Author: @Moomsxxx

Compiled by: Baihua Blockchain

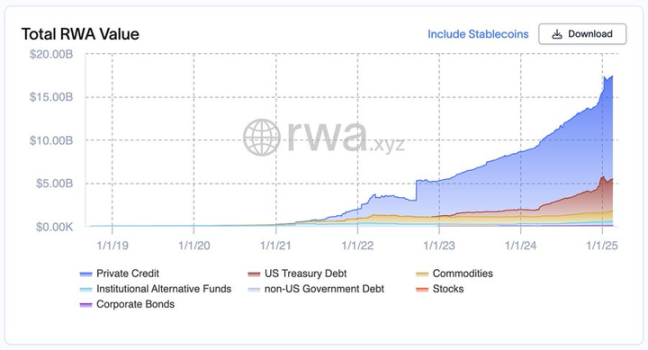

The RWA sector is growing at an astonishing pace. Just a few days ago, the total value of RWA reached a new high, and today it has broken that record again.

1. RWA TVL

Despite many ongoing challenges related to privacy solutions, digital identity solutions, interoperability, and others that continue to create operational friction and become bottlenecks for faster adoption, the $2-3 billion raised through on-chain funds and approximately $200 billion in stablecoins demonstrate the growing interest and adoption in this area of the Web3 industry.

Currently, tokenized funds account for only a small portion of the expected growth in the fund industry over the next few years.

Similarly, the growth in the private credit sector reflects the increasing interest of market participants in opportunities beyond Bitcoin, DeFi native yields, alternative coins, and meme coins.

According to data from @Preqin, the global private credit market has an investment scale close to $1.7 trillion, while according to @RWA_xyz, the scale of tokenized private credit is only about $11.9 billion.

Active loan value - Private credit market (Source: RWA.xyz)

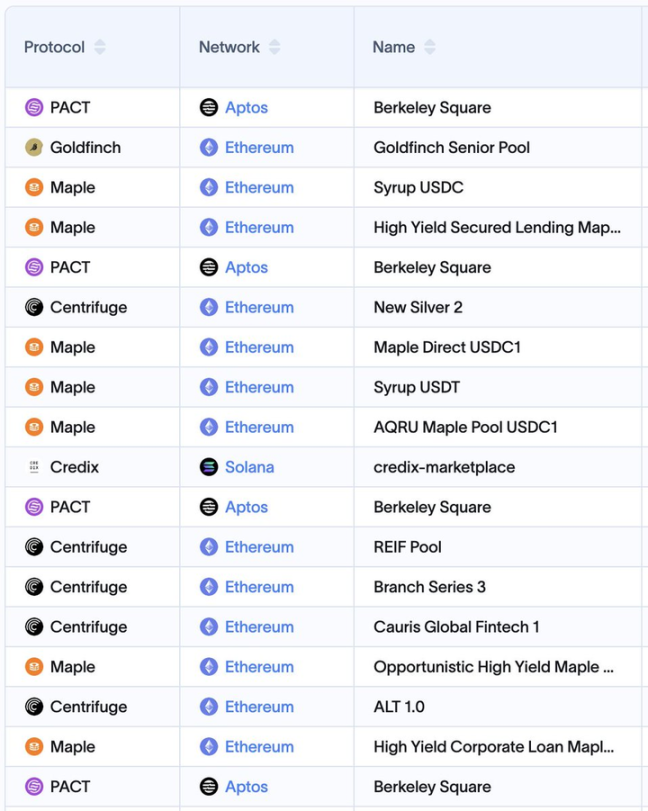

A deep analysis of this field reveals that since the market crash in 2022, the reliability of these loans has changed significantly, with teams across platforms becoming more cautious and investing more resources to ensure higher quality credit issuance.

From July 2021 to the end of 2022, borrowing was primarily dominated by crypto trading and market-making firms. As a result, borrowing in this sector collapsed during the 2022 bear market.

Since then, growth has mainly come from real-world borrowing backed by consumer asset-backed securities (such as auto loans, credit card debt, student loans, small business loans, etc.), transitional real estate loans, trade financing, and other less volatile asset classes.

Funding pools for various RWA transactions

This is evidenced by resilient protocols like @maplefinance, which demonstrated strong performance during the liquidation event on February 3, 2025—this event was the largest liquidation in crypto history. For more details, see the following link: https://x.com/maplefinance/status/1886332880411832514. Additionally, the industry has matured significantly over the past three years, with technological solutions continuously emerging to address regulatory and privacy obligations, further improving this critical area.

2. Opportunity Size

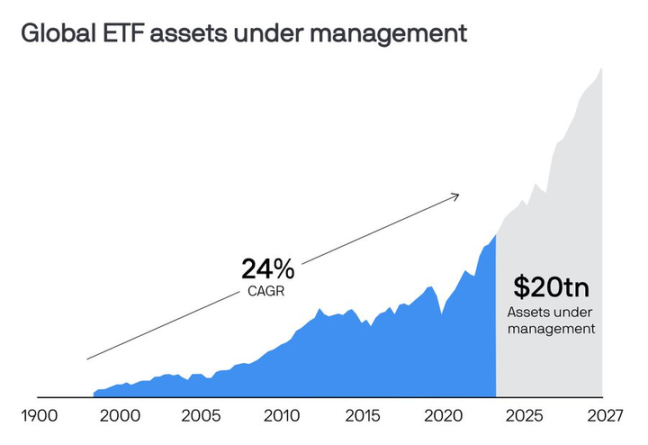

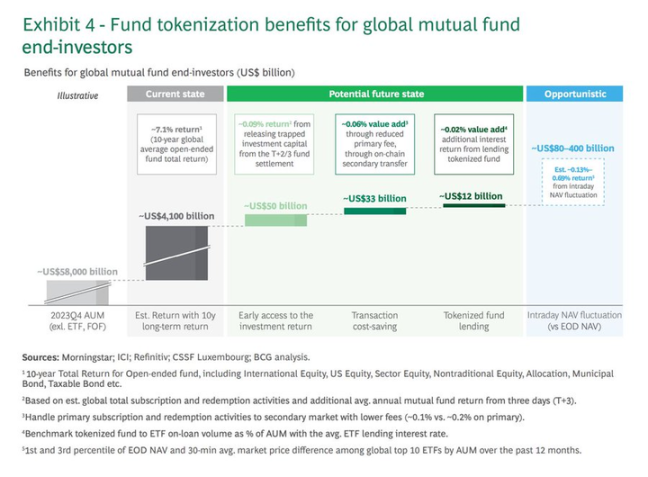

According to data from @BCG, tokenizing all global mutual funds could unlock an additional $100 billion in annual returns for investors. Meanwhile, "mature investors" (sorry, not referring to you) could earn $400 billion by "capturing intraday value changes" (in simple terms, day trading). Based on the historical adoption patterns of ETFs, it is reasonable to expect that tokenized funds will account for 1% of the global mutual fund and ETF assets under management within the next seven years.

Global ETF assets under management (Source - J.P. Morgan Asset Management)

This means that by 2030, tokenized assets will exceed $600 billion.

Furthermore, if regulators allow existing mutual funds and ETFs to convert into tokenized funds (which is simpler than launching a new tokenized fund), we could see trillions of dollars in assets under management.

Considering that similar growth expectations existed before the launch of the BTC ETF, I believe we cannot rule out the possibility that these numbers may be overly conservative, and actual growth could be astonishingly high.

However, even based on these expectations, we are still talking about at least a 200-fold increase.

Once again, at least a 200-fold increase from now.

And are you still sitting there feeling frustrated because you haven't made money yet?

Give me returns, please!

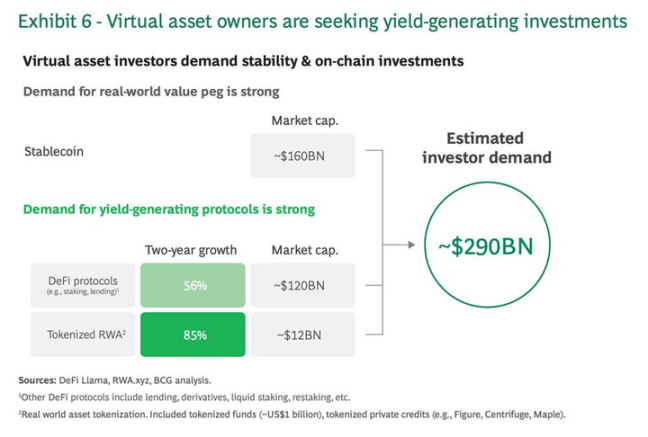

According to this @BCG study, our industry's demand for investment in tokenized funds is about $290 billion. This figure includes the demand from stablecoin holders, tokenized RWA, and DeFi protocols.

I think this number may be on the high side because it considers the growth of the DeFi protocol market cap, which comes from a risk-seeking user base, and these users' investment tendencies may differ from those willing to invest in tokenized assets.

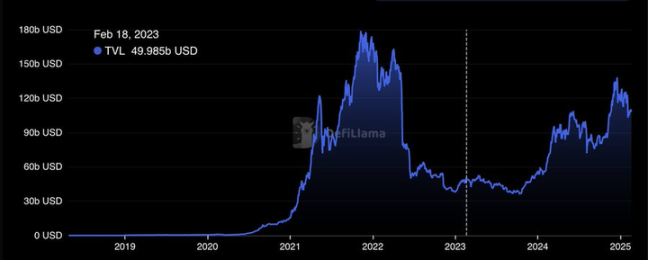

A more reasonable approach would be to consider the growth of total value locked (TVL) in DeFi over the past two years; even so, it would still be a considerable number: $58.06 billion (Source - @DefiLlama).

Total value locked (TVL) in DeFi

In any case, the value proposition of tokenized funds and RWA is undeniable. They provide a channel for accessing real-world investment opportunities, allowing investors to better diversify their portfolios as market dynamics change.

Imagine if you could exchange your on-chain tokens for stocks, commodities, and real estate through @Rabby_io in the past few months without needing to withdraw—how convenient would that be?

But why must all this happen? What benefits does it bring to traditional finance? Recently, I haven't seen much discussion on this topic in crypto Twitter (CT), especially amid the current memecoin craze and disputes. We always talk about how traditional finance (tradFi) is entering the Web3 space and adopting the technologies we are building. But why would they do that? While I plan to write a dedicated article discussing this topic, here are some key points explaining why traditional finance needs and must adopt crypto rails:

- Instant settlement, as shown in the figure below, could add about $50 billion annually to investors' portfolios.

- Lower commissions could save an additional $33 billion, which will ultimately flow into investors' portfolios.

- Composable tokenized funds will be easier to lend.

- Accessible trading of tokenized assets will make it easier for investors to trade.

How tokenization can enhance returns (Source: Boston Consulting Group)

3. Sentiment Second, Momentum First

Traditional finance is bidding, while crypto Twitter (CT) is being cut.

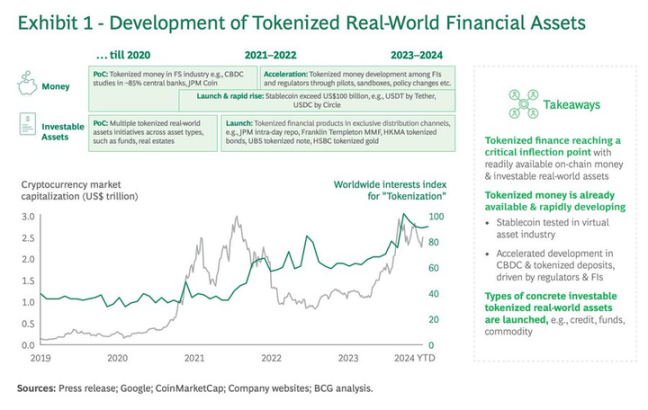

The chart above shows that regardless of market conditions, especially the sentiment in crypto Twitter (CT) (laughs), traditional finance (tradFi) institutions are more interested in tokenization, crypto, and blockchain than ever before.

This reminds you of how incredible the next few years will be.

Think about it: if traditional financial institutions were interested in tokenization and crypto in the past—even when there was almost no adoption, unfriendly regulations, and little innovation—why shouldn't they be exceptionally optimistic now?

In fact, there is only one answer.

You know it.

4. How Does the Crypto Market View It?

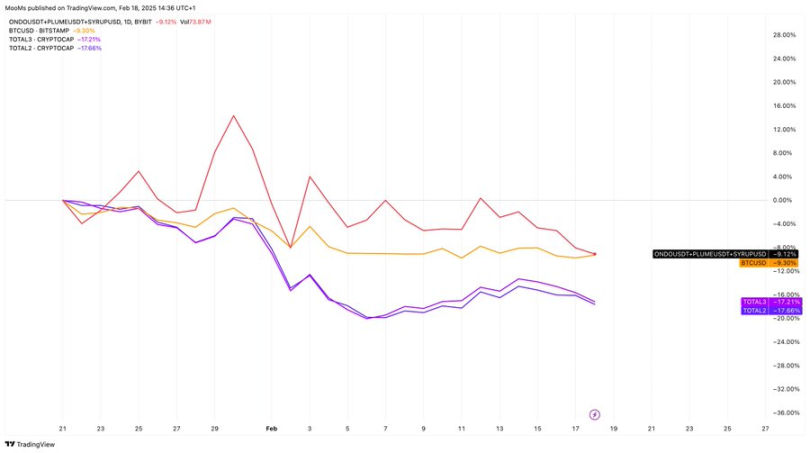

Even when market participants' sentiment is at a historical low, with most discussions focused on the nonsense of @KaitoAI, the meme cutting of Solana, and the dramatic events of KOLs, the charts loudly express another voice.

Data does not lie. Since the launch of $TRUMP, the performance of leading RWA protocols has outperformed, or rather, proven to be more resilient than the overall altcoin market.

If you include more leading RWA protocols in the index and look back over a longer time frame, the results would be the same.

5. Conclusion

The RWA sector is like a huge cake, and so far, we have only cut a small piece. However, those who tokenize early will get a large share, while others will only pick up the remaining crumbs. Traditional finance knows this, which is why they are accelerating the process.

I will conclude with a quote from a report by @DigitalAssets: "Looking back at the prospects for 2025, it is clear that investors have not missed the opportunity to join the wave of digital assets. In fact, we believe we may be entering a new era of digital assets, one that is expected to span many years—even decades. This era may see digital assets penetrate various industries—industrial, technological, sectors, balance sheets, and even at the national level. The key question facing investors now is not whether to participate, but how they will actively engage in this transformation."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。