Author: flowie, ChainCatcher

Editor: tree, ChainCatcher

Within 12 hours of the theft of nearly $1.5 billion, Bybit CEO Ben Zhou stated that the withdrawal system has fully returned to normal.

In the face of the largest theft in crypto history, in addition to the Bybit team's textbook crisis and public relations handling, various parties supporting Bybit are also working to alleviate the immense pressure on the crypto ecosystem.

Support of $320 million, who are the white knights everyone is talking about?

As of the time of writing, according to Yu Jin's monitoring, five institutions and individuals have provided loan support to Bybit, totaling approximately 120,000 ETH, worth about $321 million. Specifically, they include:

Bitget: Supporting with a loan of 40,000 ETH to alleviate withdrawal pressure

This morning, Bitget provided Bybit with a loan of 40,000 ETH ($105.9 million) to help cope with the withdrawal surge following the ETH theft. These ETH were transferred directly from Bitget to Bybit's cold wallet address.

Bitget CEO Gracy later tweeted that Bybit is a respected competitor and partner. Although the loss is significant, it is equivalent to their annual profit, and she believes customer funds are 100% safe, so there is no need for panic or bank runs. She further added that the assets lent to Bybit are from Bitget itself, and user assets will not be affected.

MEXC: Provided 12,652 stETH

This morning, Yu Jin's monitoring showed that MEXC's hot wallet transferred 12,652 stETH (approximately $33.75 million) to Bybit's cold wallet.

Other whale investors: Total support exceeding nearly $200 million

Institutions or whales withdrawing from Binance provided 11,800 ETH (approximately $31.02 million); another institution/whale withdrawing from Binance provided 36,000 ETH (approximately $96.54 million); and the address 0x327…45b provided 20,000 ETH (approximately $53.70 million).

In addition to the institutions or whale investors providing real financial support mentioned above, many CEX peers or institutions have also continuously supported Bybit, including:

OKX: Blacklisting Bybit's hacker and providing security and liquidity support

OKX President Hong Fang stated that the hacker address involved in the Bybit theft has been added to OKX's blacklist, and engineers will closely monitor these addresses. If there is any movement of funds, immediate action will be taken.

The OKX team is also in contact with the Bybit team to provide any IT security and liquidity support they can offer at this time.

HashKey: Supporting Bybit and believing the security incident will be properly resolved

HashKey condemned the hacker's illegal actions on their official Twitter and expressed confidence that Bybit's security incident will be properly handled and overcome.

BitMart: Freezing the hacker's address, founder Sheldon stated that BitMart will provide support if needed by Bybit

BitMart founder Sheldon posted on the X platform that he has frozen the relevant addresses. If any stolen assets flow into BitMart, the related assets will be immediately frozen to support recovery efforts.

He pointed out, "The cryptocurrency industry is a community of shared destiny, and the most important thing in this industry is credibility. We hope to work together to help Bybit recover losses and reclaim assets. This industry needs everyone to protect it together."

Justin Sun supports Bybit and promises to assist in tracking funds

Huobi HTX Global Advisor and TRON founder Justin Sun stated, "We have been closely monitoring the Bybit incident and will do our utmost to assist our partners in tracking the relevant funds, providing all support within our capabilities."

JuCoin: Providing 1,000 BTC as an industry co-construction fund and technical support for Bybit's security incident

In response to Bybit's recent security incident, JuCoin announced it would provide 1,000 BTC as an industry co-construction fund and offer free advanced security technology services, including threat detection, smart contract auditing, cold and hot wallet management, and multi-signature technology implementation, to ensure the safety of user assets and the stable operation of the platform.

Currently, Bitget is the institution providing the most substantial help to Bybit with real financial support. (Feel free to contact ChainCatcher to add more supporters to the list.)

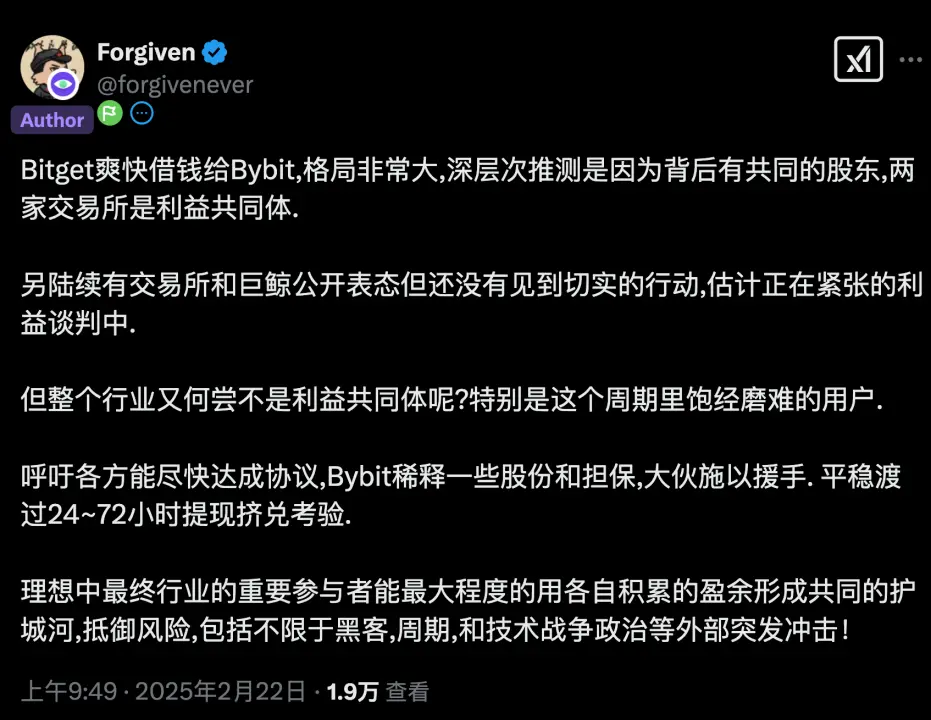

In response, Conflux co-founder Yuan Jie praised Bitget for its vision, while speculating that the underlying reason may also be due to Bitget and Bybit having common shareholders.

Regarding other exchanges or whales that have shown support but have not taken visible action, he anticipates they are engaged in tense negotiations over interests. He calls for all parties to reach an agreement quickly, suggesting that Bybit could dilute some shares and guarantees to help Bybit and its users through this crisis.

Yuan Jie believes, "Ideally, the key participants in the industry can maximize the use of their accumulated surpluses to form a common moat, resisting risks, including but not limited to hackers, cycles, and external shocks from technological warfare and politics!"

An interview with Ben is just around the corner; what drives Bybit to handle the crisis in an orderly manner?

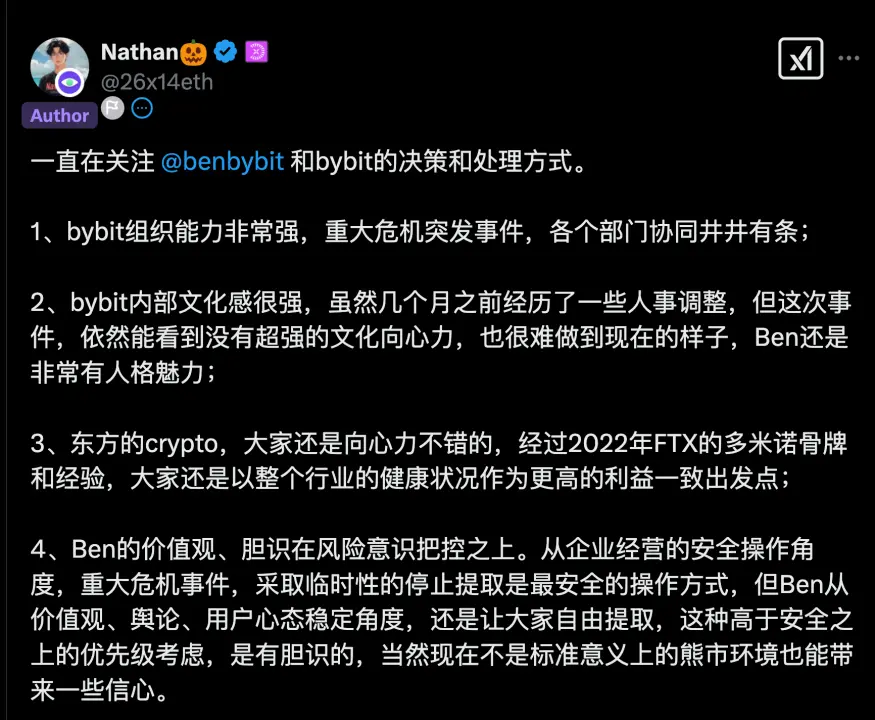

Regarding this theft crisis, crypto investor @26x14eth stated that he feels Bybit has good organizational capability and cultural cohesion.

This point was also sensed by ChainCatcher during the interview.

A few days ago, during the Hong Kong Consensus Conference, we had a brief exchange with Bybit CEO Ben Zhou.

When we raised the question of how CEXs should transform to build an on-chain ecosystem, Ben Zhou candidly mentioned that they are somewhat confused at the moment. They are not very certain about the money-burning, short-term unprofitable Web3 wallets, and they are still exploring other on-chain directions. They may form an active team of young people to experiment with playing on-chain.

There was nothing particularly official.

He had previously joked in a public interview that "he should be the only founder of a large exchange who can still speak to the media and accept interviews."

Looking back now, Bybit's ability to handle this major crisis in an orderly manner may be related to this sincere approach to facing themselves and others.

Last December, in response to KOLs questioning Bybit's insider trading and close-knit groups, before public opinion had a chance to ferment widely, Ben directly held an AMA to respond one by one. When this theft incident occurred, he also held a live stream overnight, where Ben Zhou first shared the cause of the incident, stating, "There was a problem during signing, but I didn't pay attention; the delivery address was not displayed during signing." Additionally, he also updated everyone on the most concerning issues regarding Bybit's bank run situation and treasury status.

In fact, regardless of the depth of support from various parties or the outcome, at least the market has not seen such positive energy for a long time. Especially in the past six months, many investors have complained that the industry is in a garbage time, feeling helpless and powerless.

After this Bybit theft incident, it seems we can see the return of cohesion in the crypto space from the crisis.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。