Original | Odaily Planet Daily (@OdailyChina)

For most traders currently, making money has become a hellish challenge.

On one hand, the Meme market, spurred by Trump, has seen a continuous drain of liquidity due to the craze for celebrity coins and presidential coins, with the Argentine presidential coin LIBRA becoming the "last dance." Players have lost confidence in Memes, and it may take a long time to recover; on the other hand, traders remain lukewarm towards VC coins and altcoin markets, with "shorting new coins" becoming the main profit strategy. However, the tactics of market makers seem to have changed, as recent new coins like BERA, IP, and KAITO have seen a rebound after the tokens dropped and "airdrop profit positions" were washed out, leading to heavy losses for short sellers.

Clearly, in such a market environment, blindly pursuing high returns in the Meme and altcoin markets is no longer viable. Many have shifted their focus back to the greatest application innovation in blockchain—DeFi—seeking new investment methods that combine safety and returns across various ecosystems.

Berachain, which employs a unique PoL (Proof of Liquidity) mechanism, is becoming a new hub for DeFi capital. According to DeFiLlama data, Berachain's TVL reached $3.193 billion in less than two weeks since its mainnet launch, surpassing Arbitrum to rank 7th, with only a $100 million difference from Base's TVL.

The reason DeFi capital is choosing Berachain is undoubtedly due to its rich returns, especially since BERA has risen over 47% in the past week. So how should retail investors engage with the Berachain DeFi ecosystem? What is the most efficient DeFi strategy? Odaily Planet Daily will introduce how to navigate Berachain's DeFi ecosystem in this article.

Form LP + Infrared Staking (APR over 180%)

Form LP

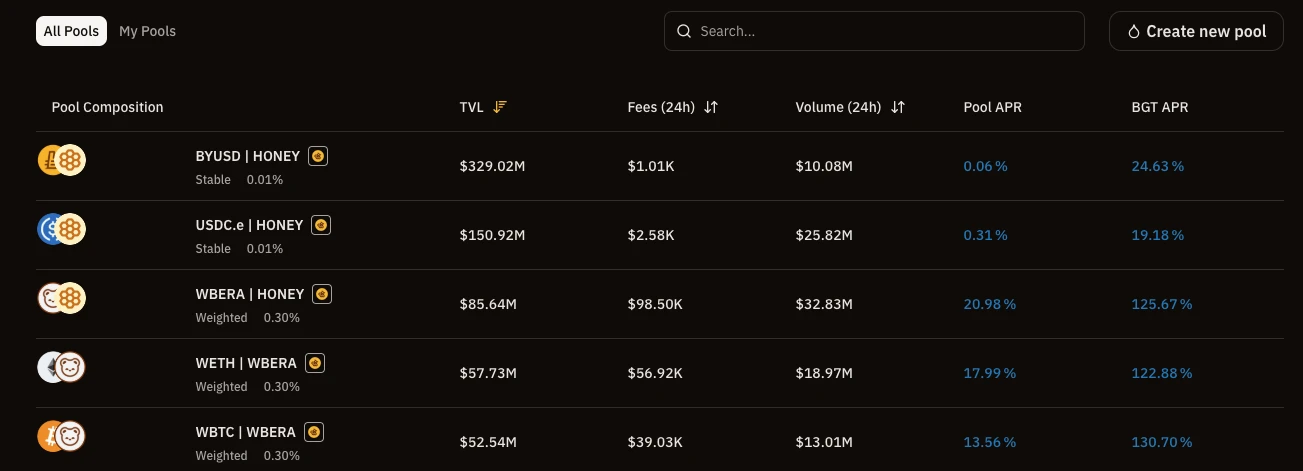

Currently, Berachain has five reward vaults, and staking the corresponding LP receipt tokens in these vaults can earn Berachain governance token BGT (which can be exchanged 1:1 for BERA). Users can add bilateral liquidity to different pools in BeraHub, and the pools that allow staking to earn BGT are as follows: BYUSD | HONEY, USDC.e | HONEY, WBERA | HONEY, WETH | WBERA, and WBTC | WBERA.

If we follow the principle of maximizing returns, adding liquidity to the WBERA | HONEY pool and then staking the LP receipt tokens in the corresponding reward vault can yield an APR of about 150%. For users who want to hold BGT to participate in Berachain network governance, this yield is already quite attractive, but if one is solely focused on "making money," there are even better strategies.

Infrared Staking

Infrared Finance is a proof of liquidity protocol on Berachain that supports staking LP receipt tokens from Berachain's official decentralized exchange (BEX) pools to earn iBGT. Although iBGT is a wrapped token of BGT, it cannot be exchanged for BGT.

Infrared Finance completed a $2.5 million seed round financing on January 29, 2021, led by Synergis Capital, with participation from NGC Ventures, Shima Capital, dao5, Signum Capital, Tribe Capital, Oak Grove Ventures, and others; on June 24, 2024, YZi Labs also announced participation, with the amount undisclosed.

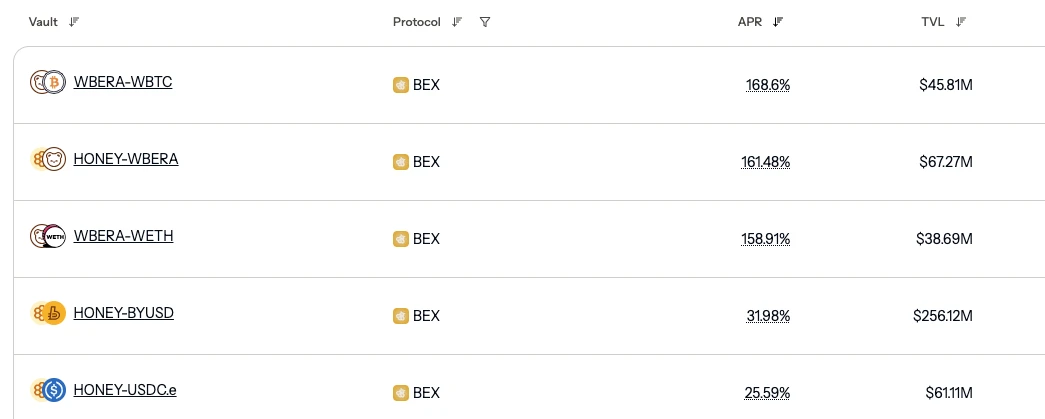

In addition to depositing into the official reward vaults, another option for LP receipt tokens obtained from adding liquidity in BeraHub is to stake them in Infrared. As of now, Infrared's TVL has reached $1.53 billion, and the vaults that support staking BEX LP receipt tokens to earn iBGT are as follows, with the highest APR being the WBERA-WBTC vault, reaching 168.6%.

However, when combining the APR of the liquidity pools on BEX itself, the yields for WBERA-WBTC and HONEY-WBERA are quite similar, both reaching 180% (Pool APR + Infrared APR). But considering stability, the HONEY-WBERA pool may be less affected by token volatility (HONEY is the stablecoin of the Berachain ecosystem).

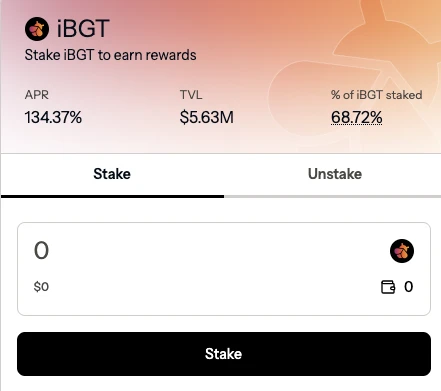

Additionally, unlike the non-transferable nature of BGT, the iBGT earned from staking in the Infrared vault can be staked again in Infrared, with an APR of 134.37%. According to official information, over 68.72% of iBGT has already been staked, with a TVL of $5.63 million.

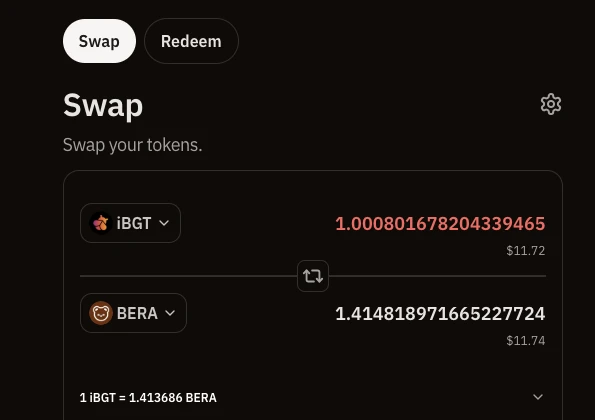

Even if users do not choose to stake iBGT, adopting a "mine, withdraw, sell" strategy, the current value of iBGT is higher than that of BGT. According to the exchange rate on BEX, currently, 1 iBGT can be exchanged for 1.4 BERA, since BGT and BERA always maintain a 1:1 exchange rate, the exchange rate between BGT and iBGT is also approximately 0.7.

Other Options for Staking BERA

If users do not want to form LP and bear the risk of impermanent loss, but simply wish to hold BERA long-term, Berachain also offers yield strategies for staking BERA.

Dolomite

Dolomite is a lending protocol on Berachain, with total financing reaching $3.4 million. On May 15, 2023, it completed a $2.5 million financing round, led by NGC Ventures and Draper Goren Holm, with participation from Coinbase Ventures, 6th Man Ventures, WWVentures, Token Metrics Ventures, RR2 Capital, Slappjakke, Matthew Finestone, and others; on March 19, 2024, it completed a $900,000 strategic financing round, with participation from Optic Capital, Sandeep Nailwal, DCF GOD, Pentoshi, Marc Boiron, and others.

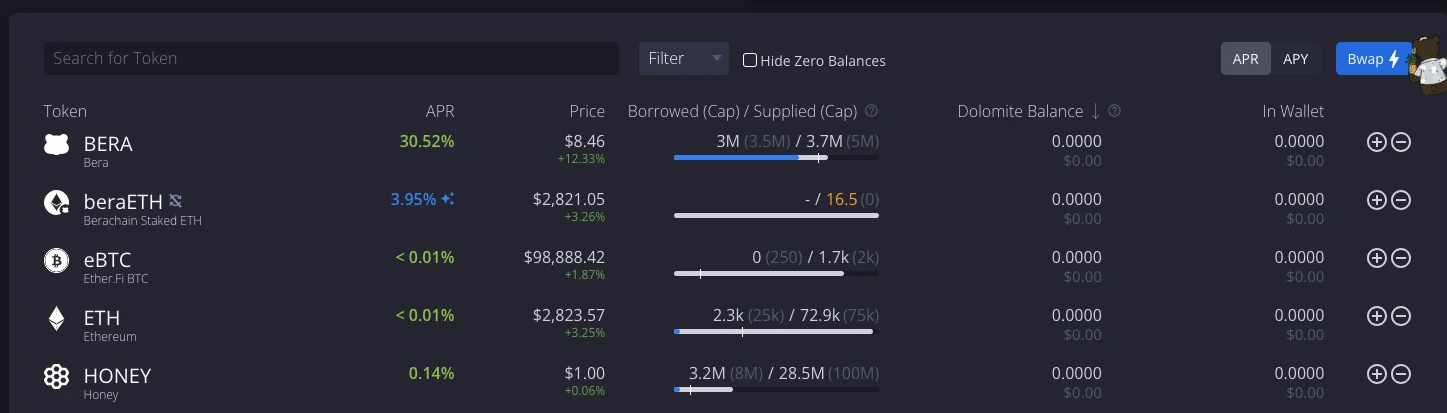

Currently, Dolomite's TVL has exceeded $1 billion, with loans exceeding $68.35 million. Depositing BERA on the platform can enjoy an APR of over 30%, but the deposit supply limit is 5 million tokens.

At the same time, Dolomite announced at the launch of the Berachain mainnet that it would conduct TEG in the coming weeks. The total supply of the token DOLO is 1,000,000,000, with 20% allocated for airdrops, of which 9% is airdropped to Dolomite users based on their borrowing and asset deposit supply data on Dolomite; the official has not yet announced the snapshot.

Kodiak

Kodiak is Berachain's native liquidity protocol, which completed a $2 million seed round financing on February 5, 2024, with participation from Amber Group, Shima Capital, No Limit Holdings, dao5, Kenetic Capital, Ouroboros Capital, Tenzor Capital, Lotus Capital, ODA Capital, Wizards Capital, Baboon VC, Dewhales Capital, Owl Ventures, and others.

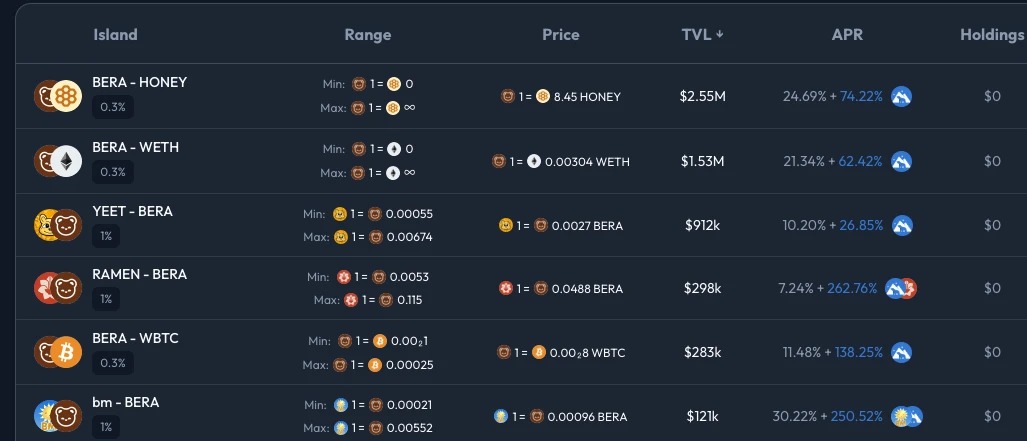

Currently, Kodiak's TVL has reached $767 million, and the platform supports adding bilateral or unilateral liquidity. As shown in the figure below, the BERA-HONEY pool offers a 24.69% fee APR plus a 74.22% Farm APR, resulting in a total yield of 98.91%.

According to official information, before the TGE of Kodiak's native token (KDK), the Kodiak protocol will incentivize users using xKDK. xKDK is non-transferable and cannot be staked. After the TGE, the rewards from before the TGE can be converted 1:1 into xKDK, and xKDK can be converted 1:1 into KDK (through the exchange process). The maximum supply of KDK is 100 million.

Memeswap

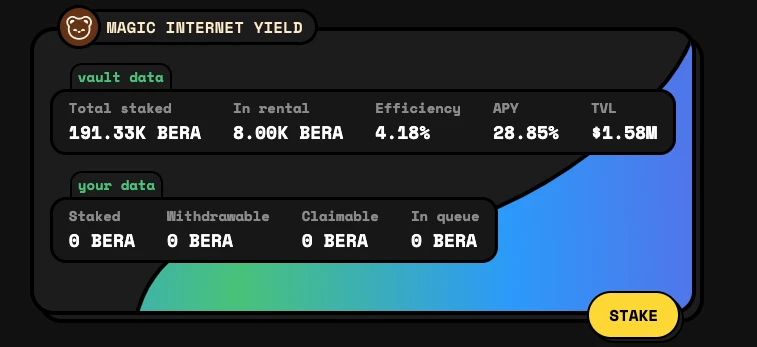

Memeswap is a Meme launch platform and DEX on Berachain, which currently also supports staking BERA, with an APY of 28.85%. The current staking amount is 191,330 BERA.

WeBera

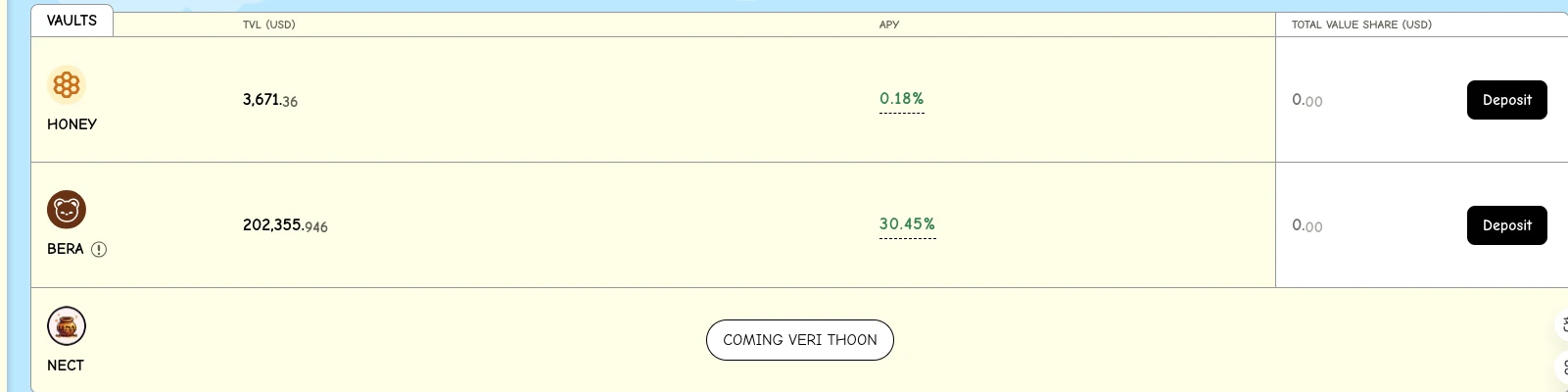

WeBera is a yield abstraction layer on Berachain, aimed at simplifying participation in DeFi within the Berachain ecosystem, and has passed a SlowMist audit. The APY for staking BERA on this platform is 30.45%, with a current TVL of $202,355.946.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。