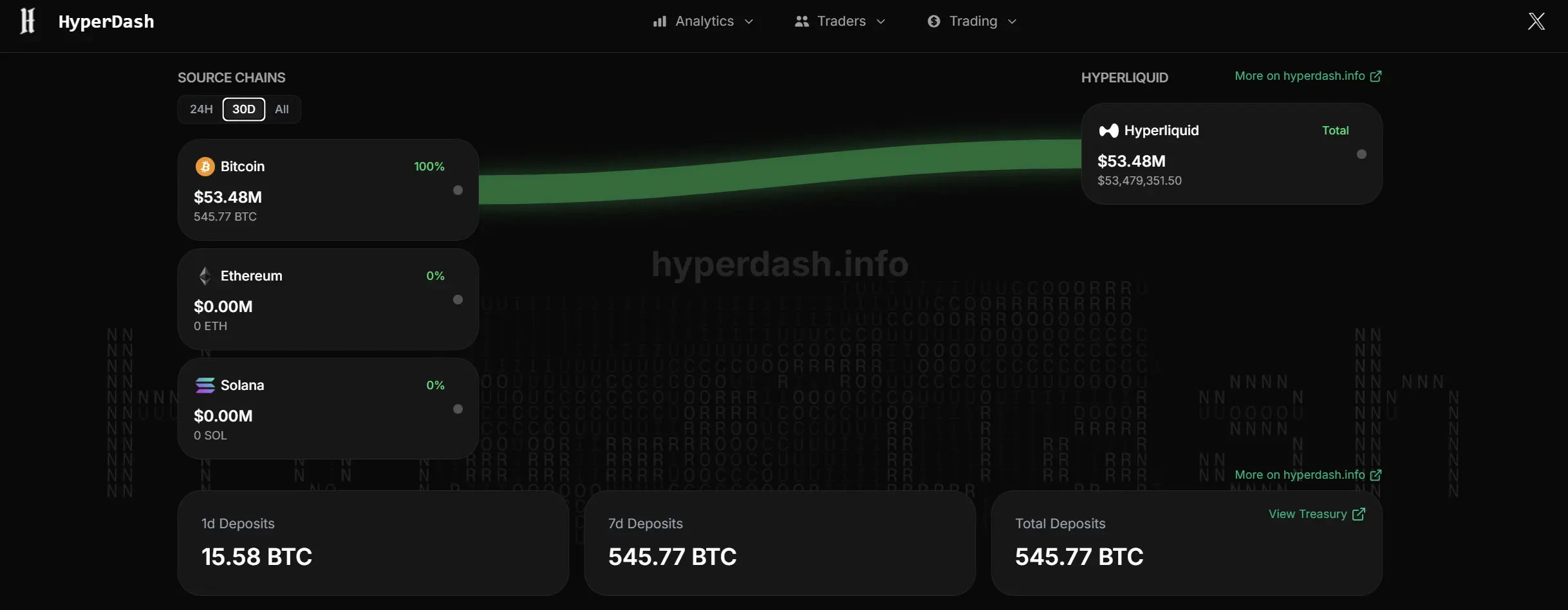

Although Twitter currently only has one project introduction, and the founders and investors are unknown, Unit has already attracted the attention of many crypto influencers, including ZhuSu. Since its launch, it has drawn over $50 million worth of BTC into Hyperliquid. Crypto KOL @chameleon_jeff even reposted and commented: "The launch of Unit brings Hyperliquid one step closer to accommodating all financial assets."

So, what exactly is this so-called "protocol designed specifically for Hyperliquid"?

What is the Unit Protocol?

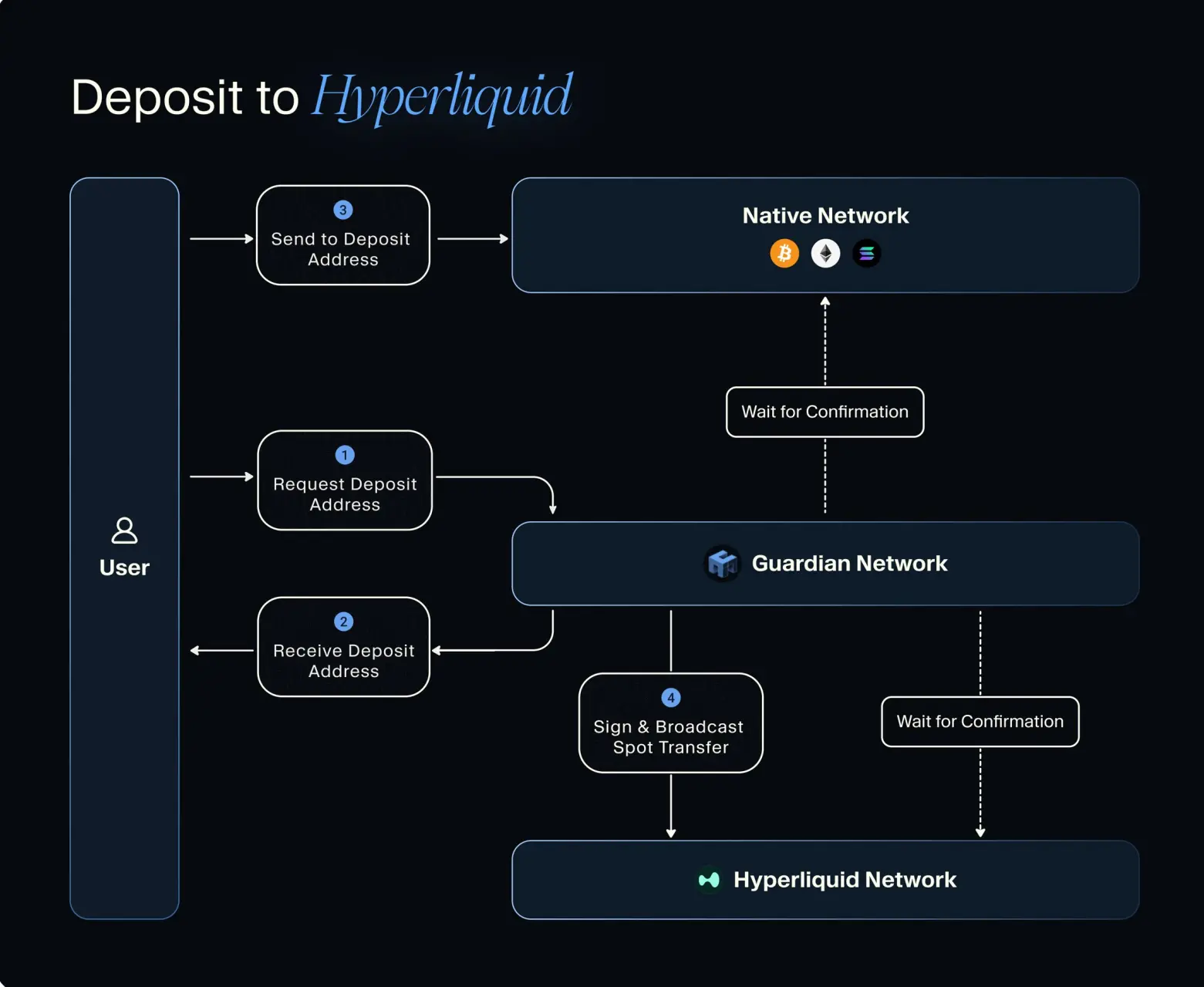

Unit is the asset tokenization protocol layer within the Hyperliquid ecosystem, dedicated to achieving seamless cross-chain deposits and withdrawals of multi-chain native assets. As the underlying infrastructure designed specifically for Hyperliquid, Unit innovatively connects mainstream crypto assets (such as BTC, ETH, SOL) between their native blockchains and Hyperliquid. Users can perform the following core operations:

- Direct Deposit: Transfer BTC/ETH/SOL from personal wallets or exchange accounts into Hyperliquid, with a minimum deposit of 0.002 BTC.

- Free Trading: Trade mainstream assets or exchange them for USDC on the Hyperliquid spot order book.

- Native Withdrawal: Withdraw assets directly to any address on the target chain.

Architecture Analysis

The Unit protocol adopts a distributed architecture design, consisting of two core modules: the Guardian Network and the Agent.

Guardian Network

- Decentralized Verification: A 2/3 threshold multi-party computation (MPC-TSS) network composed of independently operated nodes, requiring consensus from the majority of nodes for all operations.

- Full Chain Data Verification: Each node independently runs a native chain indexer to verify the finality of on-chain transactions in real-time.

- Secure Key Management: Private key fragments are stored in a distributed manner in secure environments like AWS Nitro, eliminating single-point attack risks.

- Leader-Follower Mechanism: Pre-selected leader nodes coordinate proposals, while follower nodes independently verify all instructions, with relay servers only transmitting information.

Agent

- Chain Service Module: Monitors cross-chain deposits, confirms transaction finality, and constructs broadcast transaction packages.

- Flow Management Engine: A multi-step execution framework based on state machines, ensuring protocol operations are executed in strict order.

- Consensus Service Layer: Implements t-of-n arbitration rules (default 2/3 threshold), requiring majority node signatures for key operations.

- Wallet Manager: Coordinates MPC key operations, manages encrypted private key fragments, and executes threshold signatures.

What Problems Can Unit Solve?

As a neutral infrastructure of the Hyperliquid ecosystem, Unit achieves the native cross-chain circulation of mainstream assets through its distributed architecture design while ensuring security. Its technological breakthroughs respond to the community's long-standing demand for spot trading, providing foundational support for innovation in on-chain financial products. By combining traditional CEX-level functions with DeFi native characteristics, Unit is enhancing the efficiency of decentralized trading.

At the same time, the implementation of Unit unlocks multi-dimensional application scenarios for the Hyperliquid ecosystem:

- Unified Trading Experience: Users can complete both spot and perpetual contract trading on the same platform, supporting combined margin cross-asset hedging.

- Capital Efficiency Improvement: Enhances capital utilization through a combined margin mechanism, promoting overall platform trading volume growth.

- On-chain Financial Infrastructure: Provides verifiable CLOB clearing solutions for DeFi protocols, supporting DAO on-chain treasury management.

- Derivative Innovation: Achieves spot Delta hedging and real-time settlement of options, constructing the infrastructure for spot-futures basis trading.

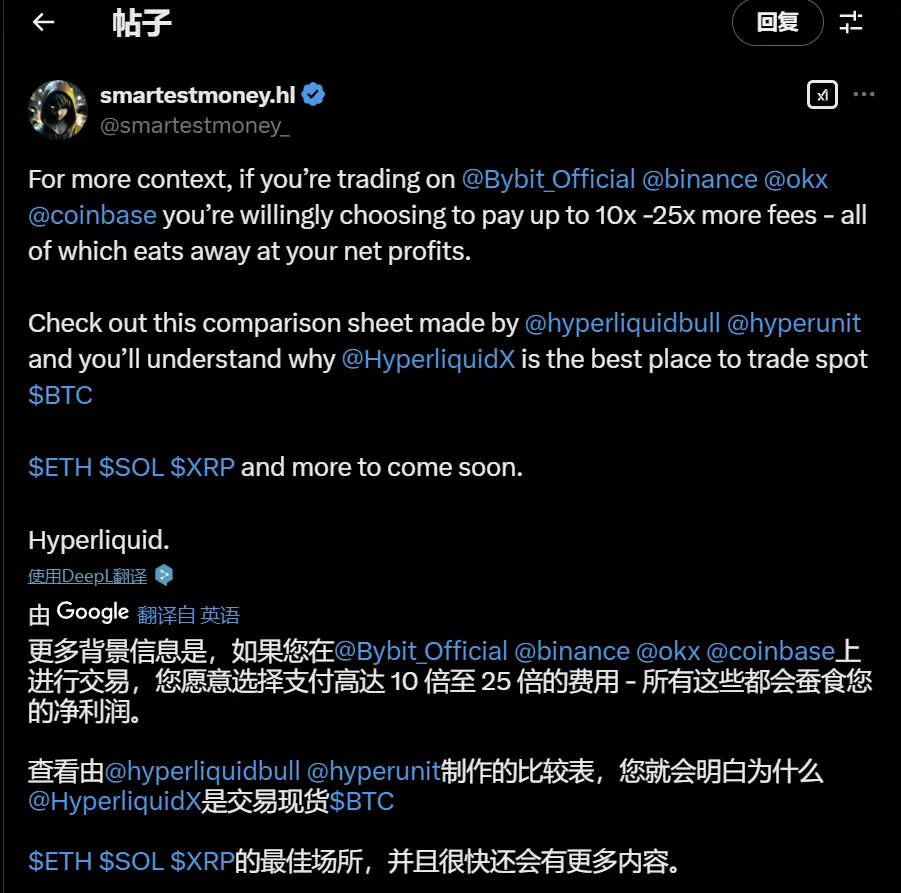

These advantages are intuitively reflected in trading fees. According to crypto KOL @smartestmoney_'s tweet, a comparison table created by @hyperunit shows that trading mainstream currencies like BTC and ETH on Hyperliquid will be 10 to 25 times lower than trading on traditional CEXs.

Currently, the official team has not disclosed more project-related information. The mainnet launch has already enabled users to deposit or withdraw BTC through self-custody wallets or centralized exchange accounts, while support for ETH and SOL functionalities will be launched in the near future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。