Before taking off, I submitted my homework. I noticed many friends asking why there was a drop over the weekend. Some events actually occurred this weekend, mainly related to tariffs and the aftermath of the Russia-Ukraine war, which still have not been clearly implemented. There is also an interesting piece of news: North Korea has provided 50% of Russia's military needs in the Russia-Ukraine war. At least we now know the final destination of the stolen cryptocurrencies. So, who are these arms being purchased from? And who is helping North Korea convert cryptocurrencies into fiat currency?

In fact, the current price fluctuations are not surprising. Investor sentiment is still not very friendly, and the U.S. has not yet presented any truly compelling positive news to engage investors. Of course, there hasn't been any major negative news either, which is why Bitcoin's price has remained in a state of fluctuation.

Next week, on Friday, the U.S. will release the core PCE data for January. This data is considered more important than the CPI and unemployment data, as it is what the Federal Reserve cares about most. Although the last CPI data was poor, the PPI data was still acceptable. Therefore, the market expects the core PCE data to be 0.6%, down from the previous 0.8%. However, I still don't believe this month's data holds much significance, as a rate cut in March has already been anticipated.

That said, if the core PCE can decline, market expectations will improve somewhat. This is the key macro data for next week; there isn't much else. Many friends in Europe and the U.S. still see a low probability of a ceasefire in the Russia-Ukraine war next week, but there is already a visible trend towards an end. If it can indeed conclude in March, it would certainly be a positive for the market. I previously wrote about the impact of the Russia-Ukraine war on U.S. inflation; a ceasefire would indeed benefit inflation, essentially offsetting tariff issues.

I have always felt that the market is still lacking a boost, and I wonder if the dot plot in March can provide that.

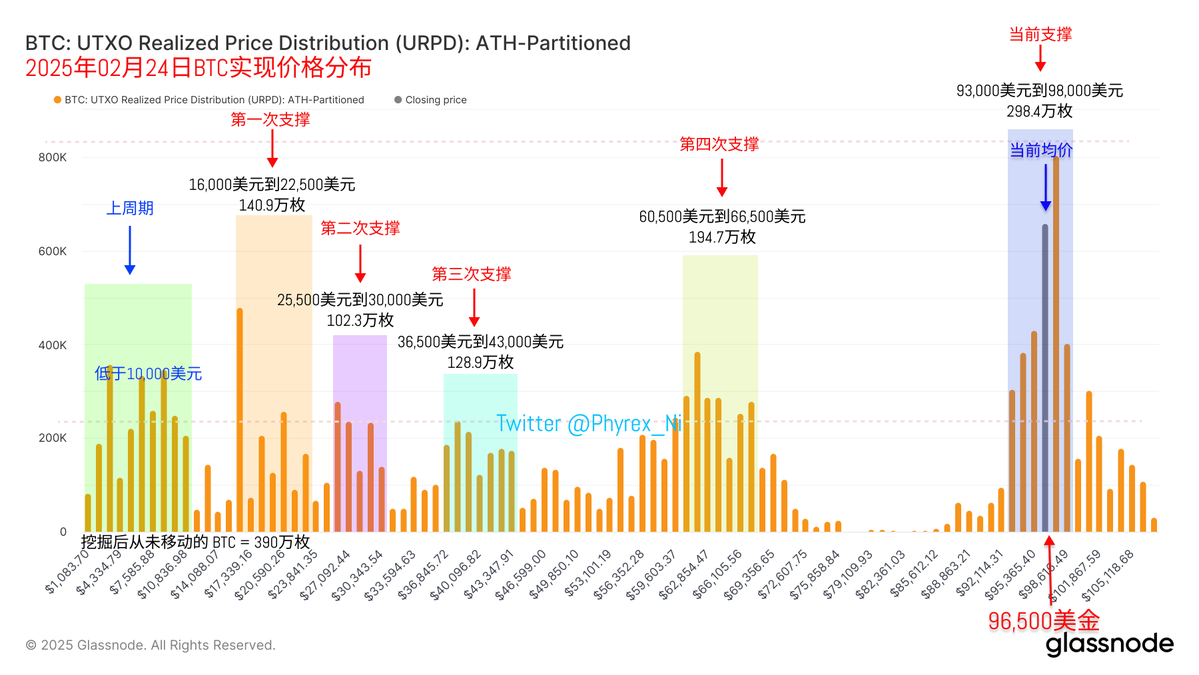

Looking back at the data for #BTC itself, the turnover rate on Sunday was incredibly low, reaching a point of being in "garbage time." This indicates that most investors have entered a state of ignoring the current market. Personally, I believe the market is still waiting for a recovery in liquidity or some absolute positive news. The former corresponds to the Federal Reserve's monetary policy, while the latter is the anticipation of Trump's BTC strategic reserve being implemented.

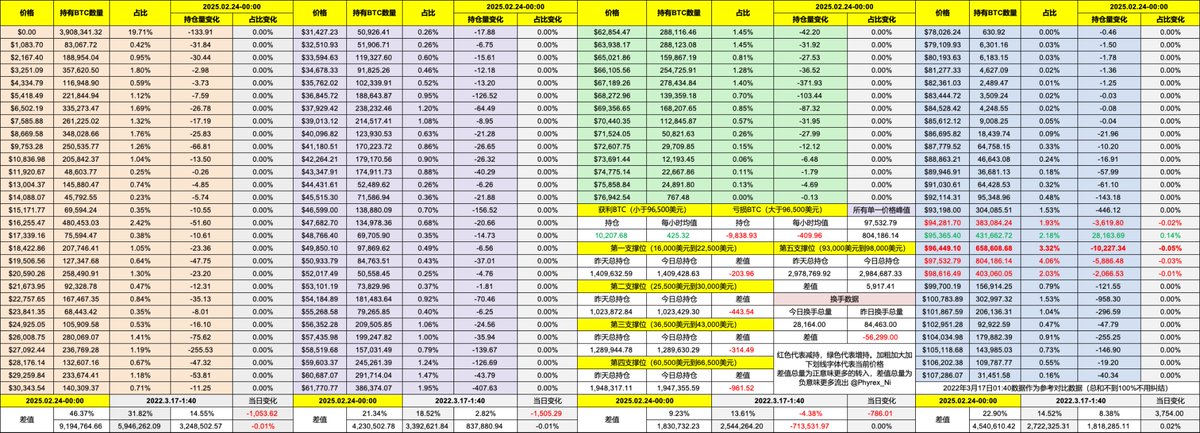

From the current support situation, such a low turnover rate makes it impossible to impact the support level. In fact, the support between $93,000 and $98,000 remains very solid. At least for now, I do not see a significant drop occurring. Of course, achieving a rapid increase is also not easy, but I am still looking forward to Q1. After next week, we will enter March, and I hope to see some new developments.

I’m going home tomorrow, exhausted to the point of almost losing half my life, especially after spending 15 hours in the air over 36 hours and 17 hours rushing through Tokyo, which is really tough. I will take another day to rest and start responding normally on Tuesday.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。