Author: Frank, PANews

On February 18, 2025, the first round of creditor payments for FTX officially commenced, marking a critical phase in the two-year bankruptcy liquidation process. However, market attention has shifted to another potential risk: on March 1, 11.2 million SOL tokens from FTX's bankruptcy auction are set to be unlocked, valued at up to $1.9 billion. Although the payments appear "mild" as they are settled in fiat currency, the expectation of a massive influx of SOL tokens has raised market concerns that the aftershocks of FTX's asset sell-off will once again impact the crypto ecosystem. Is the panic overblown, or is the risk not fully priced in?

Over $5 billion Unpaid in the First Round

According to public information, the category of creditors receiving payments in this round consists of initial beneficiaries, referring to small creditors with claims of $50,000 or less. Under FTX's restructuring plan, they will receive full repayment along with an annual interest of 9%. This group of users may ultimately receive a repayment valued at 119% in fiat currency.

According to FTX creditor Sunil, approximately $800 million has been paid in this round, covering 162,000 accounts, which accounts for 35% of the estimated 460,000 eligible claims. Additionally, payments exceeding $50,000 will not be made until after May 30.

Previous reports indicated that the overall repayment plan for the first phase involves amounts between $6.5 billion and $7 billion. This round of payments is expected to continue until March 4. However, FTX has not yet disclosed the actual repayment amount for the first round.

From the perspective of repayments, since FTX has chosen to settle in fiat currency, the commencement of payments may not cause significant turmoil in the crypto market and might even bring in some new capital.

Nearly $2 Billion Worth of OTC SOL Tokens Unlocking

Market panic regarding FTX primarily stems from the auction of crypto assets like Solana. As of 2023, documents show that FTX's total assets amount to only $4.77 billion, leaving a gap of $6.8 billion compared to the estimated $11.5 billion repayment amount. With the crypto market entering a bull run in 2024, the crypto assets held by FTX have seen significant appreciation.

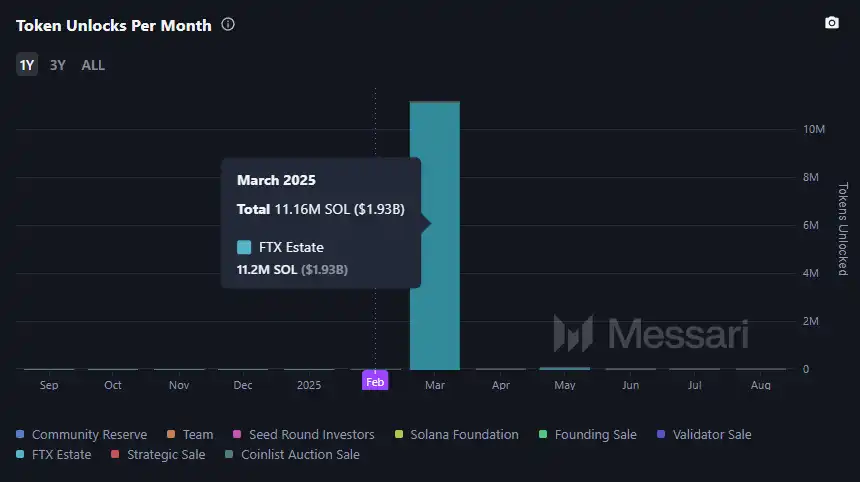

Among these, Solana has provided the most support to FTX, with SOL tokens experiencing a maximum increase of over 28 times since December 2022. As one of the main investors in Solana, FTX holds a large amount of locked SOL tokens. According to monitoring data from @ai_9684xtpa, as of February 17, FTX has sold 41 million SOL through three auctions. Of these, 11.2 million will be unlocked on March 1.

Reports indicate that these 41 million tokens were not sold directly through the secondary market but were purchased by Galaxy (buying 25.52 million at $64), Pantera and other buyers (buying 13.67 million at $95), and Figure and other buyers (buying 1.8 million at $102). Overall, these tokens have brought FTX $2.932 billion in revenue, making it the largest category of liquidation income in its crypto asset portfolio.

Regarding the unlocking of SOL tokens, this transaction should have been completed through the auction previously, and the unlocking is merely the realization of delivery. Of course, regardless of who the final controllers are, these tokens will enter circulation, and the known costs for these buyers are far below the market price. Therefore, there is indeed a risk of profit-taking sell-offs, but the number of SOL tokens set to unlock only accounts for 2.3% of the current circulating supply.

Sui Has Repurchased Equity, Unknown Disposal Methods for APT, AVAX, and Other Assets

In March 2024, FTX announced the sale of its investment in Mysten Labs for $95 million. Mysten Labs is the developer of the Sui network. By the end of 2024, these sold shares and tokens could be worth up to $4.6 billion. For the market, if FTX retains this portion of tokens, the SUI market will face greater pressure.

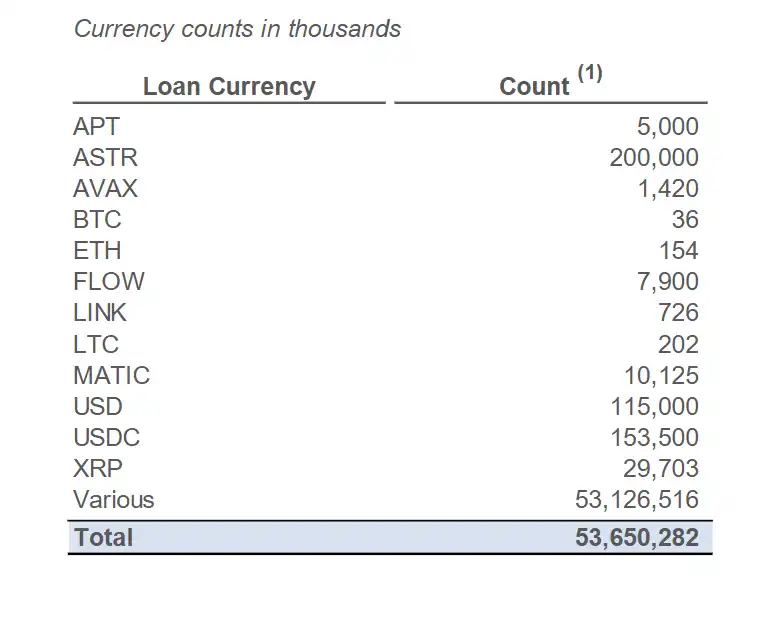

In addition to Solana and Sui, Aptos was also one of the public chains that FTX heavily invested in. According to media reports, in 2022, FTX Ventures and Jump Crypto led a $150 million financing round for Aptos. However, as of now, Aptos has not disclosed the final handling of this equity. According to data provided by FTX in March 2023, the number of APT tokens held at that time was 5 million, but currently, no APT token data can be found in the ARKM FTX chain address. Based on the price on February 19, this portion of APT is valued at approximately $31.65 million.

As of February 19, the largest token held in FTX's on-chain address is FTT, with a total of 257 million tokens, valued at approximately $505 million. The total market cap of FTT is only $657 million, and if its holdings are sold off, the price impact could pose the greatest risk. FTX previously asked users to fill in the purchase price of FTT, but in the fiat currency settlement, FTT is temporarily valued at 0, and it remains uncertain how FTT holders will receive compensation.

Documents disclosed in 2023 show that FTX also held 1.42 million AVAX (valued at $33.76 million), 36,000 BTC (valued at $346 million), 154,000 ETH (valued at $410 million), and 29.7 million XRP (valued at $76.32 million), among other major crypto assets. However, as of February 19, these assets are no longer visible in FTX's public wallet address, having been sold off during the liquidation period. As of February 19, the value of FTX's on-chain address holdings is approximately $1.269 billion.

With the commencement of FTX's repayments, the FTX bankruptcy event is finally nearing its conclusion. After more than two years of transformation, the entire crypto industry has begun a new landscape, and FTX's impact on the industry has gradually become a part of history. The recent market downturn attributed to FTX seems more like a case of chasing shadows or a reflection of panic during the current market turbulence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。