A Quick Look at the Highest TVL Protocol on Sui: The STEAMM Mechanism and Interaction Opportunities Incubated by Suilend

Written by: Alex Liu, Foresight News

In the traditional DeFi space, liquidity providers (LPs) often face a pain point: a large amount of liquidity in AMM protocols is forced to remain idle due to mechanism design, leading to low capital efficiency. With the launch of Sui's first "super liquidity AMM," STEAMM, this dilemma may become a thing of the past on the Sui chain. The protocol creates dual returns for LPs through improved mechanisms and provides customized liquidity solutions for different assets with a modular architecture, becoming a key piece in the Sui DeFi ecosystem.

STEAMM Mechanism: From Capital Efficiency to Risk Control

1. Super Liquidity Design: Turning Idle Funds into "Double Returns"

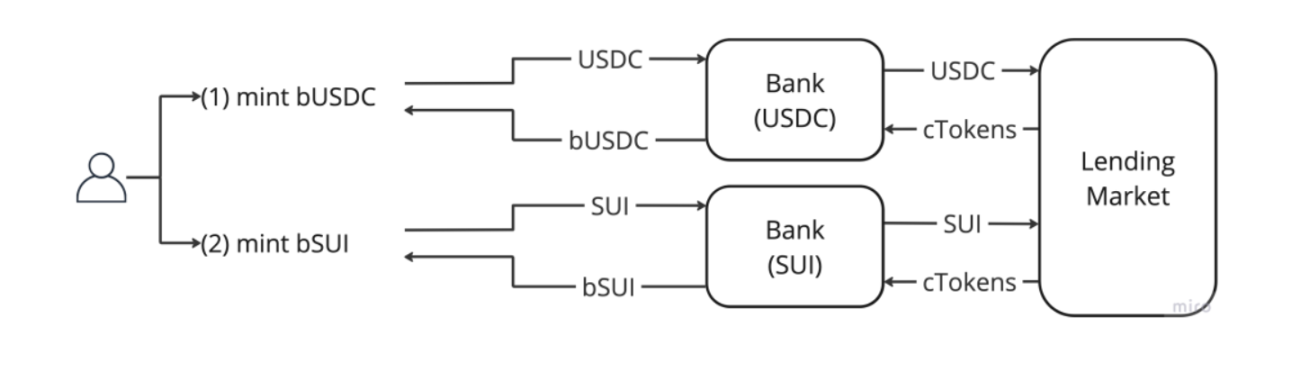

Traditional AMM liquidity pools often waste capital potential by passively waiting for trades. The "super liquidity" mechanism of STEAMM breaks this deadlock. The protocol automatically integrates idle funds seamlessly into the lending protocol Suilend (in fact, STEAMM is incubated by the Suilend protocol, effectively making it a sub-protocol of the project. Suilend is currently the protocol with the highest TVL on Sui), allowing LPs to earn both trading fees and lending interest simultaneously. This dynamic allocation ensures immediate liquidity in the trading pool while increasing capital utilization. The high trading volume/TVL ratio mechanism of STEAMM can significantly compress bid-ask spreads, reducing trading costs and increasing LP returns.

Deposit Lifecycle Diagram

2. Dynamic Pricing: The "Smart Shield" in Volatile Markets

Price lag and impermanent loss are long-term concerns for LPs. STEAMM introduces a "dynamic pricing quote engine" to address market volatility through a floating fee rate mechanism—when the market experiences severe fluctuations, the protocol automatically widens the bid-ask spread (similar to dynamic spreads in traditional markets), protecting LPs from short-term price shocks while ensuring they receive reasonable compensation during high volatility periods. For traders, the quotes reflect the real market state in real-time, helping to avoid hidden costs caused by price deviations in traditional AMMs.

3. Modular Architecture: One Protocol Fits All Scenarios

From constant product pools (like Uniswap V2) to stablecoin curve pools, STEAMM's modular design accommodates various liquidity models while allowing dynamic adjustments to fee structures. This flexibility enables different assets (such as volatile tokens and stablecoins) to match optimal liquidity solutions, ultimately achieving narrower spreads, lower slippage, and a more transparent fee system.

How to Participate in the STEAMM Beta? Overview of Current Assets and Rules

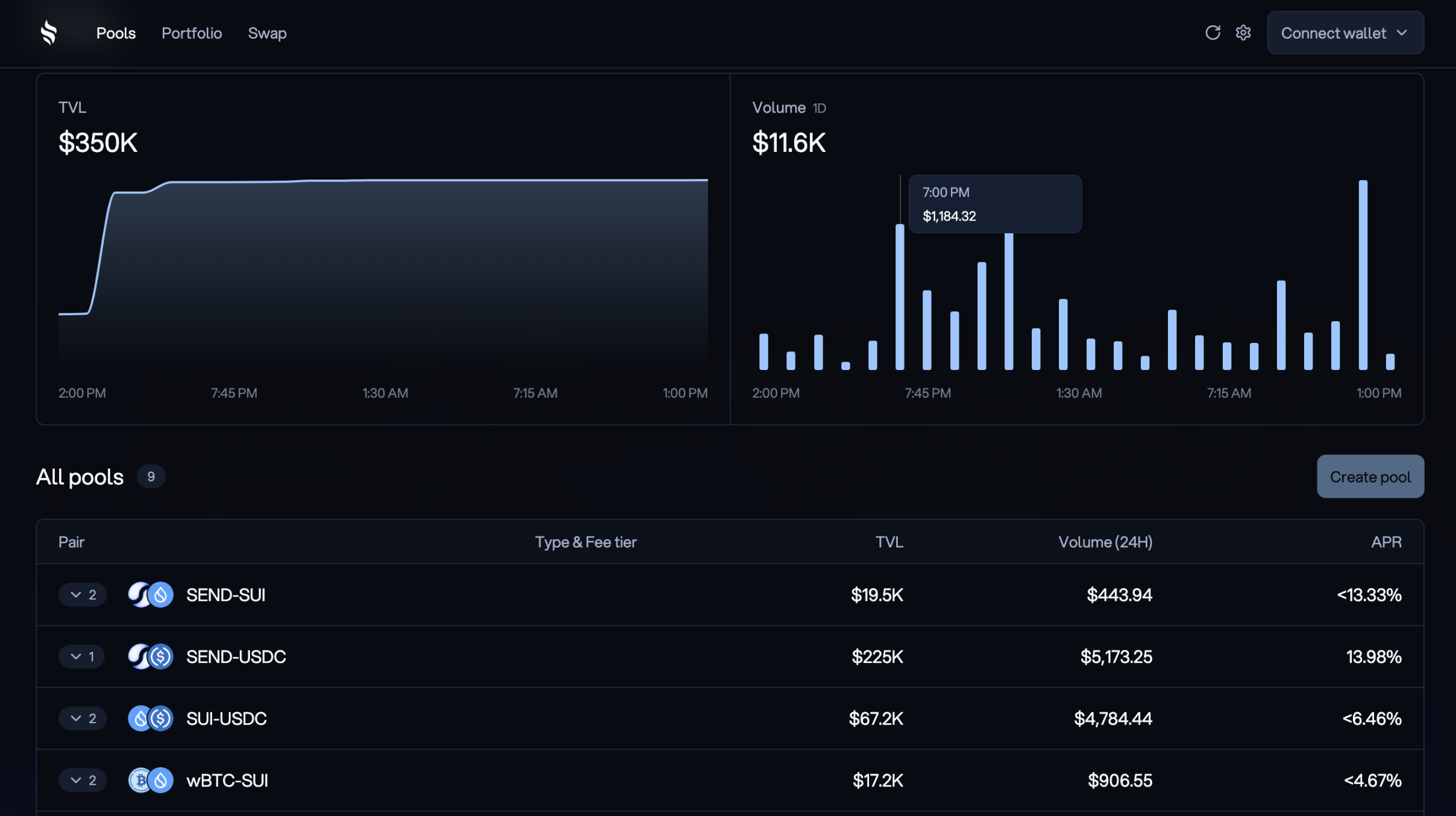

Currently, the STEAMM beta has officially launched, and users can visit the official website (steamm.fi) to experience it. Whether there are potential rewards for interacting with the beta is unknown. It is important to note that during the testing period, only holders of Rootlets NFTs (currently with a floor price of 270 SUI) can perform on-chain operations such as deposits, withdrawals, and exchanges (browsing functionality is unrestricted).

Current Supported Liquidity Pool Types and Assets

- Pool Type: The first phase only opens "constant product pools" (𝑥 × 𝑦 = 𝑘), using a pricing mechanism similar to Uniswap V2.

- Trading Pairs and Fees:

- SUI-USDC (0.3% base fee)

- SEND-SUI (2% base fee)

- wBTC-USDC (0.3% base fee)

- wBTC-SUI (0.3% base fee)

- Protocol Fee Distribution: 20% of each transaction is charged as a protocol fee, with the remaining 80% going to LPs. For example, in a pool with a 0.3% fee rate, LPs actually receive 0.24% in returns, while the protocol retains 0.06%.

The "Final Piece" of the Sui DeFi Ecosystem?

The launch of STEAMM fills a critical module in the DeFi Lego of the Sui chain. By eliminating the opportunity costs of traditional AMMs and enhancing capital efficiency, its "dual return" model may attract more liquidity. Additionally, the extensibility of the modular architecture lays the groundwork for supporting more complex derivative assets in the future. As the beta runs and features iterate, whether the Sui ecosystem can achieve a breakthrough in DeFi through STEAMM is worth ongoing attention.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。