Author | Mu Mu

Produced by | Plain Blockchain

Due to Solana's outstanding performance in this round of market trends, many believe that this bull market is Solana's bull market. Looking back at Solana's development history over the past few years, whether it rode the wave of DeFi Summer with Wall Street's entry or managed to seize the lifeline of the Meme craze after FTX's bankruptcy, the "return of the king" phenomenon makes one feel that Solana's fortune is exceptionally good.

However, giants like FTX can fall overnight, and Memes have their own tides of rise and fall. Recently, there have been clear signs of a "tide retreat" for Memes, coupled with the upcoming massive unlock, which can be described as misfortune coming in waves. Solana is under increased pressure; has its "good luck" really run out?

01. The Decline of Memes

Recently, on-chain data shows that since February, Solana's on-chain transaction volume has plummeted, and the number of launches on platforms related to Meme has drastically decreased. Popular projects in the Solana ecosystem have all seen significant declines, and various FUD voices have begun to emerge on social platforms.

The rise of Memes initially stemmed from calls for "anti-VC," "not taking over," and "fair launches." However, after the Meme craze took off, various institutions quickly became the "big players," seizing advantageous ecological positions. The crypto community soon realized that without continuous capital injection, Memes relying solely on fair launches were fleeting. Consequently, most people turned back to the embrace of various institutions, taking over their positions.

Soon after, the presidential coin representing celebrity top-tier status was born. The Trump family Token quickly drained liquidity from the market, followed by the arrival of the Milei Token, which dealt another heavy blow. In the aftermath, people gradually discovered that behind these celebrity projects was a team of operators, and some were even interconnected. Each hotly pursued project had an invisible hand manipulating it, leaving the crypto community feeling like they were being rubbed into the ground repeatedly. Some KOLs bluntly stated that our crypto community just wanted to break out, not to let outside celebrities come in and cash out…

Ultimately, the Meme craze and the bursting of its bubble exposed the "evil" of human nature. Greedy retail investors who speculated excessively could not escape the fate of being "bag holders," which dealt a significant blow to the Meme market. For the Solana ecosystem, which had rapidly risen due to the Meme craze, this was like a heavy blow to the head. The implications are self-evident.

02. Extremely Untimely Large Unlock

While still immersed in the sadness of the Meme retreat, another despairing message arrived: "On March 1, 11.2 million SOL will be unlocked." Initially, people mistakenly thought this was part of the token economic model's planned unlock, which is usually a small-scale unlock with minimal impact on the market. However, this large unlock is the second blow brought about by FTX's bankruptcy. Simply put, these 11.2 million SOL are part of the tokens sold during the FTX liquidation process. These tokens were set with a certain lock-up period (Vesting Schedule) during trading, typically lasting 1-3 years, and will be released into the circulating market by March 2025.

After FTX's bankruptcy in November 2022, the massive SOL held by its affiliated company Alameda Research became part of the liquidation assets. It is estimated that FTX/Alameda initially held about 58 million SOL, accounting for 10%-15% of Solana's total supply at that time. The bankruptcy trustee (led by John J. Ray III) subsequently sold these tokens to institutional investors at a discounted price. It is reported that institutions such as Pantera Capital, Galaxy Digital, and Figure Markets were among those who purchased these tokens. According to information on X and on-chain data (tracked by Lookonchain), the market estimates the selling price of these tokens to be around $60-80 each (30-40% of the current market price).

Since the 11.2 million SOL set to be unlocked were purchased by institutions at a discounted low cost, the market expects that if no one quickly absorbs them off-market, the unlock could bring significant selling pressure to SOL. Currently, this pressure has already affected the current market price and the Solana ecosystem community.

03. Has Solana's Good Luck Run Out?

So, has Solana's good luck really run out amid these misfortunes? It seems not. Whether it’s the anticipated approval of Solana's spot ETF this year or a series of friendly crypto policies from Trump, these can be seen as a continuation of Solana's good fortune.

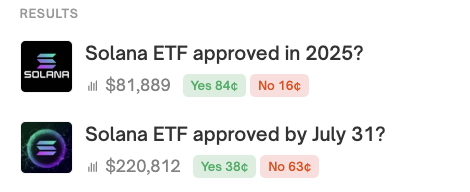

The Solana spot ETF, which may be approved as early as June this year, is highly anticipated. Currently, on well-known prediction platforms, the probability of Solana's ETF being approved by 2025 is 84%, while the probability of approval before June 31 is 38%. Based on the performance of previously approved spot ETFs for Bitcoin and Ethereum, the Bitcoin spot ETF currently has a holding value of over $110 billion, while the Ethereum spot ETF has a holding value exceeding $10 billion. Given Solana's institutional support rate, there will likely be billions of dollars flowing in, which could easily cover the negative impact of the 11.2 million unlock. However, the problem is that the unlock is imminent, while ETF approval is still months away.

Trump's series of friendly policies are indeed gradually being implemented, creating a friendly regulatory environment for the entire crypto industry. Thanks to the accelerated catalysis of the Meme craze, the Solana ecosystem has already made notable progress. By early 2025, Solana's on-chain DEX trading volume once surpassed that of Ethereum, successfully passing a pressure test, and both user numbers and activity levels are showing strong momentum.

Additionally, the growth rate of Solana's developer community is also quite rapid. Coupled with the iterative upgrades planned in Solana's future roadmap, which will improve existing shortcomings in technical solutions, its ecosystem continues to attract more attention, with top institutions like PayPal and Franklin Templeton also joining in.

04. Conclusion

Whether the Meme craze is cooling or the large unlock is approaching, these are actually short-term "growing pains," which are quite common in the crypto field. One cannot conclude that Solana will fall because of this, especially given the favorable crypto regulatory winds it encounters amid its strong ecosystem development momentum. As for the longer-term future, we will wait for more tests brought by time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。