist."

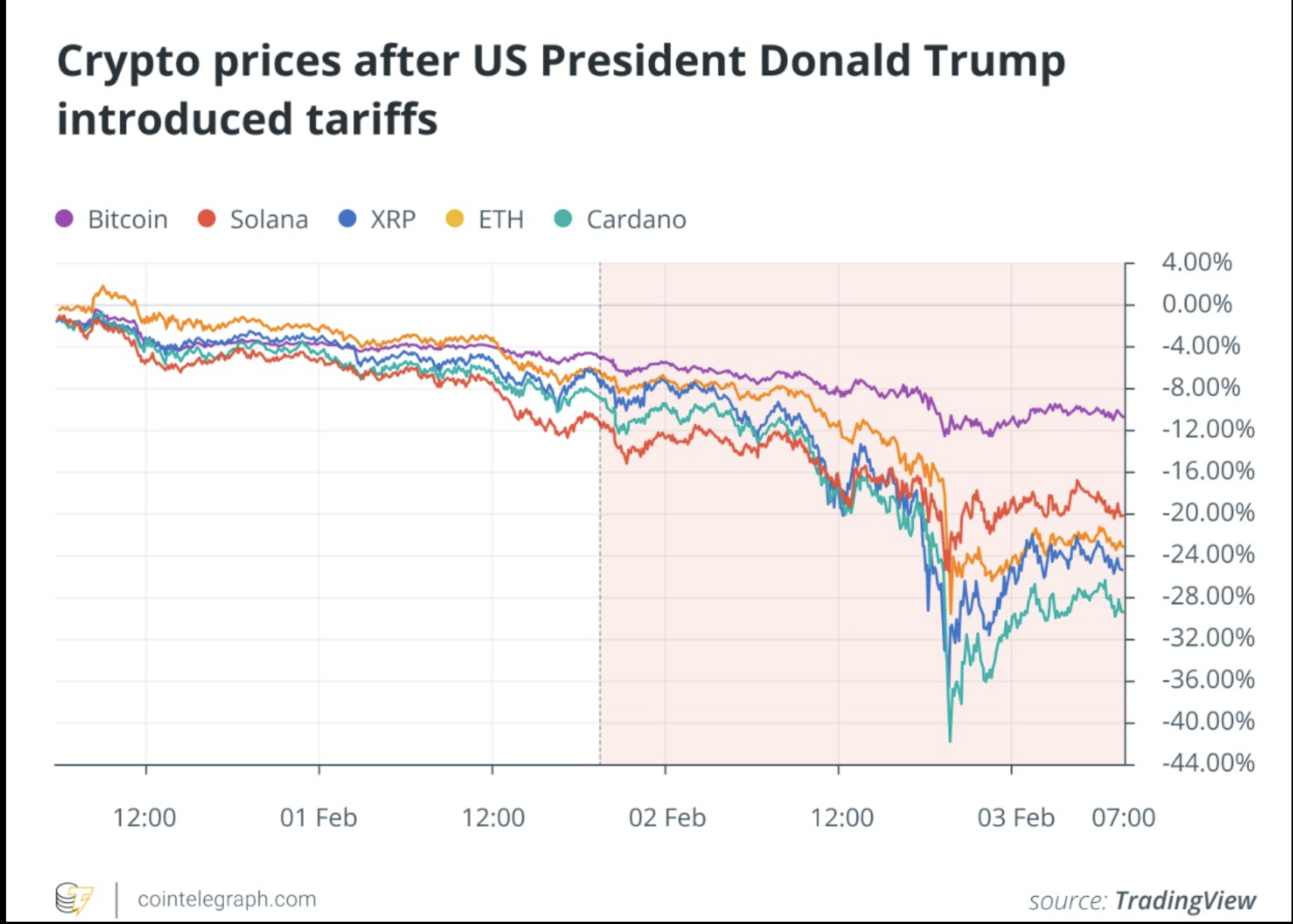

February 2 — Trump's tariffs impact stock and cryptocurrency markets

On February 2, Trump signed another executive order imposing tariffs on goods produced in Mexico, Canada, and China.

The market reacted sharply, with some tech stocks experiencing their largest single-day drop on Wall Street.

Trump ultimately suspended tariffs on Mexico and Canada, but this move was seen as part of his economic strategy. The subsequent impact on the cryptocurrency market also highlighted the increasing correlation between crypto assets and traditional financial markets.

February 3 — Trump fires head of consumer protection agency

On February 3, Trump fired Rohit Chopra, the head of the Consumer Financial Protection Bureau (CFPB). The CFPB is responsible for regulating the financial sector and has jurisdiction over banks, securities firms, payday lenders, and other profit-making institutions.

The CFPB stated in an official notice that Bessent would serve as the acting head of the agency until a successor is found.

The exact reason behind this move remains unclear. However, reports suggest it is part of a broader effort to reduce regulation in the banking sector, which Musk had previously called to "abolish."

February 7 — CFTC chair resigns

On February 7, former CFTC Chair Rostin Behnam announced that it was his last day at the agency, having served as a CFTC commissioner and chair for eight years. Behnam had previously stated he would leave a month early to allow a new acting chair to take over until a new chair is appointed.

Behnam called on lawmakers to establish clear guidelines for cryptocurrencies, stating, "The cryptocurrency era highlights the necessity of establishing rules to address the direction of the derivatives industry."

February 9 — Tariffs lead to another Bitcoin price drop

On February 9, Trump announced a 25% tariff on all steel and aluminum imported into the U.S. and stated that corresponding tariffs would be imposed on countries that levy tariffs on U.S. goods.

The White House further adopted aggressive economic policies, leading to a significant drop in Bitcoin prices. Market observers expect increased volatility due to Trump's proposal to impose tariffs on the EU, semiconductors, oil, gas, steel, and copper.

February 12 — Trump exchanges prisoners with Russia

On February 12, the U.S. exchanged Alexander Vinnik, the former operator of the cryptocurrency exchange BTC-e, for American teacher Marc Fogel, who was detained by Russia.

In May 2024, Vinnik pleaded guilty to conspiracy to commit money laundering, having illegally transferred funds through the BTC-e exchange.

Fogel has been detained in Russia since 2021 for possession of marijuana at a Moscow airport.

February 12 — New CFTC chair nominee announced

Just a week after Behnam's departure, Trump nominated Brian Quintenz, a former CFTC commissioner and executive at the event betting market Kalshi, to lead the regulatory agency.

Quintenz previously worked at the cryptocurrency-supporting venture capital firm a16z and is expected to bring positive changes to the cryptocurrency industry, having made several pro-cryptocurrency statements. He reportedly delivered multiple speeches on Bitcoin and decentralized finance during his time at the CFTC.

February 17 — DOGE to challenge SEC

Reportedly, following a wave of restructuring in other federal agencies, DOGE, under Musk's actual leadership, is targeting the SEC next.

"They're at the door," an anonymous source stated in a February 17 Politico report.

A DOGE-associated account on X (of which there are dozens) posted on February 18, inquiring about "discovering and addressing SEC waste and fraud."

February 19 — Senate confirms Trump's Commerce Secretary nominee

On February 19, the U.S. Senate confirmed billionaire Howard Lutnick as the next Secretary of Commerce.

Following a vote of 52 to 45, Lutnick immediately resigned as CEO of financial services company Cantor Fitzgerald. Although his company holds shares in cryptocurrency stablecoin issuer Tether, Lutnick stated he would sell his stakes in commercial and other private investments within 90 days.

What are Trump's next steps?

For the current U.S. president, this is a tumultuous time. Although he did not address cryptocurrencies on his first day in office, he made up for it with a flurry of executive orders in the following days.

Many of Trump's cryptocurrency-supporting nominees have already been appointed, and they are expected to introduce cryptocurrency-friendly policies that will solidify the industry's growth potential in the coming years.

Allies in Congress are beginning to draft stablecoin legislation, working to "bring" the industry into the U.S.

At the state level, momentum is building for the creation of state Bitcoin reserves, with cryptocurrency-focused legislators taking action at the local level.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。