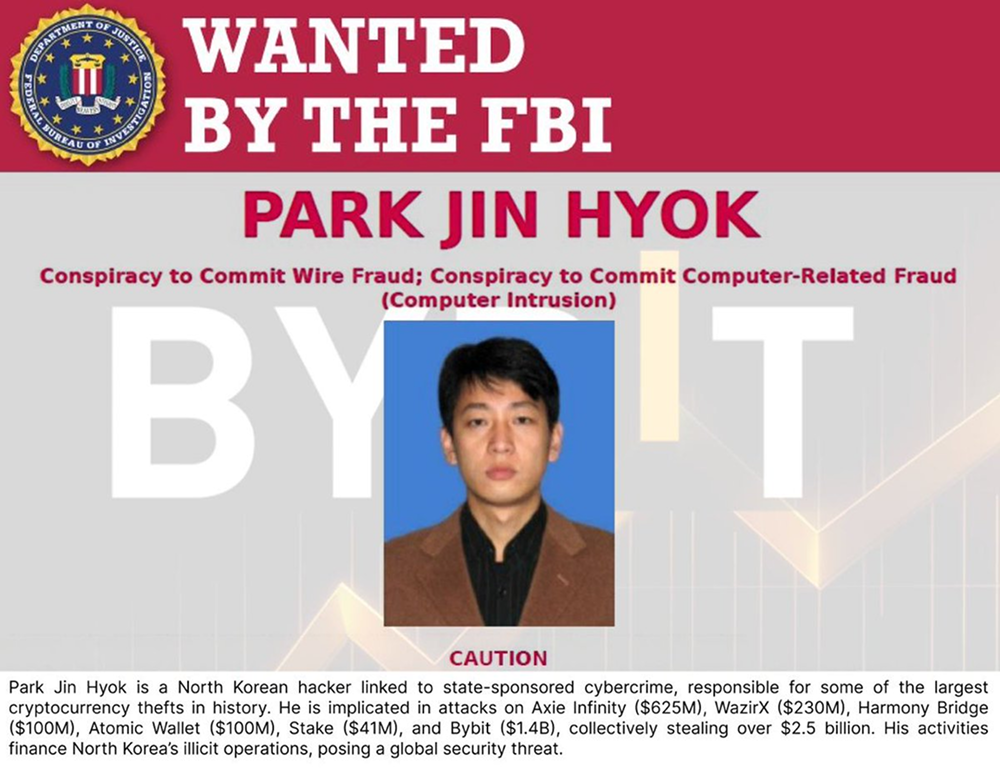

On February 21, 2025, the cryptocurrency trading platform Bybit suffered a hacker attack, resulting in a loss of approximately $1.4 to $1.5 billion in digital assets, setting a record for the largest single theft in cryptocurrency history. This incident not only exposed the security vulnerabilities of centralized exchanges (CEX) but also ignited intense debates about the decentralized Web3 ecosystem. The contradiction between the convenience of centralized platforms and the security risks has prompted the industry to reassess its future development path.

The Bybit Hacking Incident: A Timeline

According to Bybit CEO Ben Zhou's statement on the X platform, on February 21, 2025, the platform confirmed that its Ethereum cold wallet had been attacked, resulting in losses including approximately 401,347 ETH (worth about $1.12 billion), 90,376 stETH (about $253 million), and other tokens, totaling around $1.46 billion. A joint investigation by on-chain analyst ZachXBT and blockchain security firm SlowMist revealed that the hackers used "disguised transactions" to manipulate the signature interface to masquerade as legitimate addresses (such as Safe.eth), while embedding malicious smart contract logic underneath, successfully stealing a massive amount of funds.

This incident set a new record for losses in the cryptocurrency industry. According to a report released by Chainalysis in 2024, the total amount stolen from global crypto platforms throughout the year was $2.2 billion, with the Bybit incident accounting for over 60% of that, making it the largest single theft in history, surpassing any previous records.

The Convenience and Security Paradox of Centralized Exchanges

The Fatal Weakness of Single Points of Failure

CEX platforms like Bybit, Binance, and Coinbase dominate the cryptocurrency trading market. Data from Statista shows that by the end of 2024, approximately 70% of global crypto trading volume occurred on CEX platforms. These platforms attract a large number of users with efficient trading, low entry barriers, and a variety of financial products. However, this convenience is built on centralized management, creating a significant security paradox.

The Bybit incident demonstrates that even top platforms using multi-signature cold wallets cannot completely fend off attacks. Hackers infiltrated the internal trust chain through social engineering and phishing techniques, exposing the single point of failure risk inherent in CEX centralized infrastructure. In contrast, decentralized exchanges (DEX) like Uniswap and SushiSwap theoretically eliminate this weakness through distributed ledgers and user-managed private keys.

The Dilemma of Speed vs. Security

The efficiency of CEX is its competitive advantage, but it also limits the depth of security measures. Although Bybit's cold wallet transfers have strict processes, they failed to detect disguised transactions in real-time, indicating that centralized systems often prioritize speed over comprehensive security checks. In comparison, DEX relies on blockchain confirmation times and Gas fees, resulting in lower transaction efficiency but more transparent security logic.

Lack of User Education

The user-friendliness of CEX has diminished the importance placed on private key management. Following the incident, Bybit users initiated a wave of withdrawals, reflecting a crisis of trust in the platform's security. However, many users lack knowledge about using hardware wallets or multi-factor authentication, starkly contrasting with the "self-sovereignty" concept emphasized by Web3.

Web3 and the Vision for Decentralized Security

Web3 is seen as the blueprint for the future of cryptocurrency, with its core being the creation of a decentralized, trustless trading environment through blockchain and smart contracts. Following the Bybit incident, industry observers believe that this crisis may drive funds and users towards DEX and the Web3 ecosystem.

The Advantages of Decentralization

DEX removes intermediaries, giving users complete control over their assets. For example, Uniswap users interact directly with smart contracts through their wallets, without needing to entrust funds to a third party, ensuring that user assets remain safe even if the platform is attacked. Additionally, Web3 introduces technologies such as Multi-Party Computation (MPC) and Zero-Knowledge Proofs (ZKP), further enhancing private key management and transaction privacy. According to Chainalysis data, DEX trading volume grew by 35% year-on-year in 2024, reflecting user preference for decentralized models.

The Challenges of Decentralization

However, DEX is not without its flaws. Smart contract vulnerabilities pose a significant risk, as evidenced by the $624 million theft from the Ronin bridge in 2022 due to code defects. Furthermore, while user-managed private keys enhance security, they also introduce new challenges, such as the inability to recover lost or stolen keys. Compared to the second-level transactions of CEX, the high Gas fees on the Ethereum network (averaging 20 Gwei in 2024, exceeding 100 Gwei during peak times) and delays also limit the popularity of DEX.

The Impact of the Bybit Incident on the Crypto Ecosystem

Accelerated Flow of Funds to DEX

The Bybit incident triggered market turbulence. On-chain data shows that within 48 hours after the incident (February 22 to 23), trading volume on DEX platforms like Uniswap and PancakeSwap surged by about 15%. A report from Dune Analytics indicated that Uniswap's daily trading volume jumped from $500 million to $750 million, reflecting a decline in user trust in CEX. This trend mirrors the 30% increase in DEX trading volume following the collapse of FTX in 2022.

The Bottleneck of User Education

Despite the rising appeal of DEX, ordinary users still tend to prefer the convenience of CEX. A 2024 survey by Messari found that 60% of retail investors believe DEX operations are complex and costly. After the Bybit incident, some users attempted to switch to decentralized platforms but encountered new issues due to a lack of experience in private key management, such as losing keys or falling victim to phishing attacks.

An Opportunity for Web3 Innovation

This crisis provides a development window for Web3. The industry may accelerate the development of Layer 2 solutions to reduce Gas fees and optimize user interfaces to enhance the experience. According to Arbitrum's predictions, Layer 2 trading volume is expected to grow by 25% in the first quarter of 2025, indicating the potential for improved decentralized efficiency.

Conclusion and Outlook

The Bybit hacking incident exposed the deep-seated contradictions between the convenience of centralized exchanges and the associated security risks. The efficient trading and rich features of CEX have allowed them to maintain market dominance for a long time, but single points of failure and human errors make them targets for hackers. Web3 and DEX offer the promise of decentralized security but are limited by smart contract vulnerabilities and high barriers to user experience.

In the short term, CEX will continue to dominate due to their convenience, but the Bybit incident may serve as a catalyst for the industry's shift towards decentralization. In the future, CEX must strengthen multi-signature mechanisms and real-time monitoring to reduce risks, while the Web3 ecosystem should optimize efficiency and security through technological innovations (such as Layer 2 and ZKP). This incident is not only a crisis but may also be a pivotal turning point for the cryptocurrency industry towards a safer and more decentralized future.

Disclaimer: The above content does not constitute investment advice.

AiCoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。