It is worth being vigilant about the potential existence of "black swans" or "gray rhinos":

El Salvador, which has been consistently dollar-cost averaging, has stopped purchasing one BTC daily.

Strategy stated on February 18 that it has not purchased BTC and has not continued to buy BTC.

This reminds me of the last bull market when Grayscale stopped buying BTC…

Furthermore, BYbit was hacked for $1.5 billion, marking the largest hacking incident in history.

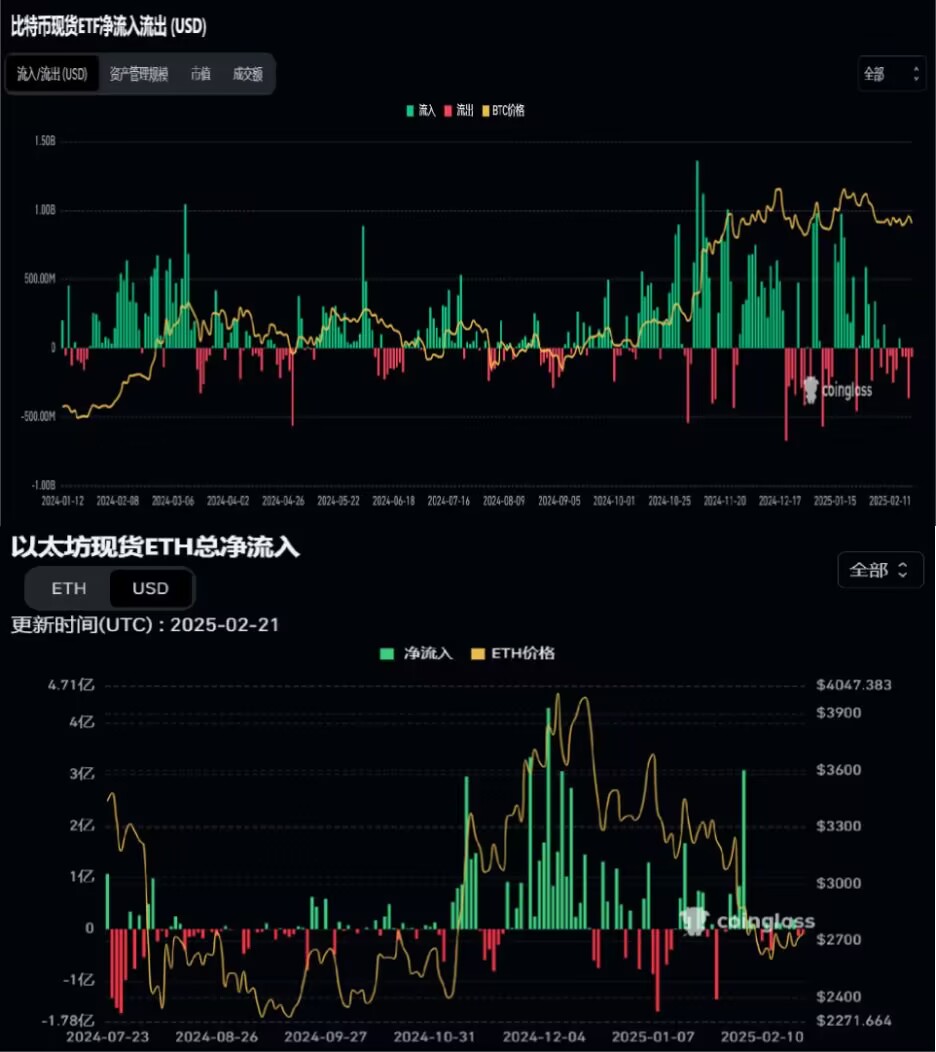

BTC and ETH spot ETFs have been experiencing continuous outflows for nearly half a month.

Additionally, U.S. stocks have struggled to break through high levels for several weeks, with a significant pullback last week.

On the macro front, expectations for interest rate cuts are declining as we look towards the second half of the year, and tariffs from the "understanding king" are intensifying…

After reaching a peak of 110,000, the market structure has been oscillating downwards for a month.

The gentleman has always been a die-hard bull, believing that BTC will always oscillate upwards, always bullish, and always teary-eyed.

However, at this critical turning point, one must be fully alert. It is difficult to make money in this bull market, but easy to incur losses. If a "black swan" occurs, there may be opportunities to buy in batches at 76,000 and 85,000 for better cost-effectiveness.

For a detailed analysis, please refer to the video released; I won't elaborate too much in text.

Bitcoin

The weekly line is about to close, likely forming a doji star. Since reaching the high point of 110,000, it has been in a downtrend, with the last three weeks consistently closing as doji stars. Prolonged stagnation must lead to change. Previously, the gentleman also anticipated a rebound followed by continued decline, but did not expect the rebound to be so weak.

The daily line has been in a narrow oscillation for 18 days, touching the upper Bollinger Band while also facing pressure from the descending channel. Next week, there is a high probability of further probing down to 91,000—92,500.

Support: Resistance:

Ethereum

There is a short-term need for a rebound. On the daily line, we first look at the rebound strength of Ethereum at 2900—3100. After the rebound, it will continue to decline. The weekly line is viewed as a large range box oscillation. 2800—2920 is the resistance for Bitcoin, which will be observed closely.

Support: Resistance:

If you like my views, please like, comment, and share. Let's navigate through the bull and bear markets together!!!

This article is time-sensitive and for reference only, with real-time updates.

Focusing on K-line technical research, sharing global investment opportunities. Public account: Trading Gentleman Fusu

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。