Author: 1912212.eth, Foresight News

On March 1, 11.2 million SOL from the FTX bankruptcy auction will be unlocked, valued at $2.06 billion, accounting for approximately 2.29% of the current circulating supply of SOL.

Such a massive selling pressure combined with a sluggish market has led to a poor performance of the SOL price. Since January this year, when the Trump TRUMP concept coin sparked a market frenzy, SOL once reached an all-time high of $295, but has since declined, currently experiencing a four-year weekly drop, with a low point around $160. Is it Solana's turn to face FUD?

This article will explore the impact of this event from multiple angles, including the background of the unlock and potential market effects.

Background of FTX Bankruptcy and SOL Unlock

The bankruptcy of FTX is one of the most iconic events in cryptocurrency history. In 2022, this once-industry giant collapsed due to a broken capital chain and mismanagement, subsequently entering bankruptcy liquidation. As an early investor in the Solana ecosystem, FTX and its affiliate Alameda Research held a large amount of SOL tokens. FTX held a total of about 41 million SOL, most of which were locked, with unlock times distributed between 2025 and 2028. To repay creditors, the FTX bankruptcy management team auctioned off these locked tokens in advance, attracting institutional investors with significantly discounted prices.

The 11.2 million SOL being unlocked is part of this previous auction. Major institutions participating in the purchase include Galaxy Digital, Pantera Capital, and Figure. Among them, Galaxy purchased 25.52 million SOL at $64 each in 2024, Pantera bought 13.67 million at $95, and Figure acquired 1.8 million at $102. These institutions bought at prices far below the market price at the time, and even if the SOL price drops to around $170, their paper profits remain quite substantial.

Potential Impact of Selling Pressure

11.2 million SOL represents 2.29% of Solana's current circulating supply (approximately 488 million), valued at over $2 billion. For an asset with a daily trading volume typically between $1 billion and $2 billion, the influx of these unlocked tokens could undoubtedly trigger market turbulence. If these tokens are quickly sold off, a short-term oversupply situation could depress SOL's price, leading to panic selling by investors and exacerbating the downward trend.

The extent of market impact depends on the behavior of holders after the unlock. The buyers of these tokens are mostly experienced institutional investors who purchased at low prices during the auction, and their current paper profits are quite substantial. If they choose to cash out immediately after the unlock, selling pressure will significantly increase. However, from another perspective, these institutions have held the tokens for months or even years during the lock-up period, indicating a certain willingness for long-term investment. Matt Maximo, an investor at VanEck, revealed that some buyers he knows have explicitly stated their goal is to pursue higher returns rather than short-term arbitrage.

Additionally, SOL's recent price performance provides some clues about market sentiment. Since the FTX bankruptcy, SOL's price has surged from a low of $22 to over $170, an increase of more than 700%. Although there has been a recent market correction, the overall trend still shows strong support.

How Likely is Market Panic?

Whether selling pressure will trigger market panic largely depends on investor psychological expectations and the market environment. Some users have expressed concerns about this unlock, believing that the $2 billion selling pressure could break through trend lines, leading to further price declines. However, there are also viewpoints suggesting that a 2.2% increase in circulating supply is relatively limited, and most SOL has already been traded multiple times in the market, so the actual impact may be exaggerated.

Crypto KOL SOLBigBrain, who entered around $20, stated that part of the price has already been accounted for, and while some may choose to sell after the unlock, the narrative and momentum for SOL remain quite strong.

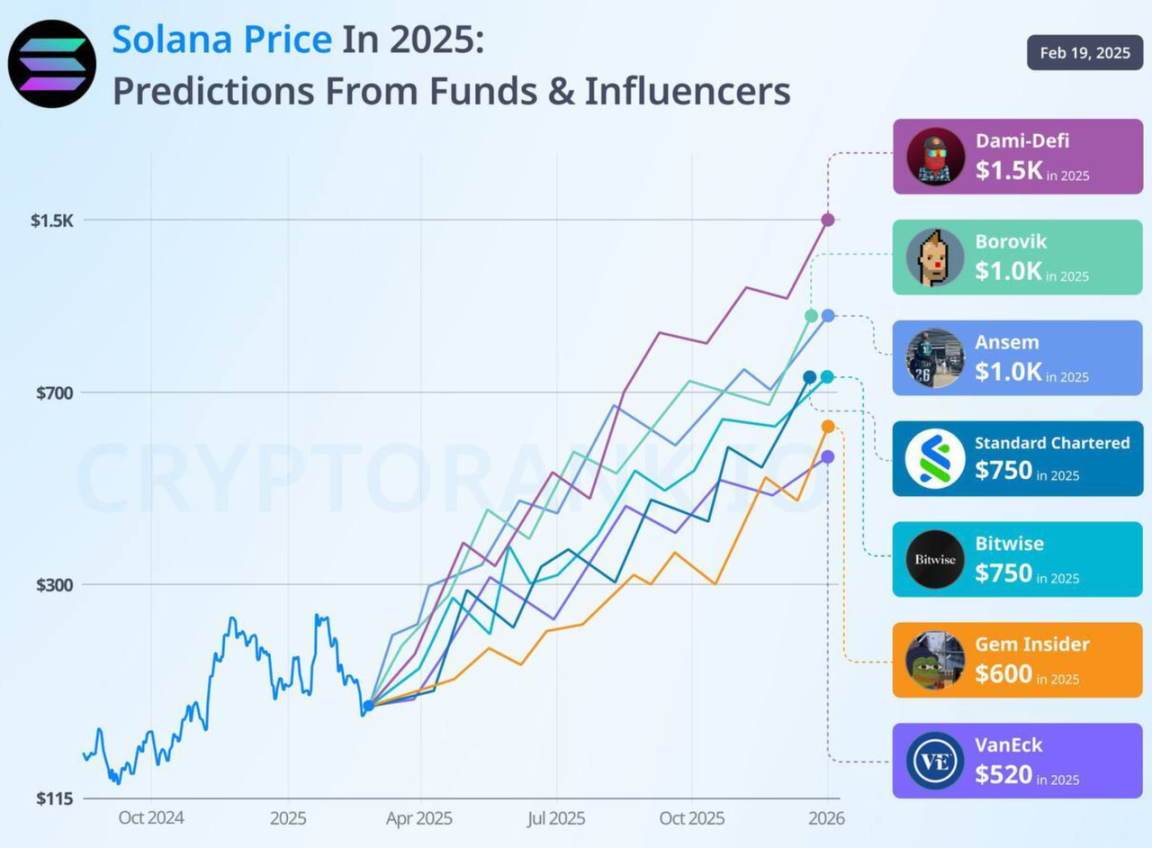

Currently, some funds and KOLs on social platforms are generally optimistic about SOL's price performance this year, with a considerable number of opinions even suggesting that SOL will exceed $700 this year.

Historically, large-scale unlock events do not always lead to market crashes. For example, when FTX was approved to sell $100 million worth of crypto assets weekly in 2023, the market did not experience significant declines but gradually absorbed the selling pressure. On January 7, 2021, SOL unlocked 362 million tokens, accounting for 55.7% of the maximum supply, at which time the price was around $3, and it reached an all-time high of $259 in November 2021.

Generally speaking, the negative effects of an unlock tend to ferment in the month leading up to the actual unlock, and after the unlock is completed, the bearish sentiment may be fully priced in, potentially even leading to a rebound at times. For instance, ONDO experienced a massive unlock in mid-January this year, and after reaching a peak in December 2024, it declined, but after the unlock was completed, there was no so-called panic selling behavior in the market; instead, the price fluctuated within a certain range. This time, although the scale of SOL's unlock is larger, the institutional nature of the participants and the high profit buffer may weaken the motivation to sell.

Solana's Fundamentals Remain Strong

The fundamentals of the Solana ecosystem itself have also helped to mitigate potential risks to some extent. As a high-performance public chain, Solana has attracted a large number of developers and users in recent years due to its low transaction costs and high throughput. Over the past year, Solana has been highly sought after and celebrated in the market due to meme trends and AI concept coins, and its on-chain wealth effect has drawn many users to flock in.

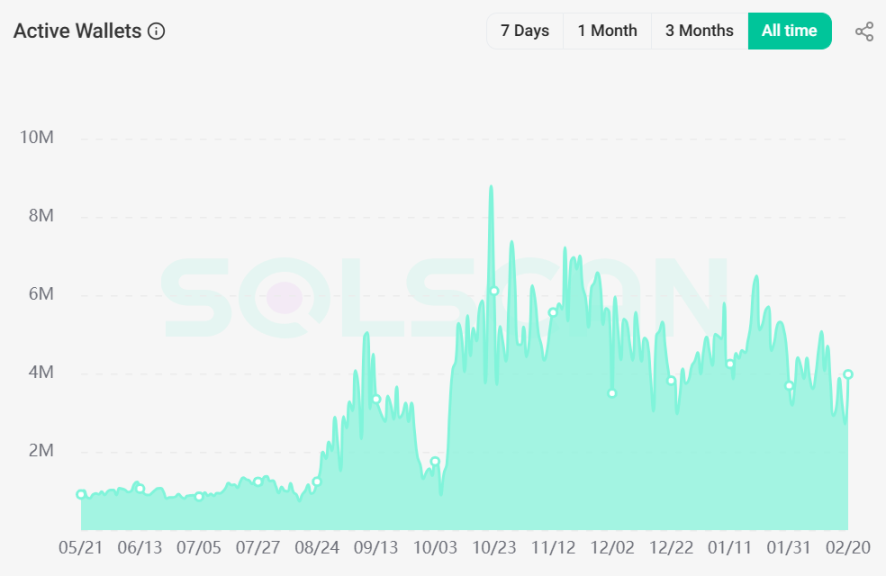

According to solscan data, the current total on-chain USDC supply has reached 9.6 billion USDC and 2 billion USDT, with the number of PYUSD also rising to around 150 million. The number of independent address holders has reached 3,288,566, and the total active staked SOL has reached 390.2 million. Although the number of active wallets has decreased, it remains at a high level.

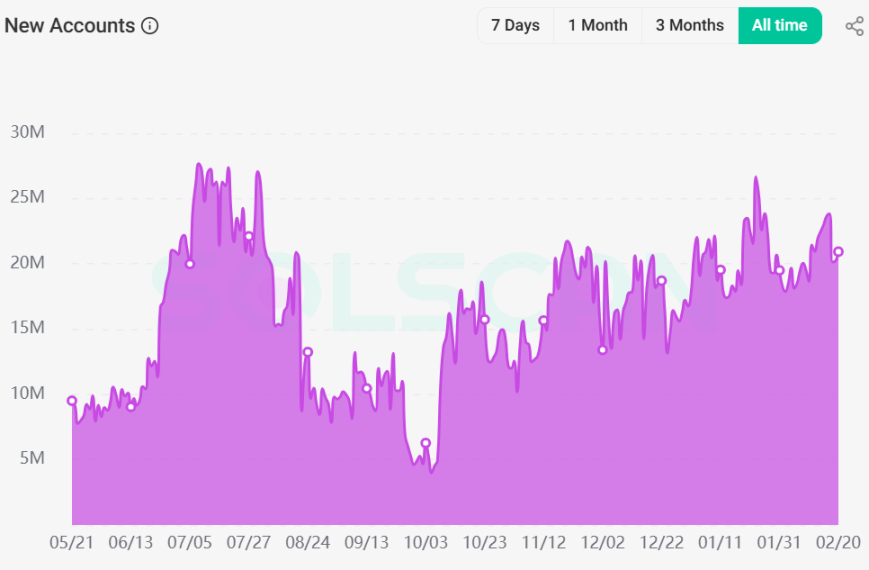

The number of new accounts has also remained high.

Conclusion

In summary, the unlocking of SOL worth over $2 billion on March 1 will undoubtedly create a certain degree of selling pressure in the market, but the likelihood of triggering widespread panic is relatively low. The rational decision-making of institutional investors, the market's absorption capacity, and the resilience of the Solana ecosystem will all be key factors in buffering this impact. For investors, focusing on price trends and trading volume changes after the unlock, while formulating strategies based on their own risk tolerance, will be the best way to respond to this event. In the ever-changing stage of cryptocurrency, opportunities and challenges coexist, and the story of SOL is clearly far from over.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。