On February 21, 2025, the global cryptocurrency industry experienced the most destructive single theft event in history. Bybit, a globally renowned cryptocurrency exchange, announced that its platform had been hacked, resulting in the loss of up to $1.4 to $1.5 billion in digital assets. This incident not only shocked the cryptocurrency community but also drew widespread attention from global media, regulatory agencies, and security experts. As the largest theft in cryptocurrency history, the Bybit incident exposed the industry's vulnerabilities in the face of advanced cyber threats and served as a wake-up call for future security measures. This article will provide a comprehensive and in-depth review of the incident, exploring its technical details, accountability, Bybit's response measures, and its impact on the entire industry.

Incident Overview

On February 21, 2025, the Bybit platform fell victim to a meticulously planned hacking attack, leading to the theft of approximately $1.46 billion in Ethereum and related tokens. This attack surpassed any previous single theft record, becoming one of the most severe cases in cryptocurrency history. Preliminary investigations revealed that the hackers employed an advanced technique known as "disguised transactions" to successfully bypass the platform's multi-signature security mechanism during the routine transfer from cold wallets to hot wallets, ultimately stealing a massive amount of assets.

The specific composition of the stolen assets includes:

- 401,347 ETH (approximately $1.12 billion)

- 90,376 stETH (approximately $253 million)

- 15,000 cmETH (approximately $44.13 million)

- 8,000 mETH (approximately $23 million)

The total loss exceeded $1.4 billion in digital assets. Following the attack, the hackers quickly dispersed the funds into over 40 wallets and exchanged some tokens for ETH through decentralized exchanges (DEX), subsequently transferring $27 million in increments to other addresses to obfuscate the flow of funds.

The scale and complexity of this incident are shocking. According to an analysis by blockchain security firm SlowMist, the attackers may have obtained Bybit's internal credentials months in advance through social engineering and phishing tactics, paving the way for the final attack.

Detailed Attack Methodology

The "disguised transaction" technique employed by the hackers was the core of this attack. This method is extremely complex and covert, exploiting potential vulnerabilities in Bybit's security processes. The specific process of the attack is as follows:

Target Locking: The hackers targeted Bybit's routine operation of transferring assets from multi-signature cold wallets to hot wallets. This process typically requires multiple signers' approval and is a critical step in the transfer of cold wallet assets.

Disguised Transactions: The attackers manipulated the signature interface to make it appear as if it were a legitimate address and URL (such as Safe.eth), while embedding malicious smart contract logic underneath. This disguise deceived Bybit's signers into approving the contract changes unknowingly.

Malicious Contract Deployment: According to SlowMist's report, the attackers deployed a malicious contract (contract address: 0xbDd077f651EBe7f7b3cE16fe5F2b025BE2969516) at UTC 2025-02-19 07:15:23. This contract allowed the hackers to gain complete control over the assets in the cold wallet.

Fund Transfer: Once the contract was activated, the hackers swiftly transferred $1.46 billion in assets to multiple pre-set wallets and laundered the funds through DEX, increasing the difficulty of recovery.

This attack method combined technical vulnerabilities and social engineering, showcasing the attackers' high skill level and long-term preparation. Experts point out that the successful implementation of the "disguised transaction" technique indicates that even multi-signature mechanisms are not foolproof, and cryptocurrency platforms need to reassess their security designs.

Accountability

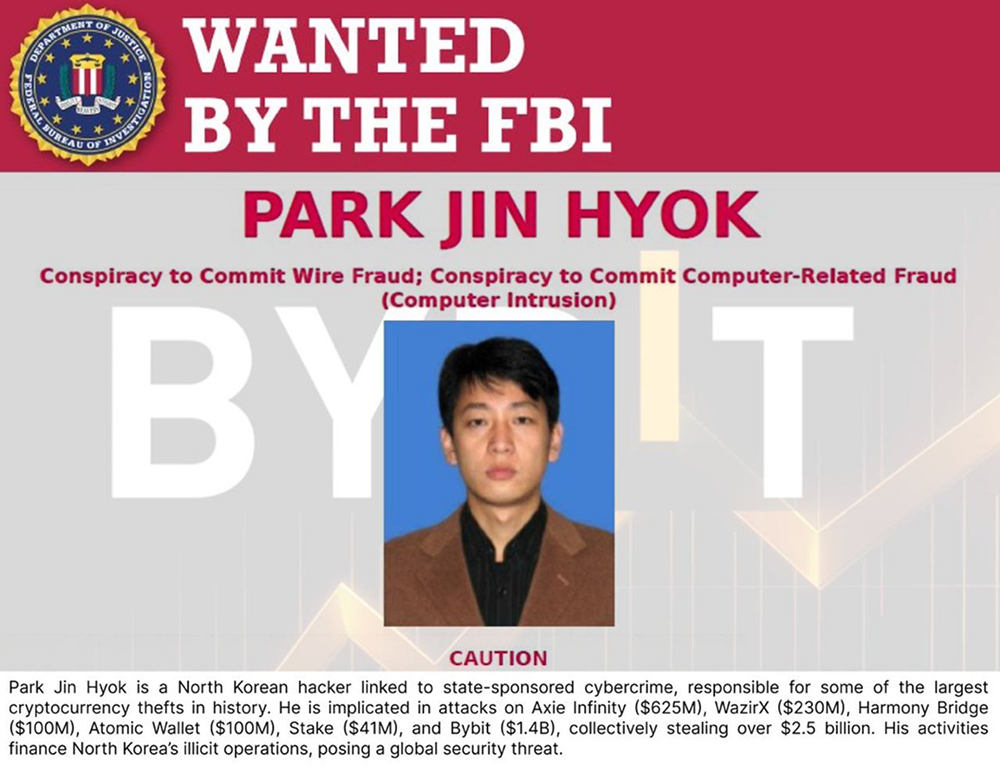

The attack has been widely attributed to the North Korean hacker group Lazarus Group, a state-sponsored entity notorious for executing large-scale thefts targeting cryptocurrency platforms. On-chain analysts ZachXBT and blockchain analysis firm Chainalysis Forensics have found that the technical characteristics of the attack closely align with previous actions by Lazarus Group. For instance, a recent attack on the Phemex exchange also employed similar tactics.

Arkham Intelligence further provided evidence supporting this conclusion, including test transaction records, associated wallet analysis, and timeline tracking. The FBI and Japan's National Police Agency have previously linked Lazarus Group to multiple high-value cryptocurrency thefts, indicating that the organization poses a persistent threat to the global financial system. Their activities are not only for economic gain but may also serve national strategic objectives, such as evading international sanctions.

Although specific evidence is still under investigation, the likelihood of Lazarus Group's involvement is extremely high. This has raised concerns about the increasing activity of state-sponsored hacker groups in the cryptocurrency space.

Bybit's Response Measures

In the face of this unprecedented crisis, Bybit quickly implemented a series of measures to stabilize market confidence and mitigate losses. The following are its main response strategies:

Bybit promptly confirmed that only the Ethereum cold wallet was affected, and that the hot wallet and other cold wallets remained unharmed. This meant that most user assets were still safe, preventing further loss.

Withdrawal services were restored: Within 12 hours of the attack, Bybit resumed normal withdrawal speeds, successfully processing over 580,000 withdrawal requests. This move effectively alleviated user panic.

Bybit CEO Ben Zhou issued a statement on social media X, emphasizing that the platform is solvent. Even if the stolen assets cannot be recovered, all customer assets are backed 1:1 and approximately 80% of the losses have been covered through other assets and bridge loans. This commitment enhanced market trust in the platform.

Bybit has reported the case to global law enforcement agencies and is collaborating with on-chain analysis firms to attempt to freeze the attackers' addresses. Additionally, the platform launched a "Recovery Bounty Program," promising rewards of up to 10% of the recovered amount to incentivize security experts to assist in recovering the funds.

Through live broadcasts and X posts, Bybit provided real-time updates on the incident's progress and publicly disclosed its response measures. Ben Zhou stated that the platform would continue normal operations and had upgraded security protocols to prevent similar incidents from occurring again. These measures demonstrated Bybit's rapid response capability and resource allocation strength during the crisis. Nevertheless, the $1.4 billion loss still significantly impacted the platform's reputation and financial status.

Industry Impact and Discussion

The Bybit incident has had a profound impact on the entire cryptocurrency industry. According to Chainalysis statistics, the total amount stolen from cryptocurrency platforms in 2024 was $2.2 billion, a year-on-year increase of 21.1%, with the Bybit incident accounting for over 60% of the annual losses. This figure highlights the severity of security issues in the industry.

Reassessment of Security: This attack exposed potential weaknesses in multi-signature mechanisms and cold wallet management, prompting experts to call for strengthened security protocols. For example, it is recommended that platforms adopt stricter signature verification processes, increase real-time monitoring systems, and conduct regular third-party security audits.

Regulation and International Cooperation: The ongoing activities of Lazarus Group have prompted regulatory agencies to reassess compliance requirements in the cryptocurrency industry. Following the incident, financial regulators in the U.S. and the EU stated that they would push for stricter anti-money laundering (AML) and cybersecurity regulations. At the same time, the international community may intensify sanctions and crackdowns on North Korean hacker organizations.

Market Confidence Fluctuations: Although Bybit's rapid response alleviated some panic, the incident still led to a brief decline in the cryptocurrency market. The price of Ethereum dropped approximately 8% within 24 hours after the attack, reflecting investors' concerns about industry security. However, Bybit's commitment to repayment and the restoration of withdrawals somewhat stabilized market sentiment.

Industry Lessons: This incident serves as a reminder to all cryptocurrency platforms that security must be prioritized. The evolving nature of attack methods requires platforms to continuously update their technical defenses and enhance employee security awareness training. For users, choosing platforms with strong financial backing and transparent communication has become particularly important.

Conclusion

The Bybit platform's $1.4 billion theft incident marks a significant turning point in the history of cryptocurrency development. It not only reveals the industry's vulnerabilities in the face of advanced persistent threats (APT) but also highlights the importance of platform crisis management capabilities. Bybit's rapid response and financial assurance measures have somewhat mitigated the impact of the incident, but the $1.4 billion loss remains a severe test of its operational capabilities.

Looking ahead, the cryptocurrency industry needs to learn from this incident, strengthen security infrastructure, improve regulatory frameworks, and collaborate internationally to address state-sponsored hacker threats. Only in this way can the industry ensure the long-term stability and security of the ecosystem while continuing to develop rapidly. For Bybit, this crisis is both a challenge and an opportunity to rebuild trust and authority.

Disclaimer: The above content does not constitute investment advice.

AiCoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。